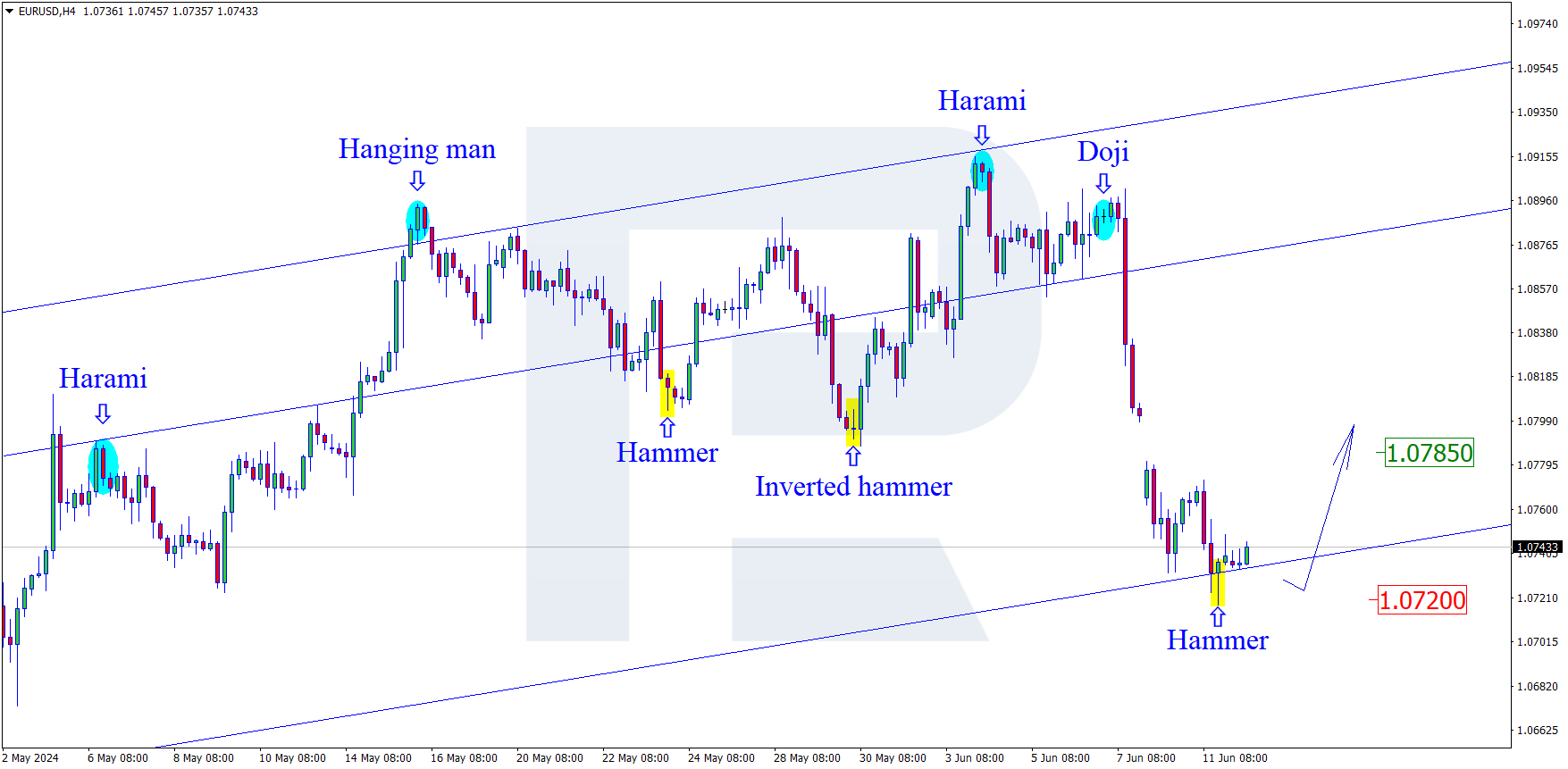

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, the convergence made the pair finish its decline at 1.0879 and start a new ascending tendency. However, one shouldn’t exclude the possibility that EURUSD may yet break the low and continue falling towards the post-correctional extension area between 138.2% and 161.8% fibo at 1.0856 and 1.0812 respectively. At the same time, according to the main scenario, the price is expected to reverse upwards. By now, the instrument has already reached 23.6% fibo and may continue growing towards 38.2%, 50.0%, and 61.8% fibo at 1.1021. 1.1064, and 1.1108 respectively to confirm the reversal and the long-term tendency change.

Looking at the H1 chart, we can see that EURUSD has reached 50.0% fibo; at the same time, there is a divergence on MACD to a new pullback. The target of this pullback may be 23.6% fibo at 1.0934. after completing the correction, the instrument may continue growing towards 61.8% and 76.0% fibo at 1.1022 and 1.1055 respectively.

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the H4 chart, USDJPY has completed the last correctional wave at 50.0% fibo. Possibly, the decline may yet continue towards 61.8% and 76.0% fibo at 105.99 and 105.42 respectively, but the main scenario implies a new growth. If the price forms a new rising impulse and breaks the high at 108.48, the instrument may reach the mid-term correctional target at 61.8% fibo at 109.37.

In the H1 chart, the price has reached 50.0% fibo. The next upside targets may be 61.8% and 76.0% fibo at 107.71 and 107.99 respectively. The support is the low at 106.48.