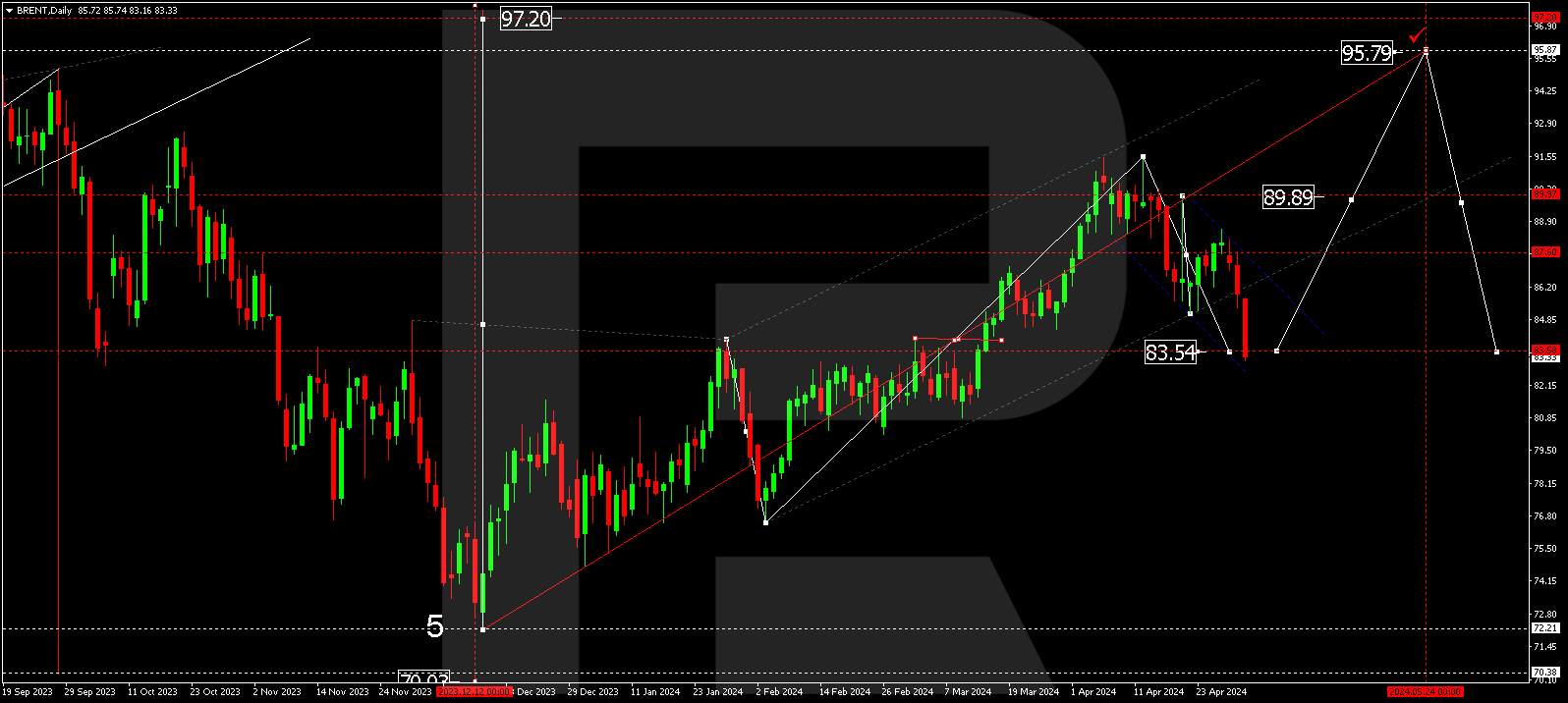

Brent

In the daily chart, after breaking the long-term 76.0% fibo and then reaching 75.70, Brent continues growing towards the long-term high at 87.09. However, a divergence on MACD may indicate a possible pullback or even a reversal.

As we can see in the H1 chart, the asset is correcting after finishing the previous ascending impulse. A divergence in making the pair fall towards 23.6%, 38.2%, and 50.0% fibo at 73.06, 71.42, and 70.09 respectively. On the other hand, a breakout of the resistance at 75.70 may result in a further uptrend.

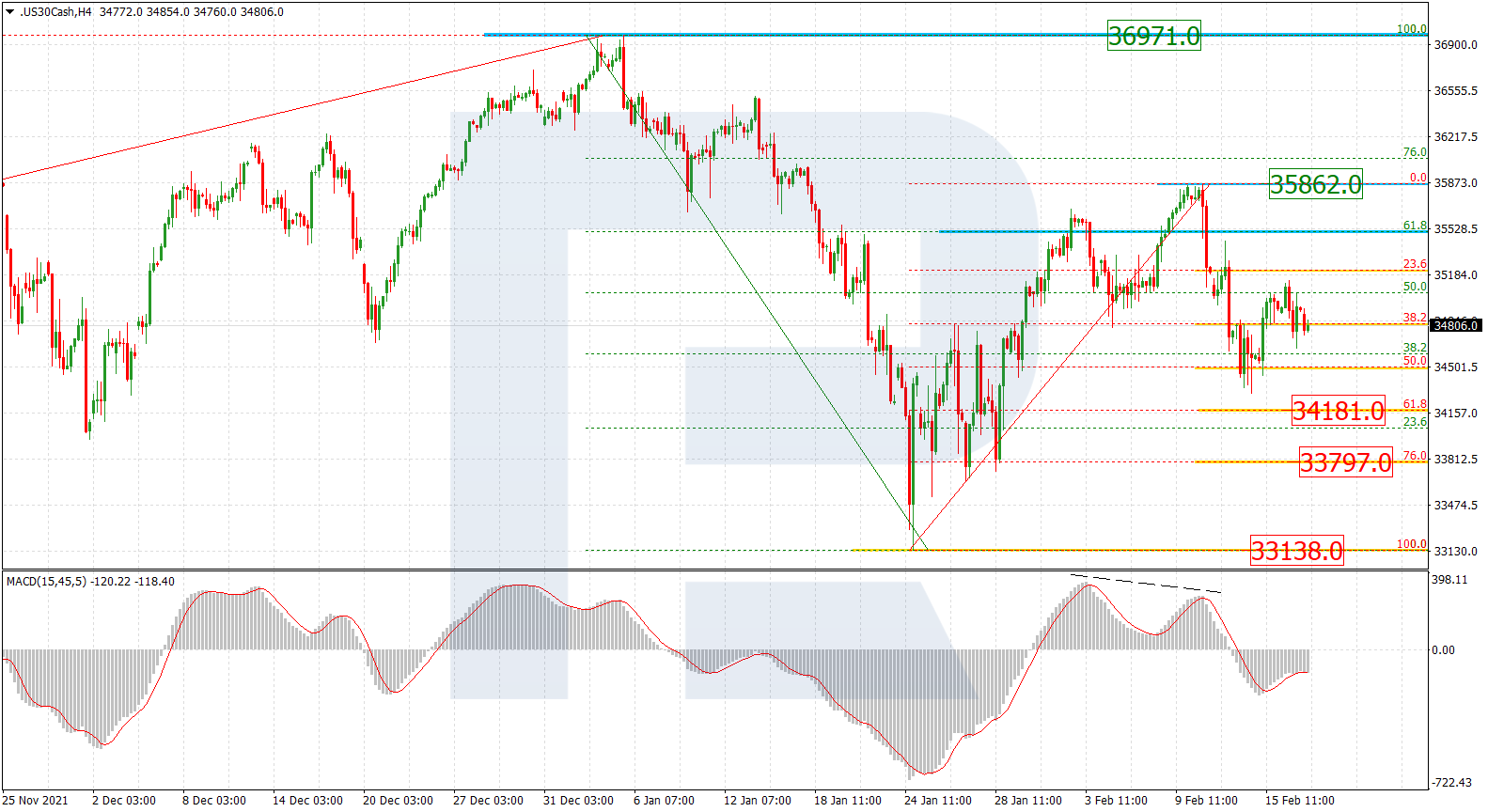

Dow Jones

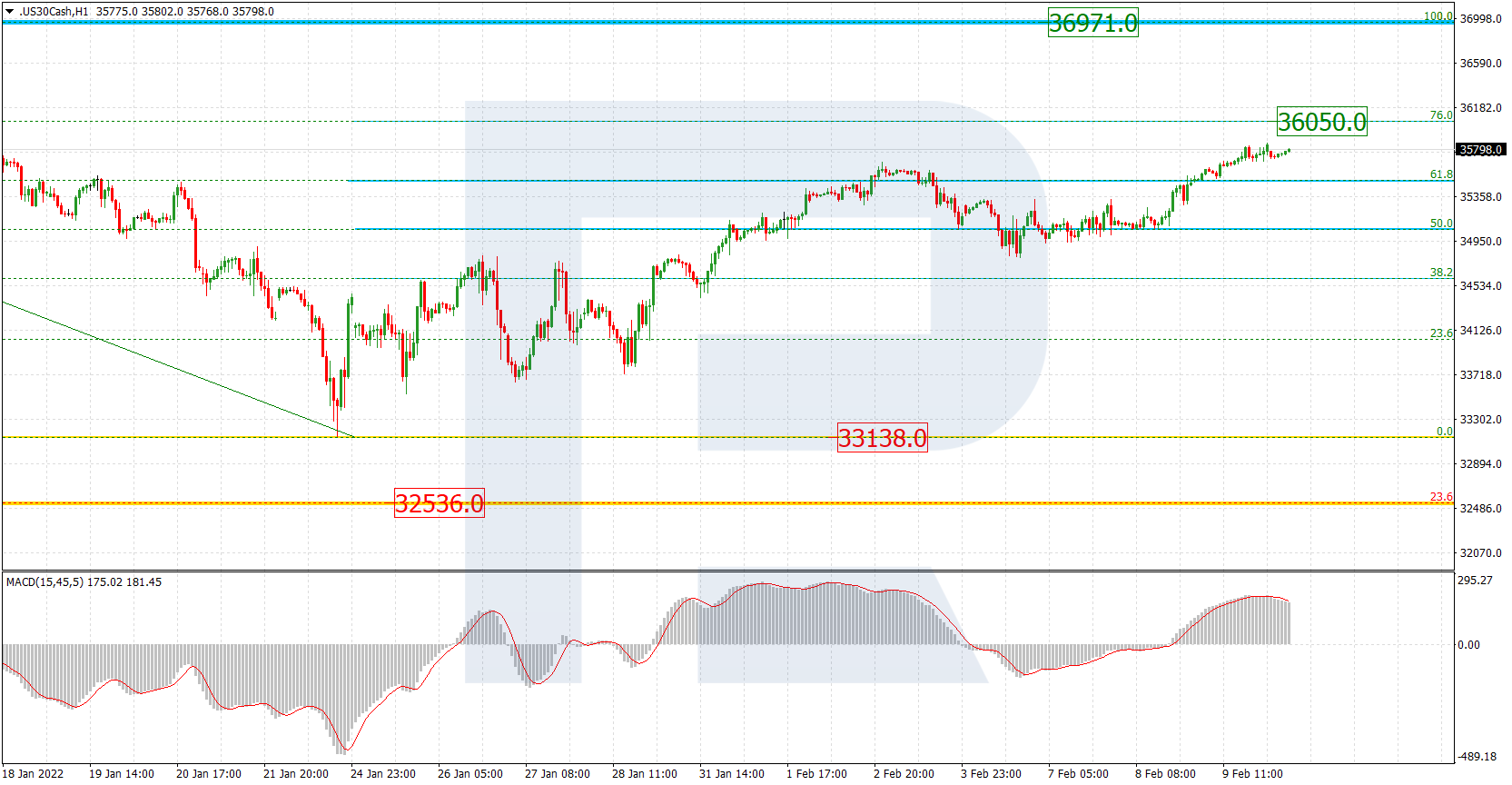

As we can see in the H4 chart, after completing two correctional waves to the downside at 23.6% fibo (32968.5), the Dow Jones index is moving upwards to break the high at 35102.0 and may later continue the uptrend towards the post-correctional extension area between 138.2% and 161.8% fibo at 35890.0 and 36378.0 respectively. The support is the low at 33035.0.

The H1 chart shows a more detailed structure of the current uptrend, which, after breaking 61.8% fibo, has reached 76.0% fibo. The closest upside target is the high at 35102.0.