XAU USD, “Gold vs US Dollar”

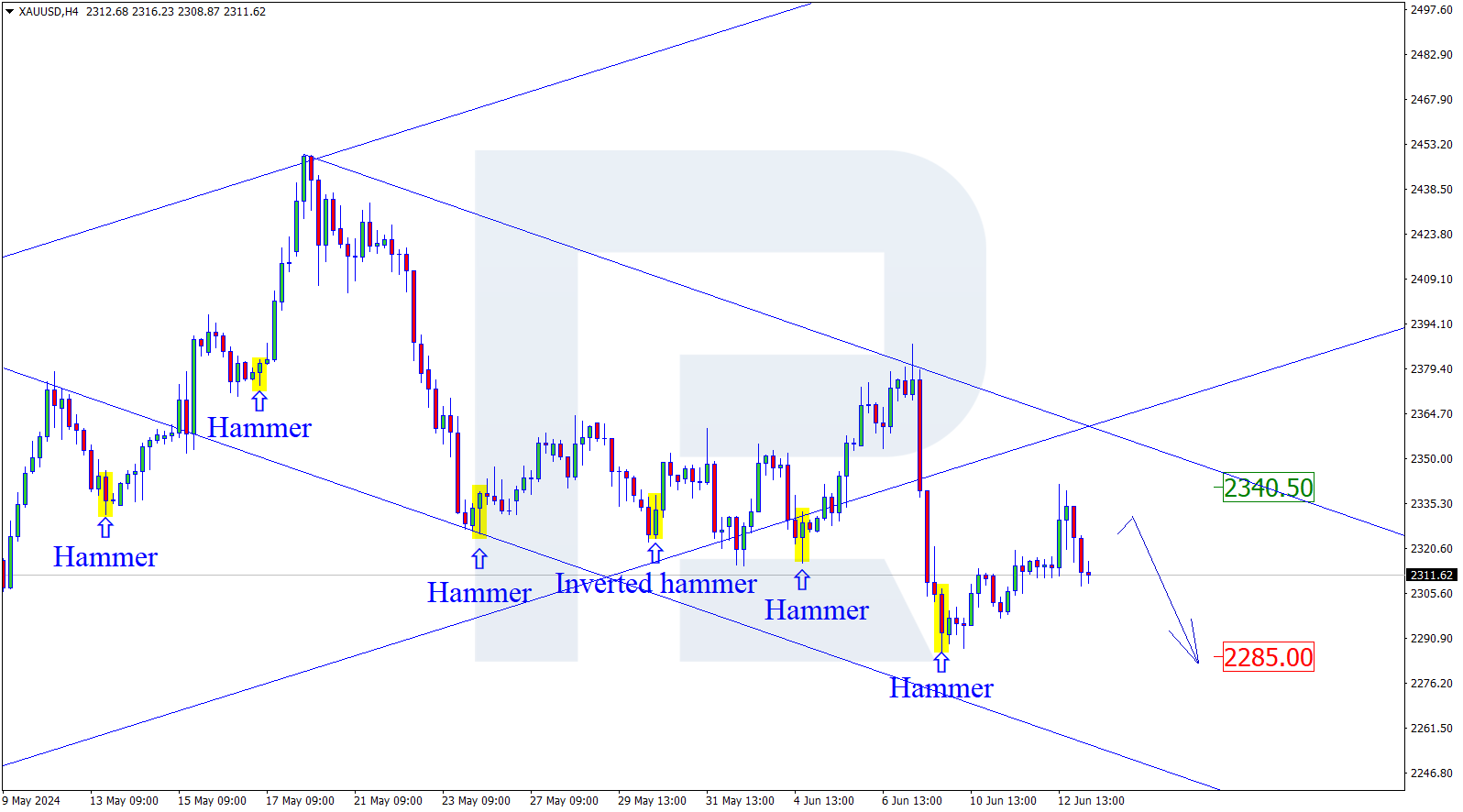

As we can see at the H4 chart, the XAU/USD pair is still being corrected to the upside and the correction has already reached the retracement of 38.2%. The next upside targets may be the retracements of 50.0% and 61.8% at 1309.00 and 1320.48 respectively. The resistance level is still close to the local high at 1357.31, and the support one – at 1260.85.

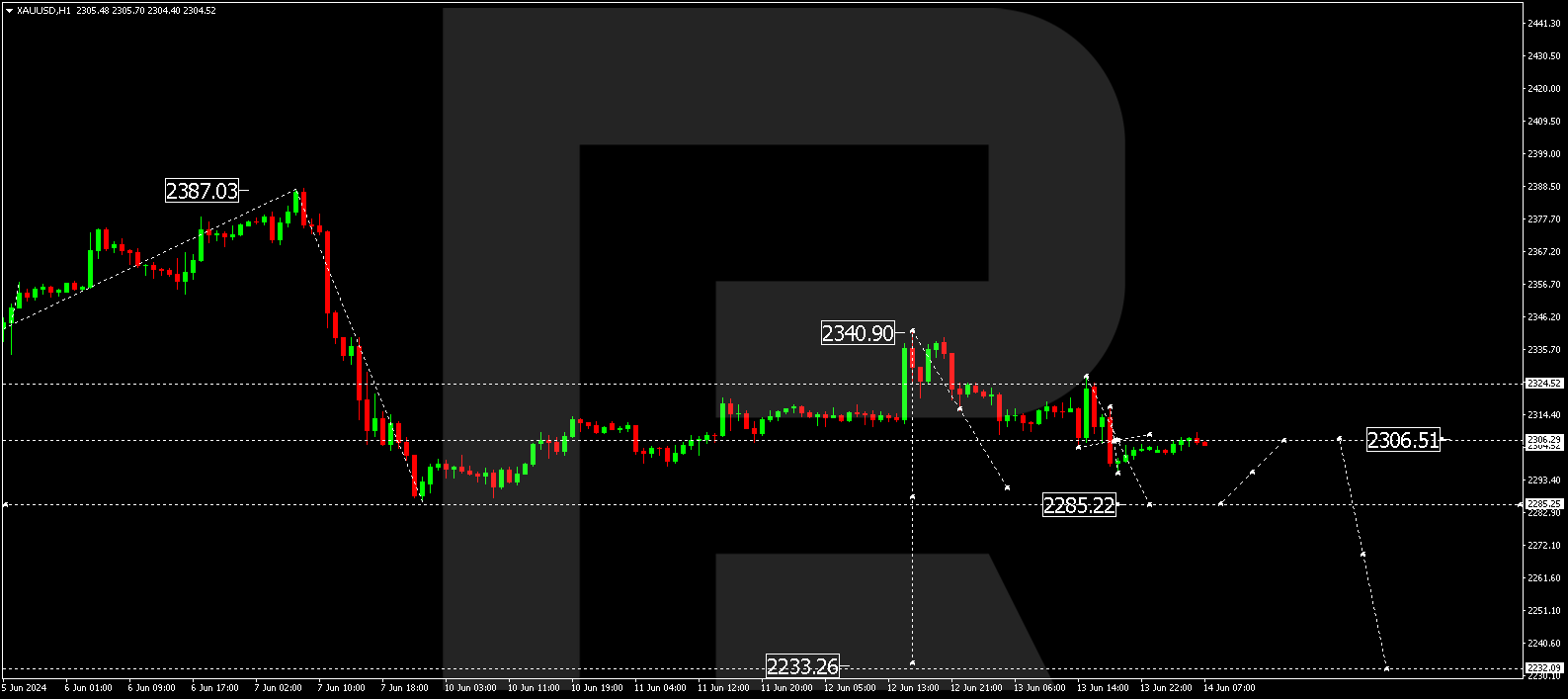

At the H1 chart, the pair is forming the divergence, which may indicate a possible correction in the short-term. The targets of the correction are the retracements of 23.6%, 38.2%, and 50.0% at 1289.50, 1284.00 and 1279.50 respectively.

USD CHF, “US Dollar vs Swiss Franc”

As we can see at the H4 chart, the USD/CHF pair has already been corrected to the upside by 38.2% and may continue growing towards the retracements of 50.0% at 0.9882. The divergence that is being formed right now may indicate a possible correction to the downside in the nearest future.

At the H1 chart we can see that after finishing the divergence the pair has already been corrected by 23.6%. the next targets of the short-term correction to the downside may be the retracements of 38.2% and 50.0% at 0.9678 and 0.9630 respectively. After breaking the current high at 0.9838, the instrument may move towards the post-correctional extension area between the retracements of 138.2% and 161.8%.

RoboForex Analytical Department