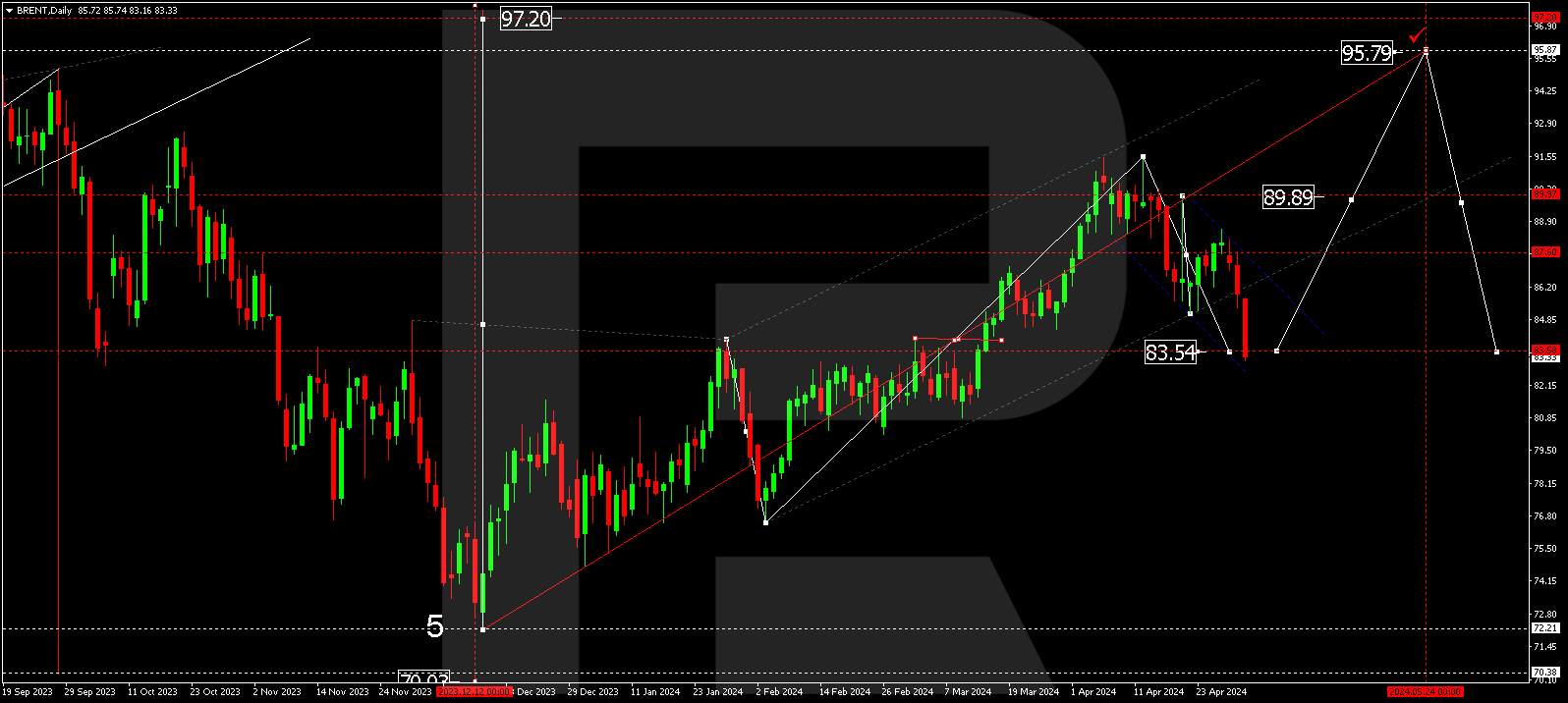

Brent

As we can see in the daily chart, Brent has reached the long-term 23.0% fibo after divergence on MACD. The fact that “bears” were so active implies that they intend to continue the descending tendency. The next downside targets are 38.2%, 50.0%, and 61.8% fibo at 59.53, 51.20, and 42.86 respectively. The key resistance is the high at 86.63.

The H1 chart shows convergence on MACD, which resulted in a new pullback. By now, the pullback has tested 38.2% fibo at 73.32. the next impulse may break this level and reach 50.0% fibo at 75.10. on the other hand, a breakout of the low at 67.66 will lead to a further downtrend in the instrument.

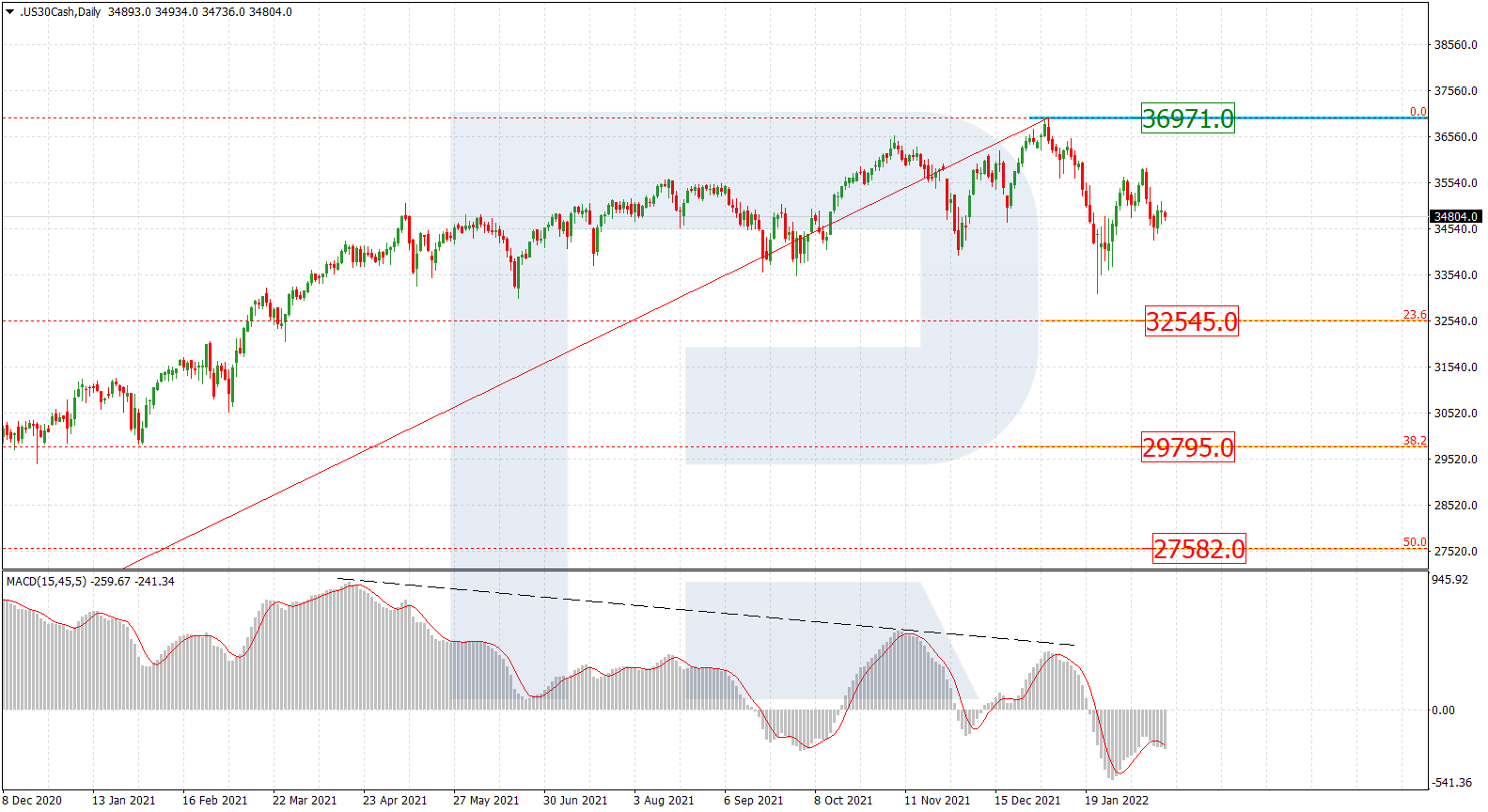

Dow Jones

As we can see in the daily chart, divergence on MACD made the asset reverse after reaching 36570.0 and start a new descending impulse, which is looking quite stable. The downside targets are 23.6%, 38.2%, and 50.0% fibo at 32230.0, 29550.0, and 27380.0 respectively. The resistance is the high.

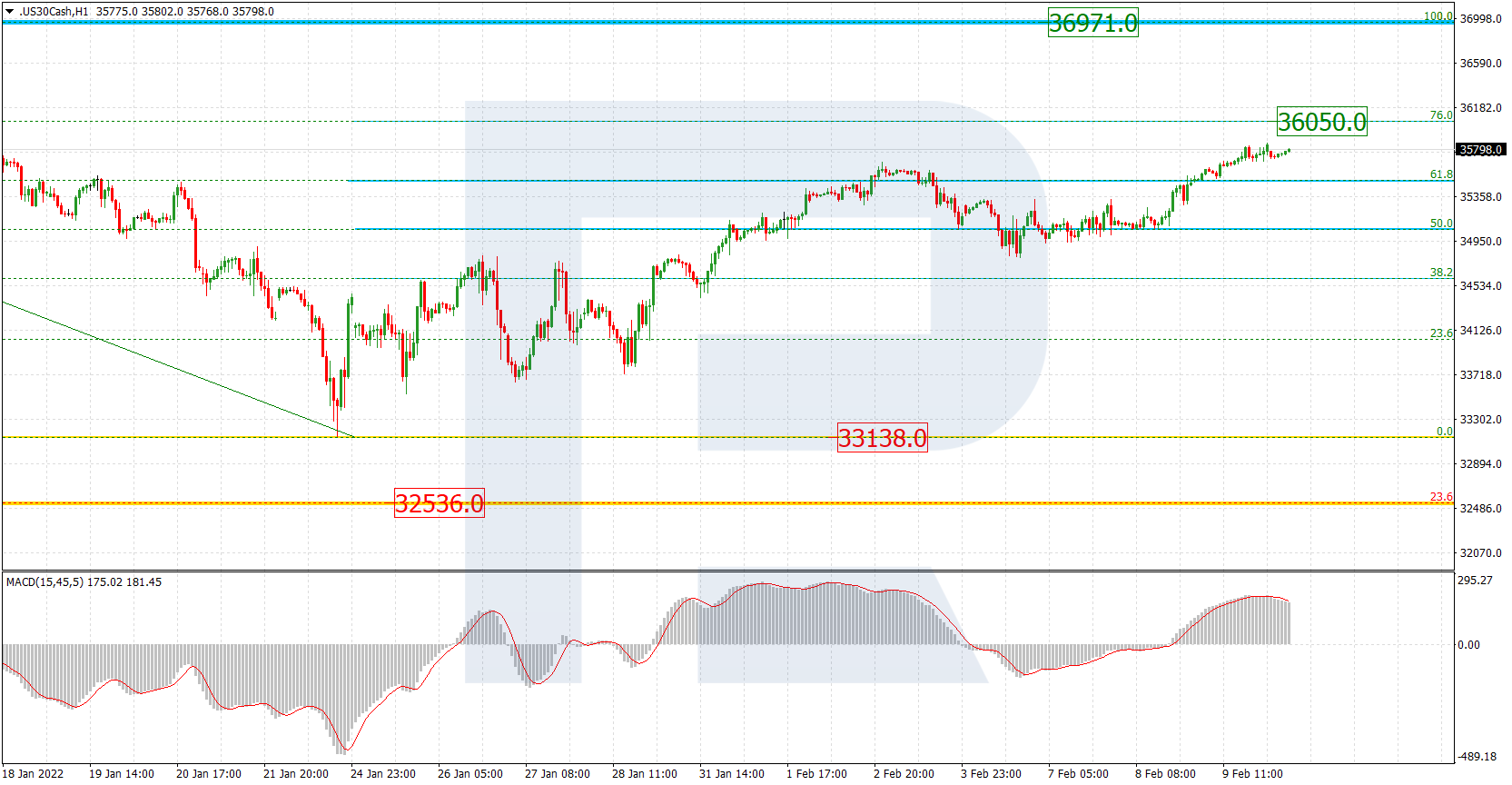

The H1 chart shows a possibility of a new correctional uptrend and convergence on MACD confirms it. The correctional targets are 23.6%, 38.2%, and 50.0% fibo at 34580.0, 34960.0, and 35265.0 respectively. A breakout of the low at 33962.0 will result in a further descending tendency.