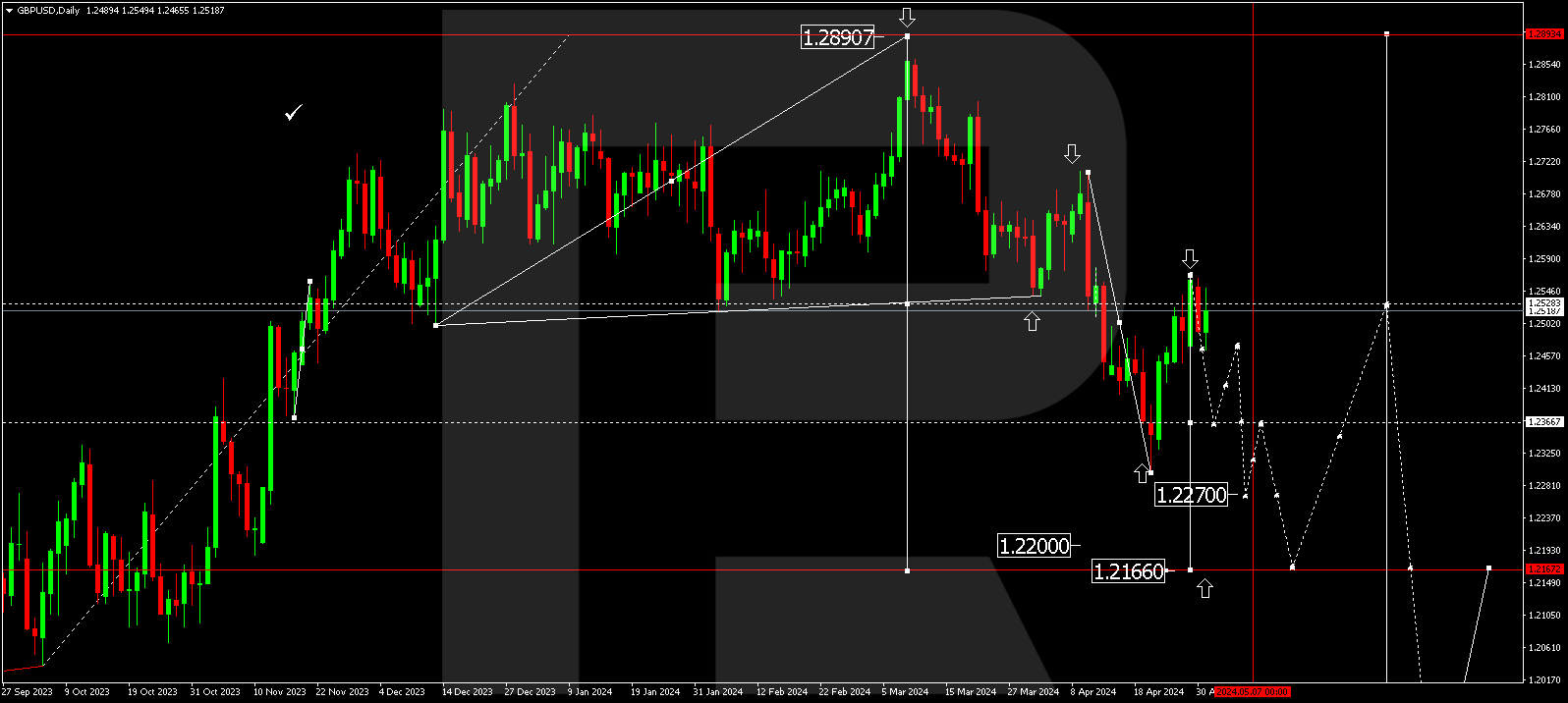

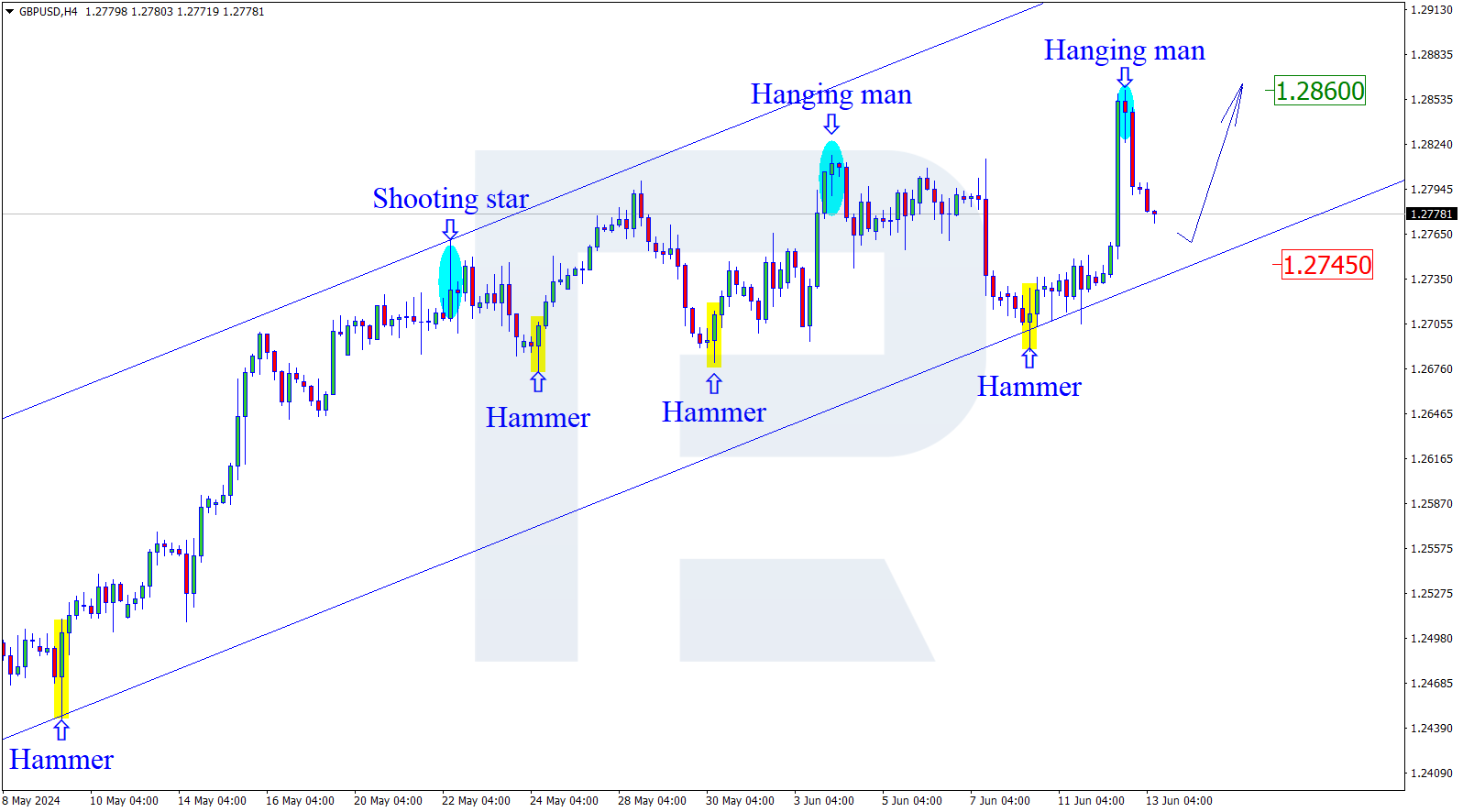

GBPUSD, “Great Britain Pound vs US Dollar”

On D1, the quotations are developing a correctional phase after stepping over the long-term level of 61.8% and a divergence on the MACD. If we look at this movement as a correction of the whole preceding uptrend, then upon reaching 23.6% Fibo, the quotations will head for 38.2% (1.2688) and 50.0% (1.2446). After the pullback, another wave of growth to the current high 1.3482 will start and continue to the long-term level of 76.0% (1.3660).

On H4, there is a decline as a correction of the last wave of growth. By now, the market has dropped below 38.2% Fibo. The next levels of the correctional decline might be 50.0% (1.2868) and 38.2% (1.2722).

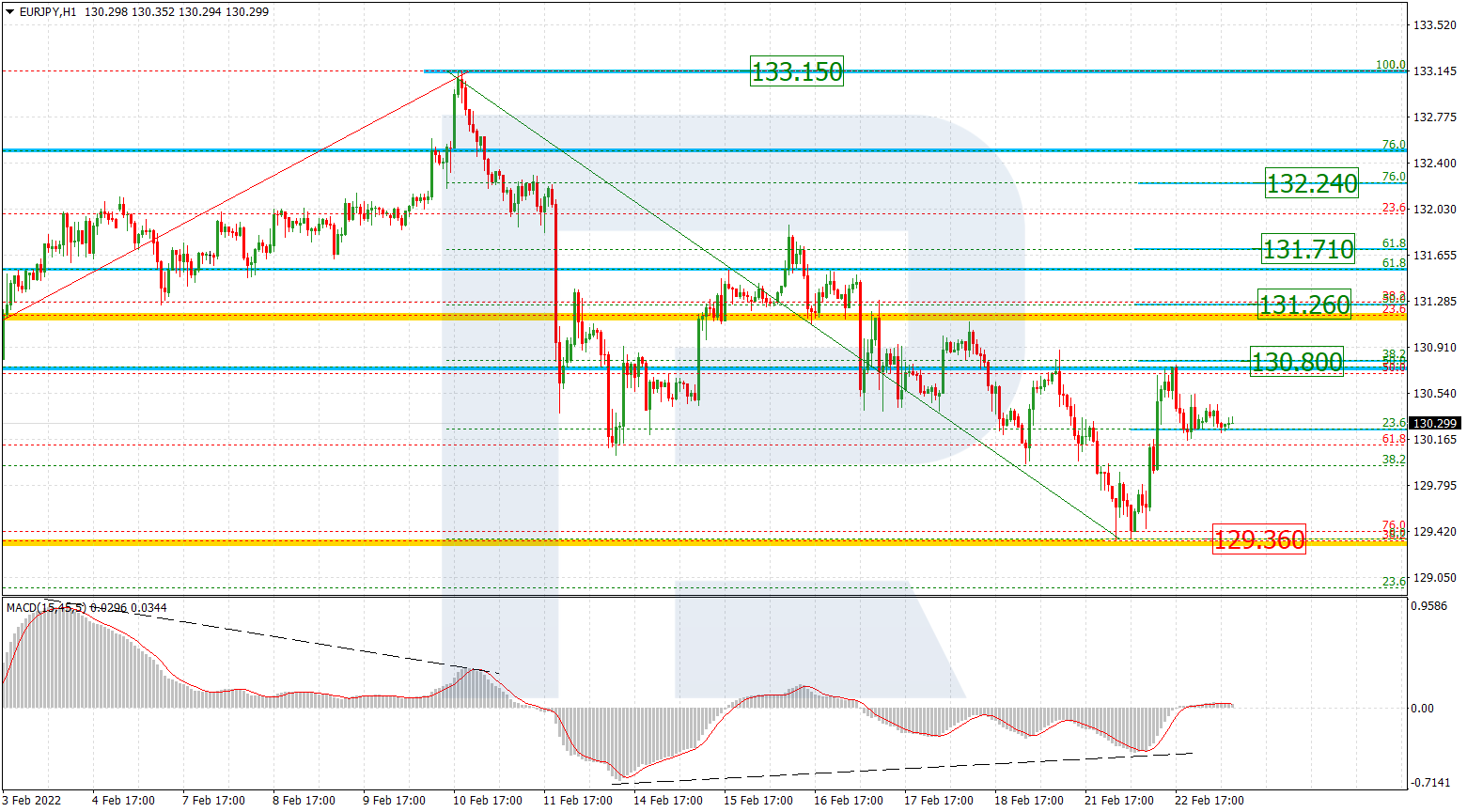

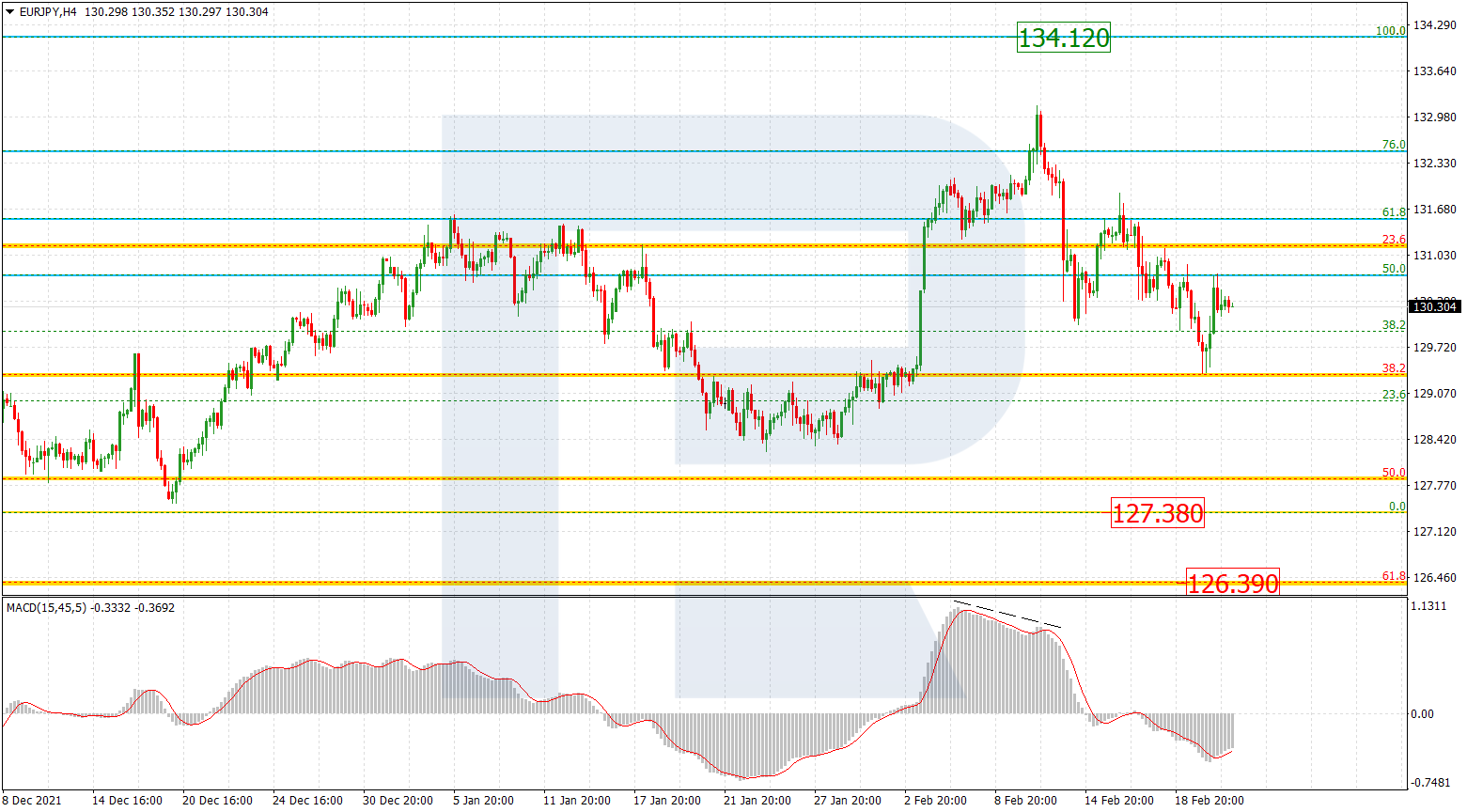

EURJPY, “Euro vs. Japanese Yen”

On H4, a correctional phase begins after the price tested the

post-correctional extension range of 138.2-161.8% (126.38-127.59) and a divergence formed on the MACD. The wave of decline is nearing 38.2% (124.12) and may proceed to 50.0% (123.21) and 61.8% (122.29). The resistance is at the high of 127.07.

On H1, we may see the wave of decline to 38.2% (124.12) in more detail. We may also see a convergence on the MACD, which may signal the end of the decline. The reversal of the local trend may let the quotations rise to the post-correctional extension range of 138.2-161.8% (126.38-127.59) again.