EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent technical analysis and forecast for 27 December 2024

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent for 27 December 2024.

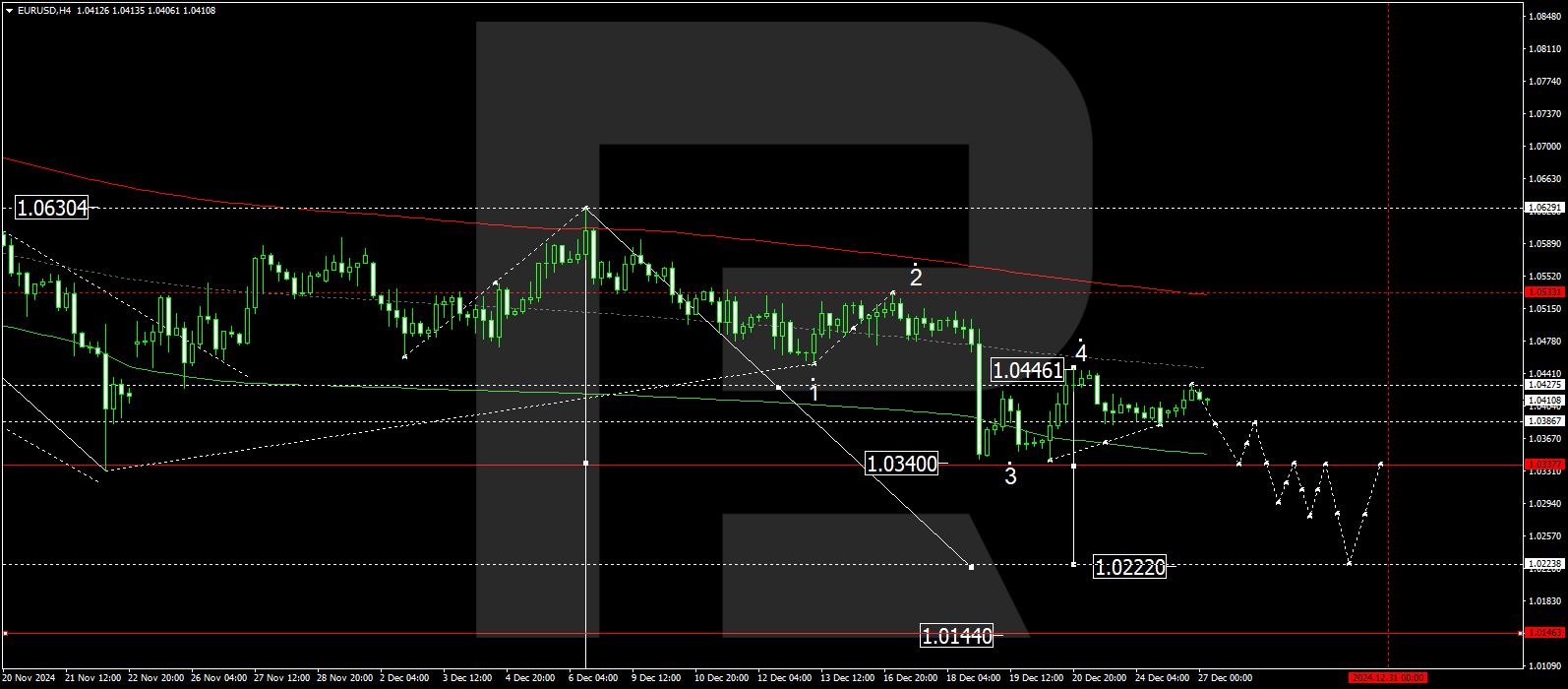

EURUSD forecast

On the EURUSD H4 chart, the market is forming a consolidation range around 1.0386. Today, 27 December 2024, it has expanded upwards to 1.0427. Subsequently, a downward expansion to 1.0333 is anticipated, followed by a rise towards 1.0386. The wave could continue towards 1.0222, the local target, if the range breaks downwards

The Elliott Wave structure and correction matrix, with a pivot point at 1.0386, technically validate this scenario. The level is considered crucial for the EURUSD rate during this downward wave. Currently, the market has bounced downwards from the central line of the price envelope at 1.0446 and continues its downward momentum towards the envelope’s lower boundary at 1.0333.

Technical indicators for today’s EURUSD forecast suggest a potential decline to 1.0333 and 1.0222.

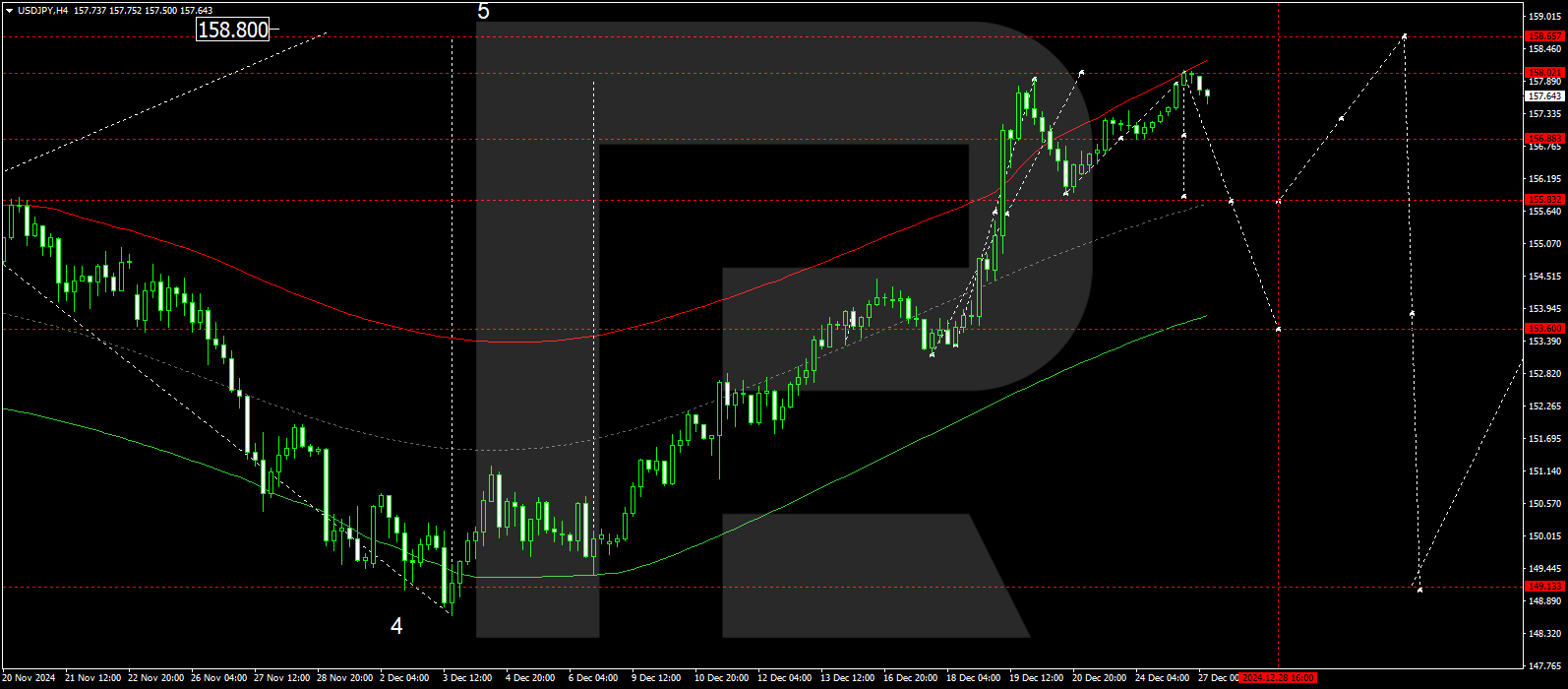

USDJPY forecast

On the USDJPY H4 chart, the market is forming a consolidation range around 156.88. Today, 27 December 2024, it has expanded upwards to 158.02. Subsequently, a downward expansion to 155.85 is anticipated, followed by a rise to 156.88. A downward wave could develop with a breakout below the range, aiming for 153.60, followed by a potential wave of growth to 158.80.

Technically, this scenario for the USDJPY rate is supported by the Elliott wave structure and the growth wave matrix centred at 153.53. Currently, the market is near the upper boundary of the price envelope. A decline to its central line at 155.85 is expected. If this level is breached, the price might continue downward toward the lower boundary at 153.60.

Technical indicators for today’s USDJPY forecast suggest a potential decline to 155.85 and 154.22.

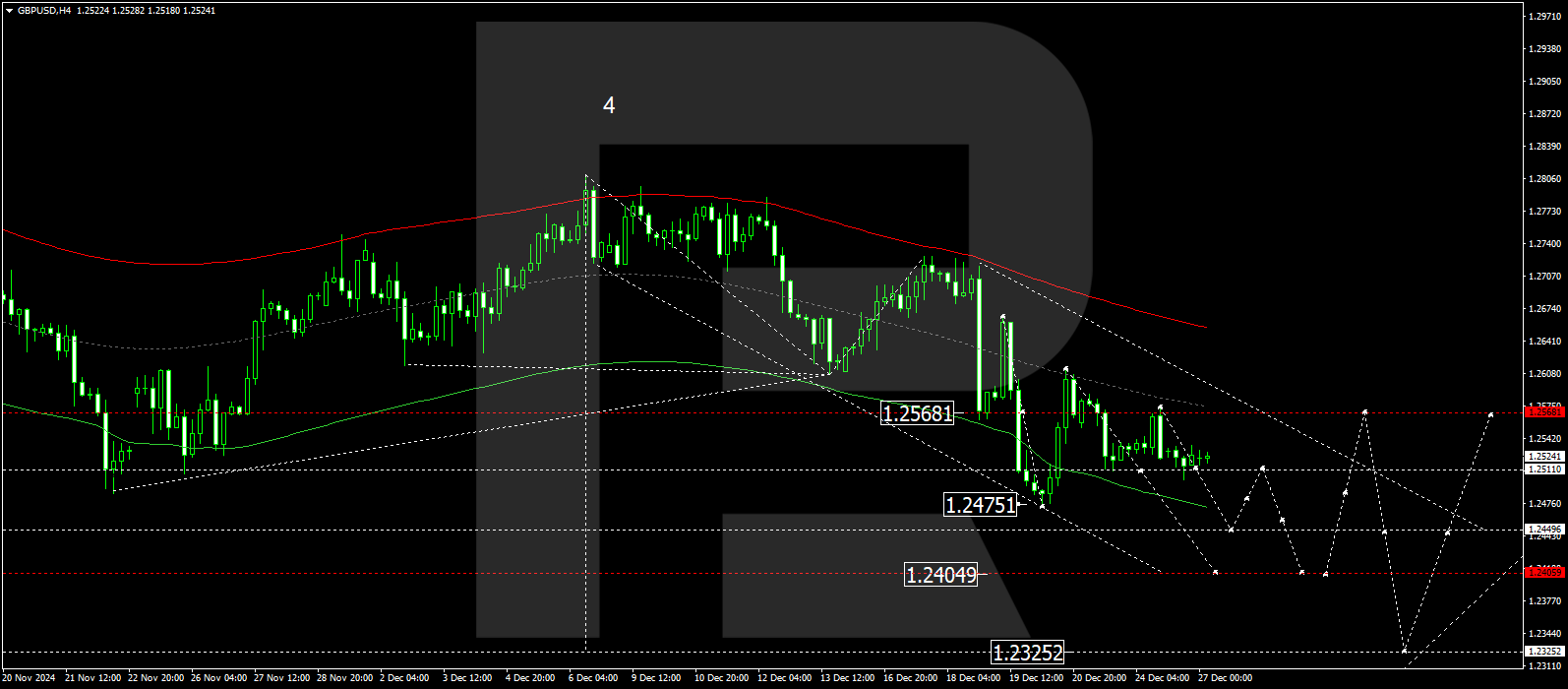

GBPUSD forecast

On the GBPUSD H4 chart, the market is forming a consolidation range around 1.2511. Today, 27 December 2024, a downward expansion to 1.2445 is expected, followed by a potential rise to 1.2511 (testing from below). Subsequently, a new downward wave is expected, aiming for 1.2405 as a local target.

Technically, this scenario for the GBPUSD rate is confirmed by the Elliott wave structure and the wave matrix centred at 1.2565. The market has rebounded from the central line of the envelope at 1.2606 and continues its downward momentum towards the envelope’s lower boundary at 1.2445, the local target. Practically, the downward wave could develop towards the main target of 1.2405.

Technical indicators for today’s GBPUSD forecast suggest that the downward wave could continue towards 1.2445 and 1.2405.

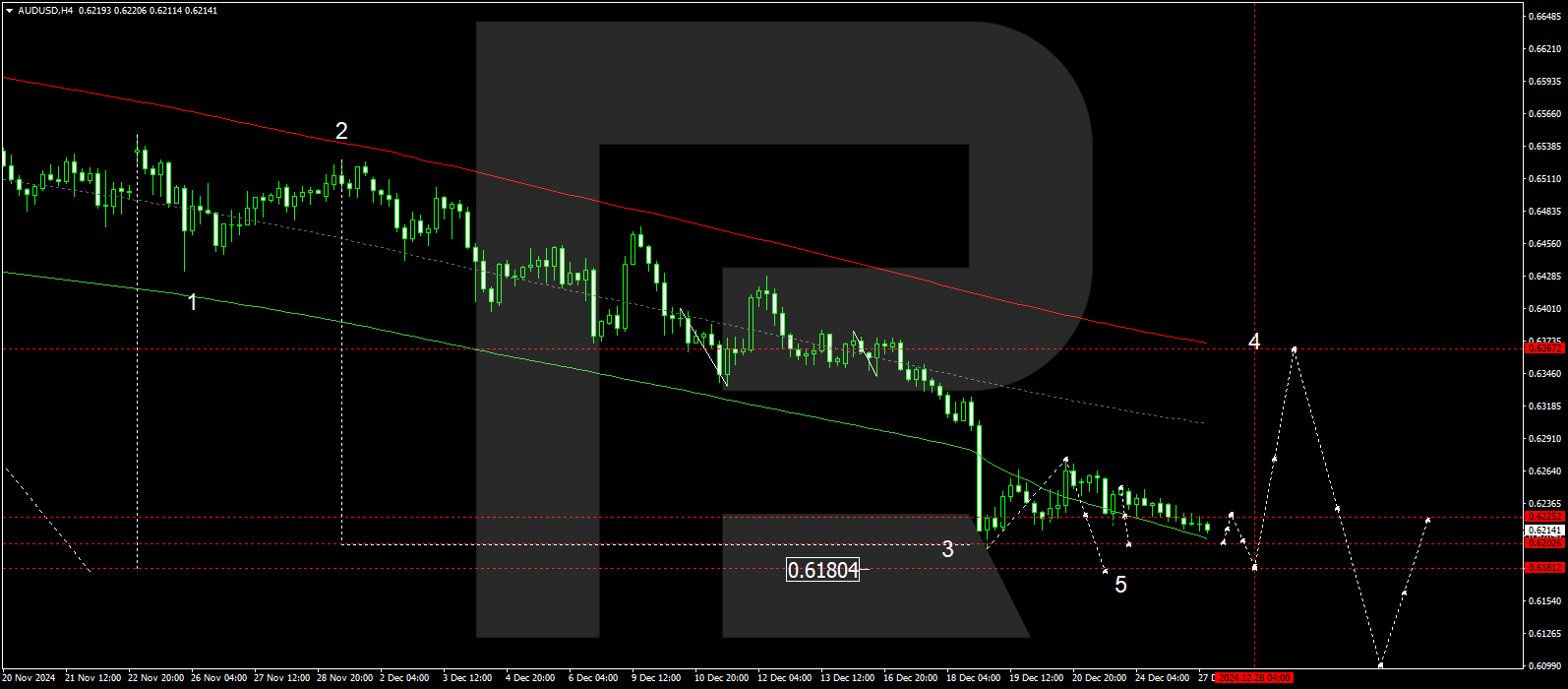

AUDUSD forecast

On the AUDUSD H4 chart, the market is consolidating around 0.6222. Today, 27 December 2024, a downward expansion to 0.6204 is anticipated, followed by a potential rise to 0.6222 (testing from below). If the range breaks upwards, a correction towards 0.6363 is likely. If it breaks downwards, the price could decline further to 0.6180, the main target.

Technically, this scenario for the AUDUSD rate is supported by the Elliott wave structure and the downward wave matrix centred at 0.6363. The market has reached the downward wave’s local target of 0.6200 and continues to consolidate near the lower boundary of the price envelope. Today, a downward wave is possible, aiming for 0.6204 and potentially continuing further to the envelope’s lower boundary at 0.6180.

Technical indicators for today’s AUDUSD forecast suggest a potential decline to 0.6204 and 0.6180.

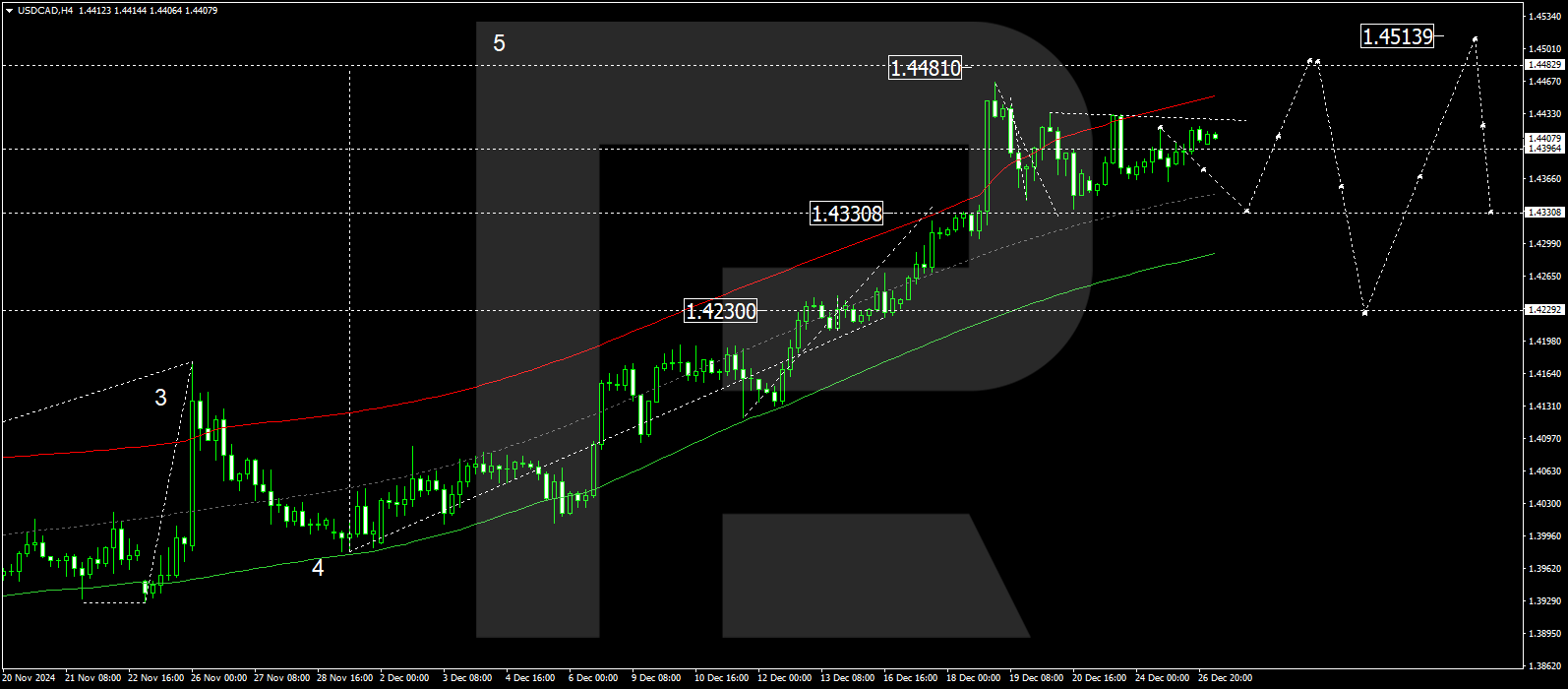

USDCAD forecast

On the USDCAD H4 chart, the market is consolidating around 1.4400 without a clear trend. Today, 27 December 2024, a downward expansion to 1.4330 is expected, followed by a potential retrace to 1.4400. An upward breakout will open the potential for growth towards 1.4810. With a breakout below the range, a correction could continue towards 1.4300.

Technically, this scenario is supported by the Elliott wave structure and the wave matrix centred at 1.4230. This level is considered crucial for a growth wave in the USDCAD rate. The market is currently consolidating near the upper boundary of the price envelope and is expected to decline to its central line at 1.4330. A breakout below this level will open the potential for a decline towards the envelope’s lower boundary at 1.4230.

Technical indicators for today’s USDCAD forecast suggest a potential decline to 1.4330.

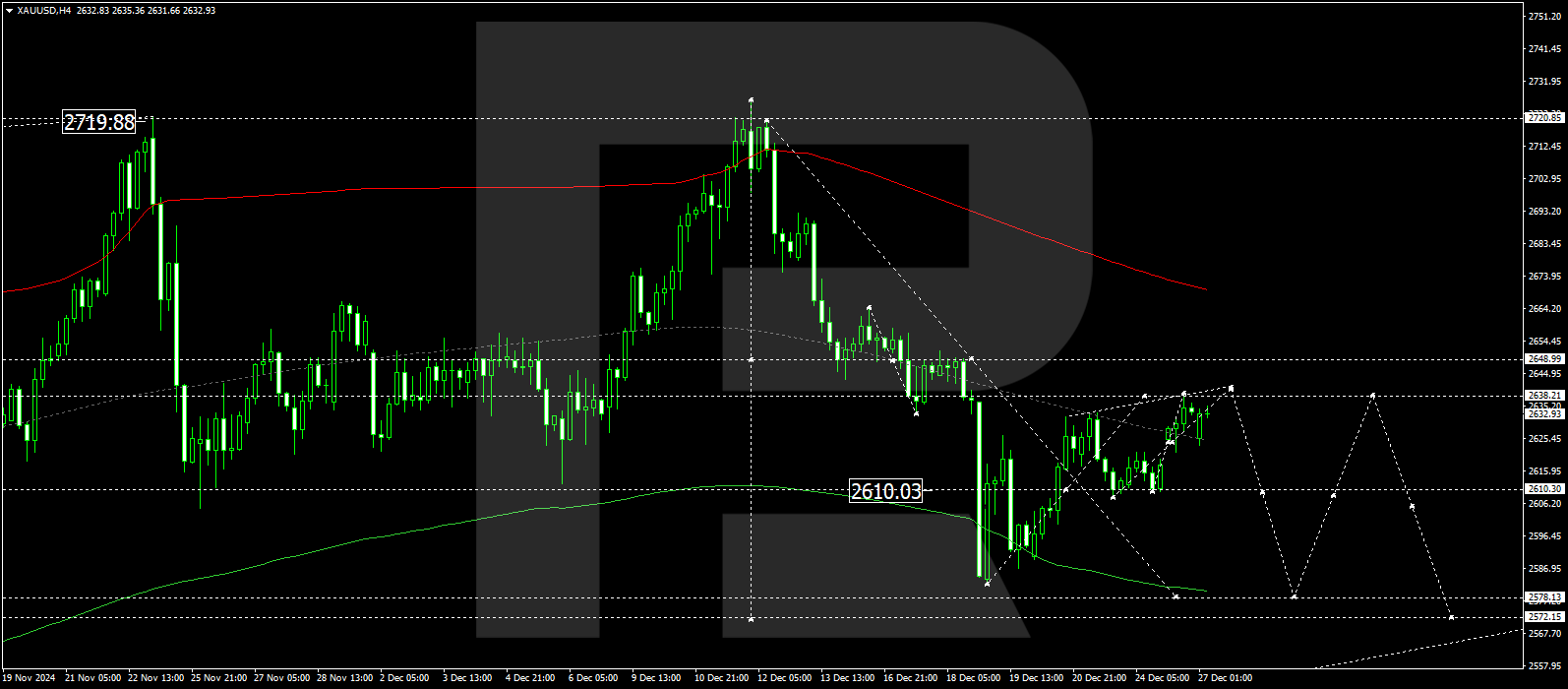

XAUUSD forecast

On the XAUUSD H4 chart, the market is forming a consolidation range around 2,610. Today, 27 December 2024, growth to 2,638 is expected, followed by a decline to 2,610. If the range breaks upwards, the correction will likely continue towards 2,648. Conversely, a downward wave could aim for 2,578, with a breakout below the range.

Technically, this scenario is supported by the Elliott wave structure and the wave matrix centred at 2,650. This level is considered crucial for the corrective downward wave in the XAUUSD rate. The wave is projected to extend towards the envelope’s central line at 2,638 before declining further towards the lower boundary of the envelope at 2,578.

Technical indicators for today’s XAUUSD forecast suggest potential growth to 2,638, followed by a decline to 2,578.

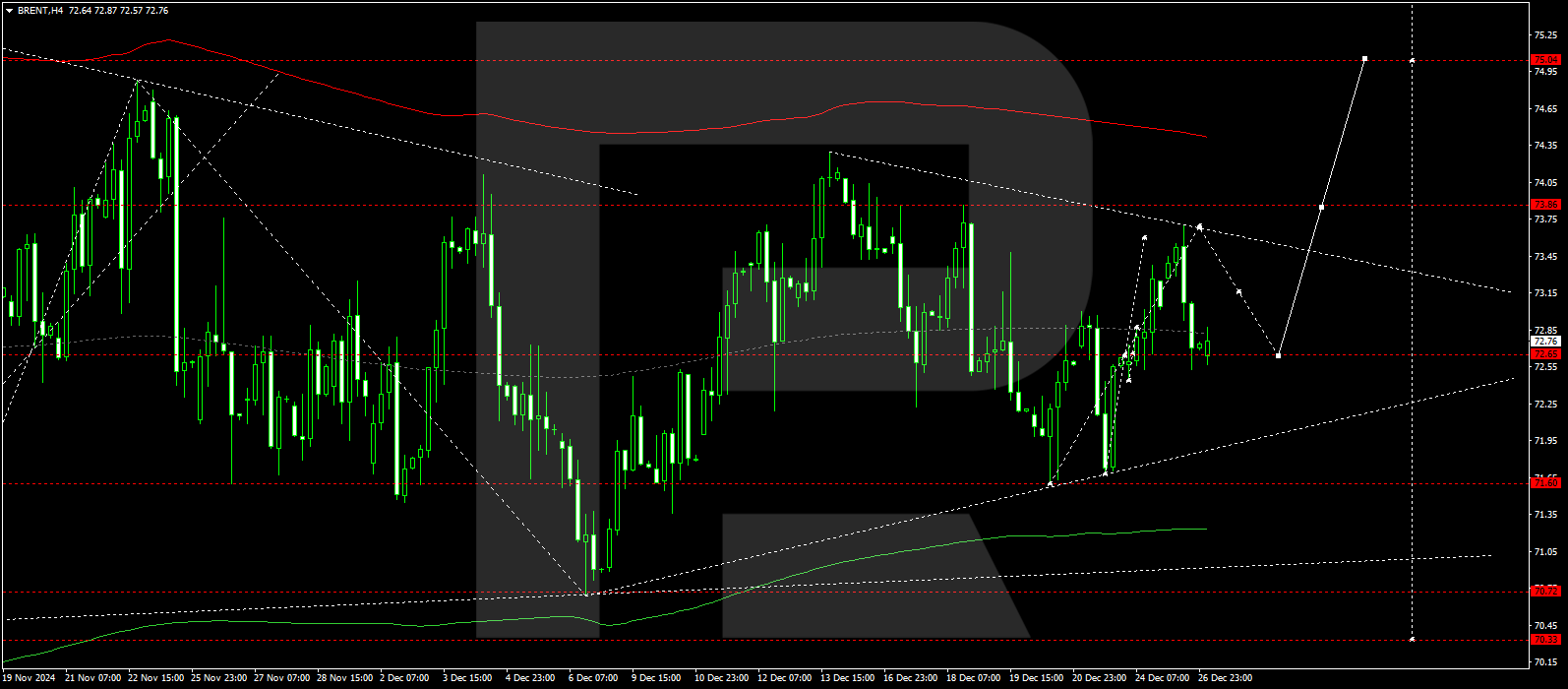

Brent forecast

On the Brent H4 chart, the market is consolidating around 72.65. Today, 27 December 2024, the range has expanded to 73.70 and retraced to 72.65. Subsequently, another decline towards 71.22 is possible, followed by growth towards 73.90.

The Elliott Wave structure and wave matrix, with a pivot point at 72.65, technically support this scenario. This level is considered crucial for the Brent rate near the central line of the price envelope. The downward wave may continue towards the envelope’s lower boundary at 71.22 today.

Technical indicators for today’s Brent forecast suggest a potential decline to 71.22.