Brent

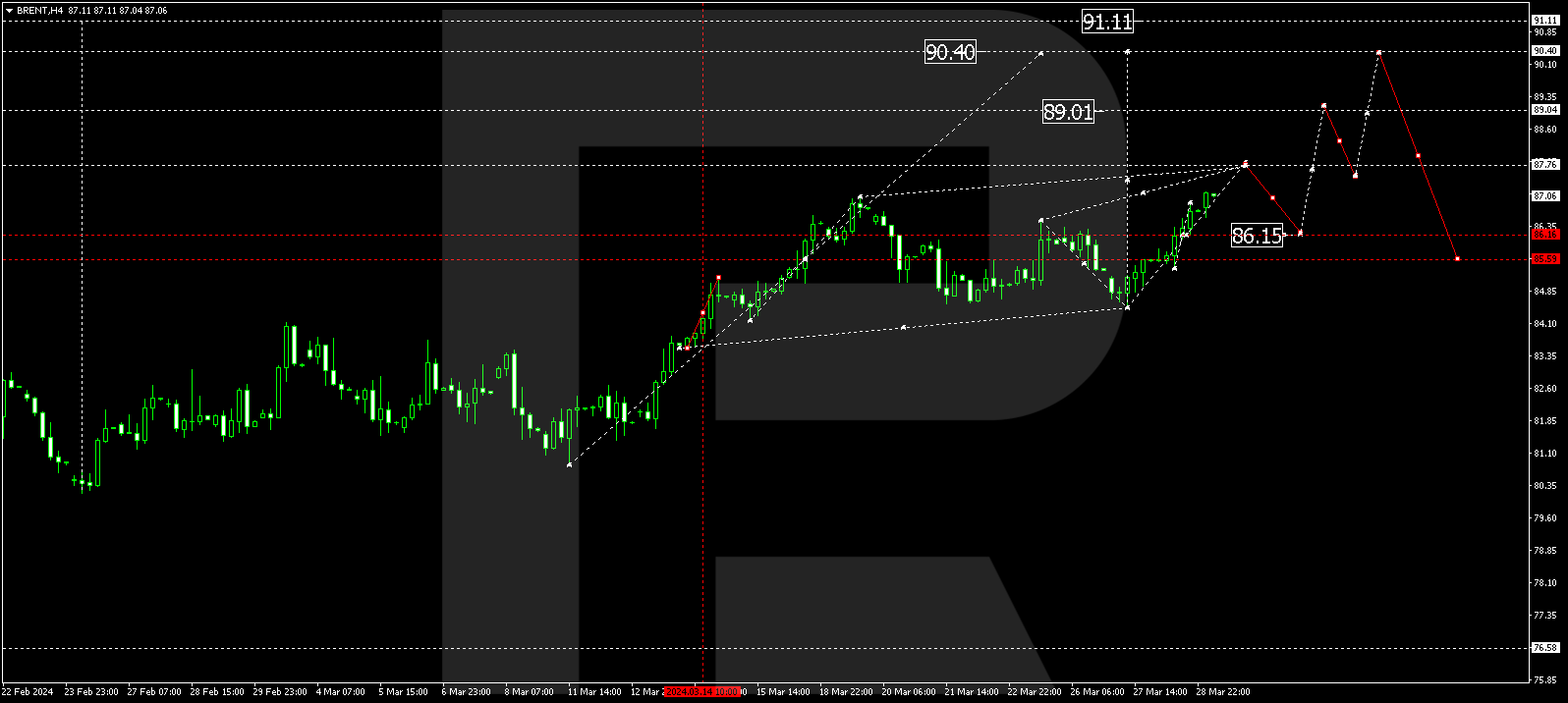

In the H4 chart, after failing to reach 23.6% fibo at 58.00, Brent is moving upwards again, probably to update the high at 71.07, a breakout of which may result in a further uptrend towards the fractal high at 87.09. At the same time, the asset may yet rebound from the high and resume falling. In this case, the next downside targets might be 23.6, 38.2%, and 50.0% fibo at 58.00, 49.94, and 43.46 respectively.

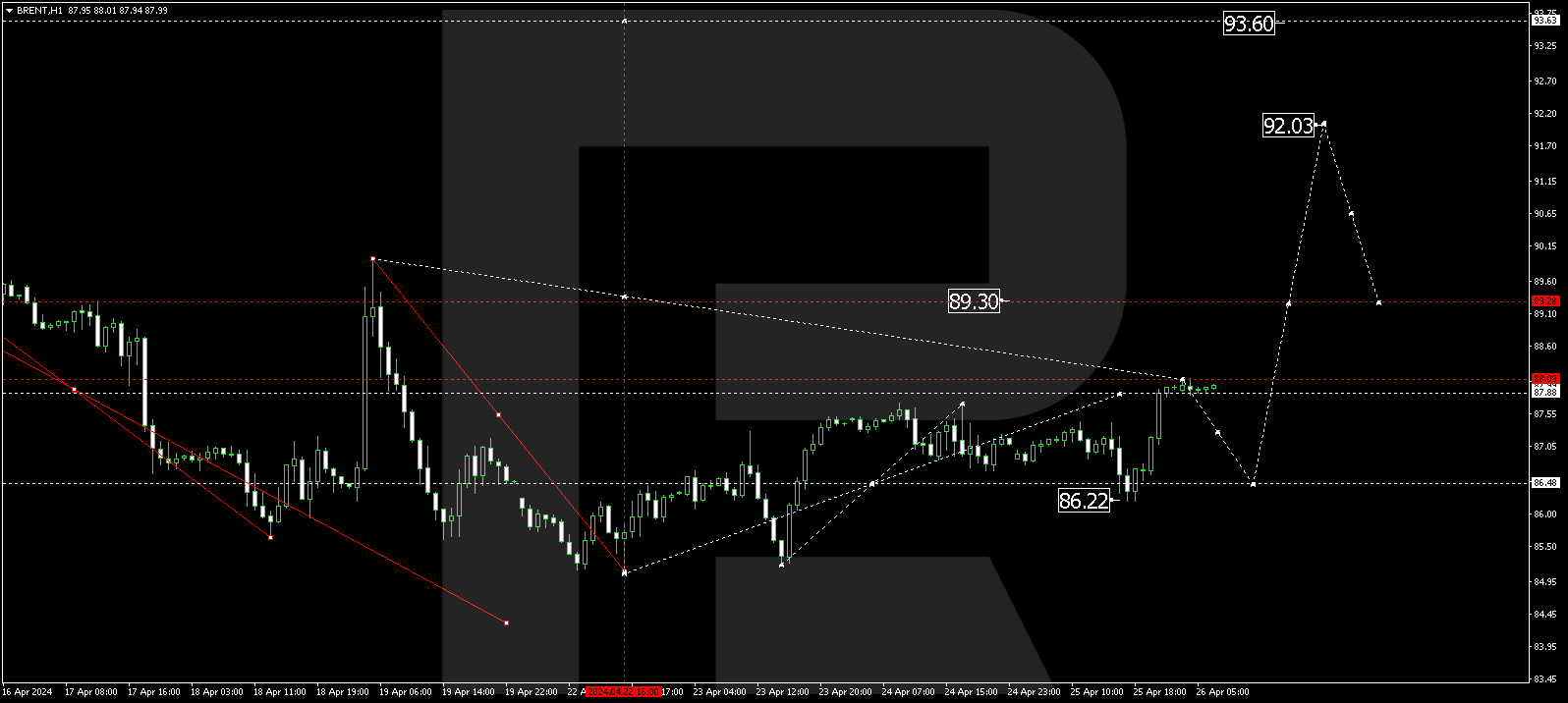

The H1 chart shows a more detailed structure of the current ascending movement. After completing the descending wave, the pair has almost reached 61.8% fibo at 67.02. A breakout of the low at 60.46 may lead to a further downtrend. The next upside target may be 76.0% fibo at 68.51. The support is the low at 60.46.

Dow Jones

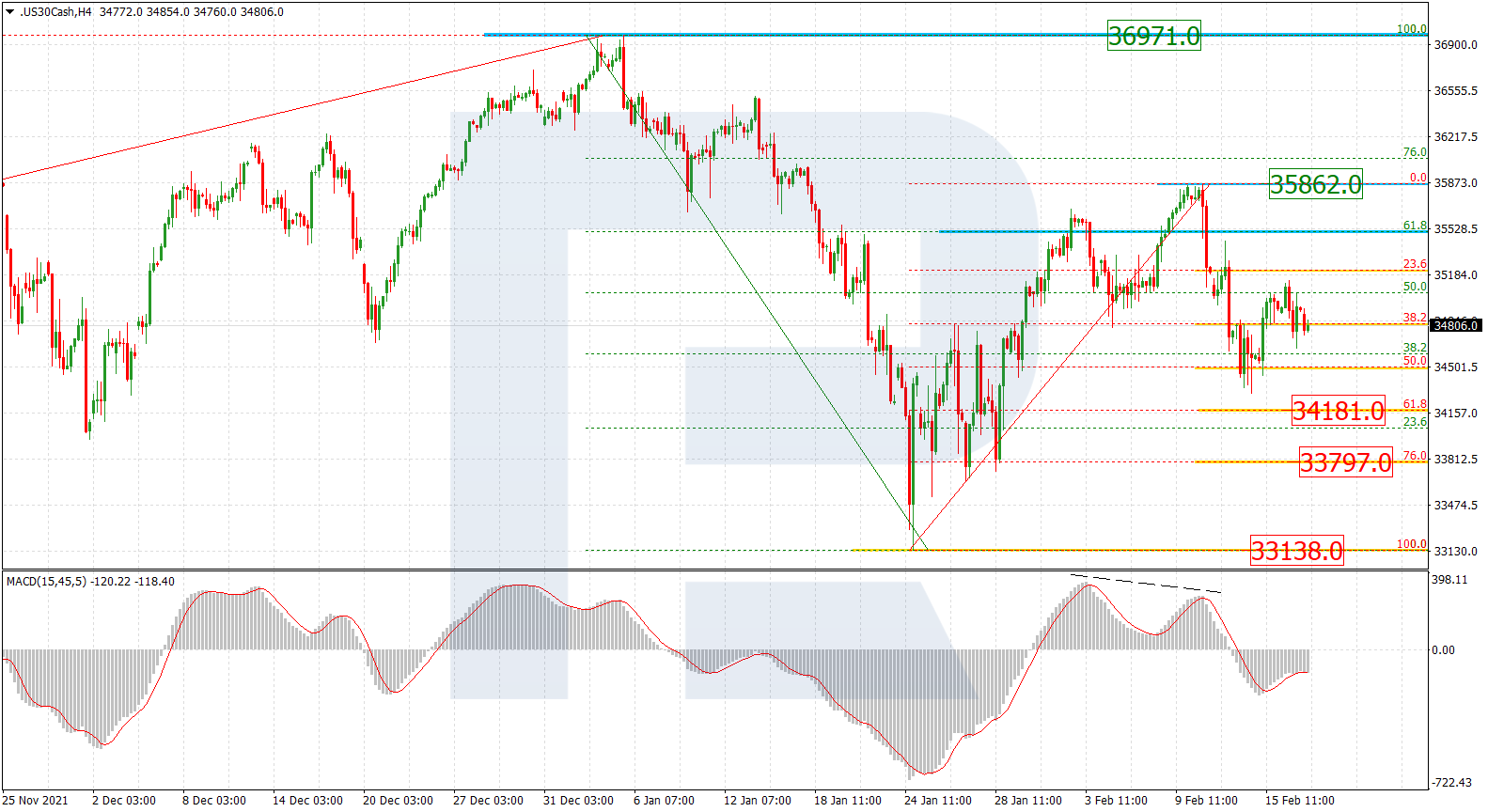

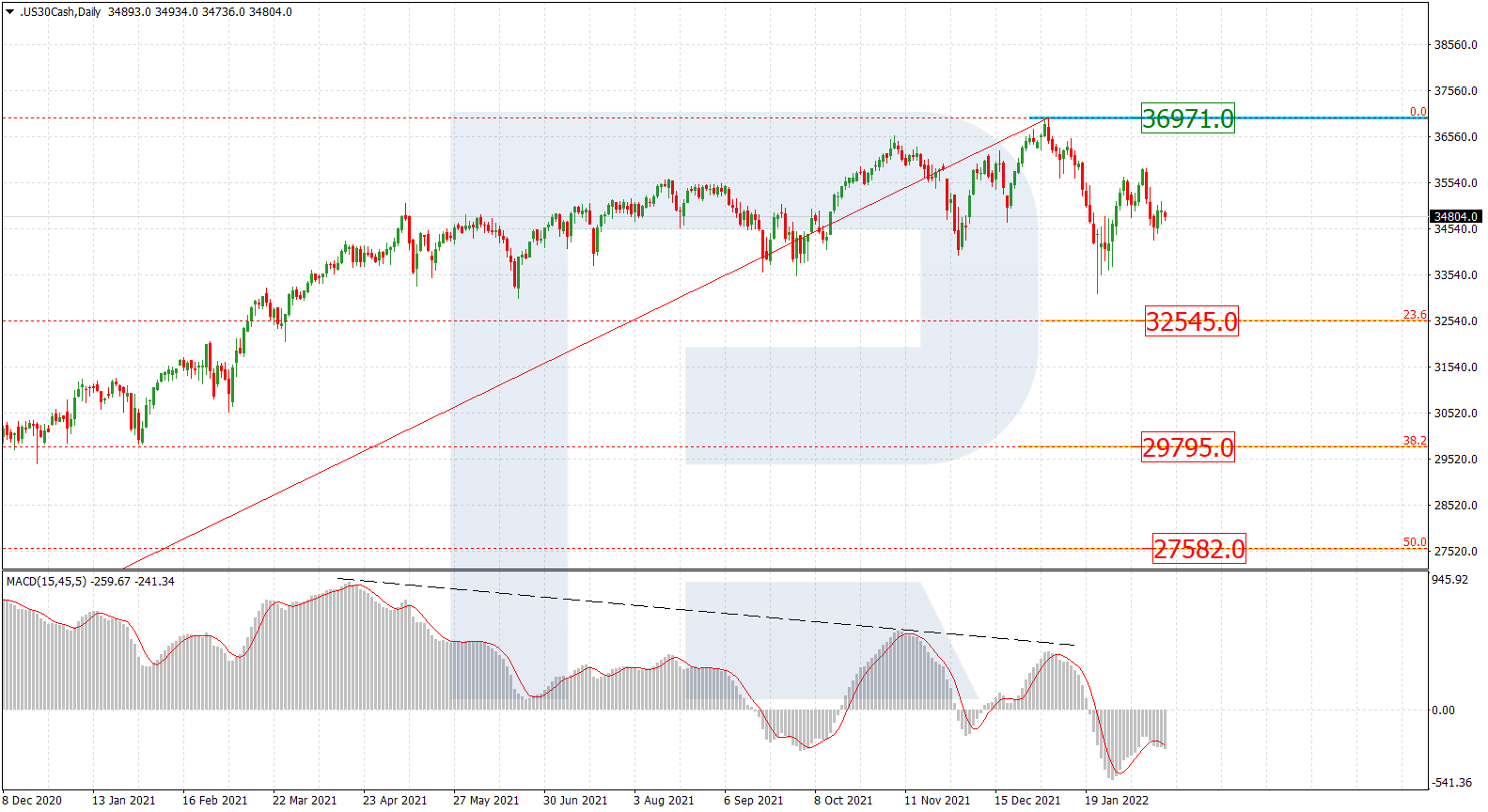

The daily chart shows that the Dow Jones continues forming a stable ascending tendency, which is approaching the post-correctional extension area between 138.2% and 161.8% fibo at 33941.0 and 36620.0 respectively. However, despite this stable uptrend, the price is slowing down and there is a divergence on MACD, which may indicate a possible pullback soon. The support is at 29585.9.

As we can see in the H4 chart, the asset is testing the downside border of the post-correctional extension area between 138.2% and 161.8% fibo at 33941.0 and 36620.0 respectively. Possibly, the price may start a new correction soon towards 23.6%, 38.2%, and 50.0% fibo at 32083.0, 30933.0, and 30002.0 respectively.