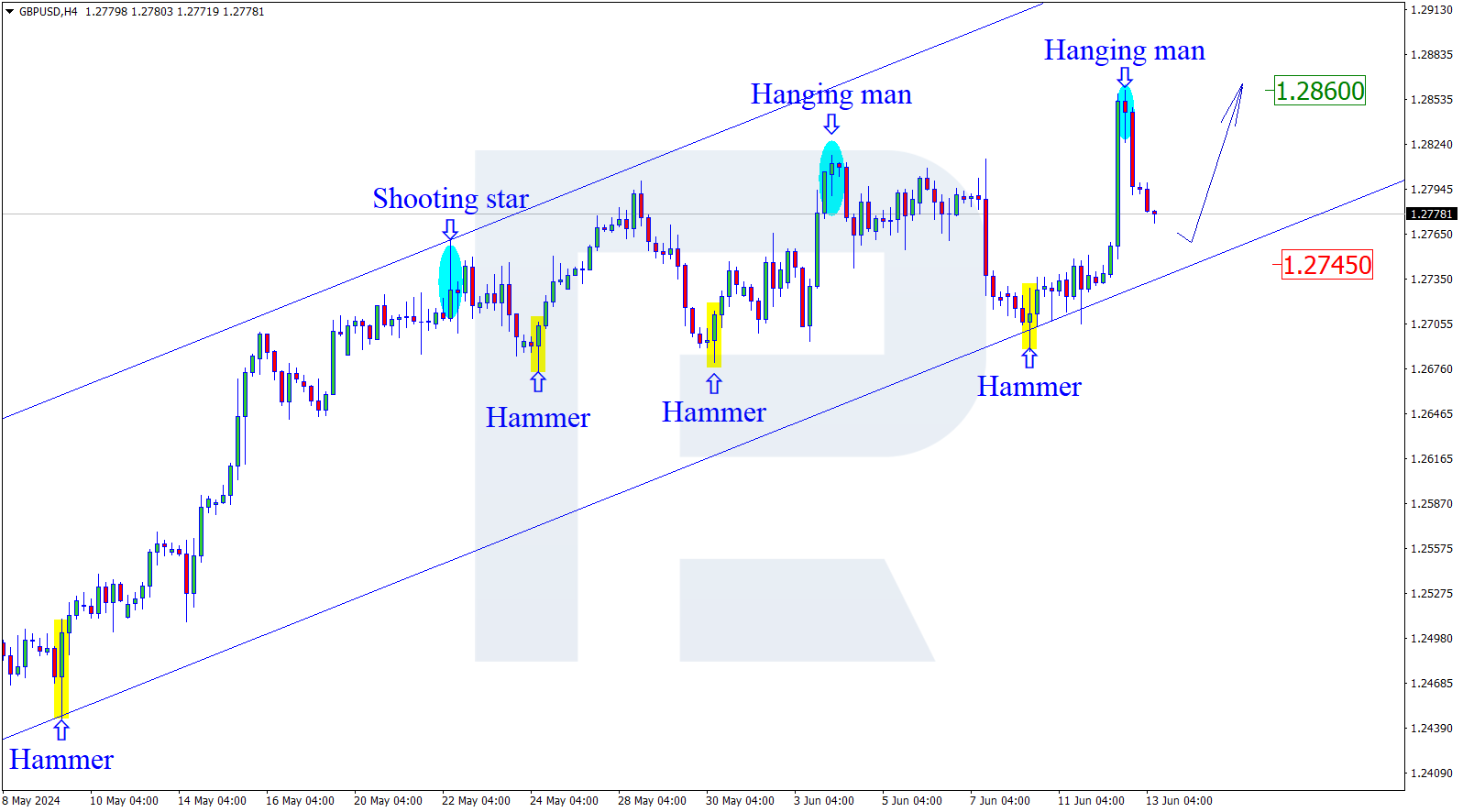

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, after testing the post-correctional extension area between 138.2% and 161.8% fibo at 1.2019 and 1.1786 respectively, GBPUSD is trading upwards and has already reached 38.2% fibo at 1.2423. The next upside targets may be 50.0% and 61.8% fibo at 1.2567 and 1.2710 respectively. The key support is at 1.1958.

In the H1 chart, the pair is slowing down on its way towards 38.2% fibo at 1.2423 because of the convergence on MACD, which may indicate a new correction soon. The target of this pullback may be 23.6% fibo at 1.2245.

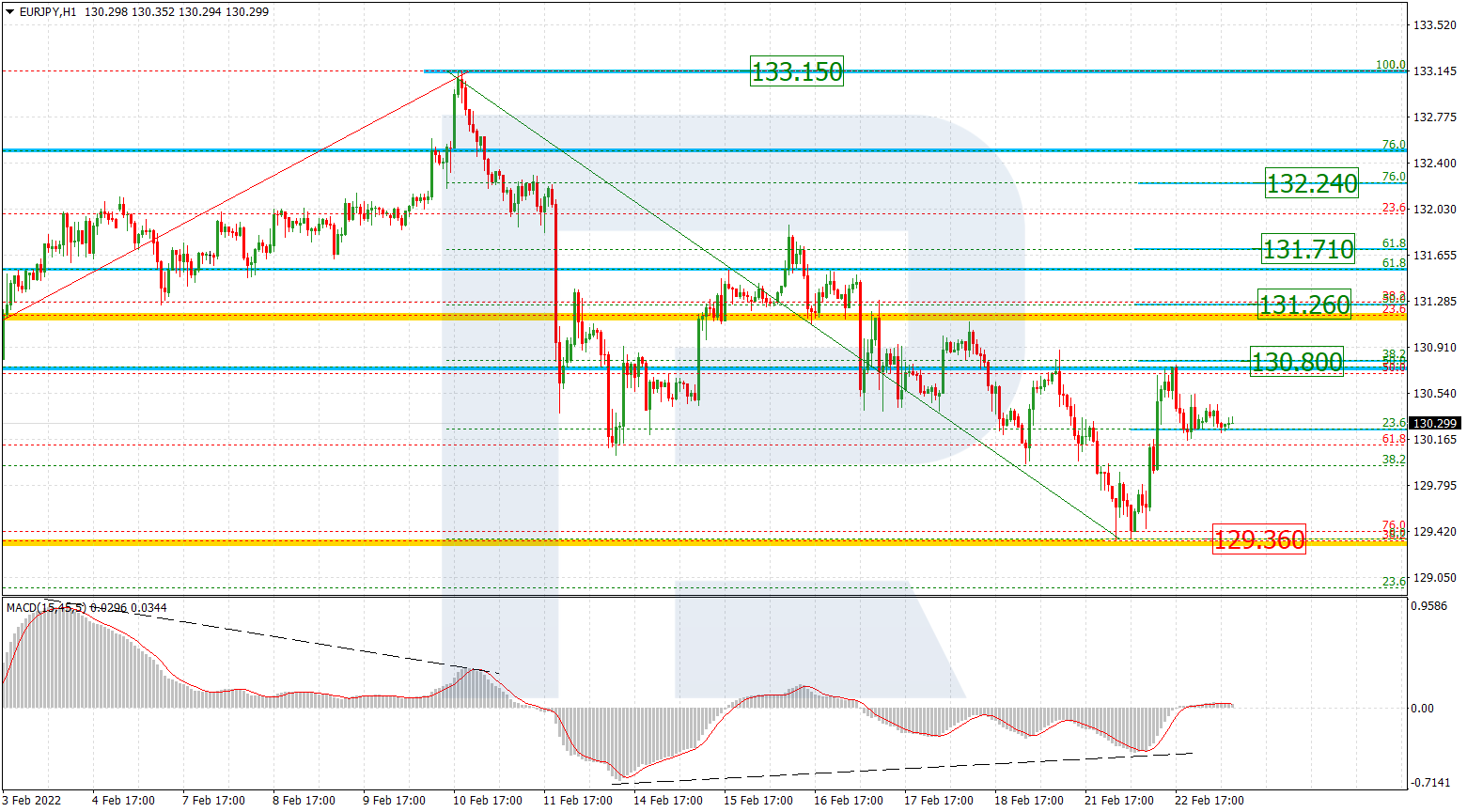

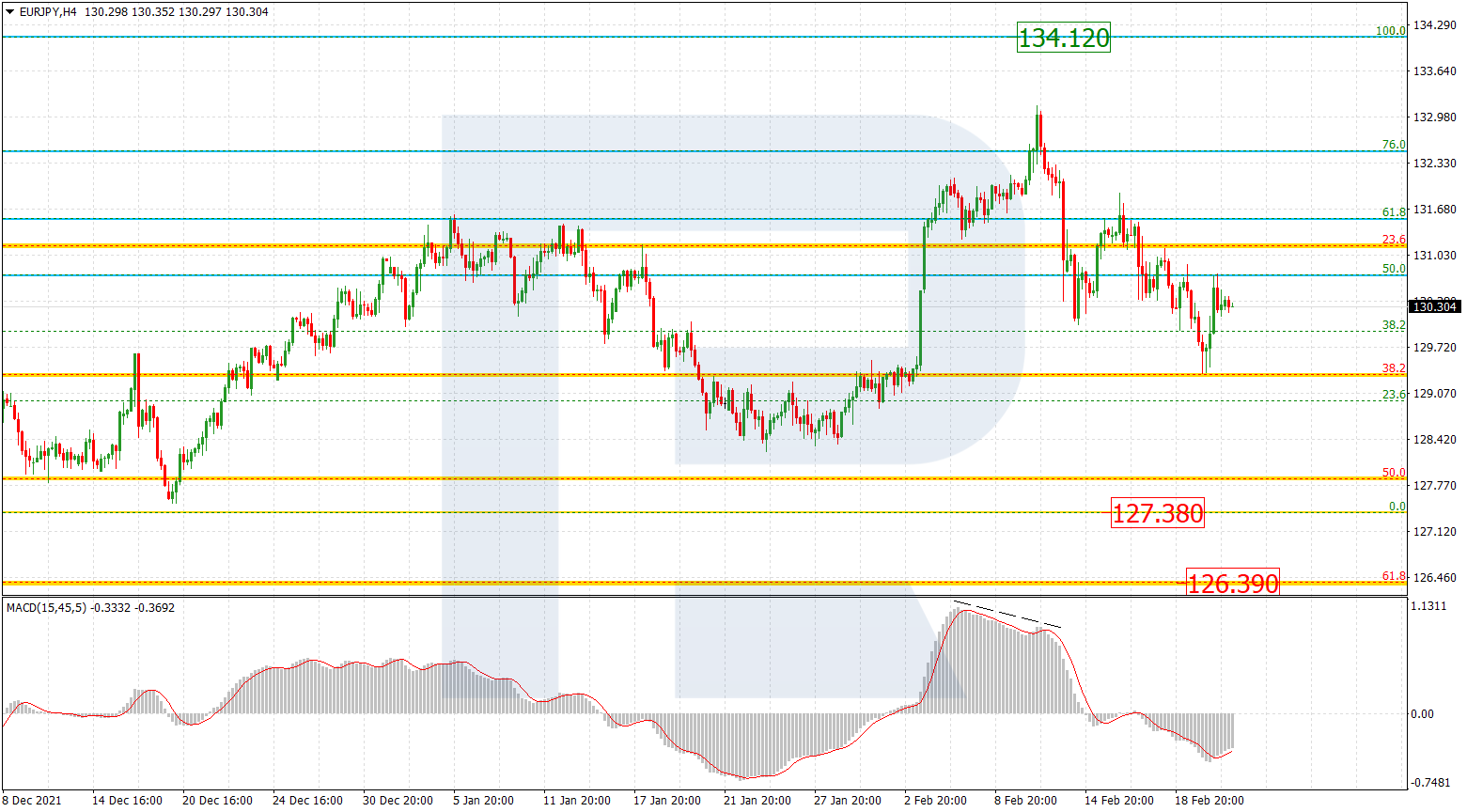

EURJPY, “Euro vs. Japanese Yen”

As we can see in the H4 chart, the convergence made EURJPY start a quick correctional uptrend, which is getting close to 50.0% fibo at 119.60. The next upside target may be 61.8% fibo at 120.49. The key support is the low at 115.86.

In the H1 chart, there is a divergence within the uptrend on MACD. After reaching 50.0% fibo at 119.60, the instrument is expected to start a new correction towards 23.6%, 38.2%, and 50.0% fibo at 118.71, 118.17, and 117.73 respectively.