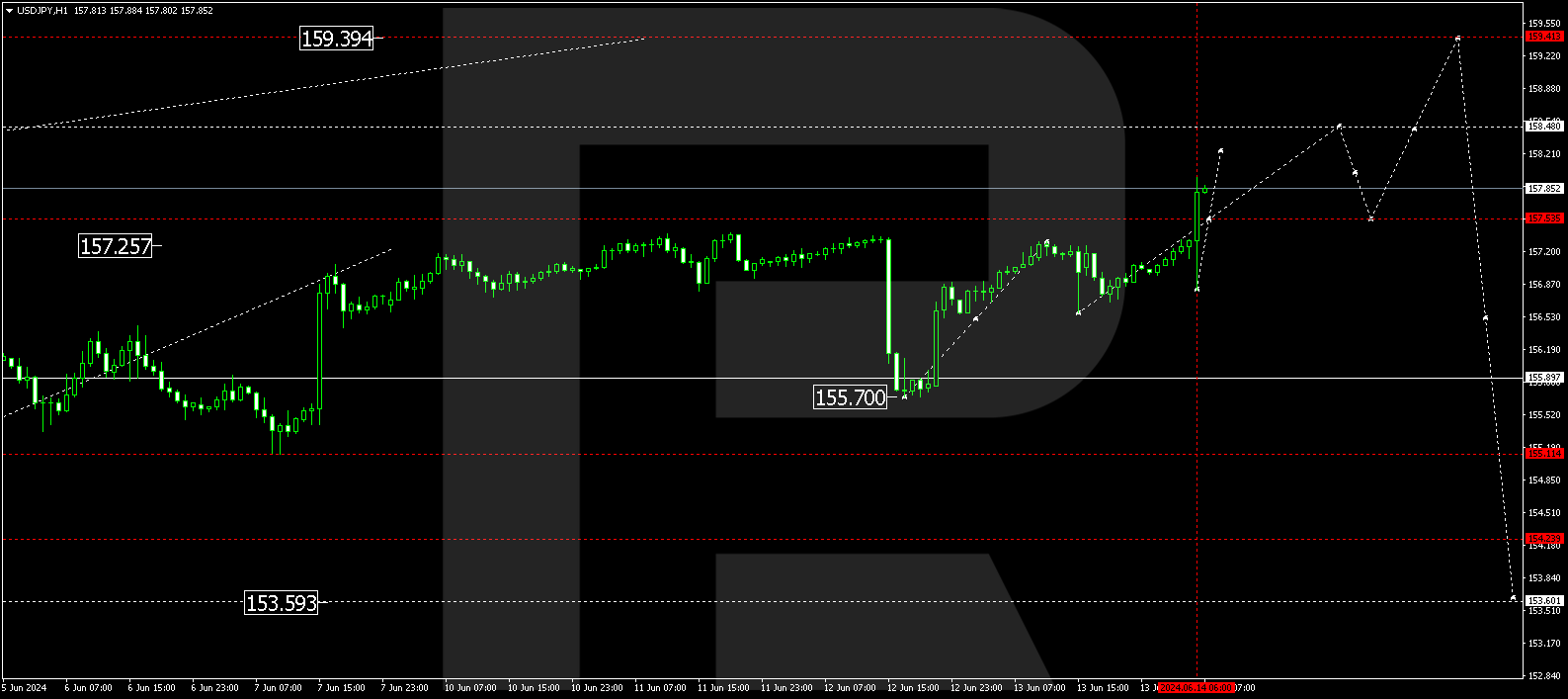

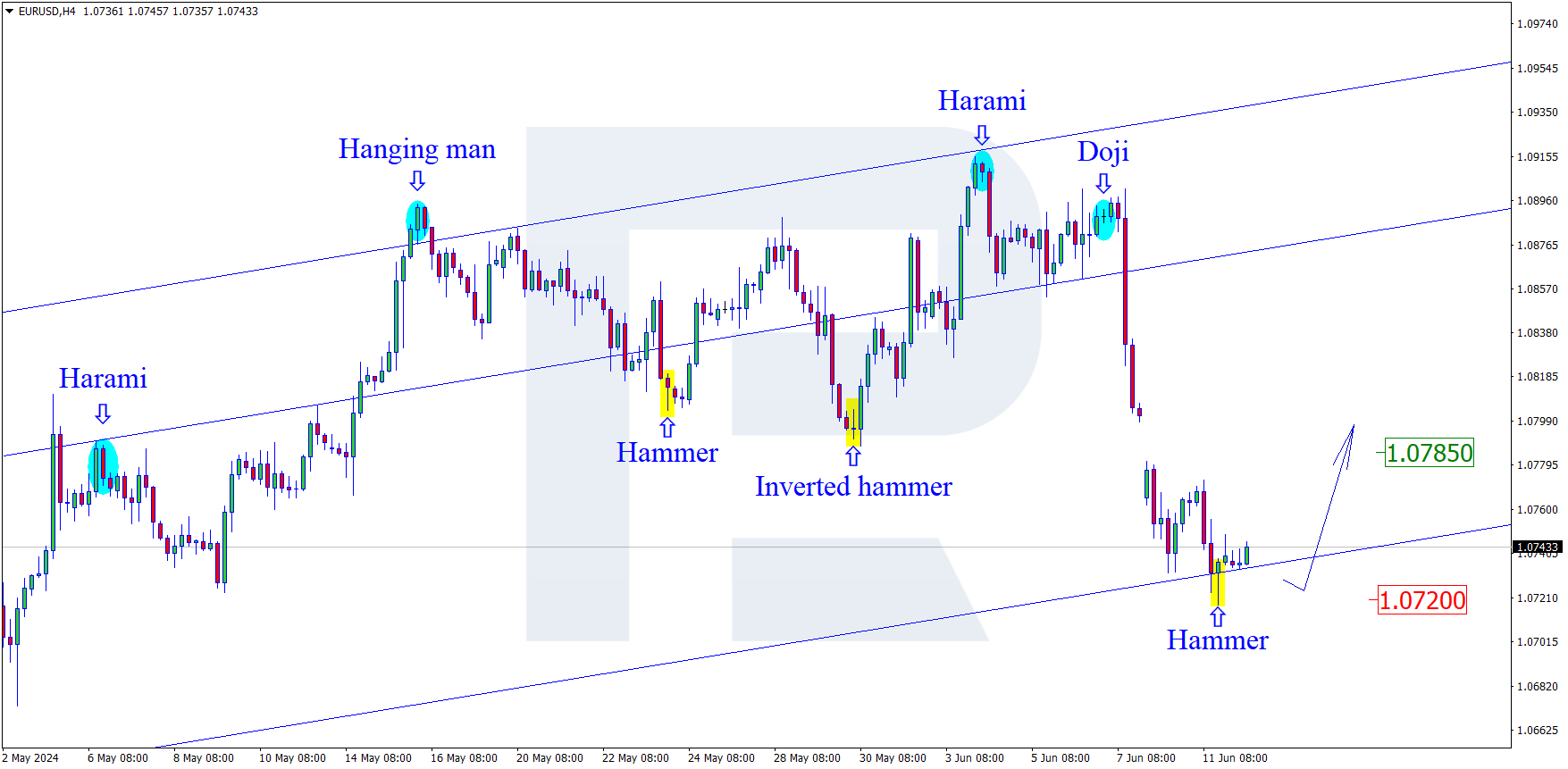

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, after reaching the post-correctional extension area between 138.2% and 161.8% fibo at 1.0942 and 1.0889 respectively again, EURUSD tried to grow and reach 61.8% fibo at 1.1126, but unsuccessfully. The current decline may be considered as a descending correction. The structure of this correction indicates uncertainty among investors, “turbulence” on the market, and a possibility of further expansion of the range, but the descending tendency is not over yet. Hence, the correction may yet continue to reach 61.8% and 76.0% fibo at 1.1126 and 1.1172 respectively in the short-term, but the key long-term targets are below the lows.

In the H1 chart, the local correction has reached 61.8% fibo, but the decline may yet continue towards 76.0% fibo at 1.0971. Later, the instrument may start a new rising impulse to reach the high at 1.1109.

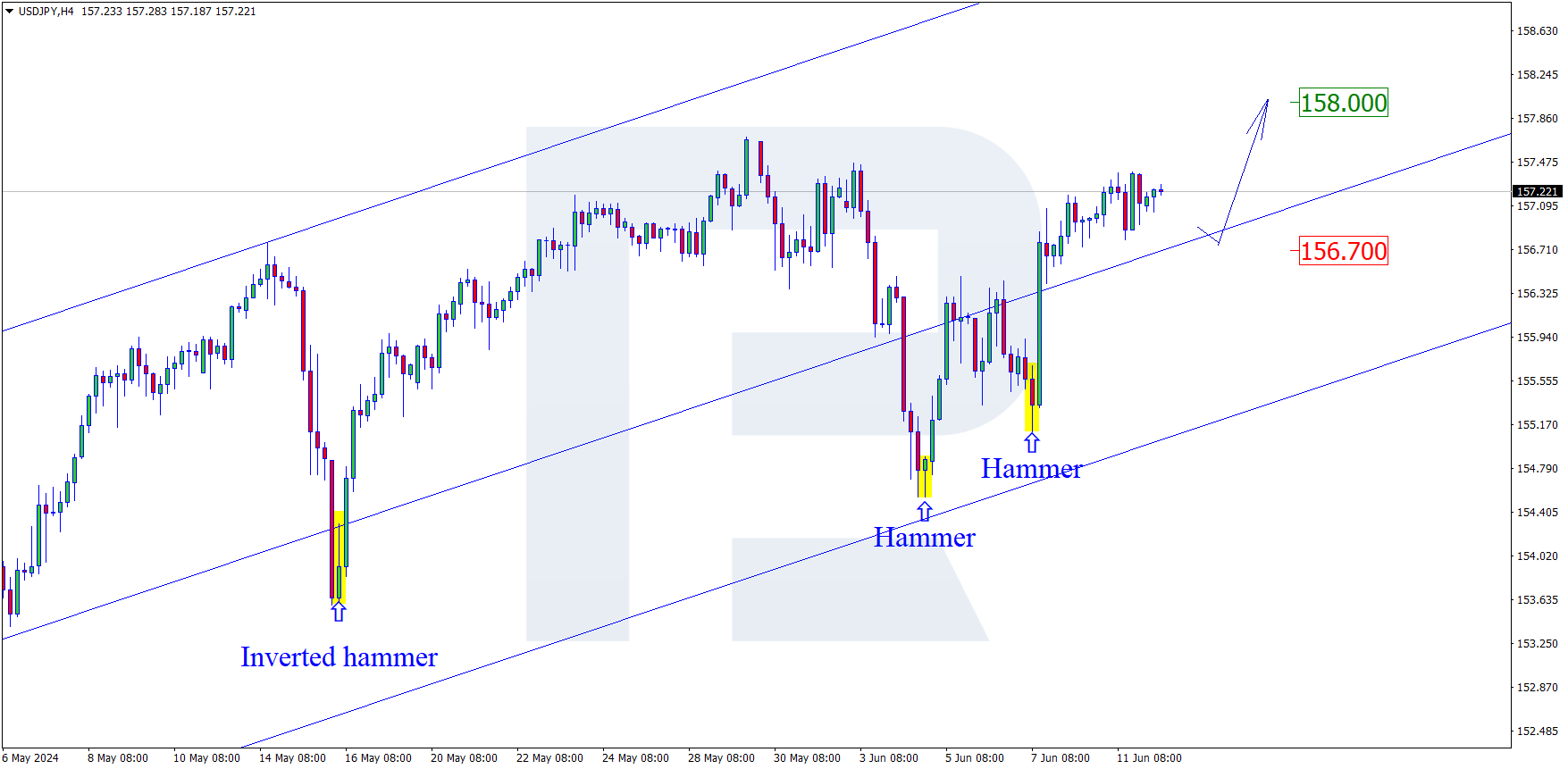

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the H4 chart, the correctional uptrend continues; it has almost reached 50.0% fibo at 108.42. At the same time, there is a divergence on MACD, which indicates a possible short-term pullback towards 38.2% fibo at 107.48. After the correction, USDJPY may resume moving upwards to reach 61.8% fibo at 109.37.

In the H1 chart, there is a divergence on MACD within the uptrend, so we may try to define possible targets of the oncoming pullback. In case of the correctional downtrend, they may be 23.6%, 38.2%, and 50.0% fibo at 107.75, 107.36, and 107.06 respectively.