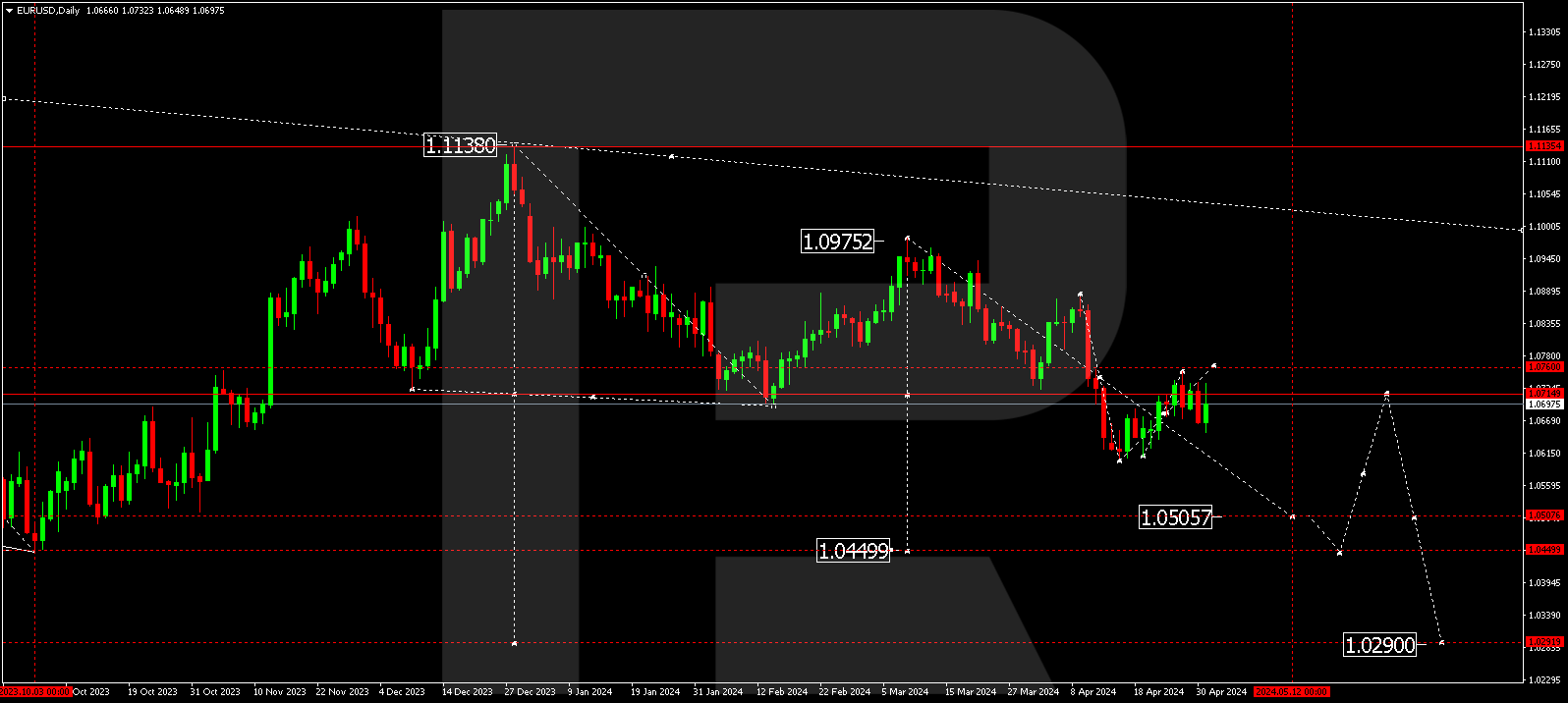

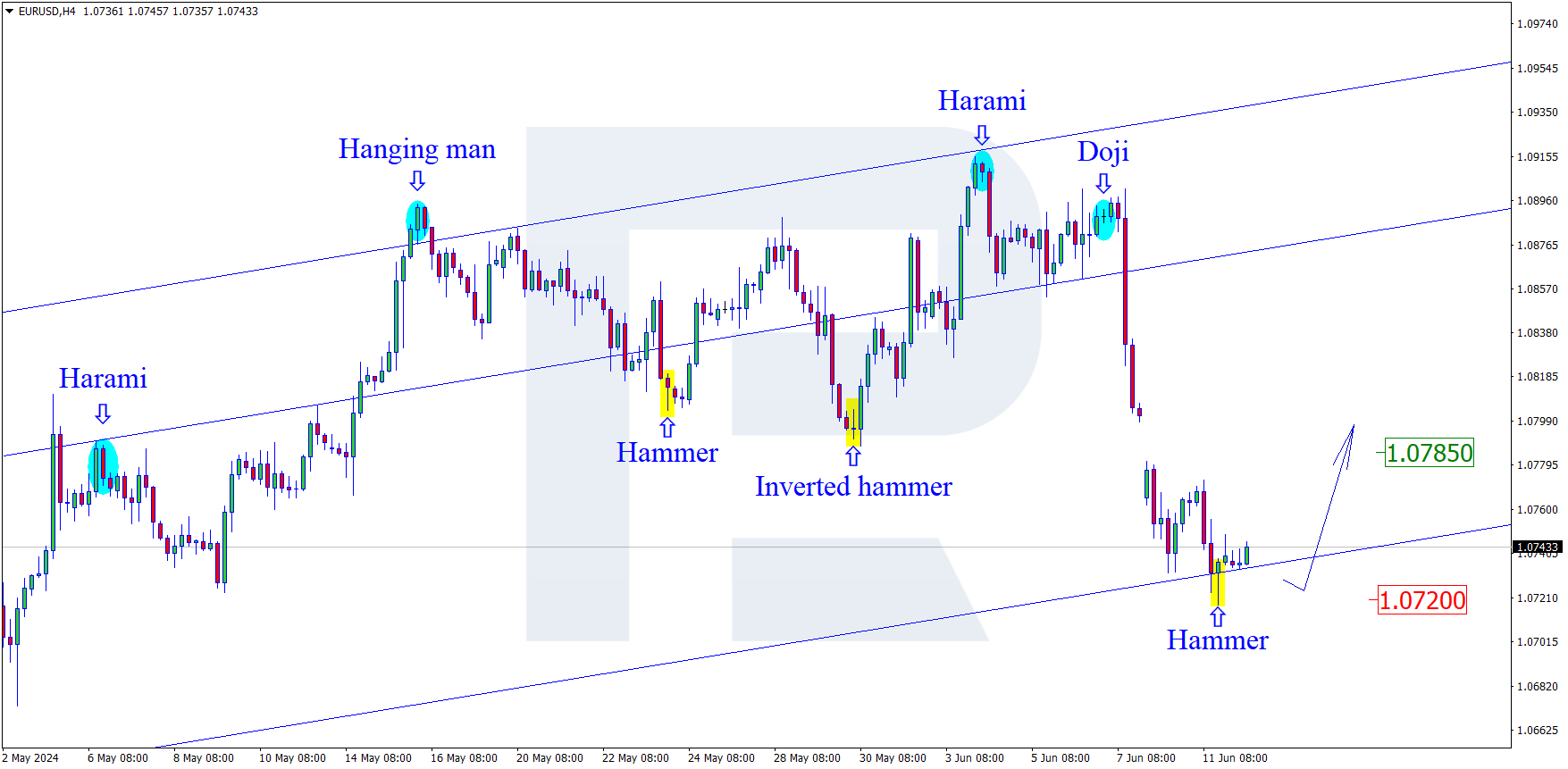

EURUSD, “Euro vs US Dollar”

As we can see in the daily chart, EURUSD is starting a new decline as a reversal signal after a long-term growth and a divergence on MACD. The current chart structure says that the asset may fall towards 50.0% fibo at 1.1594, which acts as the support. However, if this descending movement transforms into a sideways channel, it may end up as a new rising impulse to reach the long-term fractal high at 1.2555.

The H4 chart shows a more detailed structure of the current correctional downtrend. By now, the pair has broken 23.6% fibo and may continue falling towards 38.2%, 50.0%, and 61.8% fibo at 1.2065, 1.1976, and 1.1888 respectively. If EURUSD breaks the high at 1.2350n, the asset may complete the pullback and resume trading upwards.

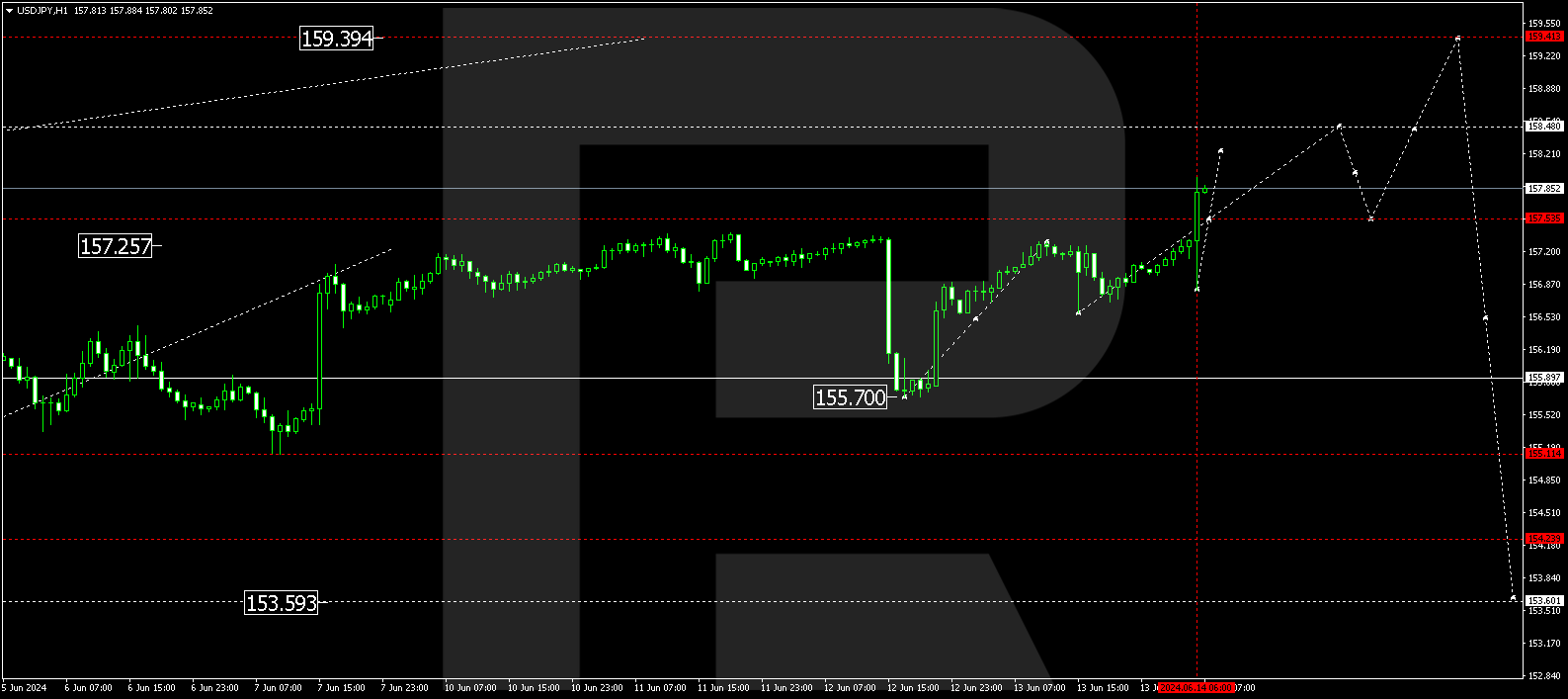

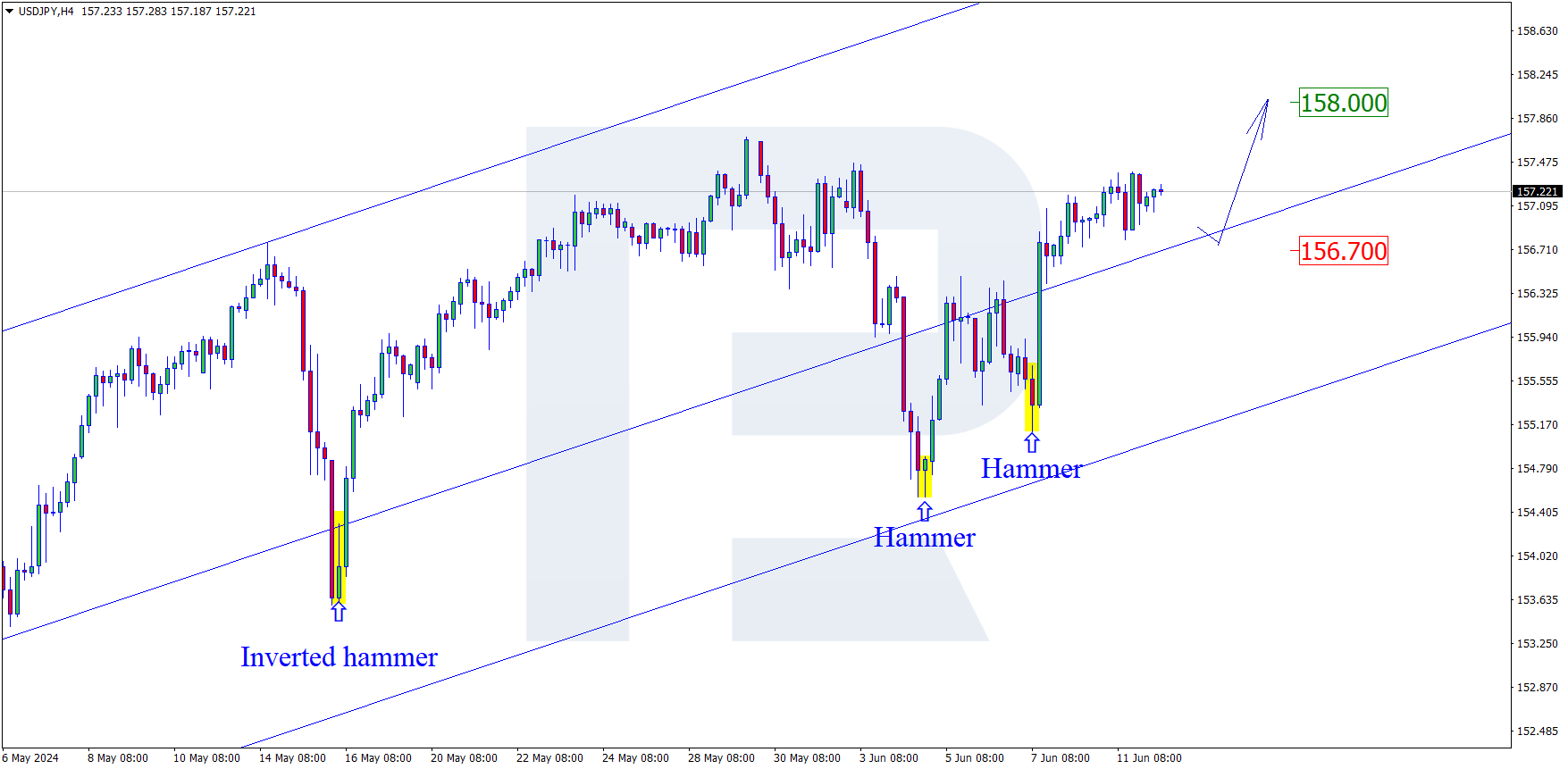

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the H4 chart, the pair is moving upwards after a convergence on MACD and may soon reach 23.6% fibo at 104.75. Possibly, the asset may break this level and then continue growing towards 38.2% and 50.0% fibo at 106.07 and 107.15 respectively. On the other hand, if the asset breaks the low at 102.59, the instrument may continue falling to reach the fractal low at 101.18.

In the H1 chart, there is a divergence on MACD, which may indicate a possible pullback after the pair reaches 23.6% fibo at 104.75. in this case, the correctional targets may be 38.2%, 50.0%, and 61.8% fibo at 103.92, 103.67, and 103.42 respectively.