EURUSD weekly forecast: euro yields to US dollar pressure

This week, EURUSD maintains a neutral-to-bearish tone amid strong U.S. economic data and weak Eurozone statistics. The Fed kept its rate at 4.5%, and Jerome Powell stated it's too early to discuss rate cuts, which supported the dollar. Rising U.S. Treasury yields and solid GDP and employment figures pressured the euro, while the Eurozone's Q2 GDP came in below expectations. The economic divergence continues to favor the dollar. The DXY index remains near two-month highs (around 100), and EURUSD is trading below 1.1440 but still above 1.1390. The market is now focused on upcoming U.S. labor and inflation data, which will shape expectations for Fed policy and the short-term direction of the pair.

EURUSD forecast for this week: quick overview

- Market focus:

Markets continue to price in tighter US trade policy. Donald Trump confirmed a base tariff of 10% and introduced retaliatory duties of up to 41% on goods from countries without a trade agreement with the US. This boosted demand for the dollar as a safe-haven asset. Additional support for the USD came from strong PCE data and a revised rate forecast: the market no longer expects a September rate cut.

In Europe, macroeconomic statistics remain restrained: the eurozone's quarterly GDP rose by only 0.1%, and business indices suggest ongoing pressure. This limits the euro’s recovery potential, despite stabilised inflation expectations.

- Current trend:

The EURUSD pair maintains its downward momentum. The pair ended the week at 1.1415, losing over 200 points in a few days. Pressure intensified after the 30 July Fed meeting, where the regulator left the rate unchanged and gave no clear signals on easing policy. The dollar's strength coincided with a sharp shift to safe-haven assets.

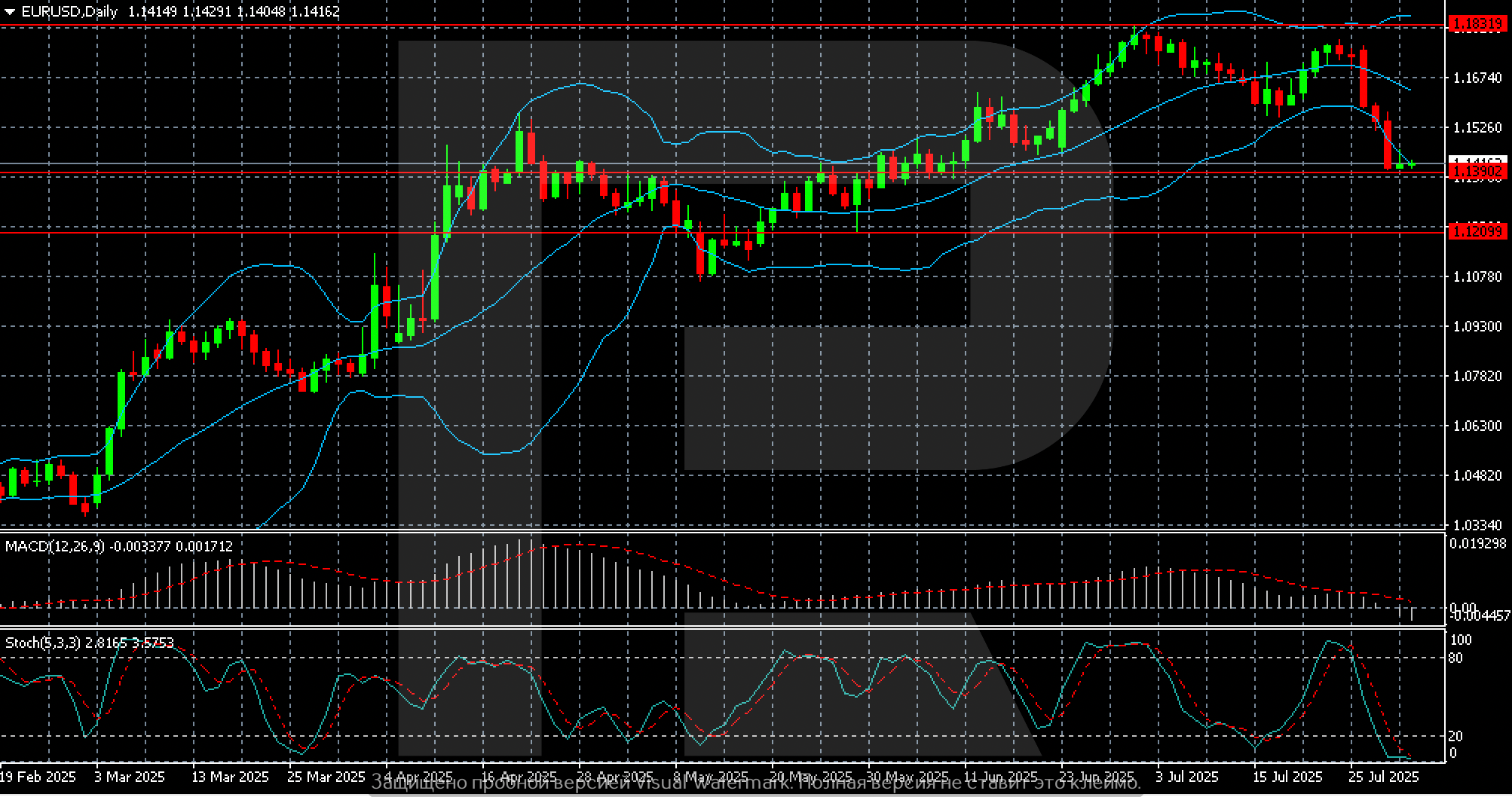

Technically, the pair consolidated below 1.1550 and tested the 1.1390 zone. MACD and Stochastic indicators show continued seller pressure, but oversold conditions raise the chance of a local rebound.

- EURUSD forecast for 4-8 August 2025:

The baseline scenario suggests a consolidation in the 1.1390-1.1500 range, with rebound potential due to local overselling. A breakout below 1.1390 could drive the pair towards 1.1210. Sustained recovery is possible only with a return above 1.1550.

EURUSD fundamental analysis

The EURUSD rate is hovering at 1.1410, under pressure from a strong dollar and weak eurozone macroeconomic data. Several factors boosted demand for USD.

US President Donald Trump signed an order introducing a global base tariff of 10% and additional duties of up to 41% on imports from countries without trade agreements with the US, including India, Canada, and Taiwan. These measures intensified global trade tensions and supported the dollar as a safe-haven asset. A 40% tariff was also imposed on goods suspected of bypassing restrictions via third countries.

The July Fed meeting held no surprises, with the rate remaining flat at 4.50%. Jerome Powell made it clear that it is too early to discuss potential cuts and provided no specific guidance. This reinforced expectations that a hawkish stance would continue over the coming months, despite market forecasts of a 25-35 basis-point rate cut by year-end.

Key US macro data releases further strengthened the dollar. Q2 GDP grew by 3%, beating the expected 2.5%. PCE prices – the Fed’s preferred inflation metric – also exceeded expectations, with the core index up 0.3% m/m and 2.8% y/y. According to ADP, the private sector added 104 thousand jobs, above the expected 77 thousand, indicating a resilient labour market. Additionally, weak data on pending home sales and home prices (Case-Shiller) were also published but had a limited impact on the exchange rate.

Against this backdrop, the euro came under pressure. Eurostat reported that the eurozone’s GDP in Q2 grew by only 0.1% q/q and 1.4% y/y. Business climate and economic sentiment indices declined, and inflation signals remain weak. All this reduces the likelihood of hawkish rhetoric from the ECB in the coming weeks.

EURUSD technical analysis

On the daily chart, the EURUSD pair remains under pressure, declining towards 1.1390. Since late July, downward movement has accelerated due to a stronger dollar and revised Fed rate expectations. The price has confidently exited the previous upward channel (in place since spring) and consolidated below the middle Bollinger Band. The support level is located at 1.1390. A breakout would open the path to 1.1210. Resistance levels are at 1.1550 and 1.1670. Only a return above these levels can restore a bullish outlook.

MACD shows a stable bearish trend: the histogram is in negative territory, and the signal line points down. The Stochastic remains in the oversold zone, indicating a potential rebound attempt, but offers no clear reversal signal. The Bollinger Bands have widened, signalling elevated volatility and sustained downward pressure.

The technical picture remains negative. While the pair trades below 1.1500, sellers have the advantage. A breakout below 1.1390 will strengthen the downward impulse, with the next target near 1.1210. Recovery is only possible with a return above 1.1550.

EURUSD trading scenarios

The EURUSD outlook for the upcoming week is neutral with a dollar bias.

Fundamentally, the euro remains under pressure due to contrasting macro data: the eurozone economy shows signs of slowdown, while strong US GDP, inflation (PCE), and labour market reports strengthen the dollar’s position. New US tariffs on countries without trade agreements also support the USD as a safe-haven asset. Technically, the pair settled below 1.1550, and the market structure signals bearish dominance.

- Buy scenario:

Long positions are possible only if the pair stabilises above 1.1440 and reversal signs form on the daily chart – for example, a double bottom or bullish oscillator divergence.

The target is to return to the 1.1500-1.1550 area. A breakout higher could open the path to 1.1660.

Stop-Loss is below 1.1390. A downward breakout would confirm continued downward pressure.

- Sell (short) scenario:

If the pair falls back below 1.1440 and no reversal signals appear, it is worth considering short positions based on the current downtrend. Technical indicators (MACD and Stochastic) remain in the sell zone, supporting the scenario of continued pressure.

The target is 1.1390 and then 1.1210 if the move accelerates.

Stop-Loss is above 1.1500. A breakout could signal consolidation or reversal.

Summary

The euro remains under pressure from strong US data and rising Treasury yields. The July Fed meeting left the rate unchanged, but Powell’s comments and fresh PCE data lowered expectations for early easing. Additional pressure on the euro came from weak eurozone GDP and US ADP job data that exceeded forecasts by nearly 50%.

Amid global risk repricing, demand for the dollar strengthened, pushing the EUR below 1.1440.

In the coming days, the pair’s dynamics will depend on US labour market data and further statements from Fed officials. While progress in US-EU trade negotiations could ease the drag on the euro, its impact remains limited for now.

The key support level is 1.1390. A breakout would open the way to 1.1210. If the EURUSD pair holds above 1.1440 and a reversal signal appears, a correction towards 1.1550 and then 1.1660 is possible. Until that happens, the market structure remains bearish.