GBPUSD

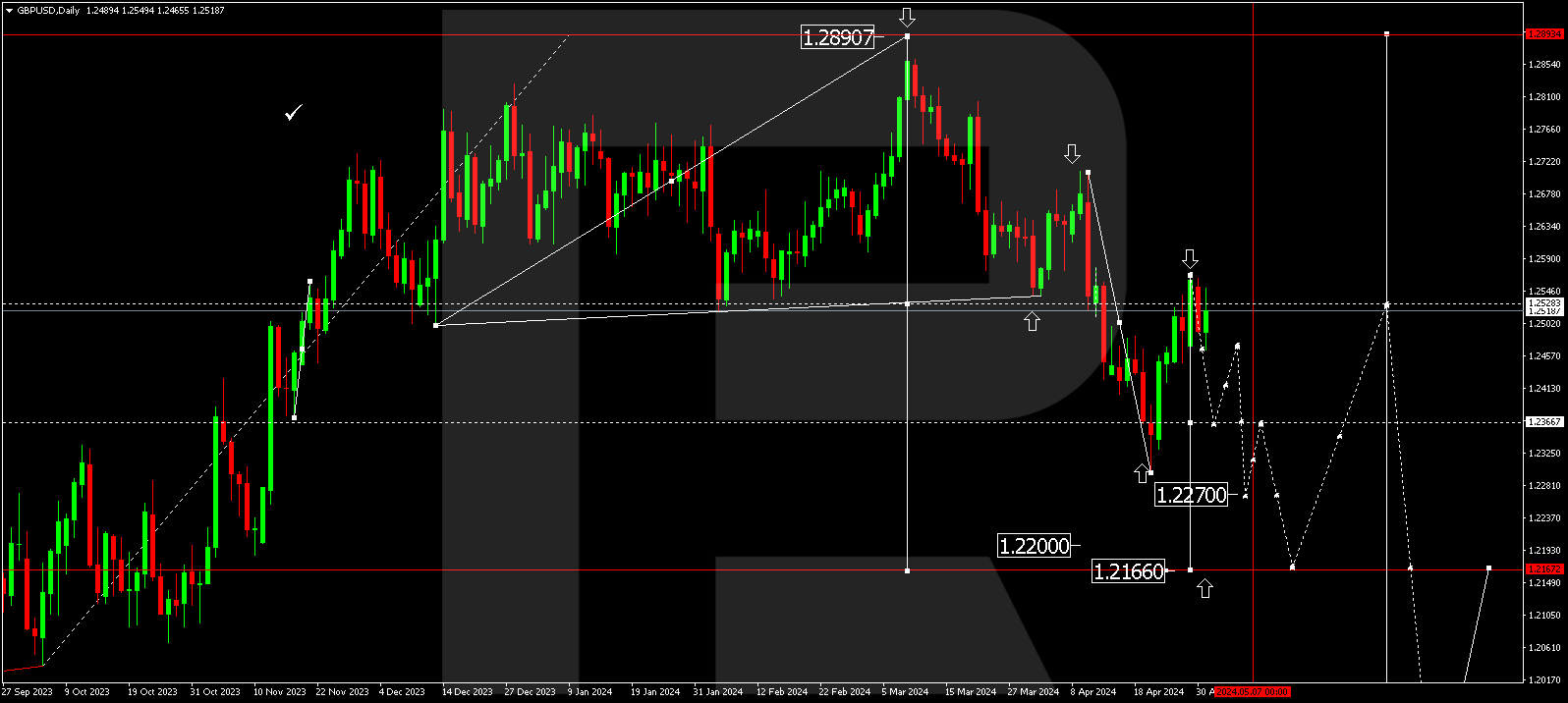

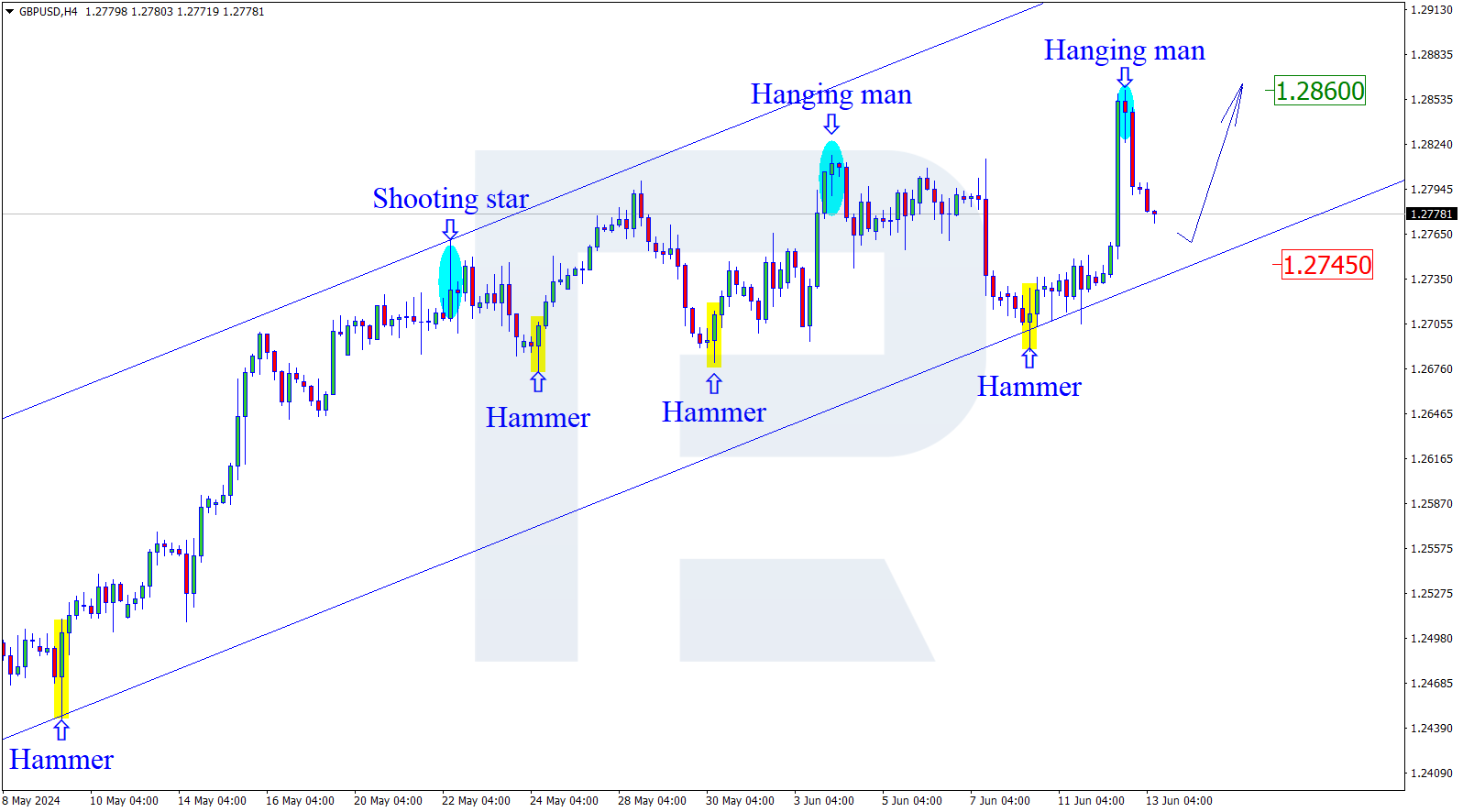

On the daily timeframe the descending of the instrument has reached a long-term minimum of 1.2395. Hence there is a convergence forming, a pullback to the resistance area of 61.8% (1.2770) may be expected. Further descending may be aiming at the post-correction amplification area of 138.2-161.8% (1.2019-1.1790) Fibo.

On H4 a short-term decline to the local post-correction amplification area of 138.2-161.8% (1.2386-1.2353) Fibo may be expected. However, judging by the convergence, a correction upwards to the local resistance at 1.2579 may follow.

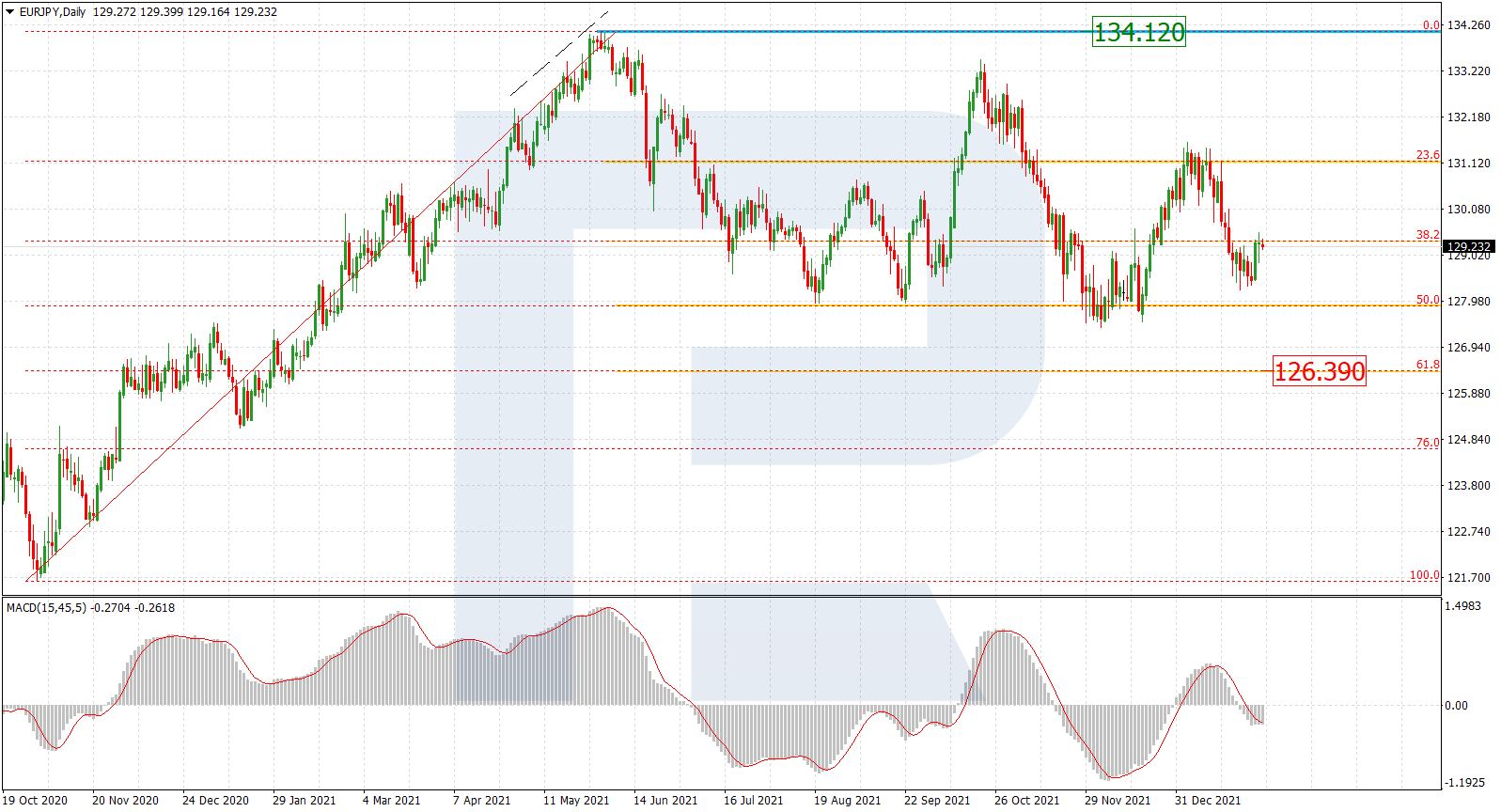

EURJPY

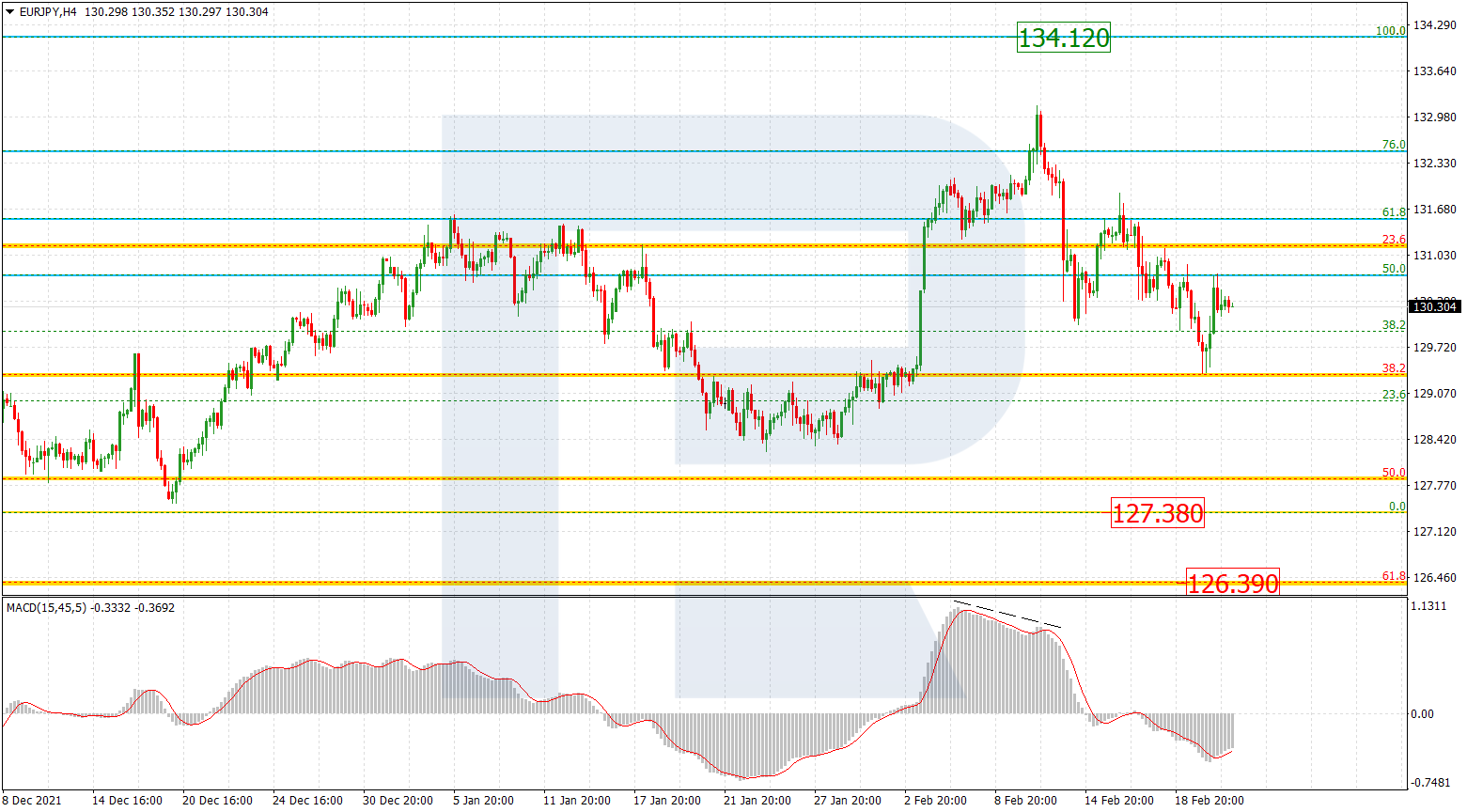

The instrument remains in the correction corridor, testing the level around 61.8% Fibo in relation with the previous ascending trend. The goals of the subsequent decline are the same: 76.0% (120.25) and the long-term minimum of 117.96.

On H4 the instrument is developing a descending movement towards the local minimum of 120.78 after a correction upwards. Upon breaking through the minimum, the quotations may head for the new goal a 76.0% (120.25), and later to the post-correction amplification area of 138.2-161.8% (119.80-119.20) Fibo. The main resistance is at 123.36.