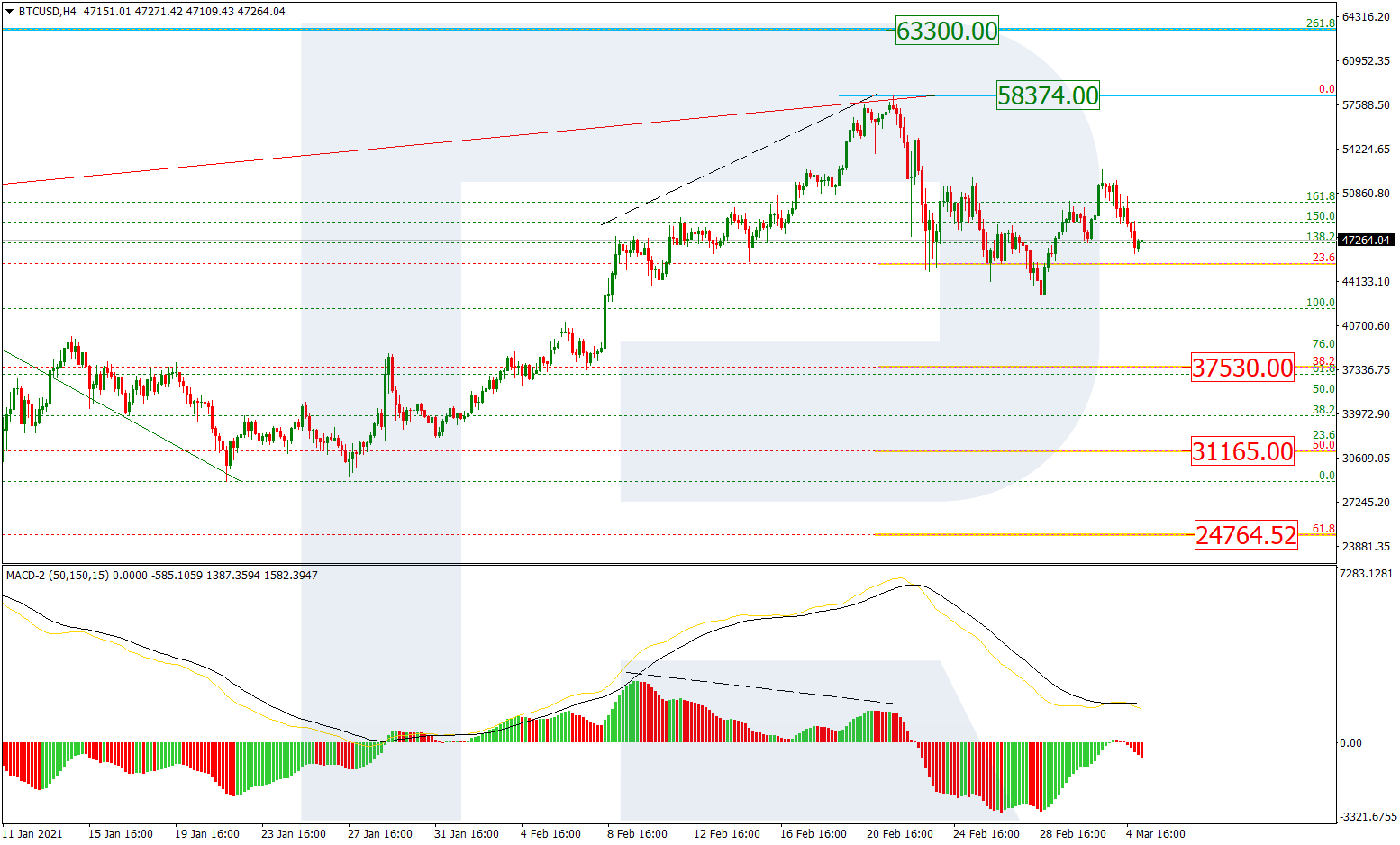

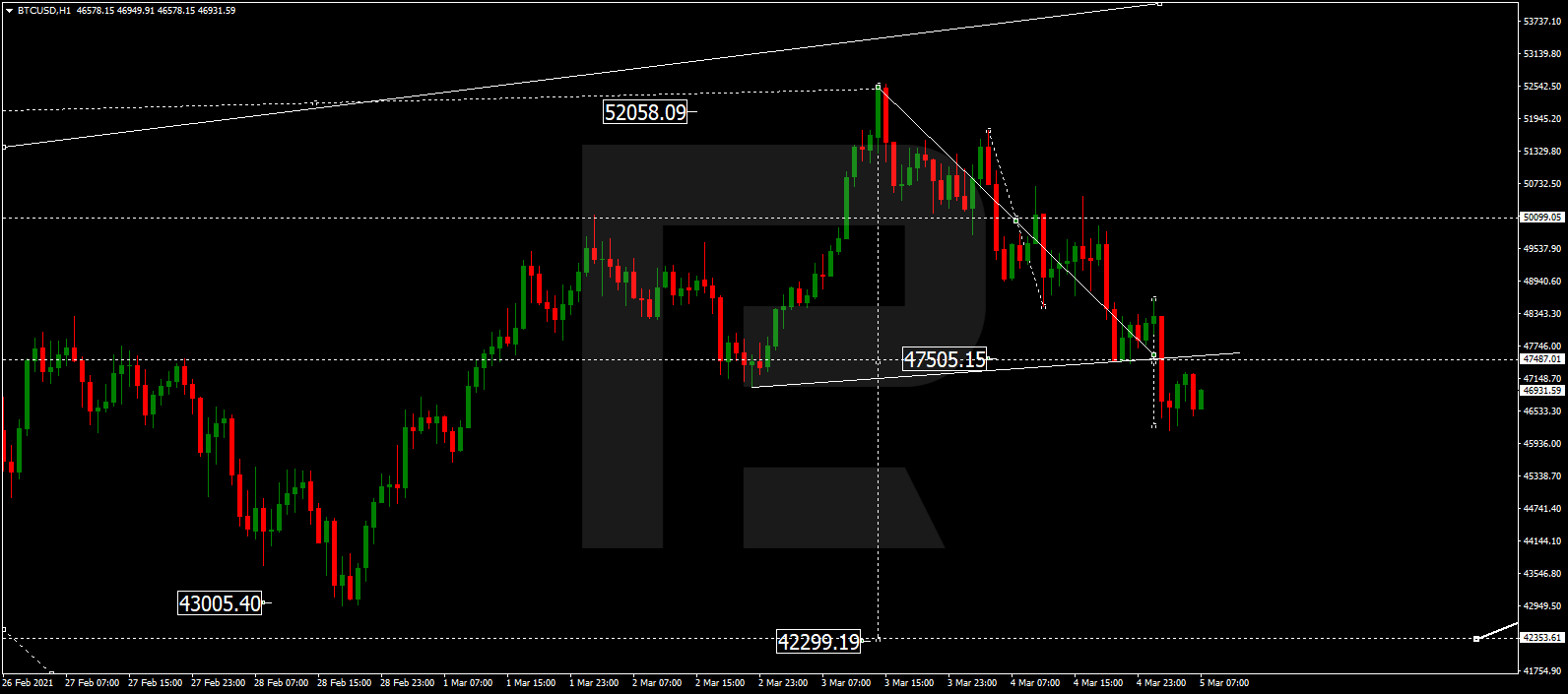

BTCUSD, “Bitcoin vs US Dollar”

As we can see in the H4 chart, after testing the previous low, BTCUSD started a new descending impulse. The downside targets may be inside the post-correctional extension area between the retracements of 138.2% and 161.8% at 3098.00 and 2875.00 respectively. The resistance level is at 3820.00.

In the H1 chart, the pair has finished the short-term correction; right now, it is trading downwards. However, there is a convergence on MACD, which indicate a new correction to the upside after the instrument reaches the targets inside the post-correctional extension area between the retracements of 138.2% and 161.8%. The local resistance is at 3634.20.

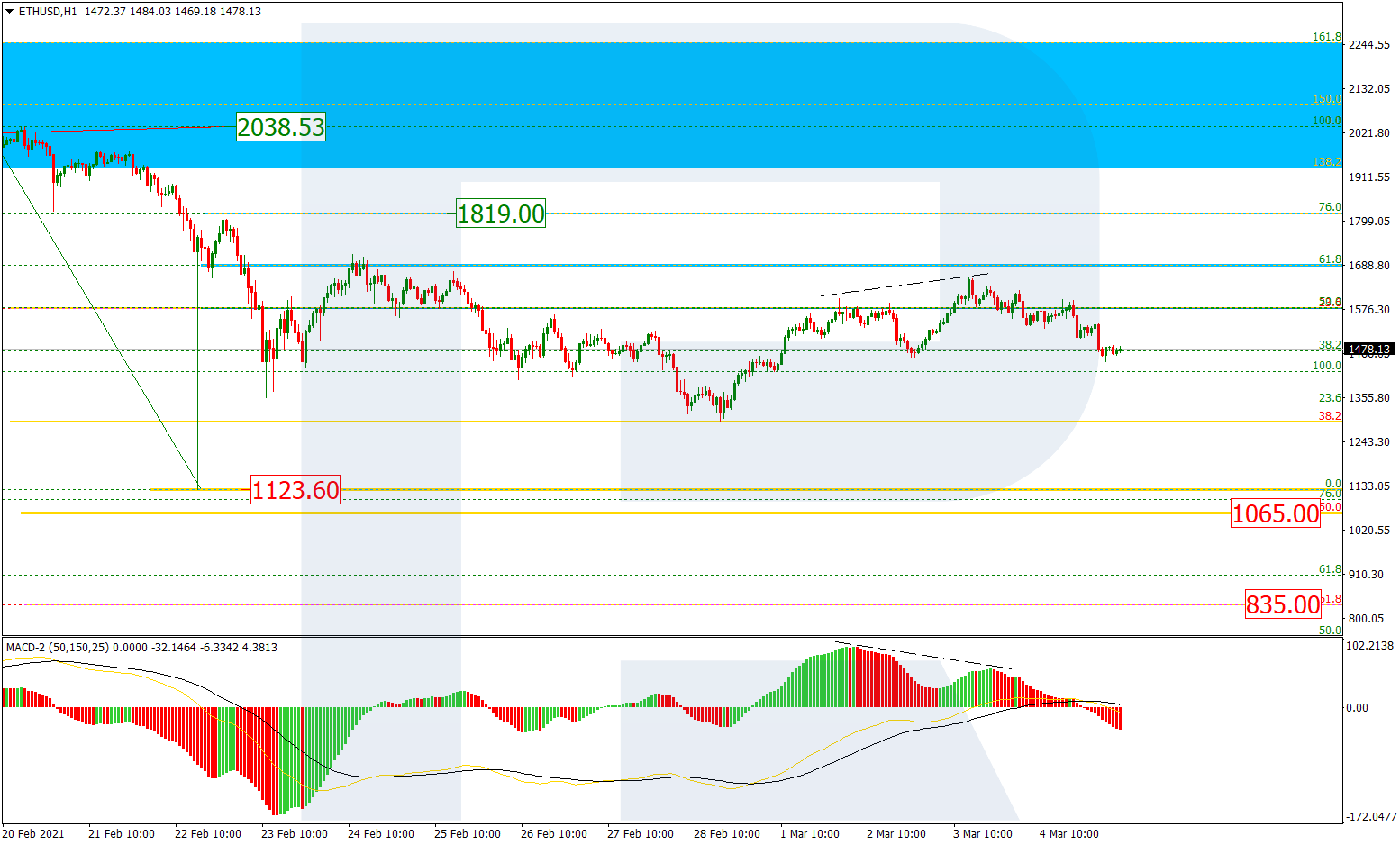

ETHUSD, “Ethereum vs. US Dollar”

As we can see in the H4 chart, ETHUSD is still trading inside the post-correctional extension area between the retracements of 138.2% and 161.8% at 87.50 and 81.00 respectively. In the future, the instrument may continue falling. The key resistance is the high at 98.04.

In the H1 chart shows more detailed structure of the current decline. Possibly, the pair may break the low at 81.00 and then continue trading towards inside the post-correctional extension area between the retracements of 138.2% and 161.8% at 74.50 and 70.40 respectively.