ExxonMobil stock outlook: shares poised to reach 150 USD as oil prices climb

The recent rise in oil prices has sparked renewed interest in ExxonMobil shares among market participants. Persistently elevated commodity prices could support the company’s financial performance and help drive XOM stock towards the 150 USD level.

Exxon Mobil Corporation’s (NYSE: XOM) Q1 2025 report revealed a 6% decline in net profit due to falling refining margins and weakness in petrochemicals. Despite higher production and stable revenue, earnings per share fell by 15%. The company’s main challenges are linked to worsening market conditions and rising operating costs.

However, escalating conflict in the Middle East has pushed oil prices higher, in turn boosting investor interest in ExxonMobil. As a result, XOM shares have approached their historical high of 123 USD. If WTI crude remains above 70 USD per barrel, ExxonMobil stock has the potential to break past this record and reach 150 USD.

This article examines Exxon Mobil Corporation, outlines its revenue streams, and summarises its Q1 performance for the 2025 financial year. A technical analysis of XOM is also included, forming the basis for a forecast of ExxonMobil shares for the 2025 calendar year.

About Exxon Mobil Corporation

Exxon Mobil Corporation is an American oil and gas company and one of the largest in the world by revenue and market capitalisation. It was founded in 1999 following the merger of Exxon and Mobil, both of which trace their origins to Standard Oil, established by John D. Rockefeller in 1870.

The initial public offering (IPO) was held in 1920 by Standard Oil of New Jersey – the predecessor of Exxon – on the New York Stock Exchange (NYSE) under the ticker ESJ.

Following the 1999 merger of Exxon and Mobil, the newly formed Exxon Mobil Corporation began trading on the NYSE under the ticker XOM, which it continues to use today.

Exxon Mobil Corporation is engaged in the exploration, production, refining and sale of oil, gas, and petroleum products, as well as the manufacture of petrochemicals. Its main competitors include Chevron (NYSE: CVX), Shell (NYSE: SHEL), BP (NYSE: BP), and TotalEnergies (NYSE: TTE).

Image of the company name Exxon Mobil CorporationExxon Mobil Corporation’s business model

Exxon Mobil Corporation’s business model spans the entire value chain of the oil and gas industry and is divided into five core segments, each contributing to revenue generation:

- Upstream: This segment encompasses the exploration, field development, and production of crude oil, natural gas, and liquefied natural gas (LNG) worldwide. Revenue is generated through the sale of extracted hydrocarbons to both internal refining operations and external markets. When oil and gas prices are high, this segment becomes a key driver of profit

- Energy Products: This segment encompasses the refining of crude oil at ExxonMobil’s refineries, along with the sale of a broad range of petroleum products, including petrol, diesel, kerosene, fuel oil, marine fuels, and others. It also includes the management of a retail network of service stations operating under the Exxon, Mobil, and Esso brands. Income depends on refining margins, logistics costs, and market demand for fuels. The segment also includes a share of global energy trading activities

- Chemical Products: This segment involves the production and sale of basic and intermediate petrochemical products, including ethylene, propylene, polyethylene, PET, alcohols, plasticisers, and other chemicals. These materials are used in packaging, construction, textiles, and the automotive and electronics industries. The segment’s profitability is cyclical, influenced by global economic demand, feedstock prices, and competition from Asia and the Middle East

- Specialty Products: This segment covers the production and sale of high-value-added petroleum products, including synthetic lubricants, motor oils, industrial greases, waxes, and other speciality items. It is a less capital-intensive but higher-margin business focused on stable B2B and B2C demand, including from automotive manufacturers, industrial firms, and the transport sector

- Corporate and Financing: This segment encompasses corporate functions, including management, IT, and strategic planning, as well as research and development (R&D) spending and financial operations – including debt servicing, hedging, and liquidity management. This segment does not generate revenue but reflects corporate-level expenses and internal cost allocations across other segments

Exxon Mobil Corporation Q1 FY2025 report

On 2 May 2025, Exxon Mobil Corporation released its results for Q1 of the 2025 financial year, which ended on 31 March 2025. Key financial figures compared to the same period last year are as follows:

- Revenue: 83.13 billion USD (0%)

- Net profit: 7.71 billion USD (-6%)

- Earnings per share: 1.76 USD (-15%)

- Operating margin: 15% (-90 basis points)

Revenue by Segment:

- Revenue Upstream: 11.28 billion USD (+41%)

- United States: 7.32 billion USD (+234%)

- Non-US.: 3.96 billion USD (+12%)

- Revenue Energy Products: 59.96 billion USD (-4%)

- United States: 23.88 billion USD (-4%)

- Non-US.: 36.08 billion USD (-8%)

- Revenue Chemical Products: 5.41 billion USD (-8%)

- United States: 2.02 billion USD (-8%)

- Non-US.: 3.38 billion USD (-7%)

- Revenue Specialty Products: 4.39 billion USD (-4%)

- United States: 1.37 billion USD (-7%)

- Non-US.: 3.02 billion USD (-4%)

The financial report reflects mixed performance. Despite stable revenue of 83.13 billion USD, virtually unchanged from the same period last year, the company recorded a 6% decline in net profit and a sharper 15% drop in earnings per share. The main pressure on results came from a sharp deterioration in margins within the Energy Products segment.

Falling global product spreads, particularly in Asia, led to a nearly 40% decline in profit from this division compared to the same period a year earlier. This was driven by rising costs, overcapacity in the refining industry, and weakening market demand. A similar situation occurred in the Chemical Products segment, where a combination of higher feedstock costs and lower sales volumes resulted in a more than threefold decline in profit.

An additional drag came from increased operating expenses, including depreciation and production costs, particularly in the Upstream segment – partly due to the integration of assets from Pioneer Natural Resources. Losses in the Corporate and Financing segment also widened, reaching 798 million USD – mainly due to falling interest income, adverse currency movements, and rising pension obligations.

Nevertheless, the Upstream segment showed resilience, with profit up 19% on the back of higher oil and gas production, favourable gas pricing, and a positive contribution from term contracts. Output reached 4.55 million barrels of oil equivalent per day – a 20% increase year-on-year.

The company maintains strong operating cash flow of 12.95 billion USD, supporting the ongoing funding of capital expenditures, dividends, and its share buyback program.

Overall, the report highlights strength in upstream operations and cash flow resilience but also underscores margin pressure and subdued demand in refining and chemicals. If these trends persist, they may weigh further on upcoming quarterly results.

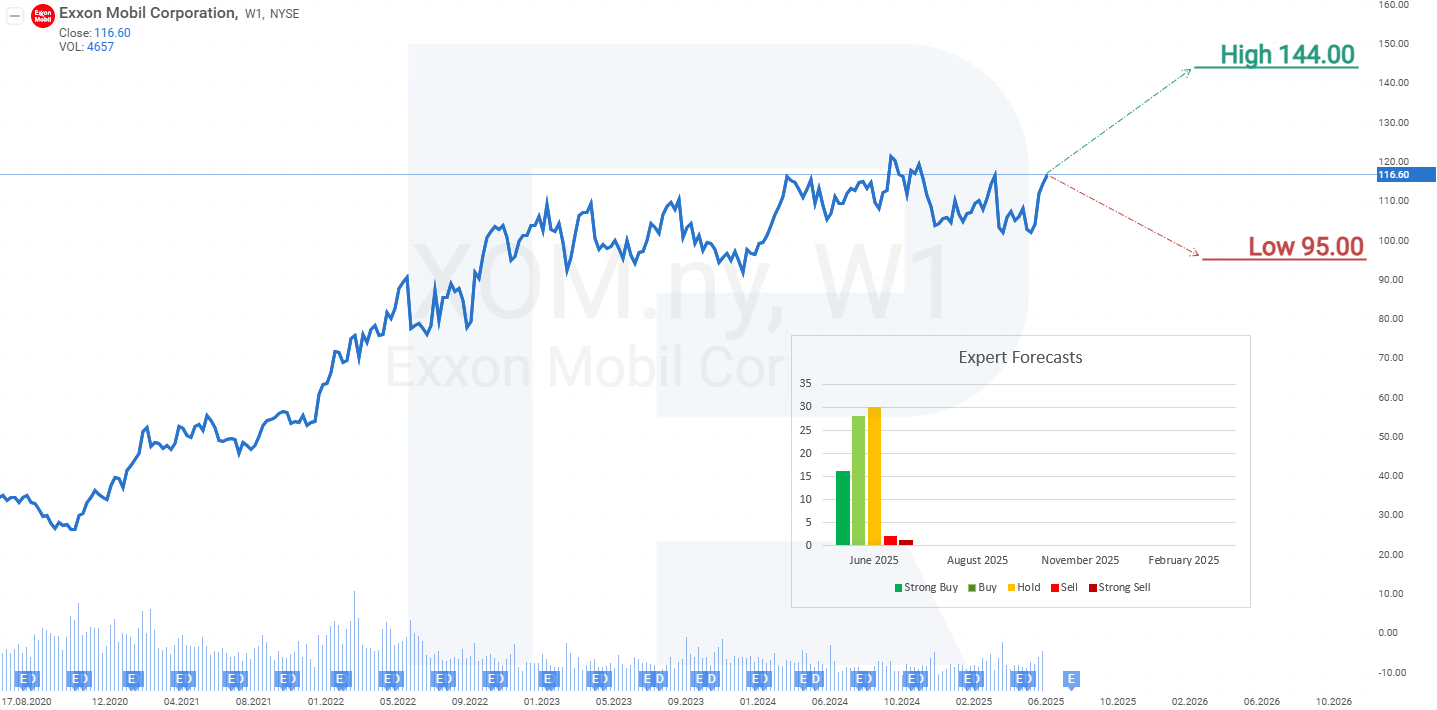

Expert forecasts for Exxon Mobil Corporation stock

- Barchart: 14 out of 24 analysts rated XOM as a Strong Buy, one as a Moderate Buy, eight as Hold, and one as a Strong Sell. The highest target price on the upside is 140 USD, while the lowest (sell-side target) is 95 USD.

- MarketBeat: 11 out of 22 analysts issued a Buy rating, 10 recommended Hold, and one advised Sell. The most optimistic target price is 144 USD, while the lowest is 105 USD.

- TipRanks: eight of the 14 surveyed analysts rated the stock as a Buy, and six recommended Hold. The maximum upside target price is 140 USD, with a downside target of 105 USD.

- Stock Analysis: two out of 17 analysts rated the shares as a Strong Buy, eight as Buy, six as Hold, one as Sell, and one as a Strong Sell. The highest target price is 138 USD, with the lowest at 105 USD.

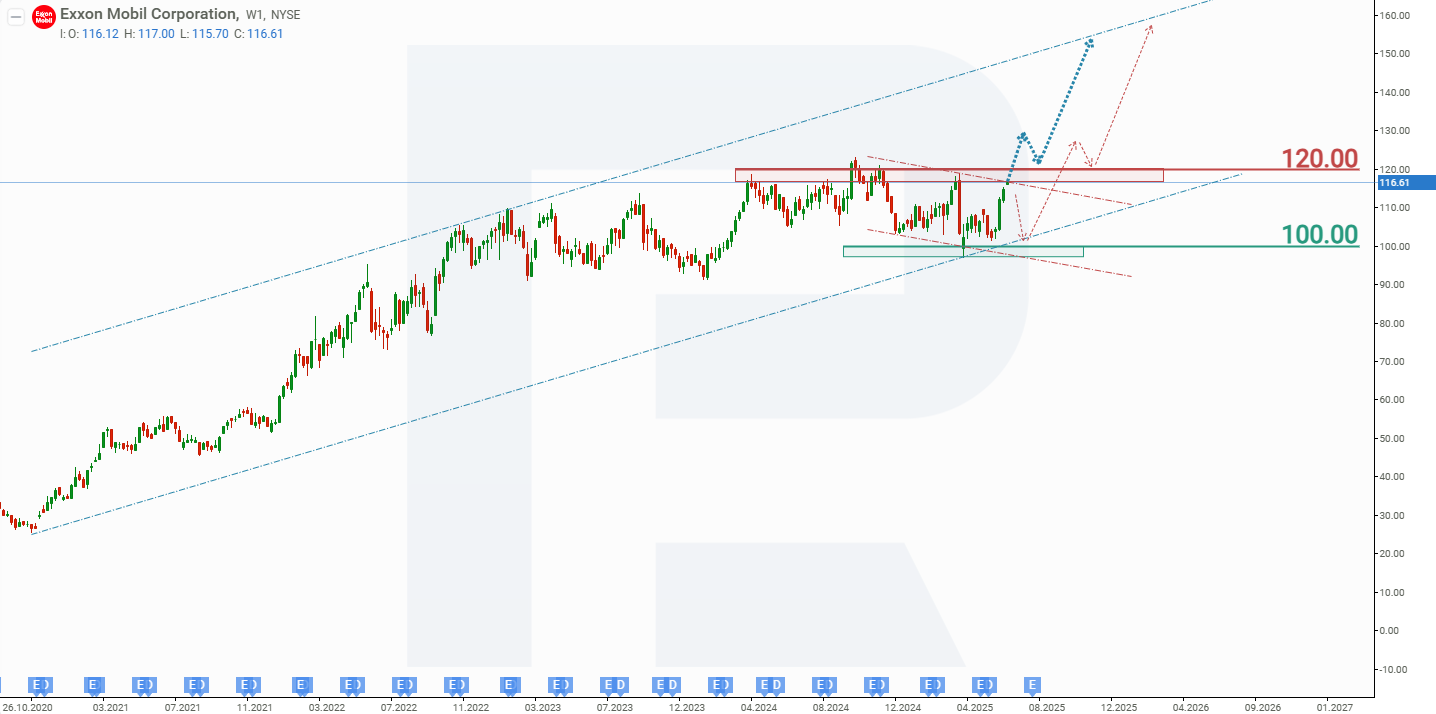

Exxon Mobil Corporation stock price forecast for 2025

On the weekly timeframe, ExxonMobil shares are trading within an upward price channel. Since April 2024, XOM has been in a phase of sideways consolidation within a range of 100 to 120 USD. For the prevailing uptrend to resume, the stock would need to break above the resistance level at 120 USD. Based on the recent performance of XOM stock, the possible scenarios for its price movements in 2025 are as follows:

The base case forecast for ExxonMobil stock anticipates a breakout above the 120 USD resistance level, which would act as a potential catalyst for further upside towards the upper boundary of the channel at 150 USD. This scenario is supported by ongoing geopolitical tensions in the Middle East, which could drive global oil prices higher and thereby support ExxonMobil’s revenue and profit growth.

The alternative forecast for ExxonMobil shares suggests a rejection at the 120 USD resistance level. In this case, XOM could again test the support zone near 100 USD. A rebound from this level would serve as a potential signal for the end of the consolidation phase and a resumption of the stock’s long-term upward trend.

Exxon Mobil Corporation stock analysis and forecast for 2025Risks of investing in Exxon Mobil Corporation

Текст 8

Investing in Exxon Mobil Corporation shares involves several risks that could negatively affect the company’s revenue:

- Volatility in oil and gas prices: Energy prices remain overly sensitive to geopolitical events (particularly conflicts in the Middle East), OPEC+ decisions, and demand fluctuations in China. A sharp decline in prices, whether due to falling global demand or oversupply, could significantly reduce ExxonMobil’s income, especially in the Upstream segment

- Regulatory and political risks: Stricter environmental legislation in the US and other countries – including potential bans on exploration in sensitive regions, new emissions standards, and tighter regulation of refining – could increase operating costs or limit production capacity

- Litigation and ESG-related risks: The company faces lawsuits related to its climate impact and alleged misstatements in public emissions reporting. This creates reputational and financial risks, particularly as ESG-oriented investors gain influence

- Geopolitical instability and sanctions: ExxonMobil’s presence in politically unstable regions (Africa, the Middle East, and Latin America) leaves its operations exposed to sanctions, nationalisation, armed conflict, and supply disruptions

- Rising asset maintenance costs: Inflationary pressures, higher capital costs, and increased expenses for drilling services, equipment, and labour may reduce project margins and slow development

Taken together, these factors make ExxonMobil’s earnings vulnerable to both short- and long-term shocks despite its current financial resilience and global scale.