FedEx’s revenue decline: what it signals and how it affects the company’s stock

The reduction of the US Federal Reserve’s interest rate by 0.5% indicates that the country’s economy is slowing down, which could ultimately negatively impact the revenues of logistics companies. On 19 September 2024, FedEx Corp (NYSE: FDX) published a quarterly report that fell short of expectations, causing the company’s shares to fall by more than 15%. This signals serious challenges in the US economy, and if the situation worsens, FedEx’s revenue may continue to decline.

This article presents a fundamental analysis of FedEx, describes the company’s business model, and lists factors that could positively affect revenue. It also provides a technical analysis of FedEx stock, based on which a forecast for FedEx stock for 2024 has been prepared.

About FedEx Corp

FedEx Corp is an American logistics company founded in 1971 by Frederick Smith. The company provides worldwide express delivery, freight transportation, logistics, and e-commerce services. In 1978, it conducted an IPO on the NYSE, where its stock trades under the ticker FDX.

FedEx holds a leading position in the global logistics and delivery market. However, its market share varies depending on the region and delivery segment. Major players like Amazon Logistics, DHL, and United Parcel Service, Inc. (NYSE: UPS) are the company’s main competitors.

FedEx Corp business model

FedEx’s business model is based on providing logistics and transportation services, primarily express delivery and freight transportation. The company generates revenue from various segments of its business, catering to different client categories: individuals, small and medium-sized enterprises, and large corporations. The main sources of the company’s income are:

- FedEx Express: one of the key segments responsible for the fast delivery of parcels and documents worldwide. Revenue is generated through tariffs based on weight, distance, and delivery speed

- FedEx Ground: ground delivery of freight and parcels is usually slower but cheaper than air transportation. This segment is popular among small and medium-sized enterprises, as well as in the e-commerce sector

- FedEx Freight: this segment transports freight across the US and international routes. It is focused on large and heavy cargo

- FedEx Services: provides logistics and business solutions, including supply chain management, IT services, and e-commerce support for corporations

- FedEx Office: retail and business services, including document printing, mailbox rentals, and package handling and shipping at service points

The company reports on two segments – FedEx Express and FedEx Freight – while other divisions are categorised under “Other Income".

FedEx Corp's report for Q1 2025

On 19 September 2024, FedEx presented disappointing financial results for the past quarter. On the company’s website, this period is designated as the report for Q1 of the 2025 financial year, which ended on 31 August 2024. Below are the key financial indicators for this period compared to the same quarter of the previous year:

- Revenue: 21.60 billion USD (-0.5%)

- Net profit: 890 million USD (-26.0%)

- Earnings per share: 3.60 USD (-21.0%)

- Operating margin: 5.60% (-170 basis points)

Revenue by Segment:

- FedEx Express: 18.30 billion USD (-1.0%)

- FedEx Freight: 2.32 billion USD (-2.0%)

- Other and eliminations: 945 million USD (+9.0%)

- US market: 11.79 billion USD (-2.0%)

- International market: 5.67 billion USD (+1.0%)

A fundamental analysis of FedEx’s report shows that while the company has no revenue growth, its expenses are increasing. For example, transportation costs rose by 5% to 5.27 billion USD, and business optimisation expenses increased by 22% to 128 million USD. As a result, the company’s net profit decreased from 1.16 billion to 0.89 billion USD. Experts had predicted more substantial results: revenue was expected to be 21.96 billion USD, 360 million USD more, and earnings per share were forecasted at 4.86 USD compared to the actual 3.60 USD. After the data was published, FedEx’s share price fell by more than 15%.

A logistics company's lack of revenue growth is a worrying signal for market participants, as it may indicate a peak in the US economic growth.

On 23 July 2024, FedEx’s main competitor, United Parcel Service, published its Q2 2024 report, failing to meet forecasted indicators. Another factor contributing to a decline in economic activity is the US Federal Reserve’s decision to cut interest rates by 0.50% instead of 0.25%. Consequently, if the US economy has indeed peaked, FedEx will likely face challenging times ahead.

FedEx Corp’s forecast for the 2025 fiscal year

For the 2025 fiscal year, FedEx presented a cautious forecast, lowering expectations for revenue and profit. Key forecast points include:

- Revenue growth: more modest year-over-year revenue growth is expected, below the initial forecast that assumed a rise to higher single-digit figures.

- Earnings per share (EPS): FedEx adjusted the projected earnings per share to 17.90-18.90 USD, below previous expectations of 18.25-20.25 USD.

- Cost reduction: The DRIVE transformation program is expected to reduce fixed costs by 2.20 billion USD. This program involves investments in network optimisation, fleet modernisation, and improving operation efficiency.

FedEx is showing restraint in its forecasts, considering the current economic conditions, reduced demand, and a slowdown in industrial production.

Comments from FedEx Corp’s management

President and CEO Rajesh Subramaniam commented on the weak results for Q1 2025, pointing out three key factors negatively affecting revenue:

- Demand reduction: the primary reason for the weak figures was reduced demand for priority delivery services and increased orders for deferred (slower and cheaper) services. This led to a decline in overall revenue and operational performance.

- Operating expenses: higher operating costs and fewer working days negatively affected the quarterly results.

- Slowdown in industrial production: with industrial production continuing to decline, demand for logistics services has been negatively impacted.

Rajesh Subramaniam expressed cautious optimism about potential improvement in the industrial production sector in the second half of 2024. However, he emphasised that forecasts remain restrained, with FedEx anticipating low growth rates in this sector due to existing economic conditions.

Factors favouring investment in FedEx Corp stock

The recent FedEx report indicates the company’s performance over the past period; however, the situation may change in the upcoming period. Below are factors that could contribute to revenue growth and, accordingly, lead to an increase in the company’s share value:

- Interest rate reduction: this reduction has a broad impact on the economy and the company in particular.

- Reduction of borrowing costs: FedEx often uses loans to expand its operations. A decrease in the Federal Reserve’s interest rate will lead to lower borrowing costs, allowing FedEx to reduce debt servicing expenses and increase profitability.

- Stimulating economic growth: lower interest rates stimulate economic activity as loans for businesses and consumers become more accessible. This can lead to increased consumer spending and higher demand for delivery services.

- Rising corporate demand: when business clients gain access to cheaper loans, they can expand their activities and purchases, contributing to the growth of delivery volumes and FedEx’s logistics operations.

- DRIVE transformation program: this is FedEx’s strategic initiative to reduce operating expenses and increase efficiency. DRIVE includes restructuring the operational network, optimising air and ground transportation, reducing staff, and retiring old aircraft.

- Growth in international shipments: FedEx continues to expand its international logistics network, especially in Asia. The quarterly report shows that the international market is experiencing shipment growth, unlike the domestic US market.

- Strike at ports on the East Coast and Gulf of Mexico: the labour contract between the International Longshoremen’s Association (ILA) and the United States Maritime Alliance expires in September 2024. If negotiations are unsuccessful, ports could be closed as early as October. The strike will create significant delays in maritime transportation, prompting companies to seek alternative delivery routes, including air transport. FedEx heavily relies on air transport for cargo delivery; therefore, demand for its services could significantly increase. However, this income would be related to short-term profits and does not affect the company’s long-term activities.

Technical Analysis of FedEx Corp Shares

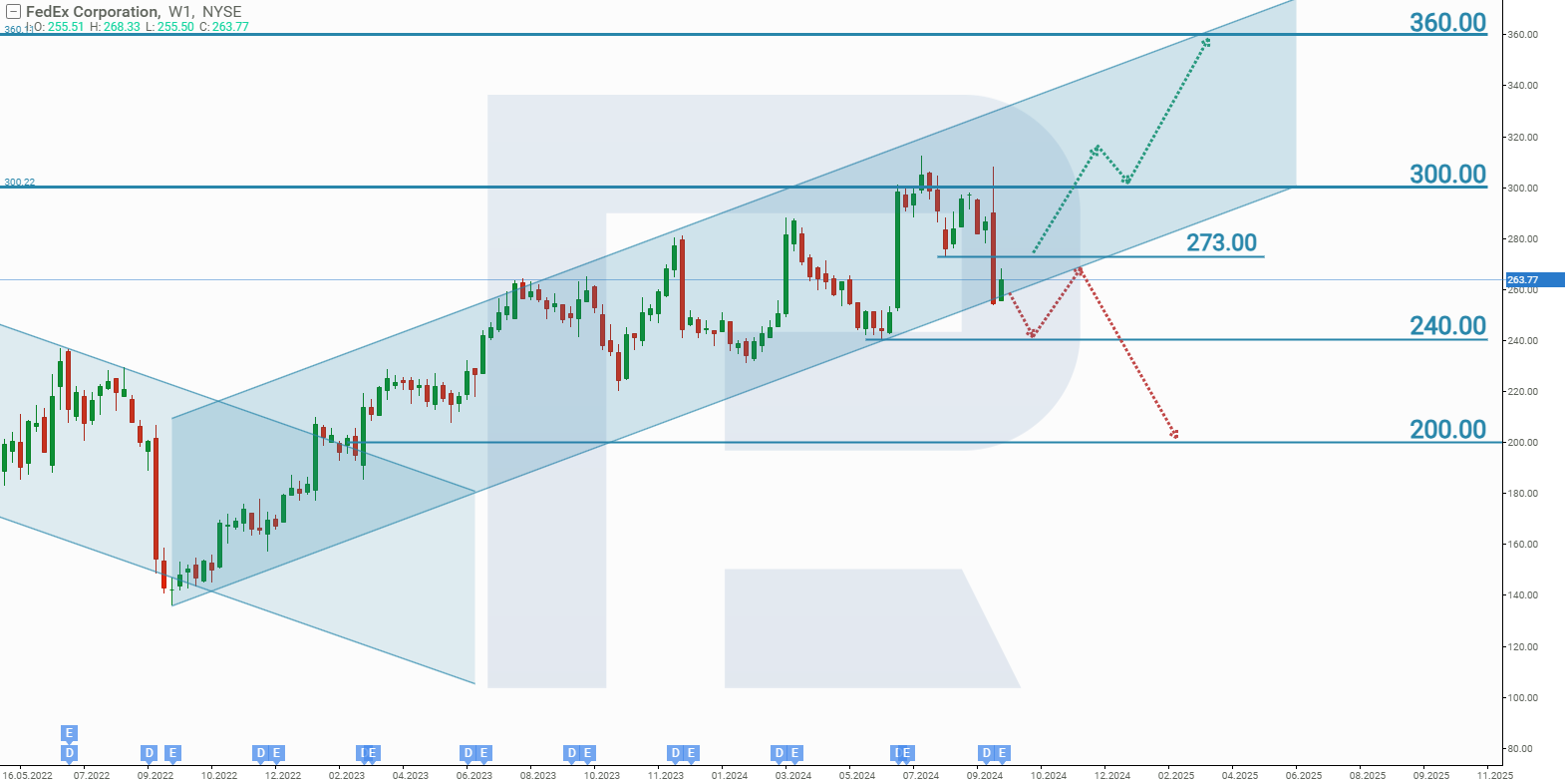

Since October 2022, FedEx shares have been trading within an upward channel. In June 2024, the share price reached a resistance level of 300 USD but failed to break through. Subsequent attempts to breach this resistance were also unsuccessful. The release of the quarterly report weakened the bullish sentiment, causing the price to drop to the trend line, which acts as support. Based on these price movements, two scenarios are possible:

The optimistic forecast for FedEx stock in 2024 suggests a break above the 273 USD resistance level, followed by growth to 300 USD. If this level is surpassed, the growth of FedEx shares within the ascending channel will continue, potentially pushing the price towards 360 USD.

The pessimistic forecast for FedEx stock in 2024 suggests breaking the trend line, testing support at 240 USD. If this support level does not hold, the price could drop to 200 USD.

The negative forecast for FedEx shares in October 2024 remains the primary expectation, as the company missed its forecasted targets last quarter and issued a weak forward outlook. Deteriorating economic conditions in the US are expected to impact FedEx’s revenue further, reinforcing negative sentiment among investors.

FedEx stock analysis and outlook for 2024Summary

FedEx’s primary revenue-generating market is the US. As a result, the company is in a situation where its efforts to sustain revenue growth may have a limited impact on earnings. If the US economy continues to slow, revenue from the Asian market will not likely offset losses in the US market. The upcoming quarter, as predicted by the company’s management, may prove challenging. However, the situation could improve if the US government takes steps to stimulate economic growth, as is currently happening in China.