EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent technical analysis and forecast for 28 February 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent for 28 February 2025.

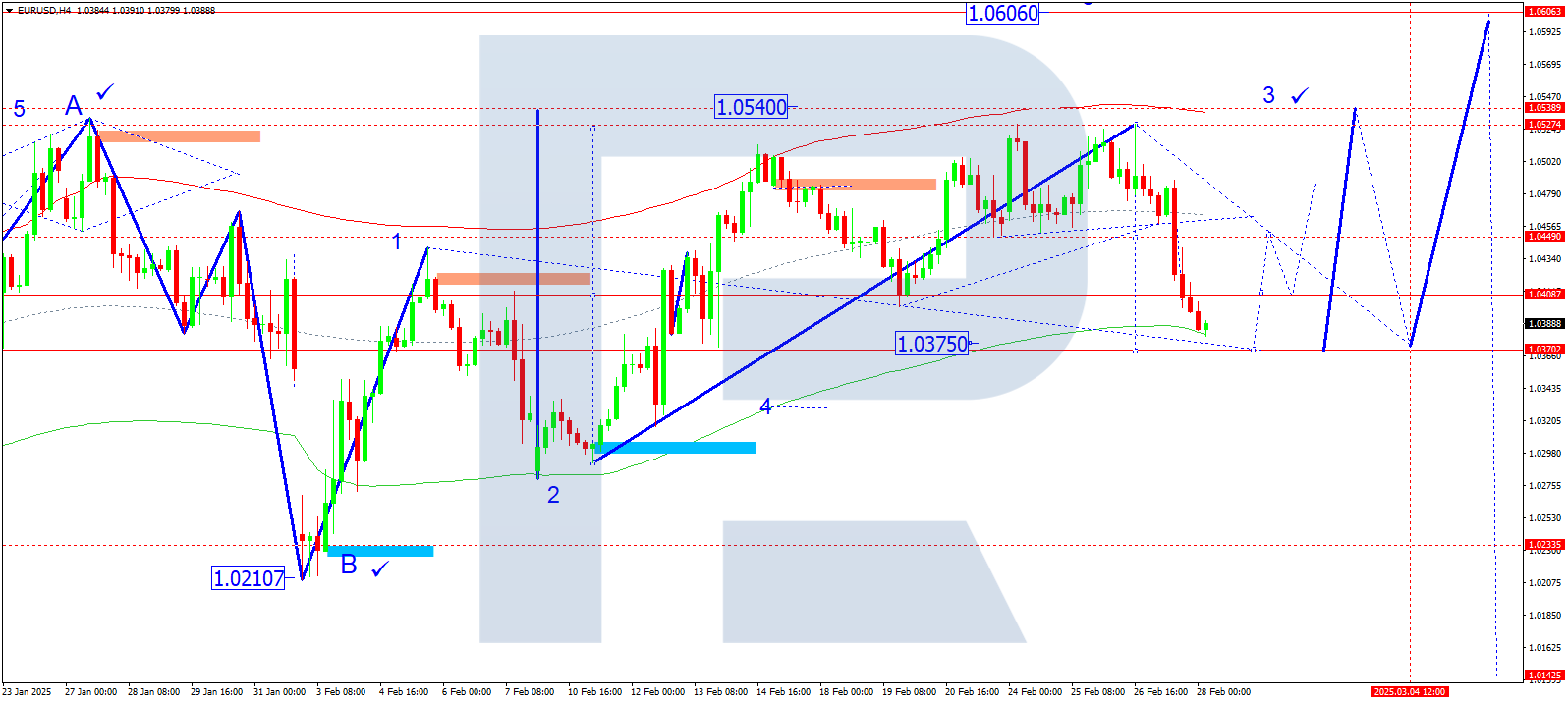

EURUSD forecast

On the H4 chart, EURUSD broke below the consolidation range and executed a decline to 1.0380. Today, 28 February 2025, a retest of 1.0440 from below is possible before the market resumes a downward movement towards 1.0375, with an extension to 1.0370. This entire decline is considered a correction of the previous growth wave. After its completion, a rise towards 1.0540 is expected.

Technically, this scenario aligns with the Elliott wave structure and the growth wave matrix, with a pivot point at 1.0400. The market is forming a decline towards the lower boundary of the price Envelope at 1.0380. Further movement towards 1.0370 remains likely before a possible rebound to 1.0440.

Technical indicators suggest a continuation of the correction towards 1.0370.

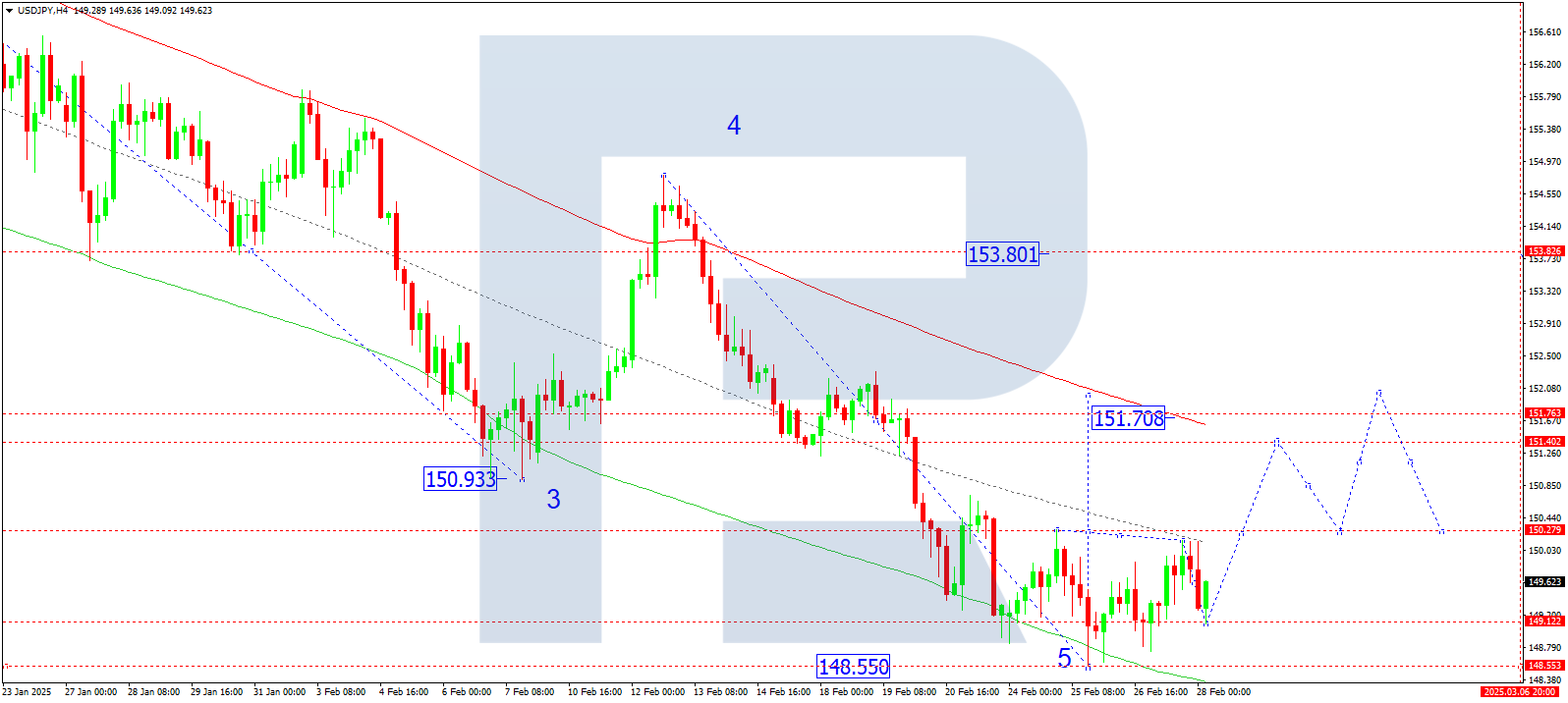

USDJPY forecast

On the H4 chart, USDJPY completed a growth wave to 150.15, followed by a correction to 149.10. The market has established a consolidation range at the lows of the decline. Today, 28 February 2025, an upward breakout from this range is expected, with a target of 151.40. Once this level is reached, a pullback to 150.20 is possible.

Technically, this scenario is supported by the Elliott wave structure and the declining wave matrix, with a pivot point at 153.80. The market has moved towards the central line of the price Envelope at 150.15. A further increase towards 151.40 is anticipated.

Technical indicators suggest the beginning of a growth wave towards 151.40.

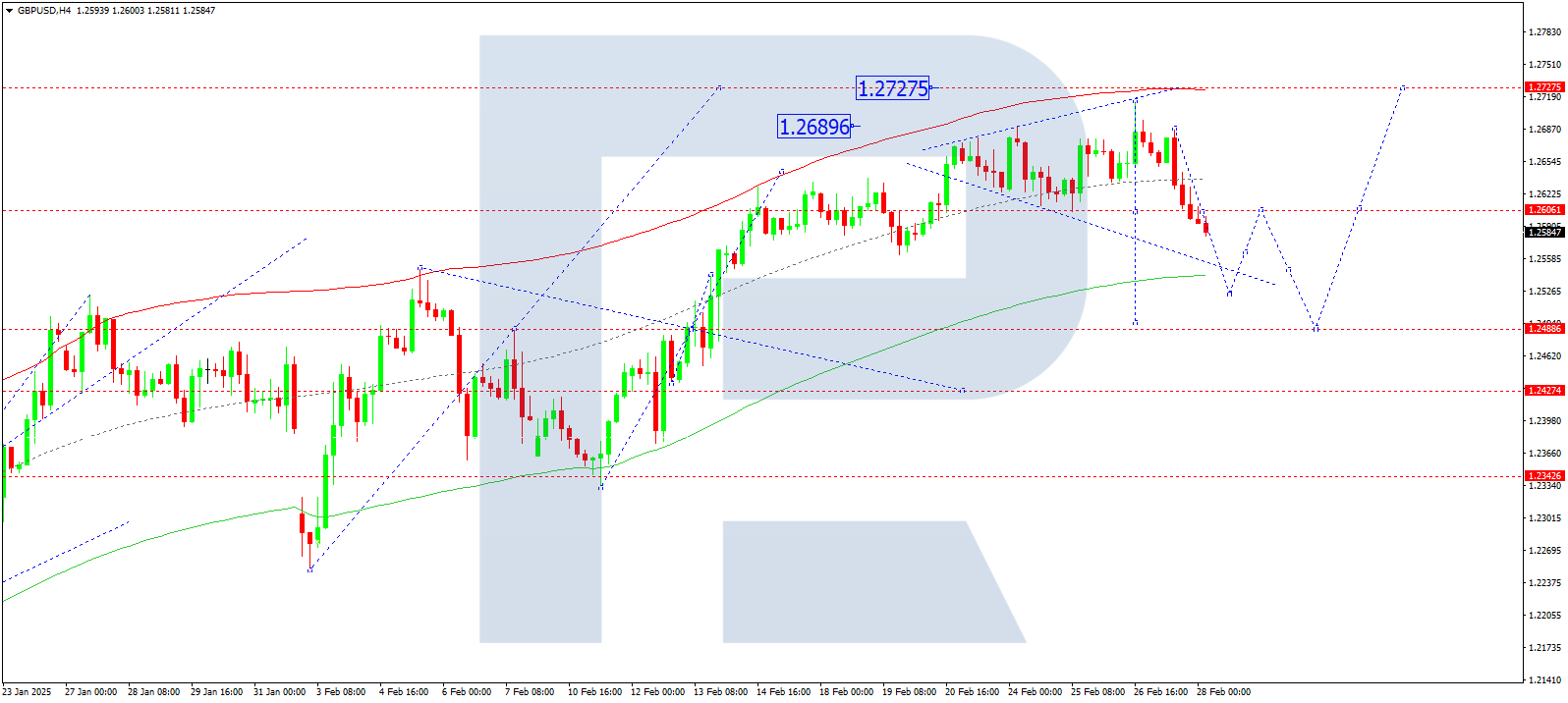

GBPUSD forecast

On the H4 chart, GBPUSD broke below 1.2606, continuing a decline. Today, 28 February 2025, the price is expected to reach 1.2525. A retest of 1.2600 from below is possible before a further decline to 1.2488.

Technically, this scenario aligns with the Elliott wave structure and the growth wave matrix, with a pivot point at 1.2488. The market is currently moving towards the lower boundary of the price Envelope at 1.2525.

Technical indicators suggest a correction towards 1.2525.

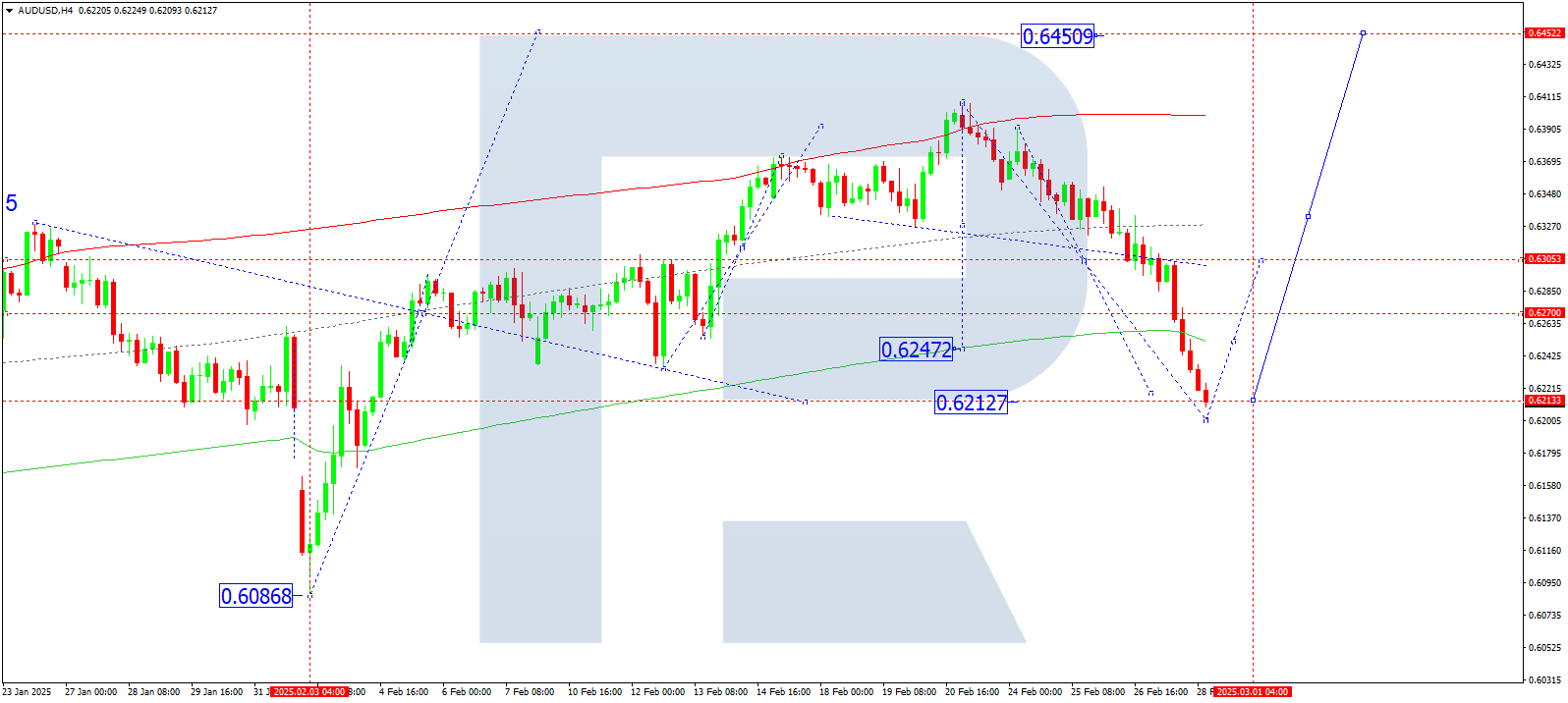

AUDUSD forecast

On the H4 chart, AUDUSD completed a decline to 0.6215. Today, 28 February 2025, a rebound towards 0.6300 (retesting from below) is possible. Further, the market may continue to decline towards 0.6200.

Technically, this scenario is supported by the Elliott wave structure and the growth wave matrix, with a pivot point at 0.6270. The price has reached the lower boundary of the price Envelope at 0.6215. A potential rebound towards 0.6300 is expected before a further decline towards 0.6200.

Technical indicators suggest a continuation of the downtrend towards 0.6200.

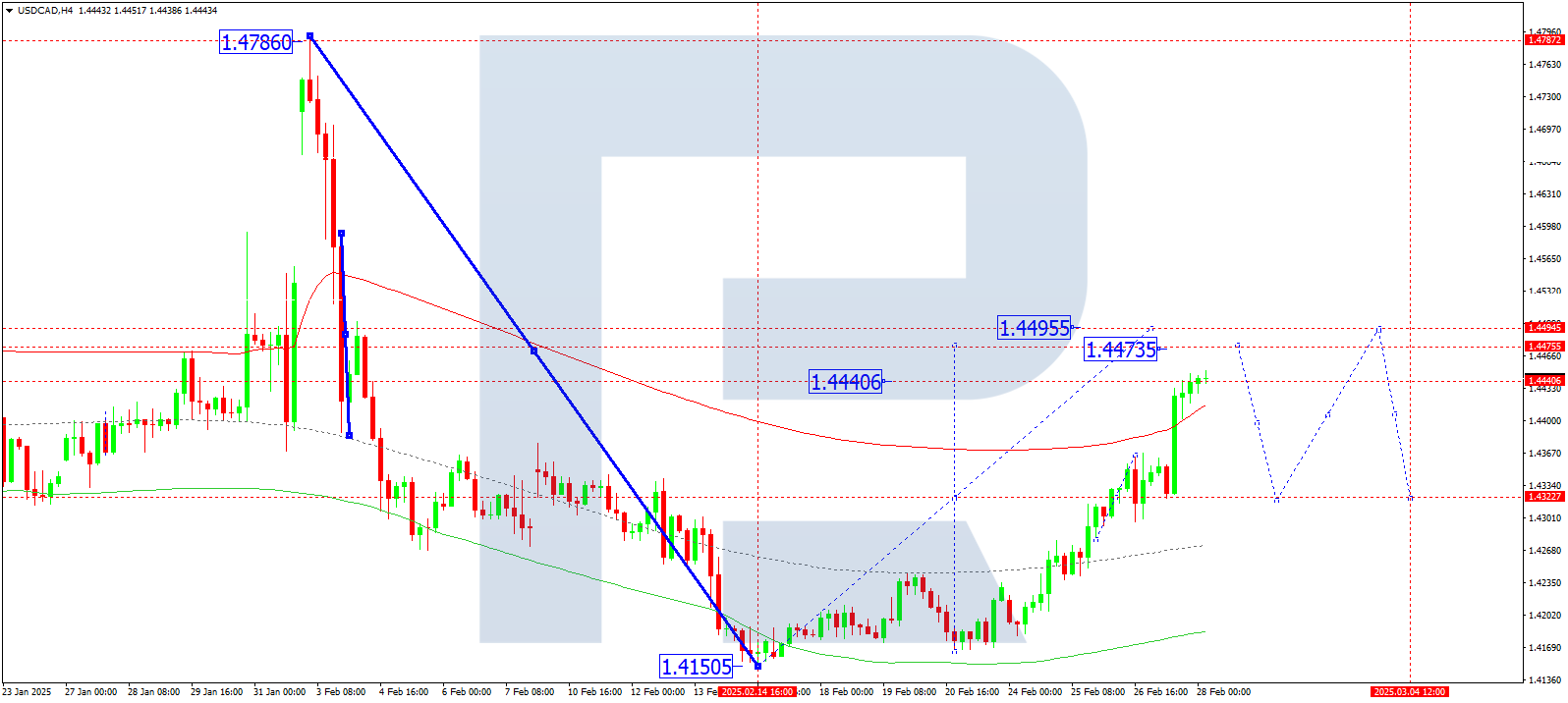

USDCAD forecast

On the H4 chart, USDCAD is continuing its growth wave towards 1.4475. Today, 28 February 2025, this level is expected to be reached, followed by a correction to 1.4333. After that, a new growth wave towards 1.4495 is likely.

Technically, this scenario aligns with the Elliott wave structure and the declining wave matrix, with a pivot point at 1.4488. The market is moving towards the upper boundary of the price Envelope at 1.4475. A correction towards 1.4333 is possible before the next upward impulse.

Technical indicators suggest further growth towards 1.4475.

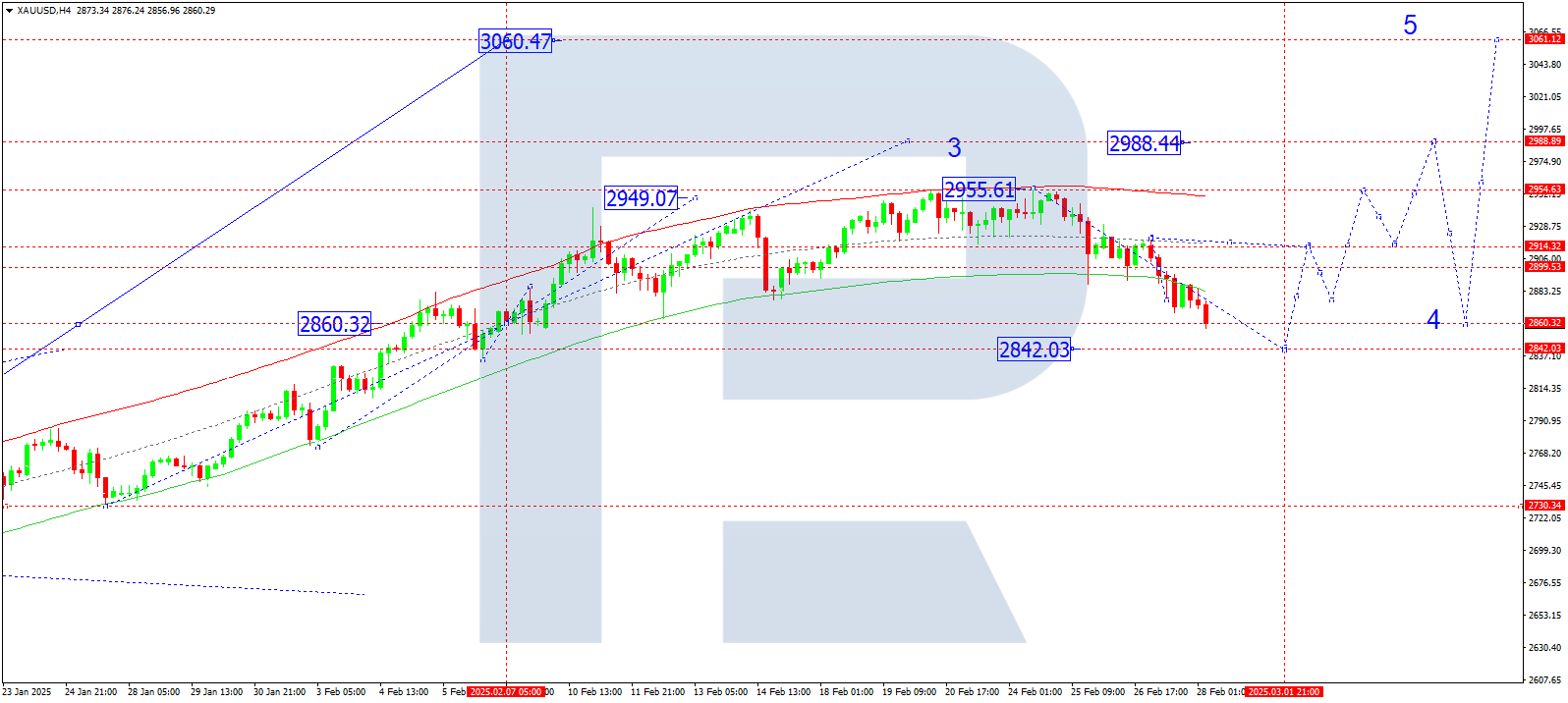

XAUUSD forecast

On the H4 chart, XAUUSD executed a decline to 2860. Today, 28 February 2025, the market is expected to continue declining towards 2842. After that, a new growth wave towards 2988 is possible.

Technically, this scenario aligns with the Elliott wave structure and the growth wave matrix, with a pivot point at 2860. The market has reached the lower boundary of the price Envelope at 2860. A potential rebound towards 2900 is possible before the price continues downward towards 2842.

Technical indicators suggest a further decline towards 2842.

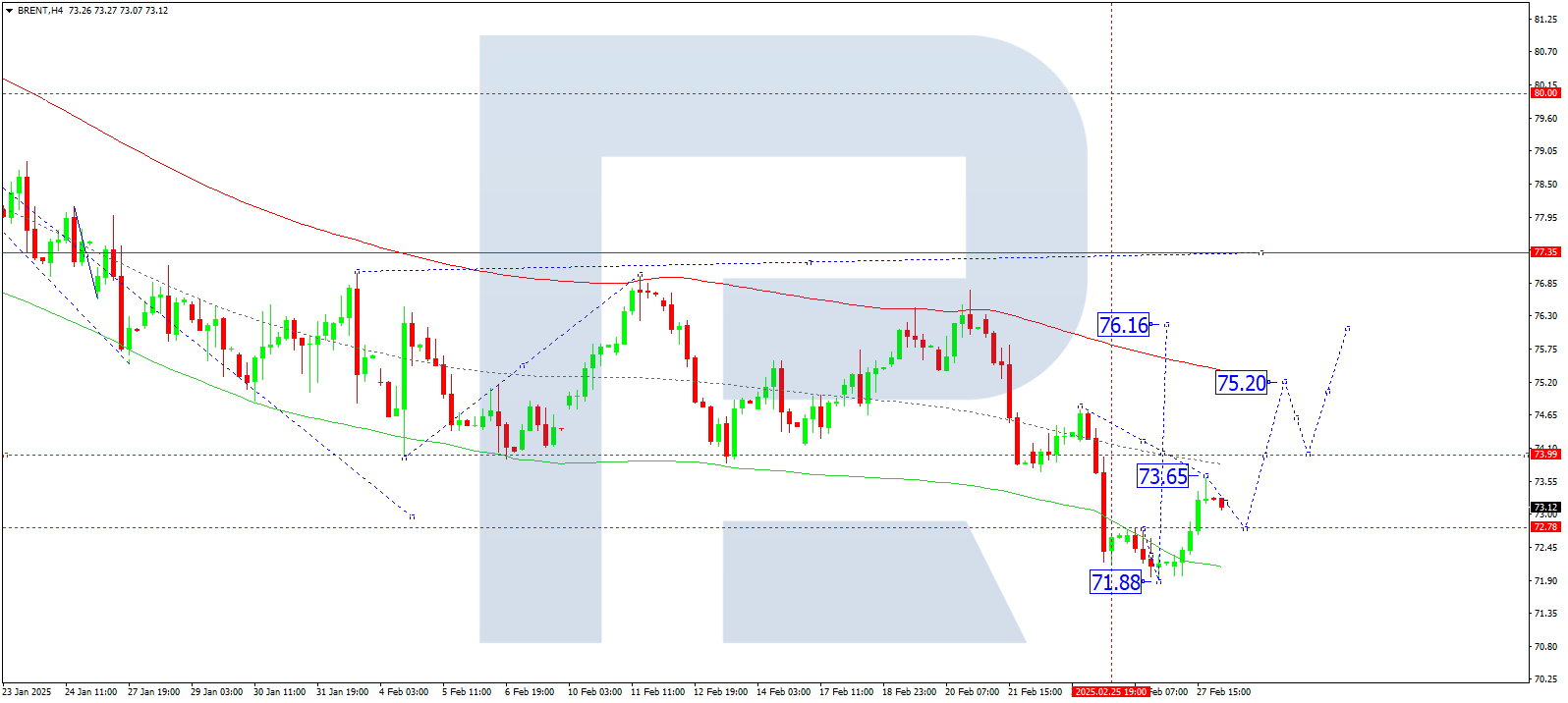

Brent forecast

On the H4 chart, Brent rose to 73.65. Today, 28 February 2025, a correction towards 72.78 is expected before the price resumes an uptrend towards 75.20.

Technically, this scenario aligns with the Elliott wave structure and the declining wave matrix, with a pivot point at 77.40. The market has reached the central line of the price Envelope at 73.65. A short-term pullback to 72.78 is expected before a potential rise to 75.20.

Technical indicators suggest the start of a growth wave towards 75.20.