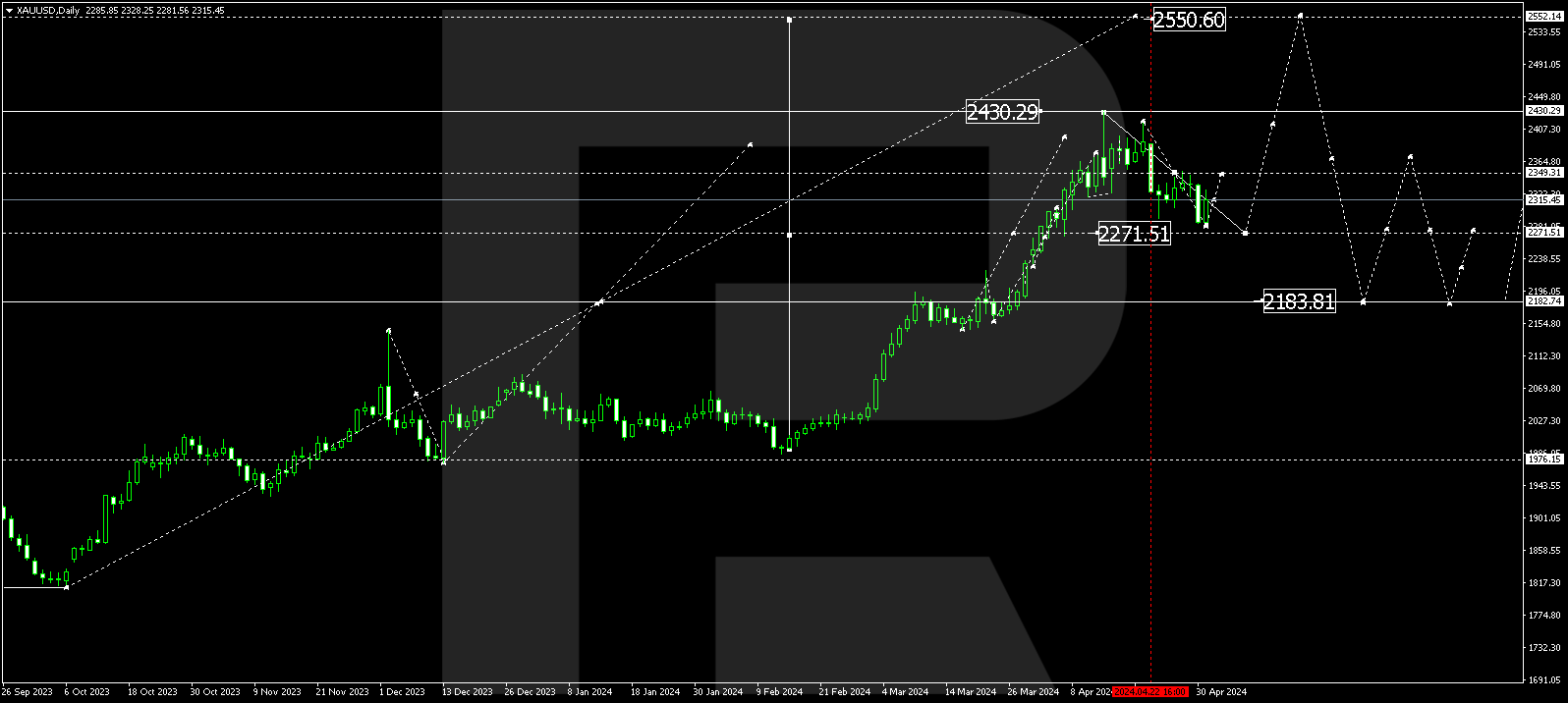

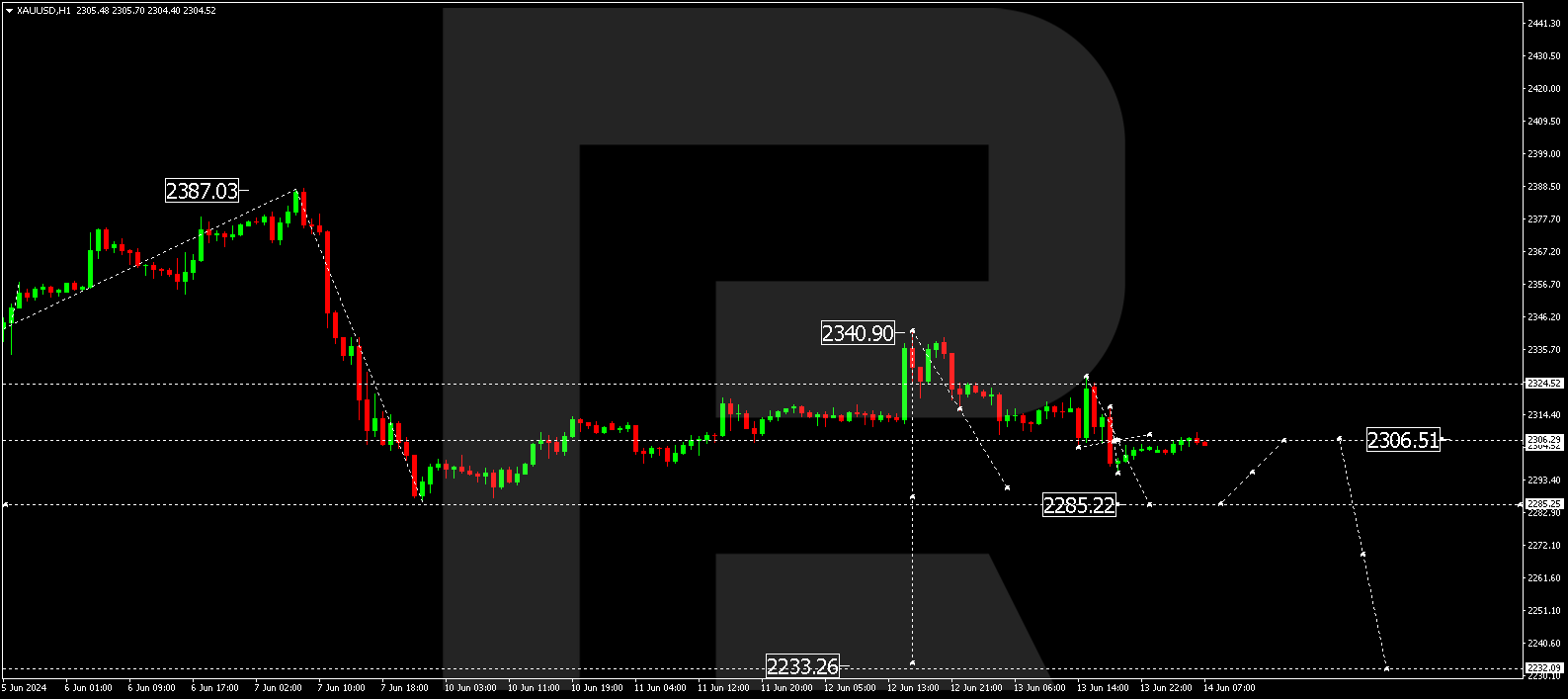

XAUUSD, “Gold vs US Dollar”

In the daily chart, after completing the correctional downtrend, the asset may start a new wave to the upside towards 50.0%, 61.8%, and 76.0% fibo at 1856.55, 1908.00, and 1969.50 respectively. However, the key upside target will be the high at 2074.75. The support is the low at 1638.76.

As we can see in the H1 chart, convergence on MACD made the asset start a new correctional impulse, which has already reached 38.2% fibo and may later continue towards 50.0%, 61.8%, and 76.0% fibo at 1777.77, 1791.10, and 1807.00 respectively. However, the key short-term upside target will be at 1833.74. On the other hand, a breakout of the support at 1721.65 will lead to a further downtrend to reach the mid-term 61.8% fibo at 1713.41.

USDCHF, “US Dollar vs Swiss Franc”

In the H4 chart, after breaking the previous high at 0.9275, USDCHF were trying to reach the post-correctional extension area between 138.2% and 161.8% fibo at 0.9373 and 0.9433 respectively. However, divergence on MACD made the asset start a new correctional downtrend. After the correction is over, the pair may resume trading upwards. The key support remains at 0.9018.

As we can see in the H1 chart, the pair is correcting and testing 23.6% fibo. The next downside targets may be 38.2% and 50.0% fibo at 0.9235 and 0.9193 respectively. A breakout of the local high at 0.9368 will result in a further uptrend.