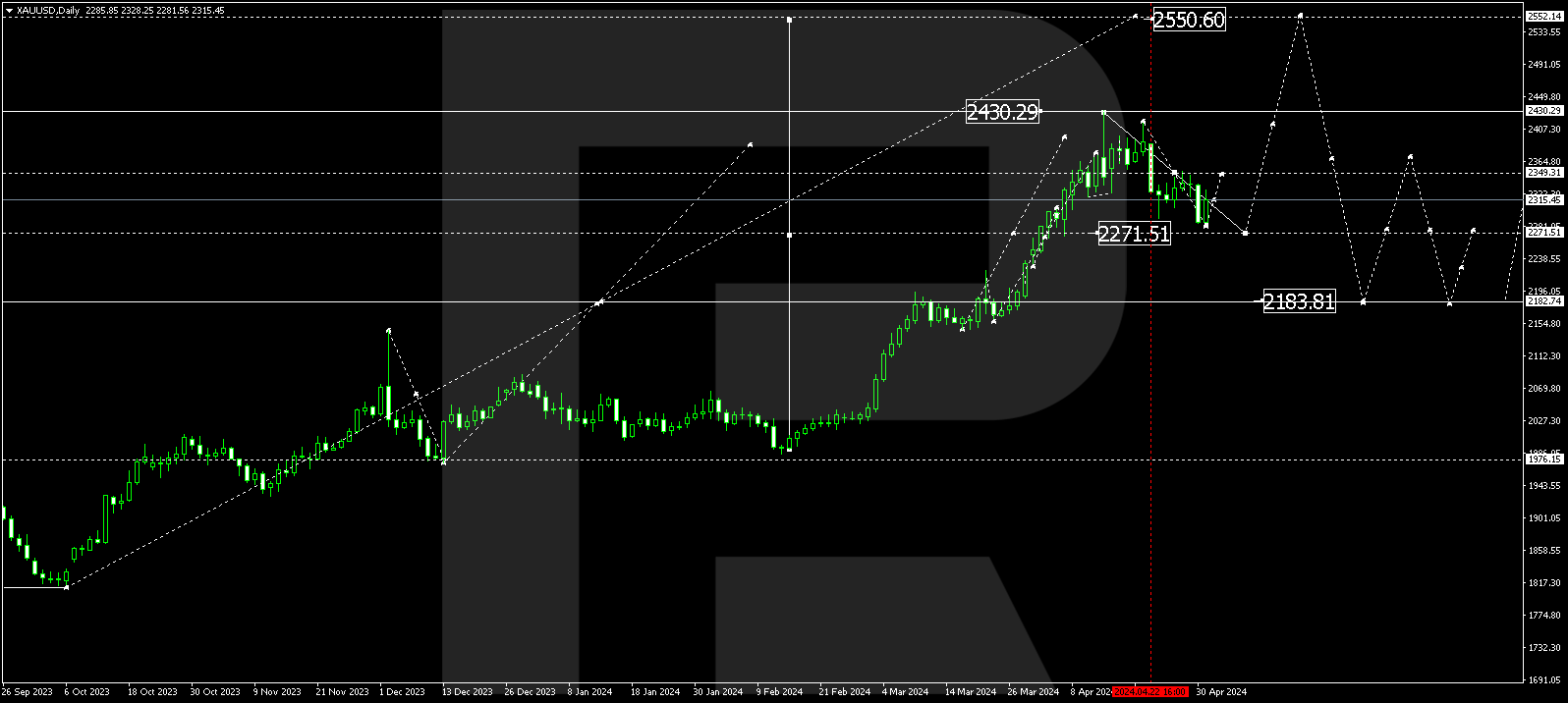

XAUUSD, “Gold vs US Dollar”

As we can see in the daily chart, the divergence made the pair reverse to the downside after reaching 76.0% fibo at 1708.10. Right now, XAUUSD is getting closer to 38.2% fibo at 1496.50, which is a long-term support level not far from 50.0% fibo at 1482.50. After reaching and breaking this area, the price may continue falling towards 50.0% and 61.8% fibo at 1431.95 and 1367.80 respectively. The resistance is the high at 1703.17.

In the H1 chart, there was a local convergence that made the pair start a rising pullback, which has almost reached 38.2% fibo at 1580.40 and may later continue towards 50.05% fibo at 1604.05. If the price breaks the low at 1504.30, the mid-term decline may continue.

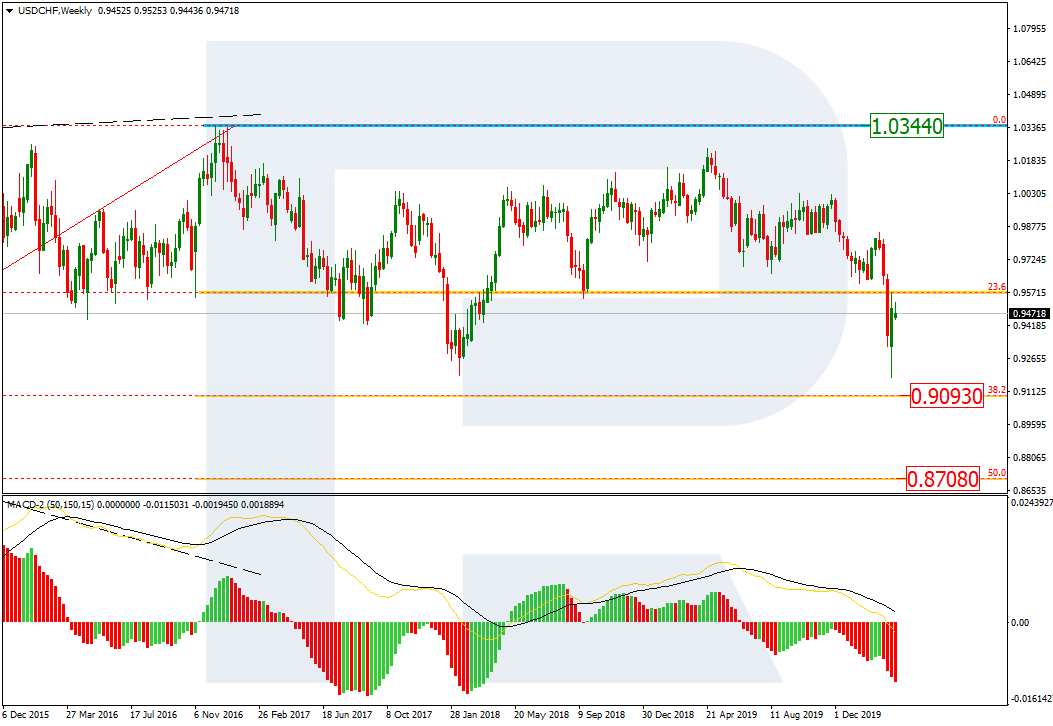

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the weekly chart, the divergence made the pair start a long-term bearish trend, which is heading towards 38.2% and 50.0% fibo at 0.9093 and 0.8708 respectively. The resistance is the high at 1.0344.

In the H4 chart, after forming a quick descending wave and trying to reach 38.2% fibo at 0.9093, the pair is correcting and has already reached 50.0% fibo. Later, the pair may grow towards 61.8% at 0.9593. After completing the pullback, the instrument is expected to resume falling towards the low at 0.9176 or even deeper.