EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent technical analysis and forecast for 30 January 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent for 30 January 2025.

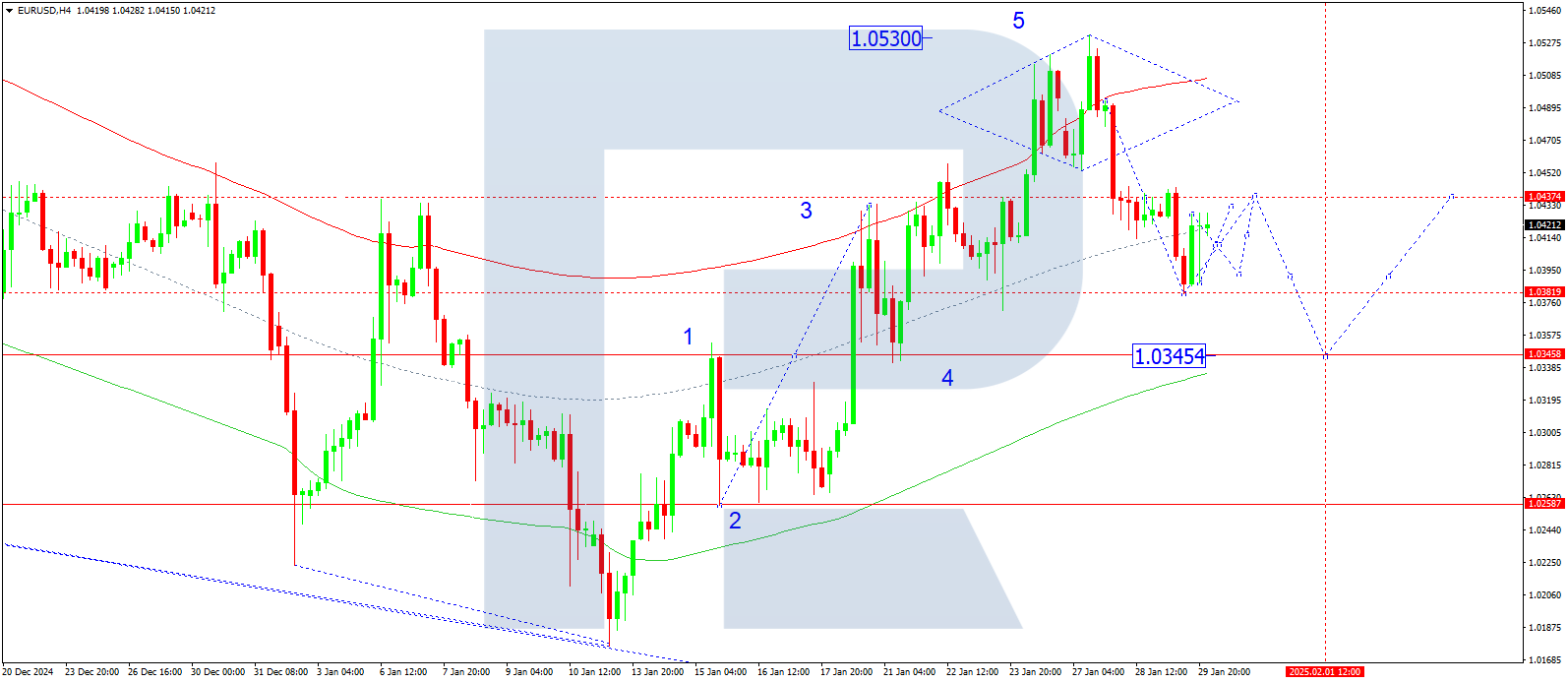

EURUSD forecast

On the H4 chart, EURUSD completed a downward wave to 1.0382. On 30 January 2025, a correction to 1.0437 is expected. After completing this correction, another downward wave towards 1.0345 is likely as the first target. Once this level is reached, another correction to 1.0430 (test from below) may occur.

Technically, this scenario aligns with the Elliott Wave structure and the downward wave matrix centred at 1.0430, which is crucial for EURUSD. The market is currently consolidating around the central line of the price Envelope at 1.0410, with a possible rise towards 1.0430. A breakout downwards could extend the decline to the lower boundary at 1.0345.

Technical indicators for today’s EURUSD forecast suggest a potential decline to 1.0345.

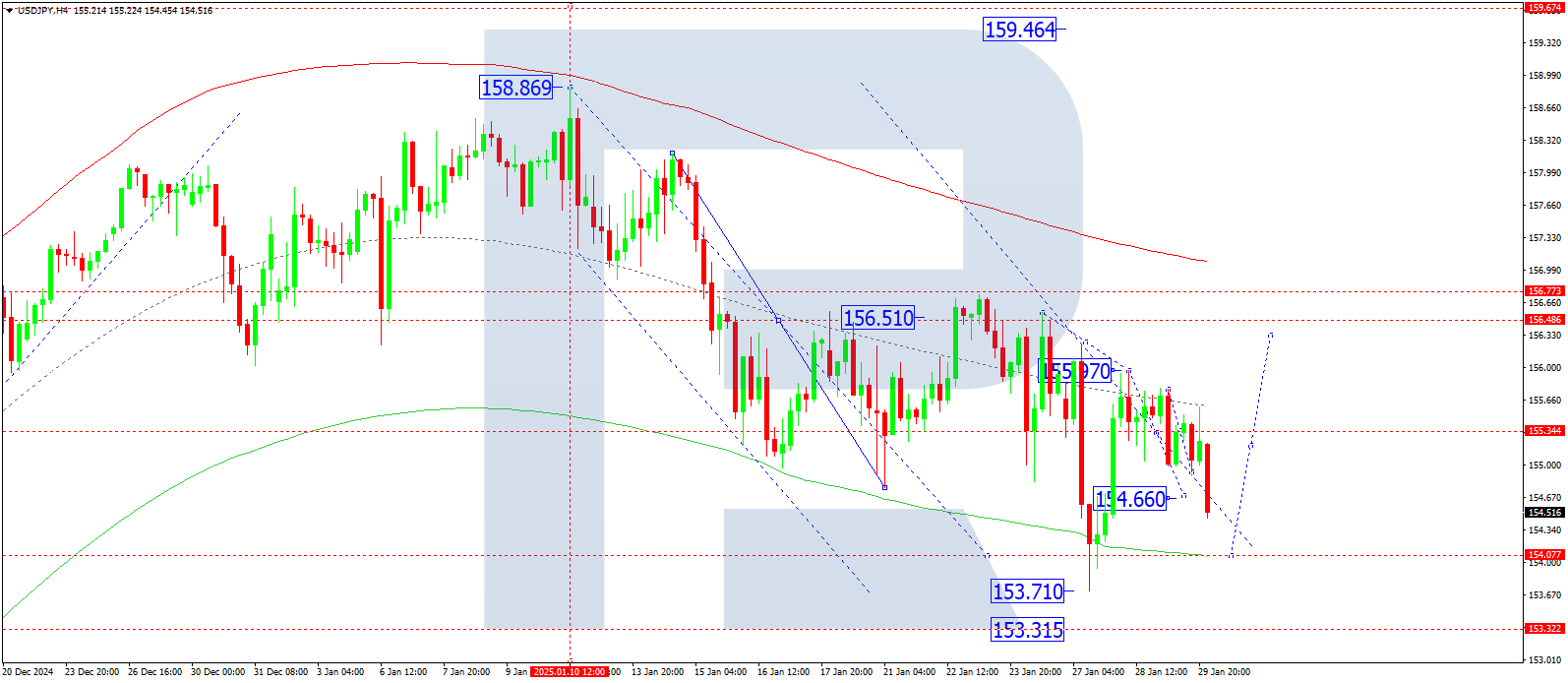

USDJPY forecast

On the H4 chart, USDJPY completed an impulse growth to 155.97, followed by a correction to 154.66. On 30 January 2025, consolidation around this level is expected. If the market breaks upwards, a continuation of the upward wave towards 156.50 is likely as the first target. If a downward breakout occurs, the range may extend towards 154.10.

Technically, this scenario aligns with the Elliott Wave structure and the growth wave matrix centred at 155.10. The market is consolidating below the central line of the price Envelope. A breakout upwards could push the price towards the upper boundary at 156.50.

Technical indicators for today’s USDJPY forecast suggest potential growth to 156.50.

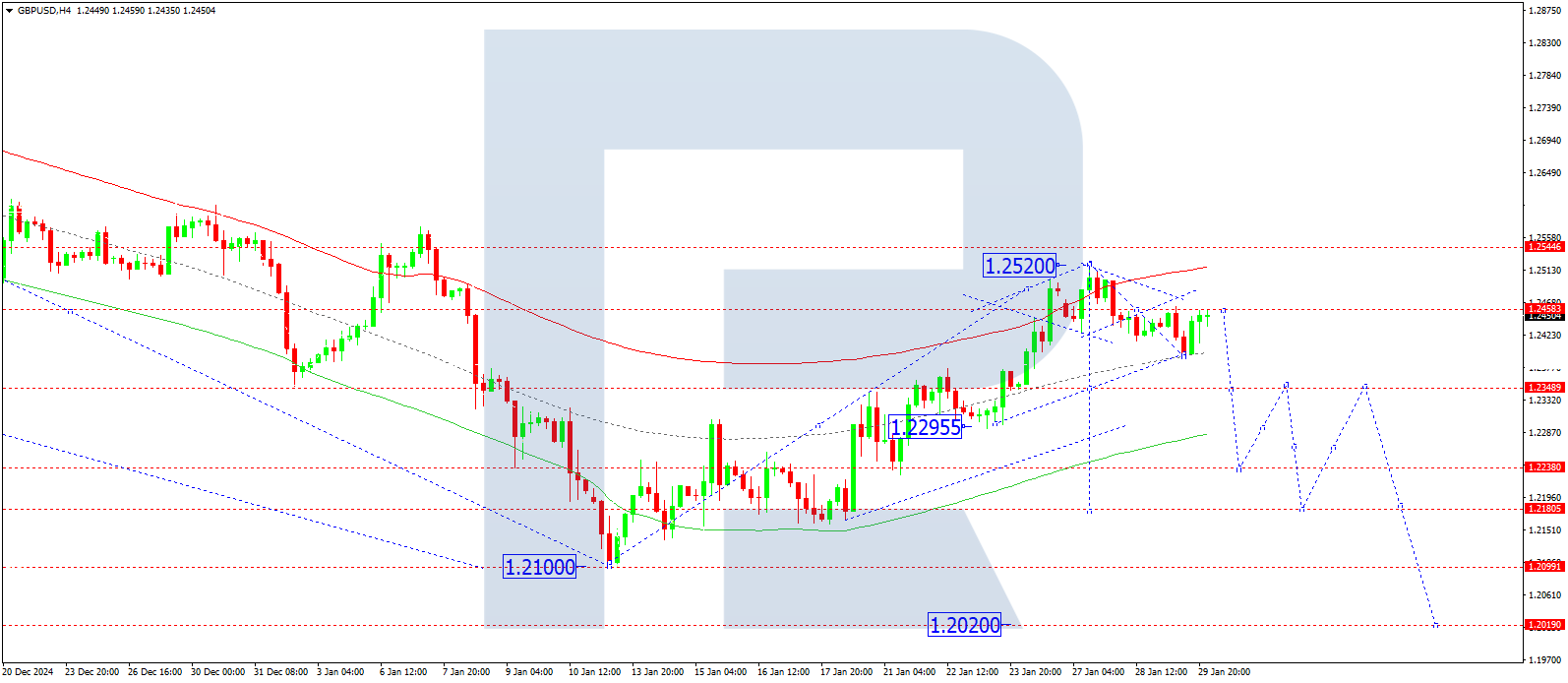

GBPUSD forecast

On the H4 chart, GBPUSD completed a downward wave to 1.2393. On 30 January 2025, a correction to 1.2458 is expected, forming a consolidation range between these levels. If the market breaks downwards, a continuation of the downward wave to 1.2350 is likely. A further breakout could lead to a continuation of the trend towards 1.2240 as the local calculated target.

Technically, this scenario aligns with the Elliott Wave structure and the downward wave matrix centred at 1.2350. The market is consolidating above the central line of the price Envelope. A breakout downwards could push the price towards the lower boundary at 1.2240.

Technical indicators for today’s GBPUSD forecast suggest a potential decline to 1.2240.

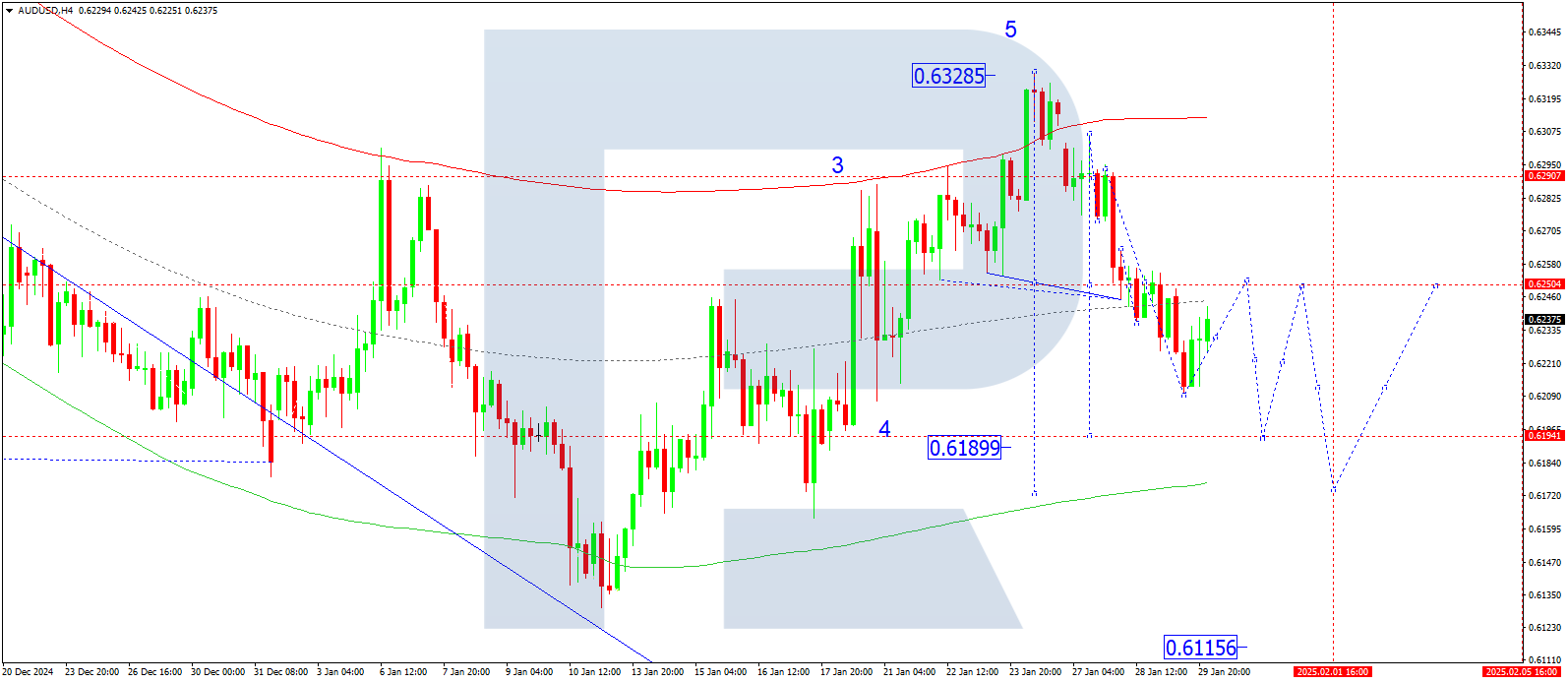

AUDUSD forecast

On the H4 chart, AUDUSD formed a downward wave to 0.6209. On 30 January 2025, a correction to 0.6250 is expected. Once this correction is completed, a new downward wave towards 0.6194 is likely as the local target.

Technically, this scenario aligns with the Elliott Wave structure and the downward wave matrix centred at 0.6250. The market has formed a consolidation range around the central line of the price Envelope and has broken downwards. A further decline towards the lower boundary at 0.6194 is anticipated.

Technical indicators for today’s AUDUSD forecast suggest a potential decline to 0.6194.

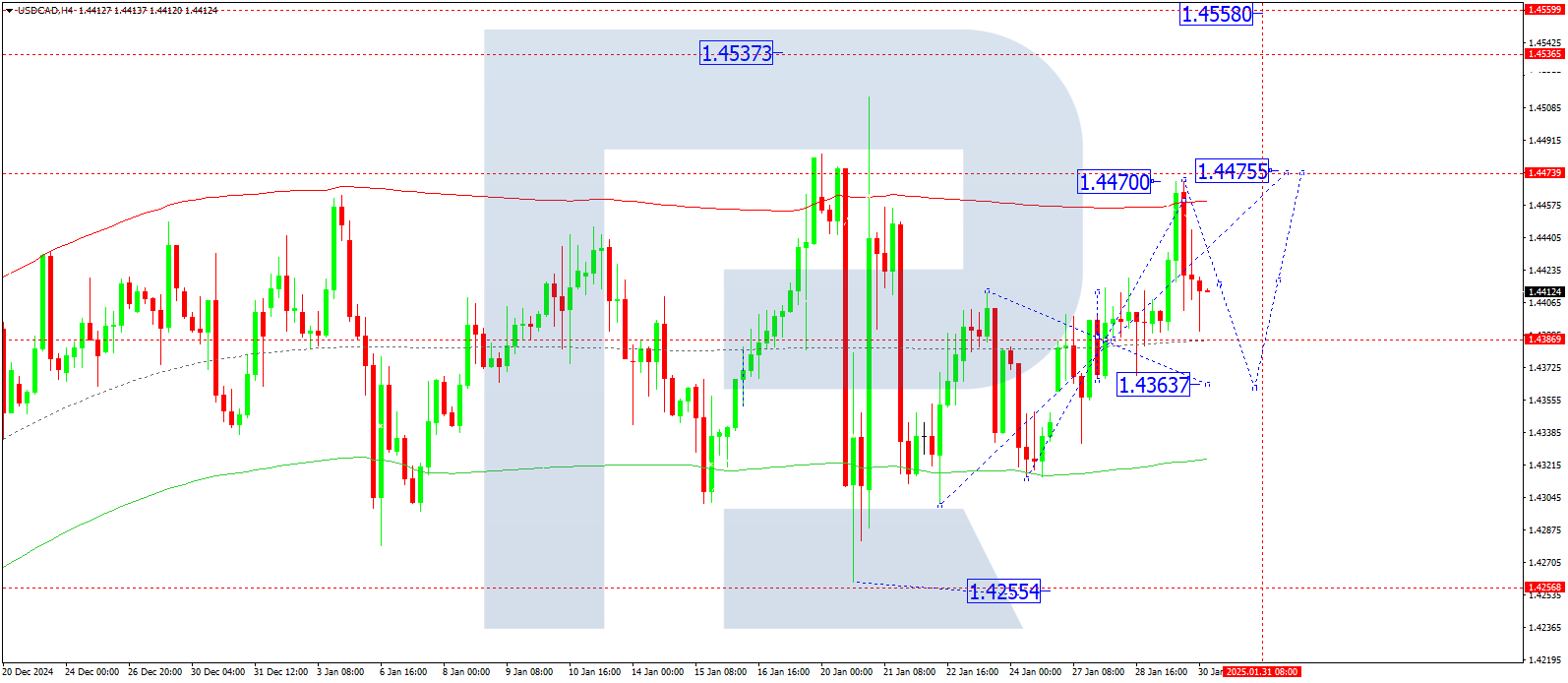

USDCAD forecast

On the H4 chart, USDCAD completed a growth wave to 1.4470 and began developing a correction. On 30 January 2025, a decline to 1.4363 is expected. Once this level is reached, another growth wave to 1.4477 may follow.

Technically, this scenario aligns with the Elliott Wave structure and the growth wave matrix centred at 1.4387. This level is key for USDCAD in this structure. The market is currently consolidating around the central line of the price Envelope at 1.4387. A breakout upwards could push the price towards the upper boundary at 1.4477, while a downward movement may lead back to 1.4387.

Technical indicators for today’s USDCAD forecast suggest potential growth to 1.4477.

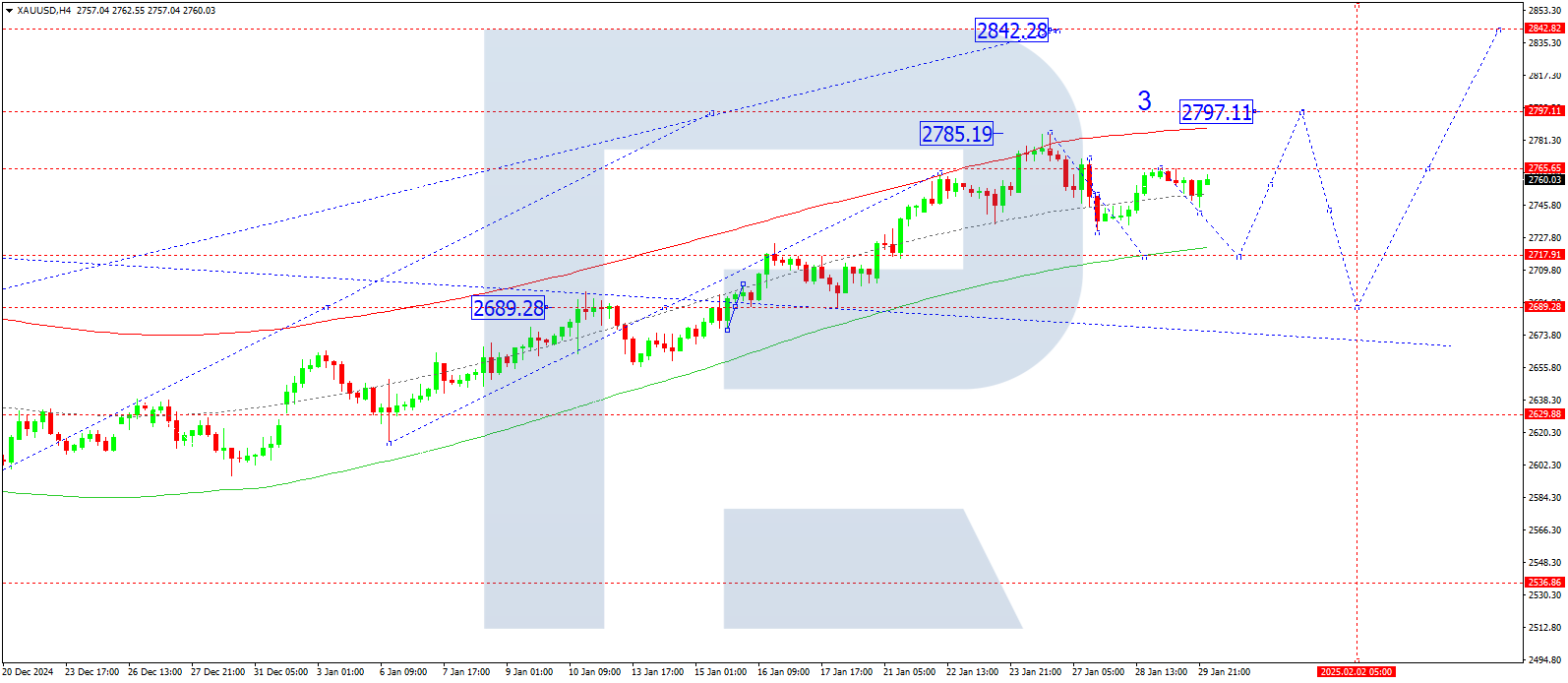

XAUUSD forecast

On the H4 chart, XAUUSD completed a downward wave to 2,730, followed by a correction to 2,765. The market has formed a consolidation range between these levels. On 30 January 2025, a decline to 2,720 is expected. If this level is breached, further movement towards 2,689 is likely. If the market breaks upwards, a rise towards 2,797 may follow.

Technically, this scenario aligns with the Elliott Wave structure and the growth wave matrix centred at 2,689. The market has completed a downward impulse to the central line of the price Envelope at 2,730. A breakout downwards could push the price towards the lower boundary at 2,689.

Technical indicators for today’s XAUUSD forecast suggest a potential decline to 2,720.

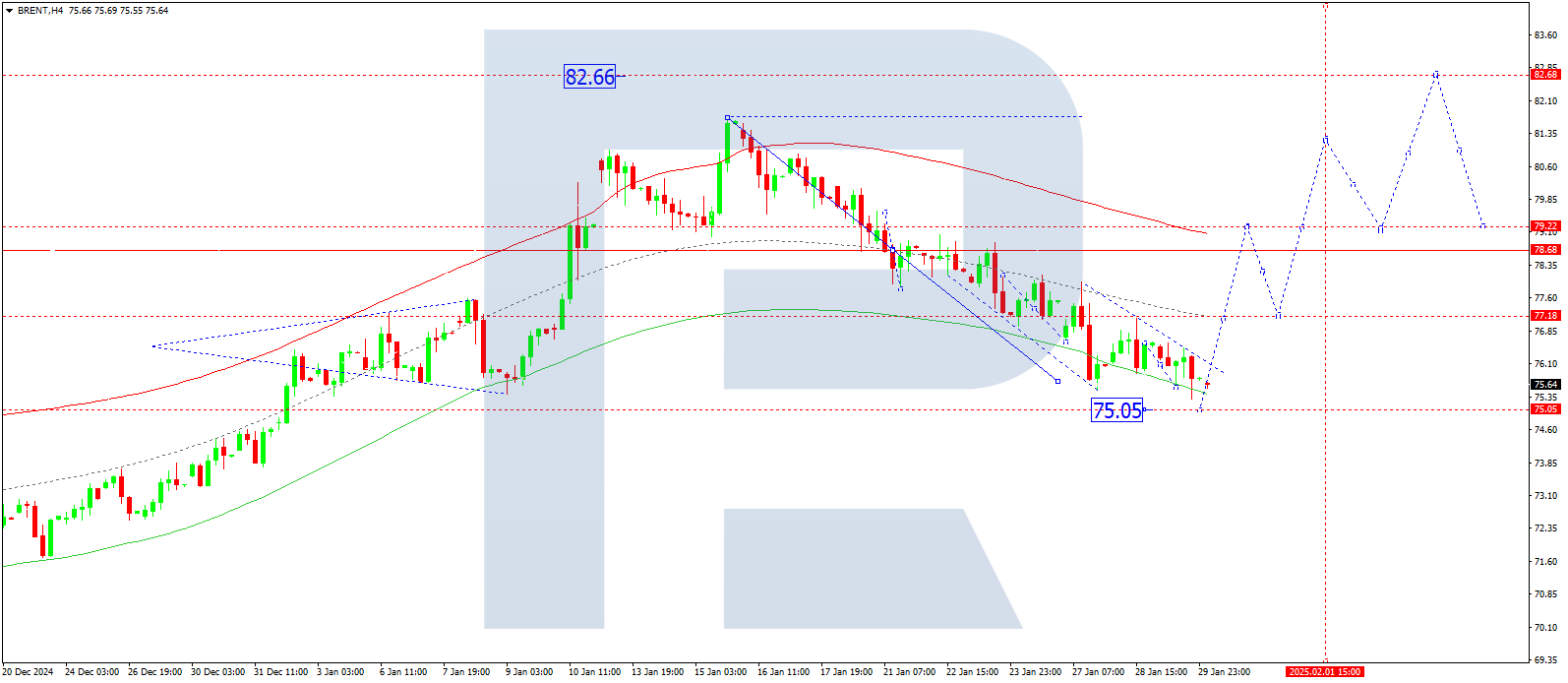

Brent forecast

On the H4 chart, Brent crude formed a consolidation range around 76.00. On 30 January 2025, a downward breakout towards 75.05 is possible. If the market breaks upwards, the upward wave is likely to continue towards 79.22 as the first target.

Technically, this scenario aligns with the Elliott Wave structure and the correction wave matrix centred at 78.68, which is key for Brent. The market completed a downward wave to the lower boundary of the price Envelope at 75.55, forming a consolidation range. A breakout upwards could push the price towards the central line at 79.22, with potential further movement towards 82.60.

Technical indicators for today’s Brent forecast suggest potential growth to 79.22.