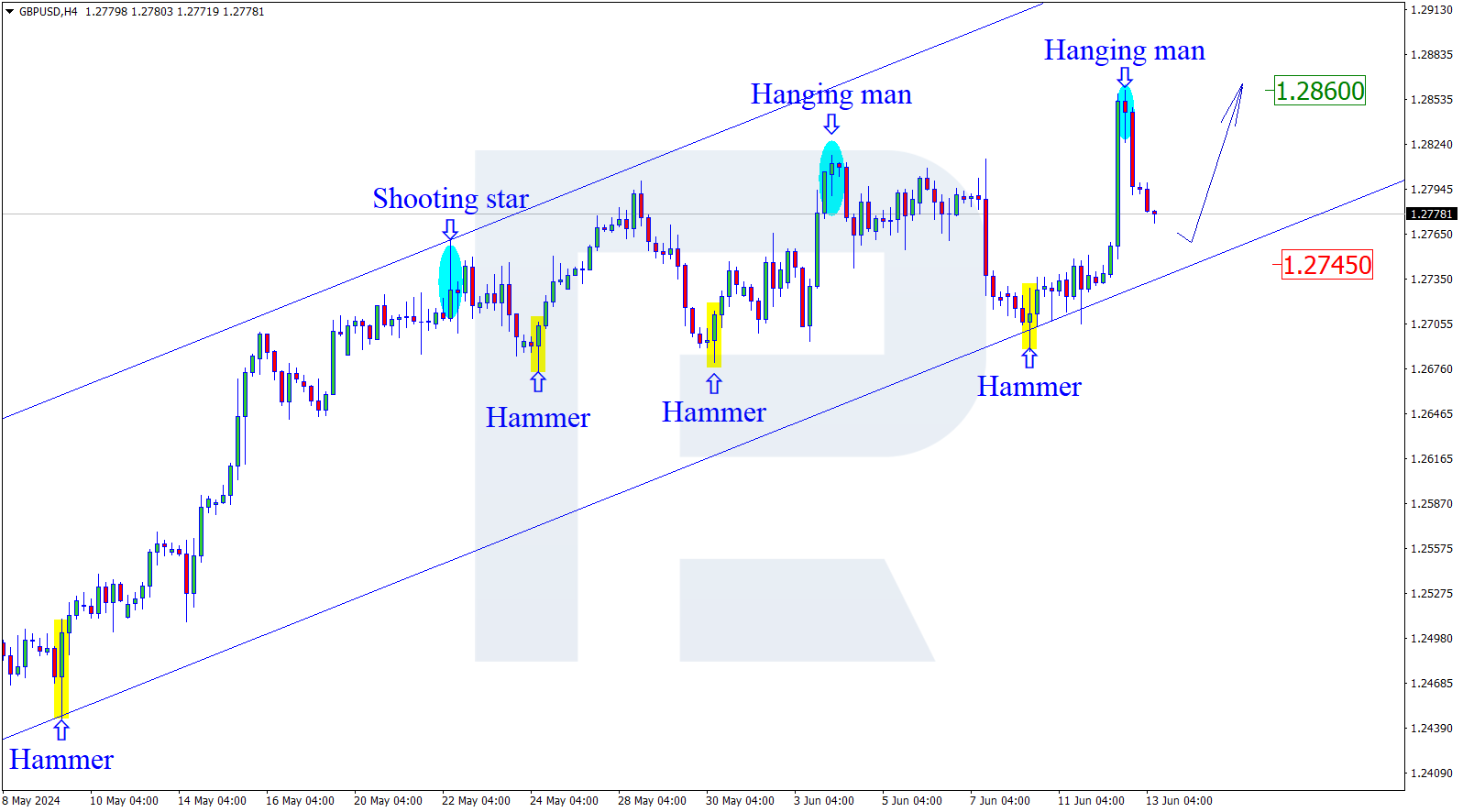

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, GBPUSD has completed the correction to the downside and has started a new ascending impulse. The closest upside target is the shot-term high at 1.4244. After breaking this level, the price may continue growing to reach the long-term high at 1.4345 and then the post-correctional extension area between the retracements of 138.2 and 161.8% at 1.4350 and 1.4416 respectively. The support level is at 1.3965.

In the H1 chart, the pair is trading upwards to reach the target at 1.4244. Taking into account the convergence that is being formed right now, it may be assumed that after reaching its short-term upside targets, the instrument may start a new pullback towards the retracements of 23.6%, 38.2%, and 50.0% at 1.4177, 1.4137, and 1.4106 respectively.

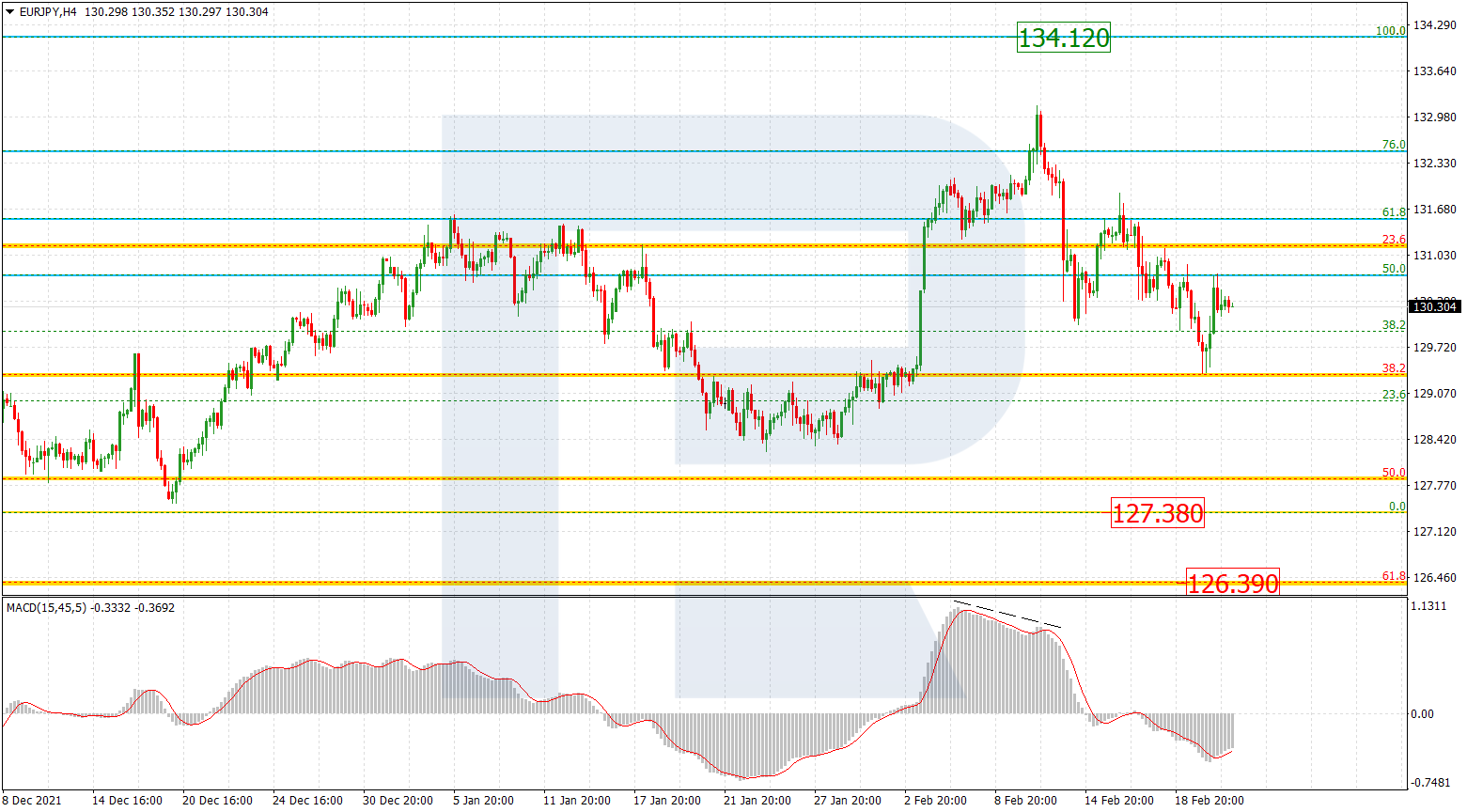

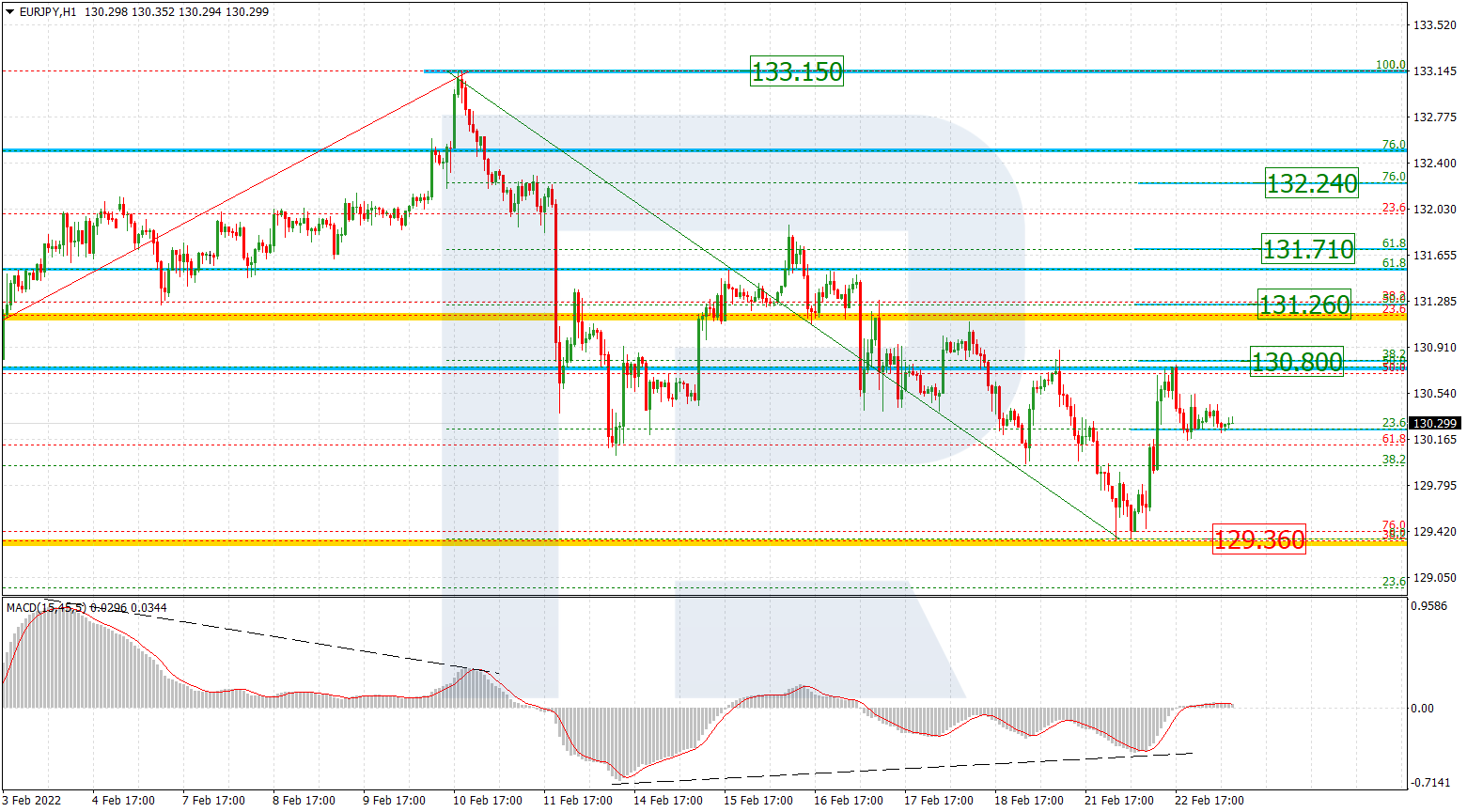

EURJPY, “Euro vs. Japanese Yen”

As we can see in the H4 chart, the convergence made EURJPY reverse and start a new growth, which has already reached the retracement of 23.6% and may continue towards the retracements of 38.2% and 50.0% at 132.22 and 133.22 respectively. The support level is the low at 128.94.

In the H1 chart, the pair is steadily trading upwards to reach the retracement of 38.2% at 133.22.

RoboForex Analytical Department