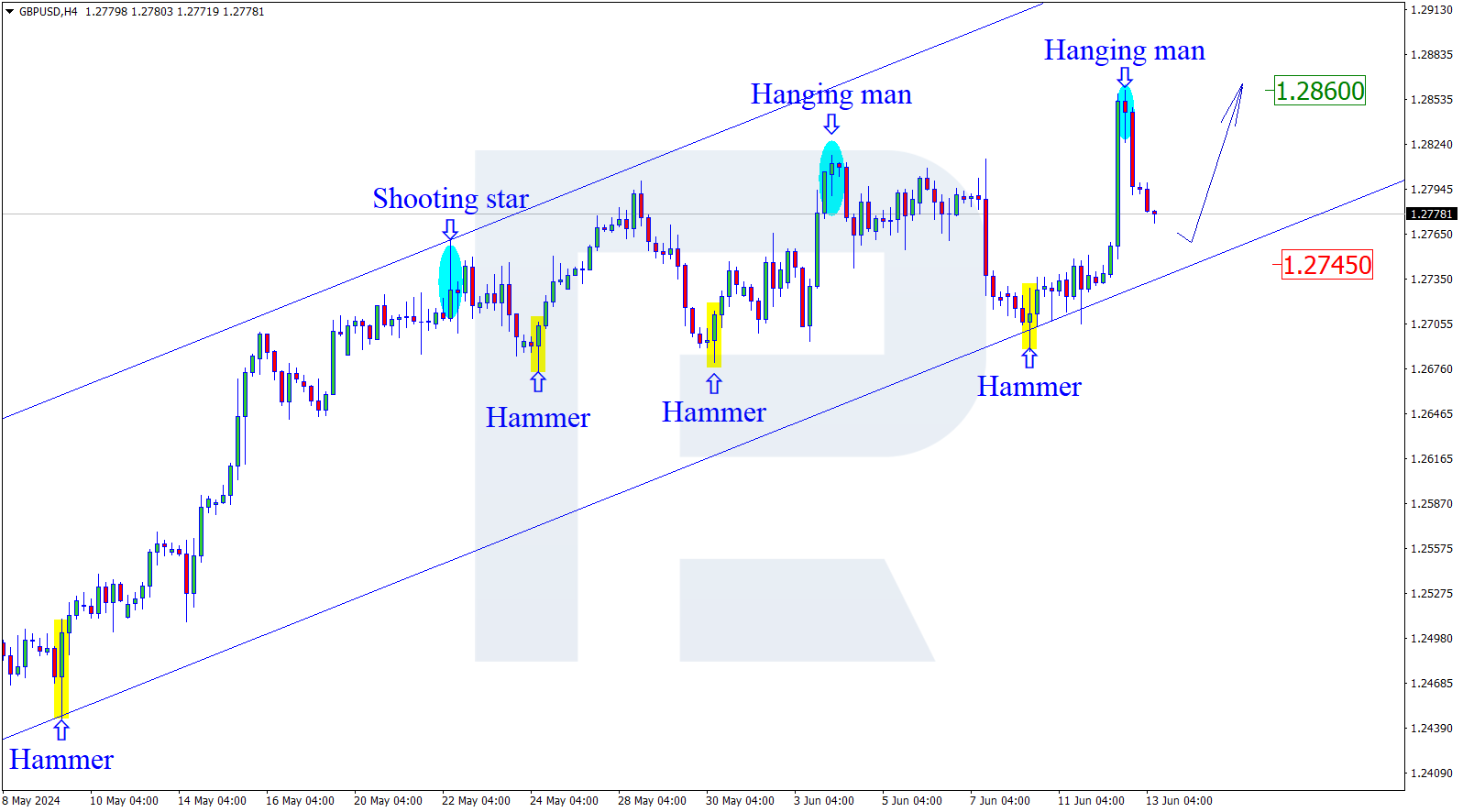

GBPUSD, "Great Britain Pound vs US Dollar"

On H4, the pair has been moving in a correctional decline for a fortnight, aiming at 61.8% (1.3991) Fibo. This decline is not characteristics for the highly volatile pair. This might turn into a wave of decline, aiming below the low of 1.3572, but this is quite an uncertain option, and the priority is a new impulse of growth to 76.0% (1.4086) , and perhaps the high of 1.4250. A breakaway of the low, in its turn, will let the market continue developing the medium-term correction phase to 38.2% (1.3419).

On H1, the descending correction of the previous wave of growth can be seen in more detail. The quotations are currently testing 38.2% Fibo. Further decline might aim at 50.0% (1.3778) and 61.8% (1.3729). On the MACD, there is a local convergence forming, which might be a warning of a soon end coming to the decline and a wave of growth starting towards the high of 1.3983.

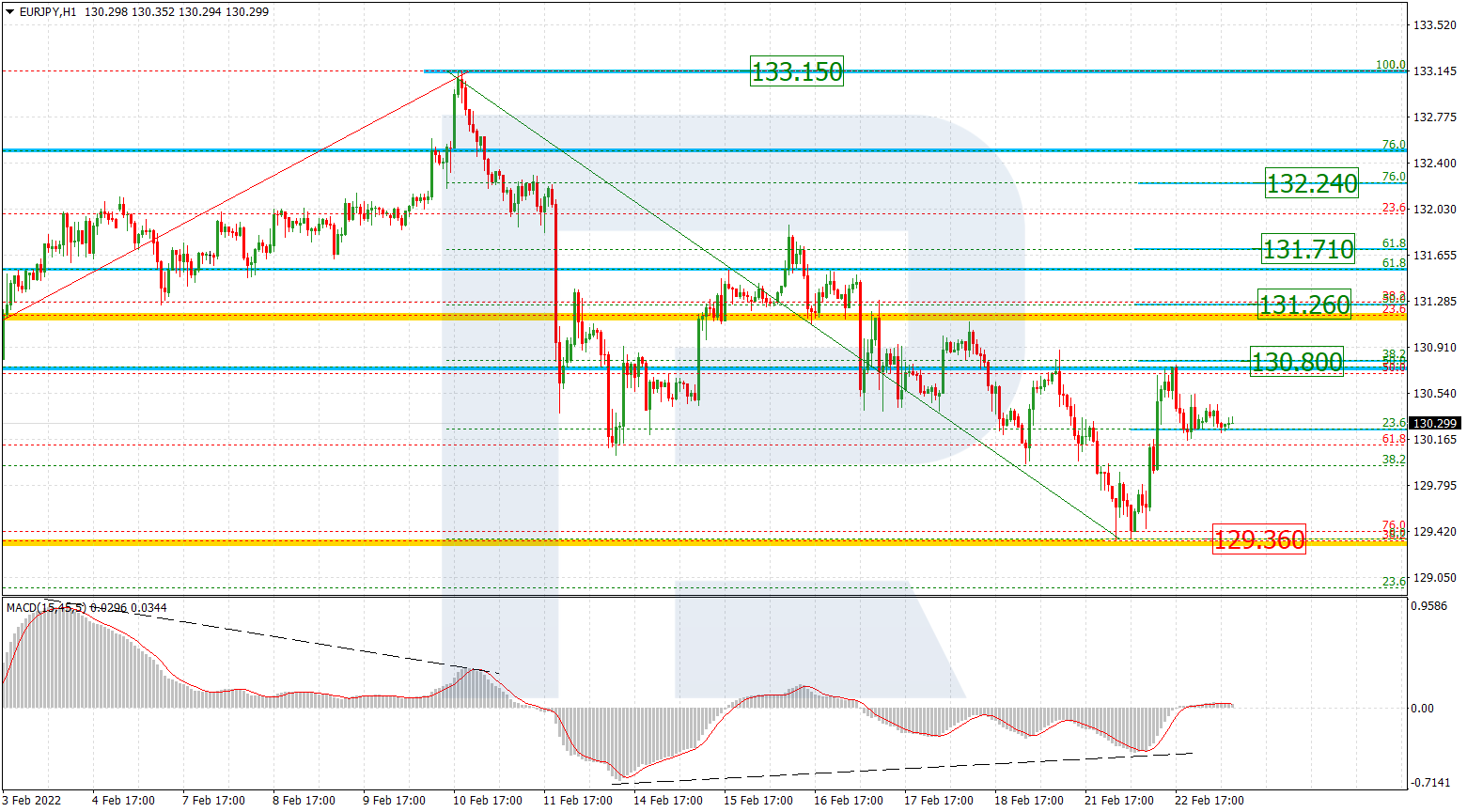

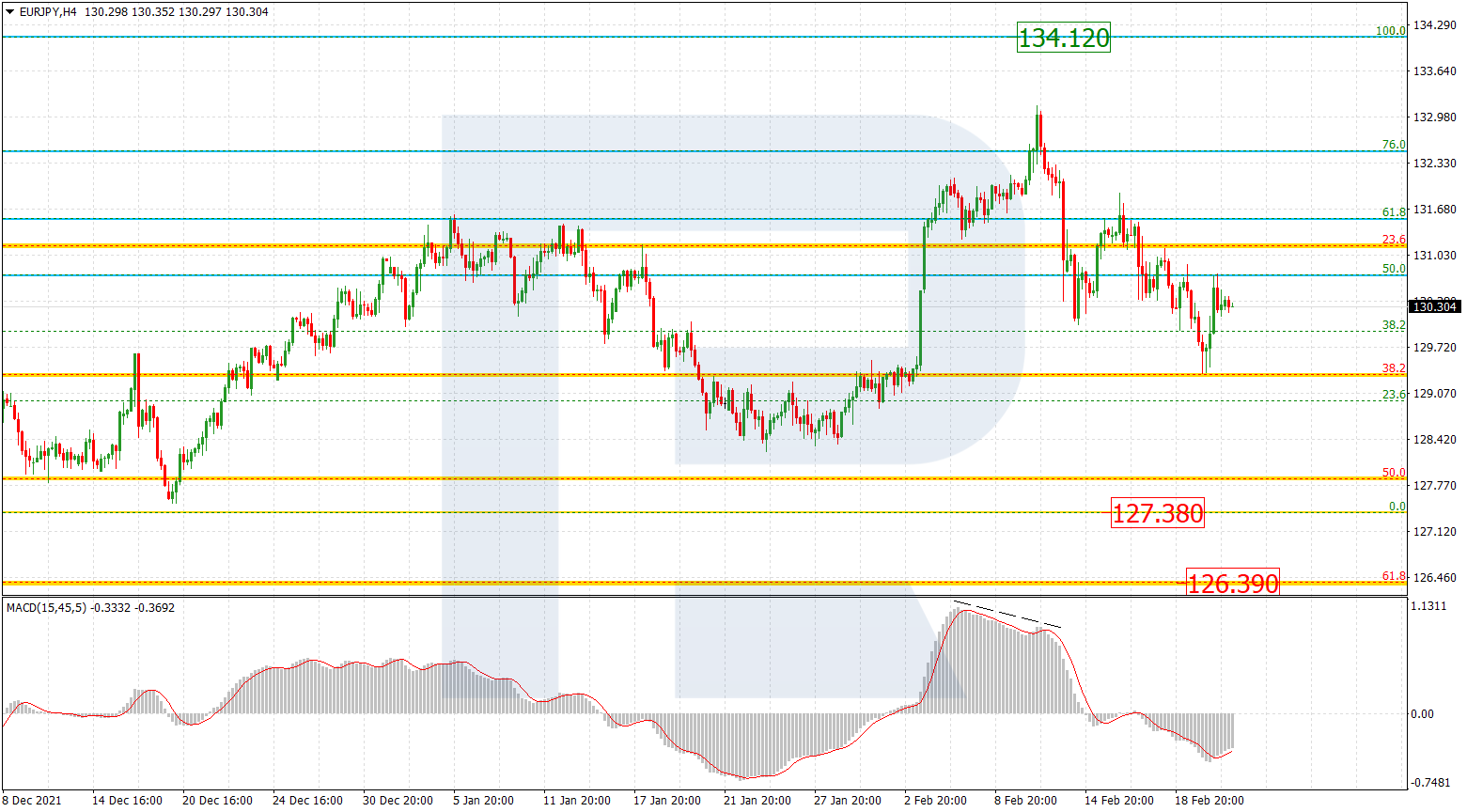

EURJPY, "Euro vs Japanese Yen"

On H4, the correction after a convergence is taking the appearance of a consolidation. With such a technical picture, it is highly probable that a new impulse of growth will start towards 38.2% (130.71) and 50.0% (131.37) Fibo regarding the previous decline. After the correctional growth is over, we may expect another wave of decline to break through the low of 128.60 and head for the medium-term level of 50.0% (127.87).

On H1, the descending after a divergence reached 61.8% but failed to go on falling to 76.0% (129.07) Fibo. Further growth of the quotations will aim at the high of 130.56.