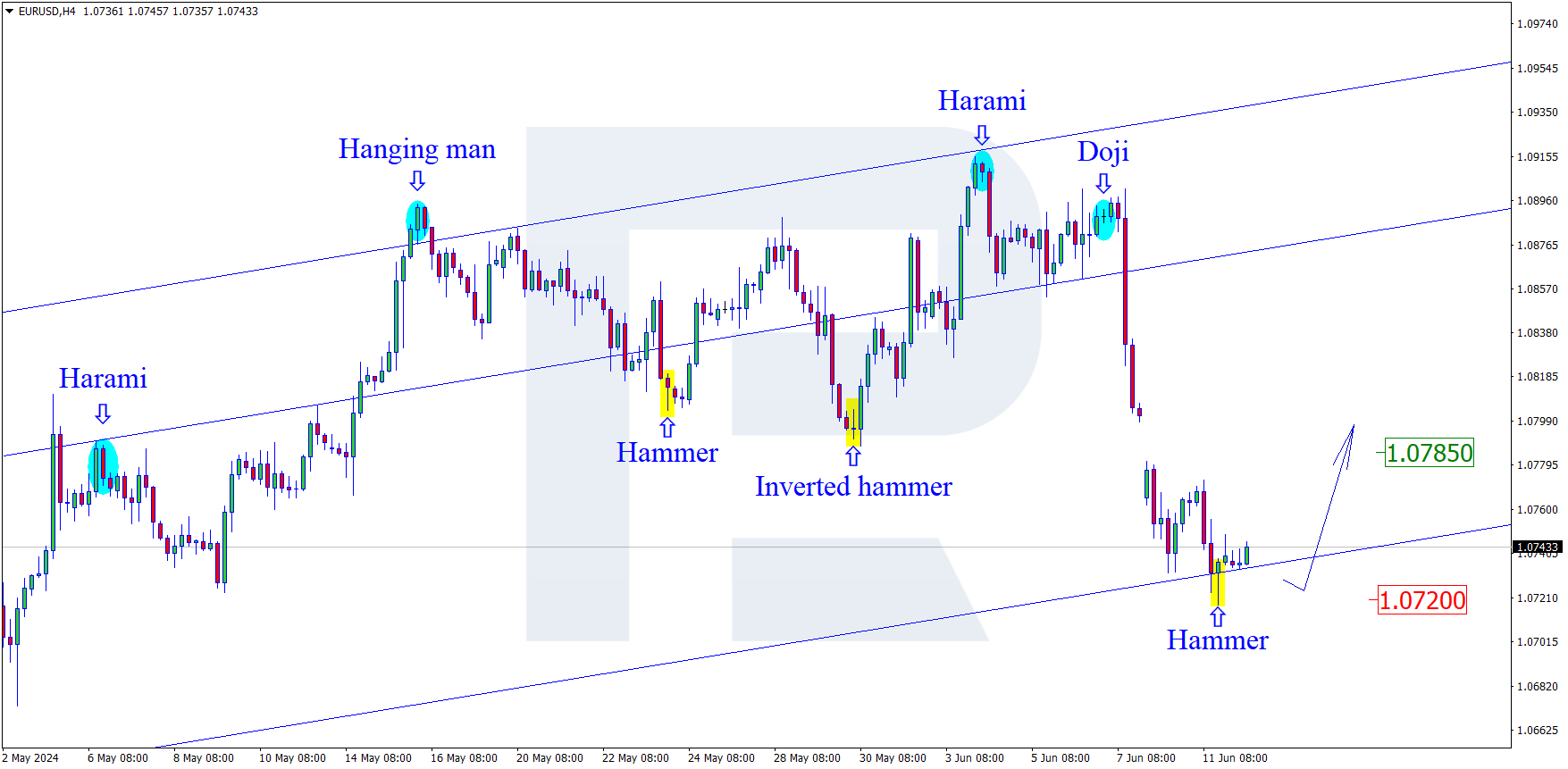

EUR/USD

On the H4-chart of EUR/USD we see a divergence being formed, but the current uptrend can be extended also. The descending correction which has started is moving towards the first Fibo level - 23.6% (1.1622 mark). The 38.2% and 50% Fibo levels (1.1525 and 1.1448 mark correspondingly) can be the next targets for this downward move.

The H1-chart confirms the analysis. A correction that happens after the divergence can in near term But if the current high (1.1776) is hit and broken, price can move higher towards the area of post-correction elongation 138.2 - 161.8% (a range of 1.1822 - 1.1854).

USD/JPY

The H4-chart of USD/JPY shows that after the descending correction of more than 61.8% of the previous impulse yet another impulse had been formed, and this new impulse got 38.2% of the downtrend. If price moves higher than the local high 112.11, this will suggest development of a new uptrend, and the 113.02 mark can be the nearest target for it (61.8% Fibo level). It is not improbable that a further downward move occurs. Therefore, the 110.16 mark can serve as the next target for the downward movement. This target corresponds to 76.0% Fibo level for the previous ascending impulse. Then an elongation towards 161.8% Fibo level is possible also which is measured from the last ascending microimpulse.

The H1-chart of USD/JPY confirms the senior timeframe's analysis.