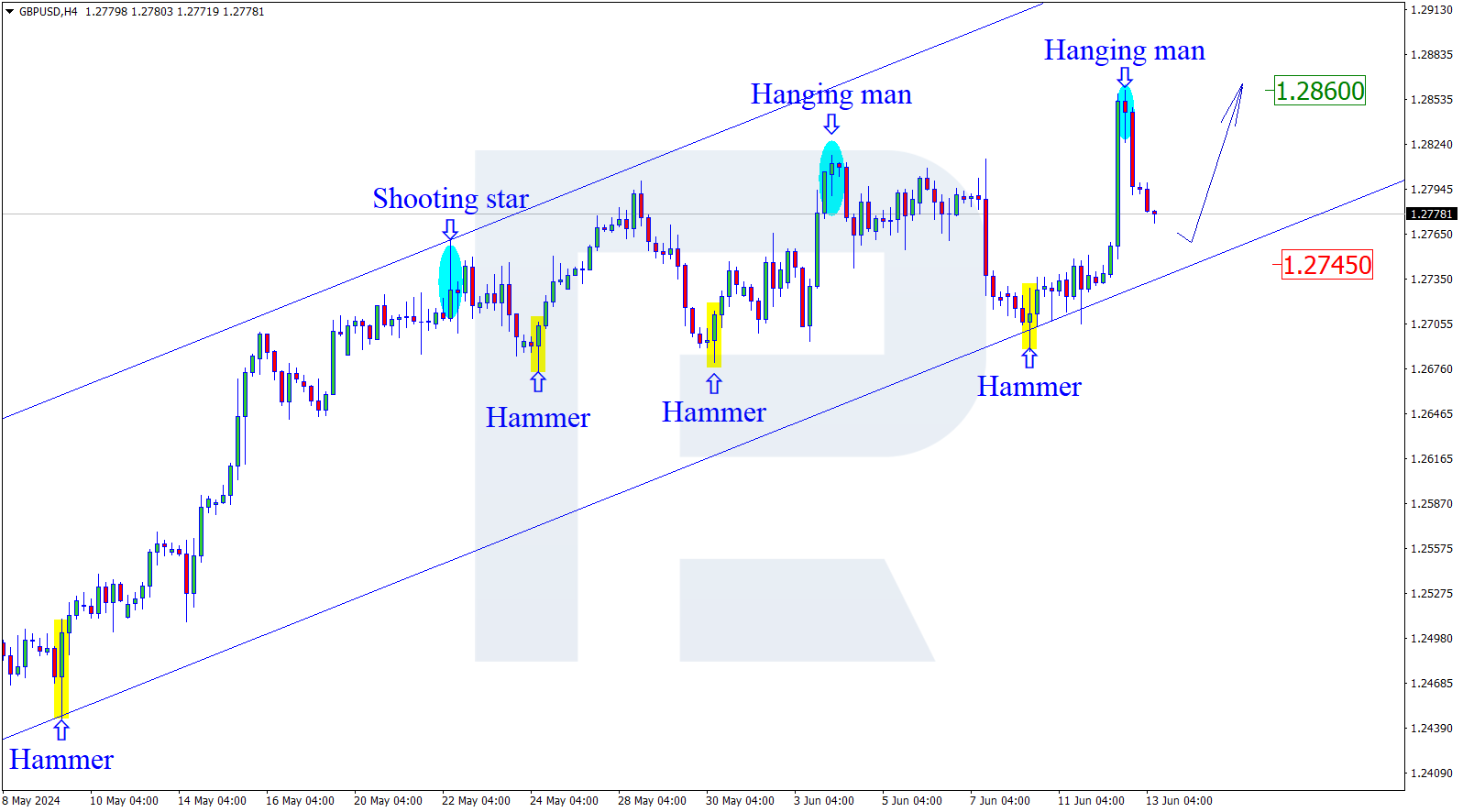

GBPUSD, “Great Britain Pound vs US Dollar”

In the H4 chart, the technical situation hasn’t changed much as GBPUSD is still testing the mid-term 23.6% fibo; the current movement may be considered as consolidation before either a new growth or decline. If the price breaks this consolidation range to the upside, the market may resume growing to break the current high at 1.4241 and then continue trading upwards the fractal high at 1.4376; if to the downside – form a new descending structure to reach 38.2% and 50.0% fibo at 1.3643 and 1.3459 respectively.

The H1 chart shows that after correcting to the downside and reaching 61.8% fibo at 1.3799, the asset has rebounded and may resume growing towards the local high at 1.4009, as well as the mid-term 61.8% fibo at 1.4022. However, the main scenario implies a further downtrend to reach 76.0% fibo and the low at 1.3751 and 1.3669 respectively.

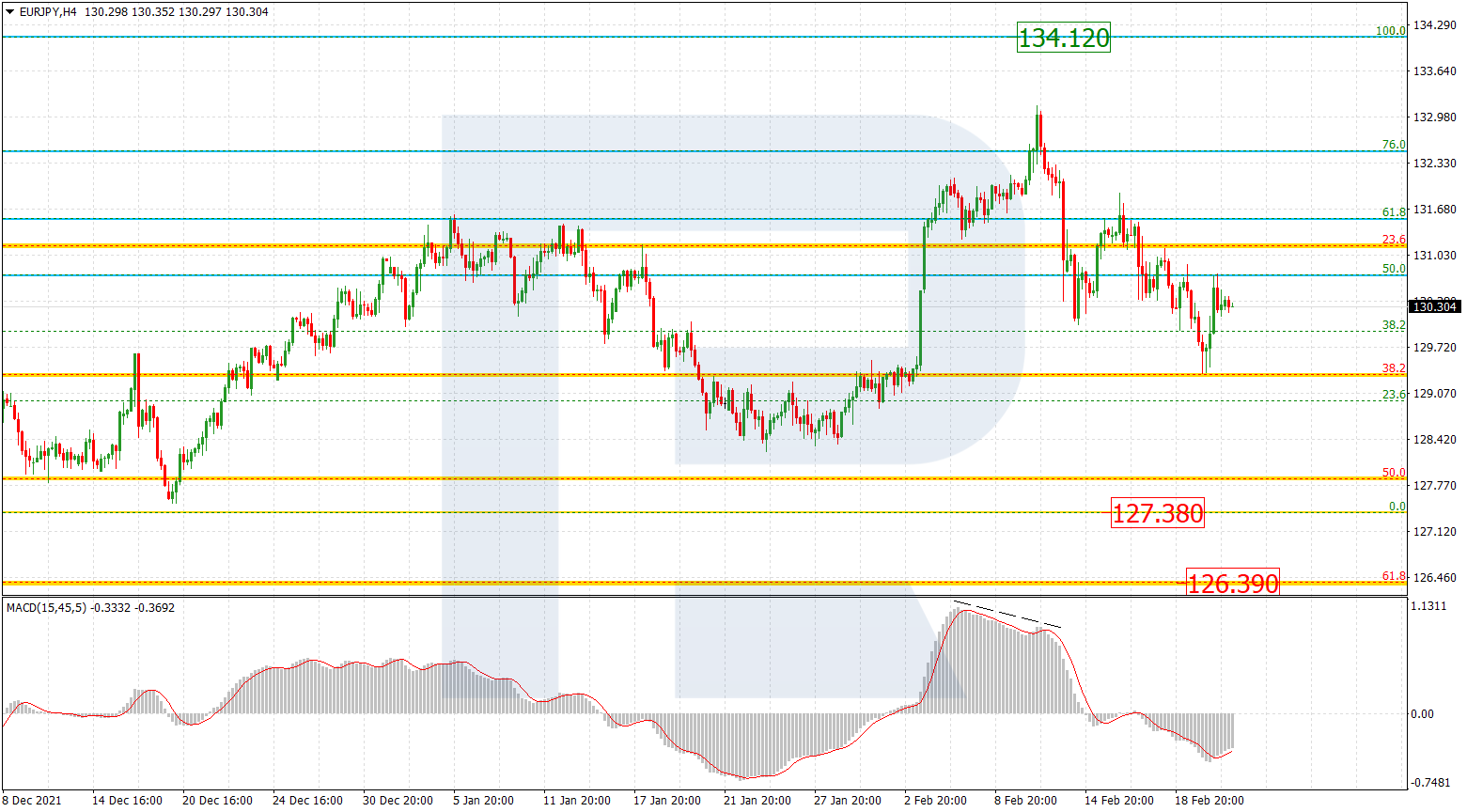

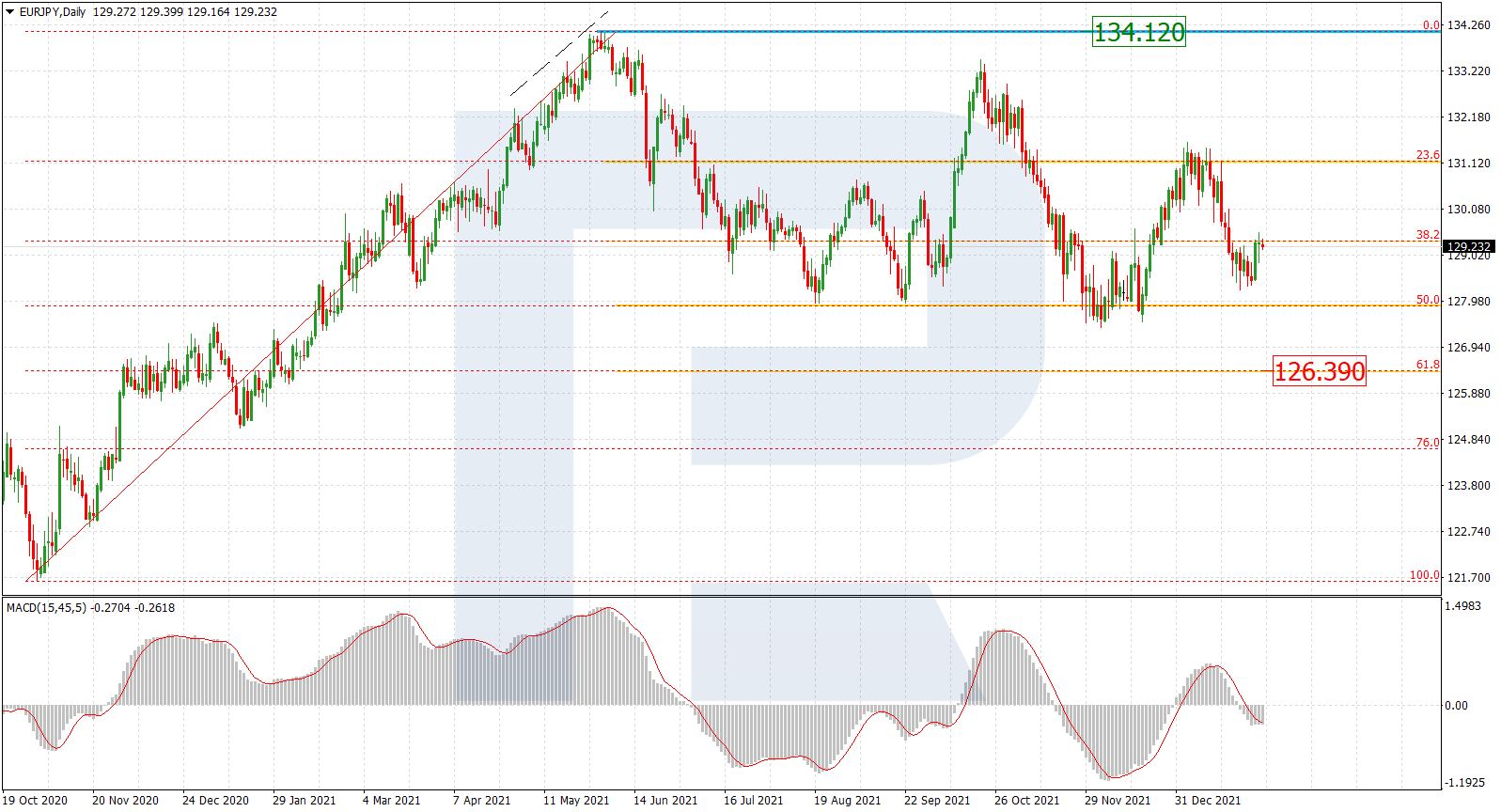

EURJPY, “Euro vs. Japanese Yen”

In the daily chart, EURJPY has reached its target at the long-term 76.0% fibo. Also, there is a divergence on MACD, which hints at a possible correctional downtrend to reach the local support at 61.8% fibo (128.69.). After finishing the correction, the instrument may form a new rising impulse towards the high at 137.50.

The H4 chart shows possible correctional targets after a divergence on MACD – 23.6%, 38.2%, and 50.0% fibo at 129.84, 128.27, and 127.00 respectively.