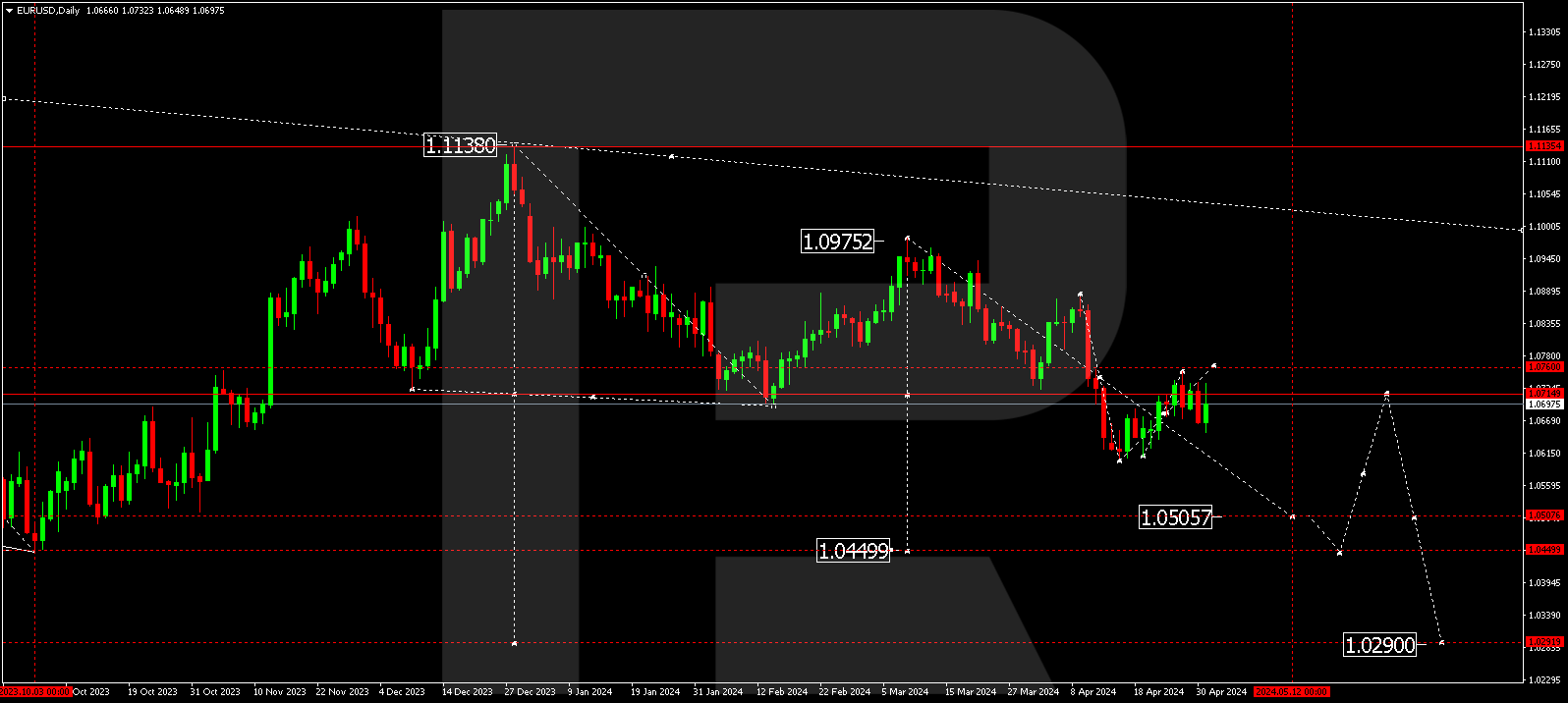

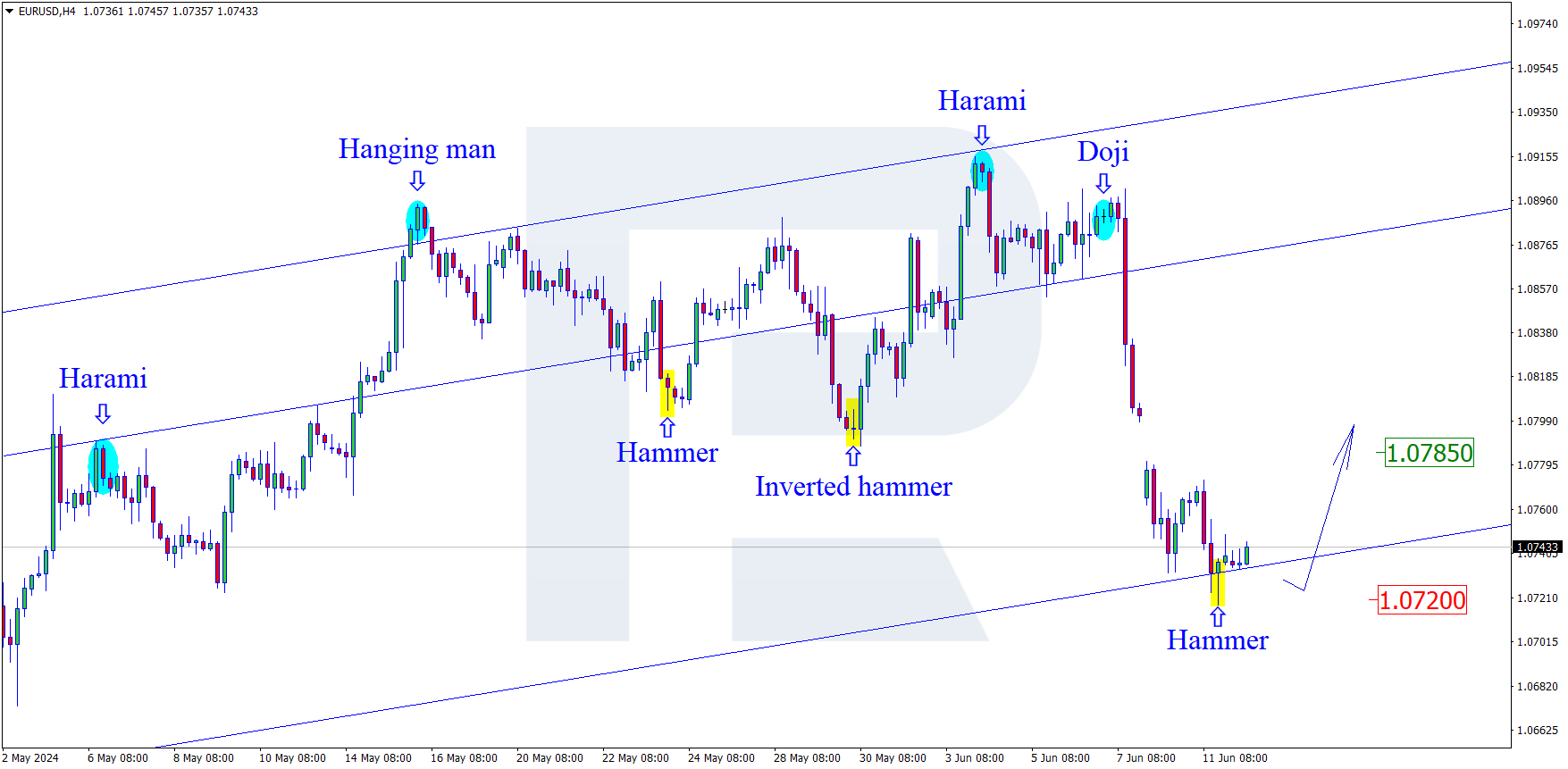

EURUSD, "Euro vs US Dollar"

On D1, the pair demonstrates a bounce after a test of 38.2% (1.1695) Fibo. Such a bounce should be interpreted as a correction of the previous wave of decline. After the pullback, we should expect a new wave of decline aiming at a breakaway of 38.2% (1.1695) and further down to 50.0% (1.1493) and 61.8% (1.1292).

On H4, there is an ascending correction beginning after a convergence on the MACD. By now, the quotations have neared the first target level of 23.6% (1.1832). Further growth can be aimed at 38.2% (1.1910) and 50.0% (1.1974) Fibo. A breakaway of the local low of 1.1704 will signal the continuation of the medium-term downtrend.

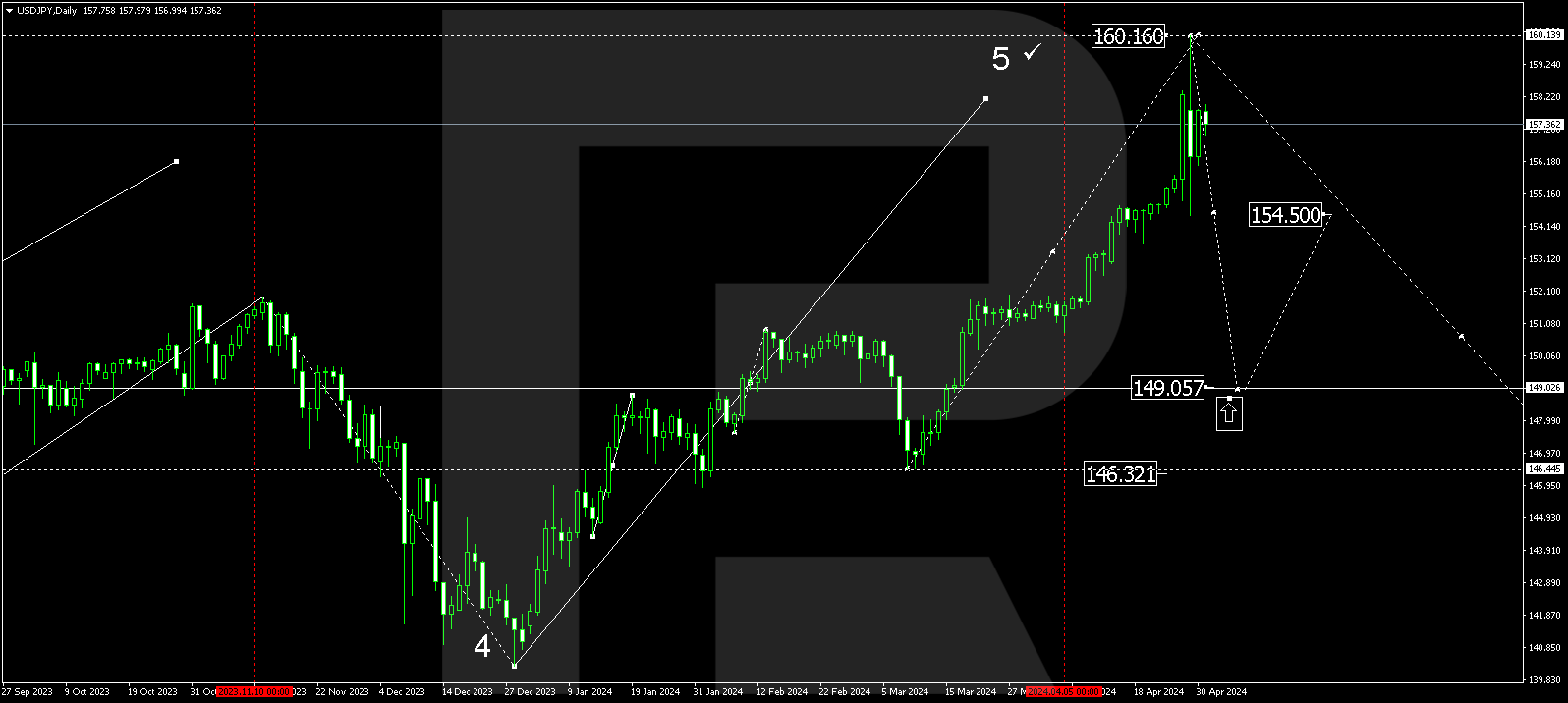

USDJPY, "US Dollar vs Japanese Yen"

On D1, the wave of growth has failed to rise to the long-term fractal high of 111.71. The market seems to be preparing a pullback, and when it is over, a new wave aiming at a breakaway of the high is likely to start. After the breakaway, the quotations might head for the post-correctional extension area of 138.2-161.8% (115.18-117.35) Fibo. The local support level is 61.8% (108.23) Fibo.

On H4, there is a declining impulse beginning as a correction after a lengthy uptrend. The aims of the correction might be 23.6% (109.00), 38.2% (107.77), and 50.0% (106.78) Fibo. A breakaway of the local high of 110.97 will signal the continuation of the uptrend.