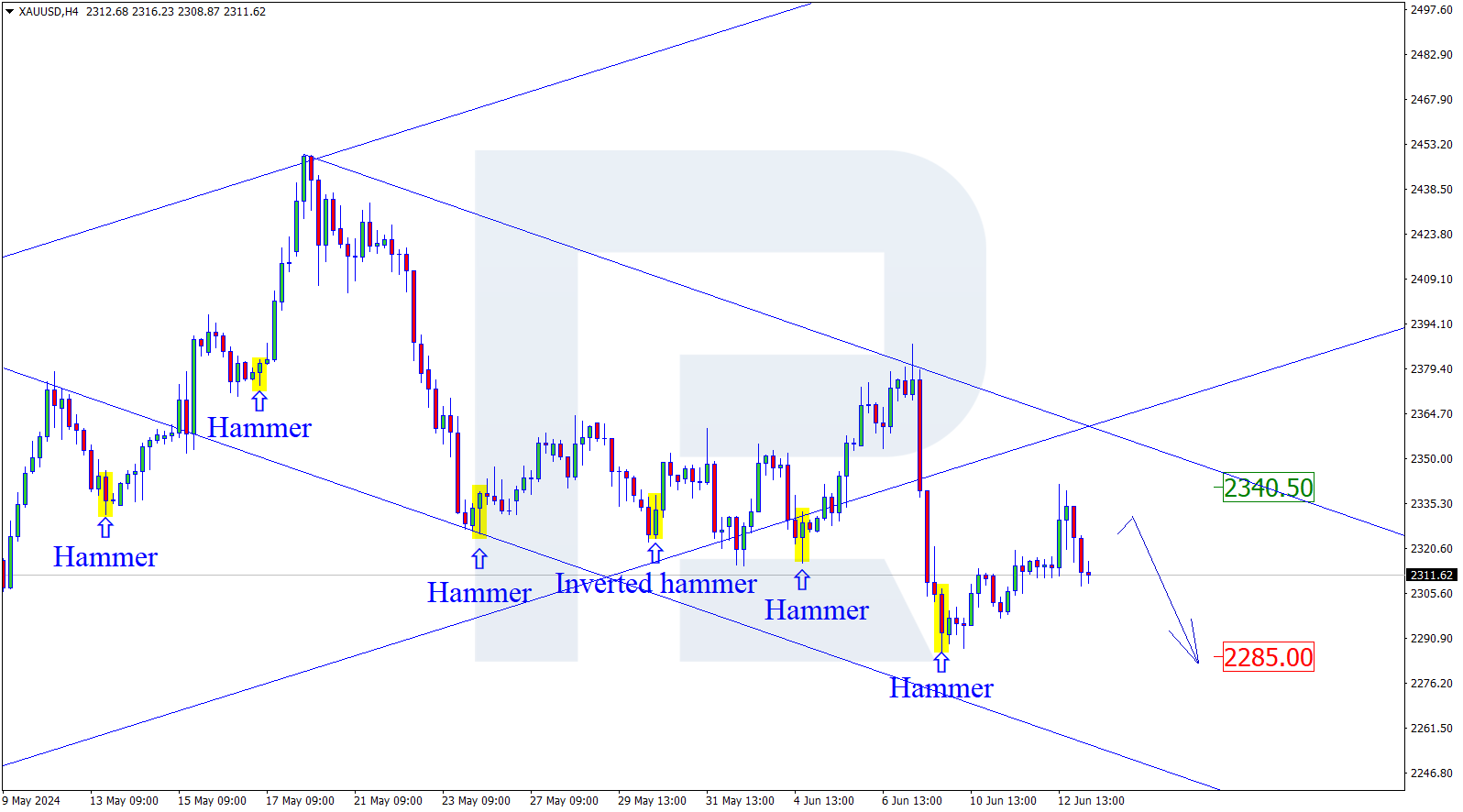

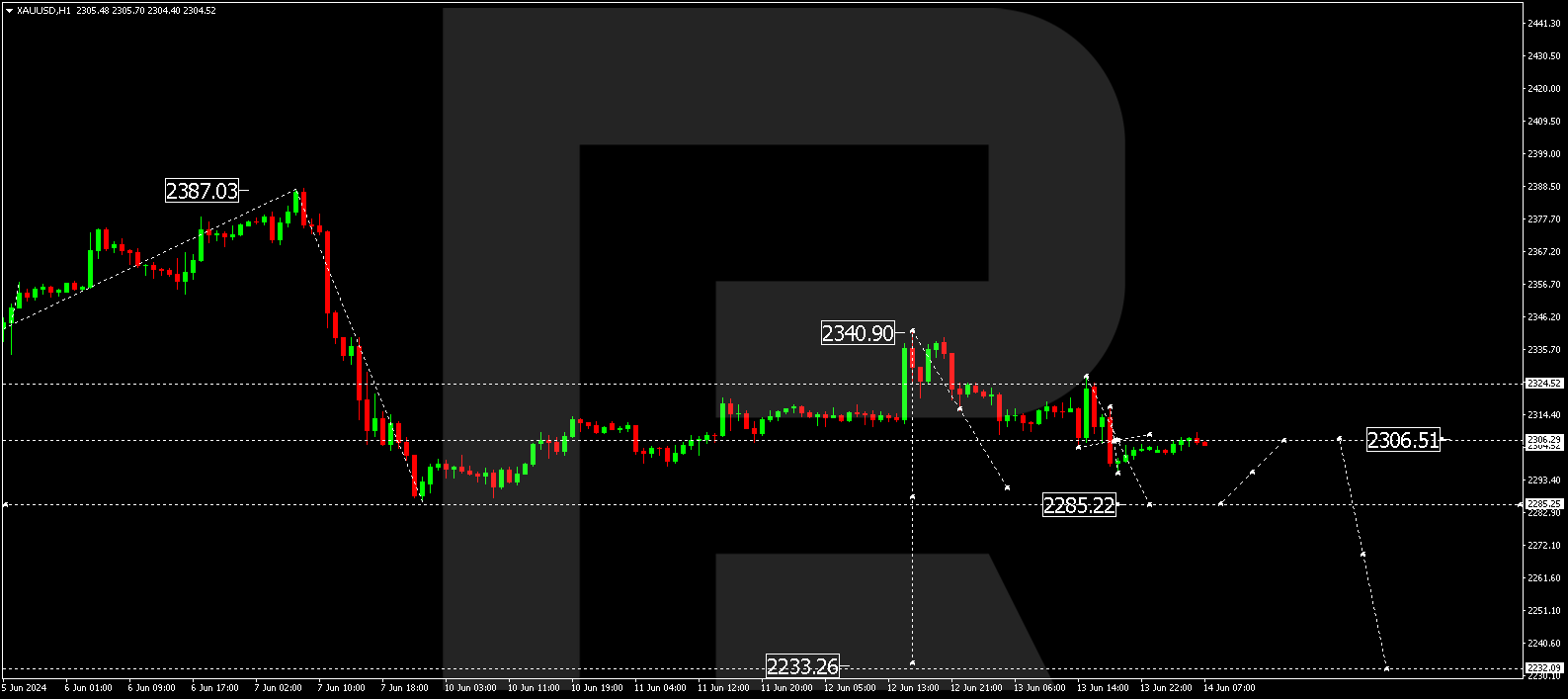

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, the correctional downtrend continues; it has already reached the retracement of 50.0% at 1300.80. The next short-term downside targets may be the retracements of 61.8% and 76.0% at 1285.60 and 1264.20 respectively. After breaking the short-term low, the instrument may continue trading towards the post-correctional extension area between the retracements of 138.2% and 161.8% at 1279.20 and 1264.20 respectively. The resistance level is at 1335.30.

In the H1 chart, the short-term convergence made XAUUSD start a new correction to the upside, which has already reached the retracement of 23.6%. The next targets may be the retracements of 38.2% and 50.05 at 1322.10 and 1328.30 respectively.

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, USDCHF is still moving upwards and getting closer towards the retracement of 76.0%. The main upside target may be the high at 1.0344. The main support level is at 0.9902.

In the H1 chart, the uptrend continues, but one can see the divergence being formed, which may indicate a possible pullback towards the area between the retracements of 23.6% and 61.8% at 0.9951 and 0.9822 respectively.

RoboForex Analytical Department