Brent

On H4, after growth and a bounce off the fractal resistance level, the market is developing another wave of decline. While the first declining wave tested 23.6% Fibo, the next one will aim at 38.2% (61.85) and 50.0% (57.00). The resistance level remains at 77.47. If it is broken away, the quotations may rise to the fractal peak of 87.09.

On H1, the wave of decline is testing 61.8% Fibo. Upon testing this level, the decline will continue to 76.0% (69.54) and later — to the low of 67.46. A breakaway of this low will be the main confirmation of further development of the decline. A local short-term resistance level is at 76.14.

Dow Jones

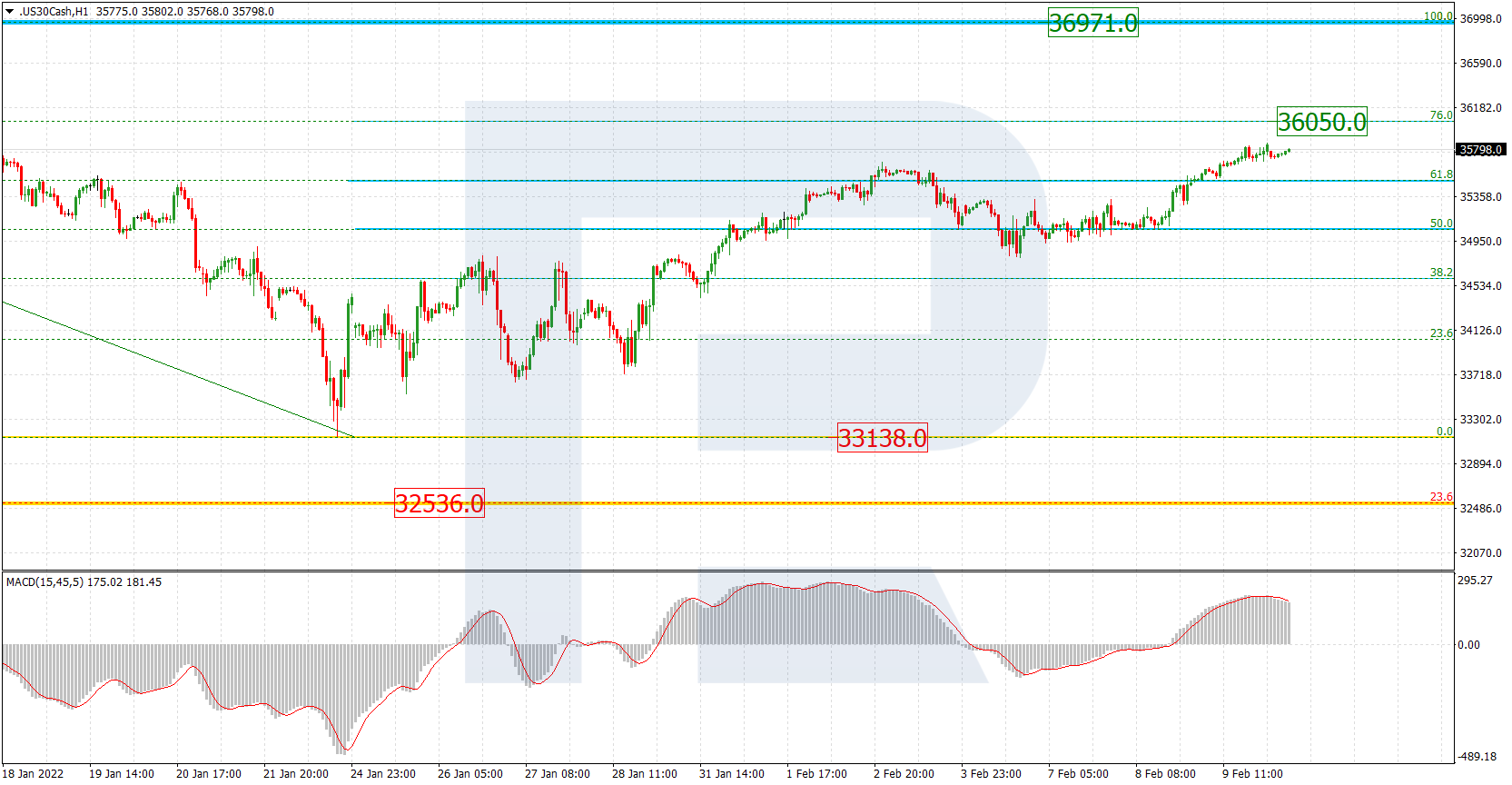

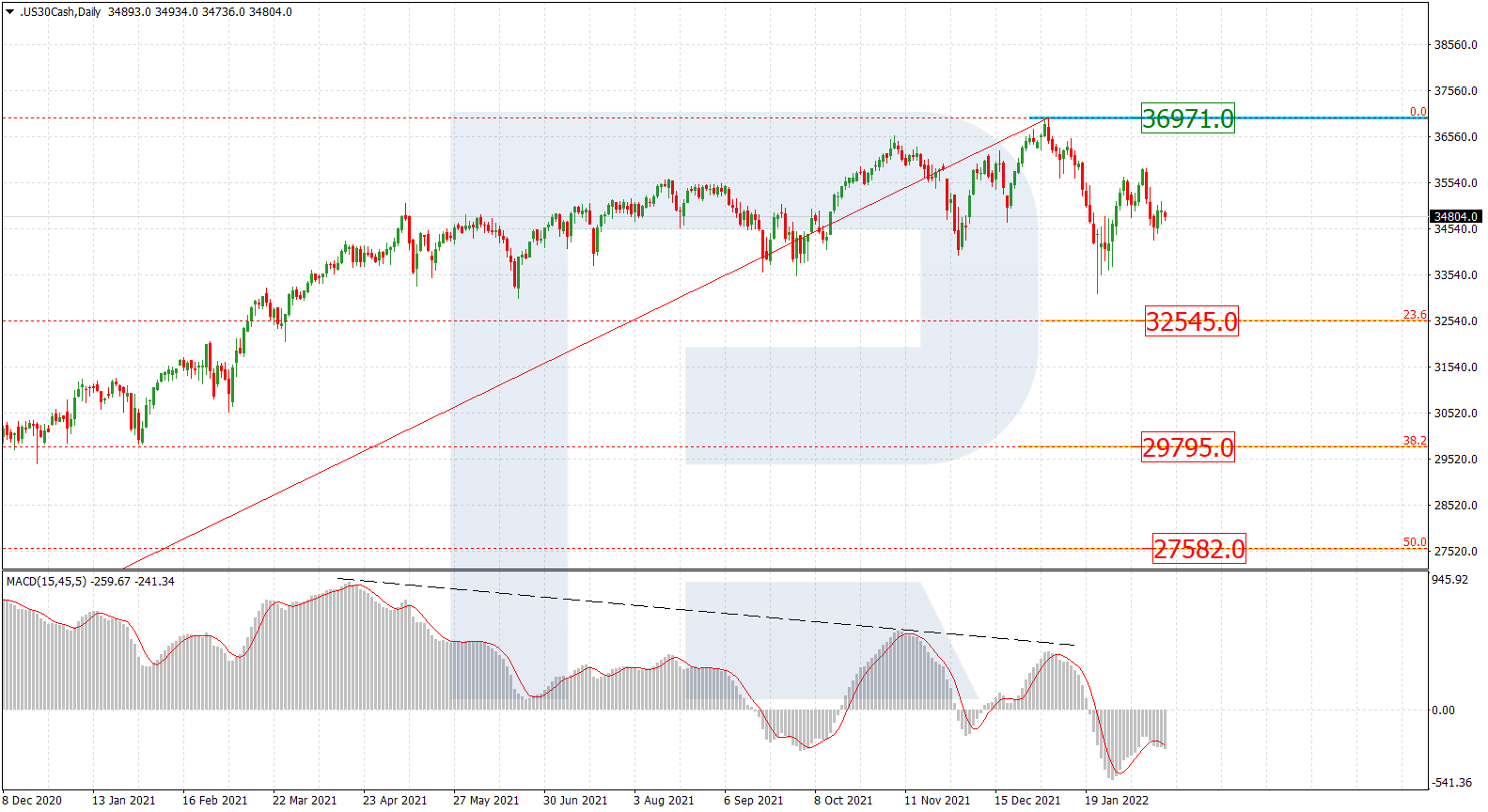

On D1, the market is trying to renew the highs but fails to do it as successfully as before. Such a technical picture might mean that a downtrend is likely to develop as a correction of the last wave of growth. The aims of the supposed decline are 23.6% (31172.0), 38.2% (28705.5), 50.0% (26694.0), and 61.8% (24682.0) Fibo. The last high of 35197.0 acts as the main resistance level.

On H1, there is bearish phase forming after a divergence. The first declining impulse reaches 23.6%, while the second one is trying to break through it a decline to 38.2% (34641.4), 50.0% (34470.0), 61.8% (34300.0), and 76.0% (34093.0) Fibo. However, the main goal of the decline will be the fractal support —the low of 33744.0.