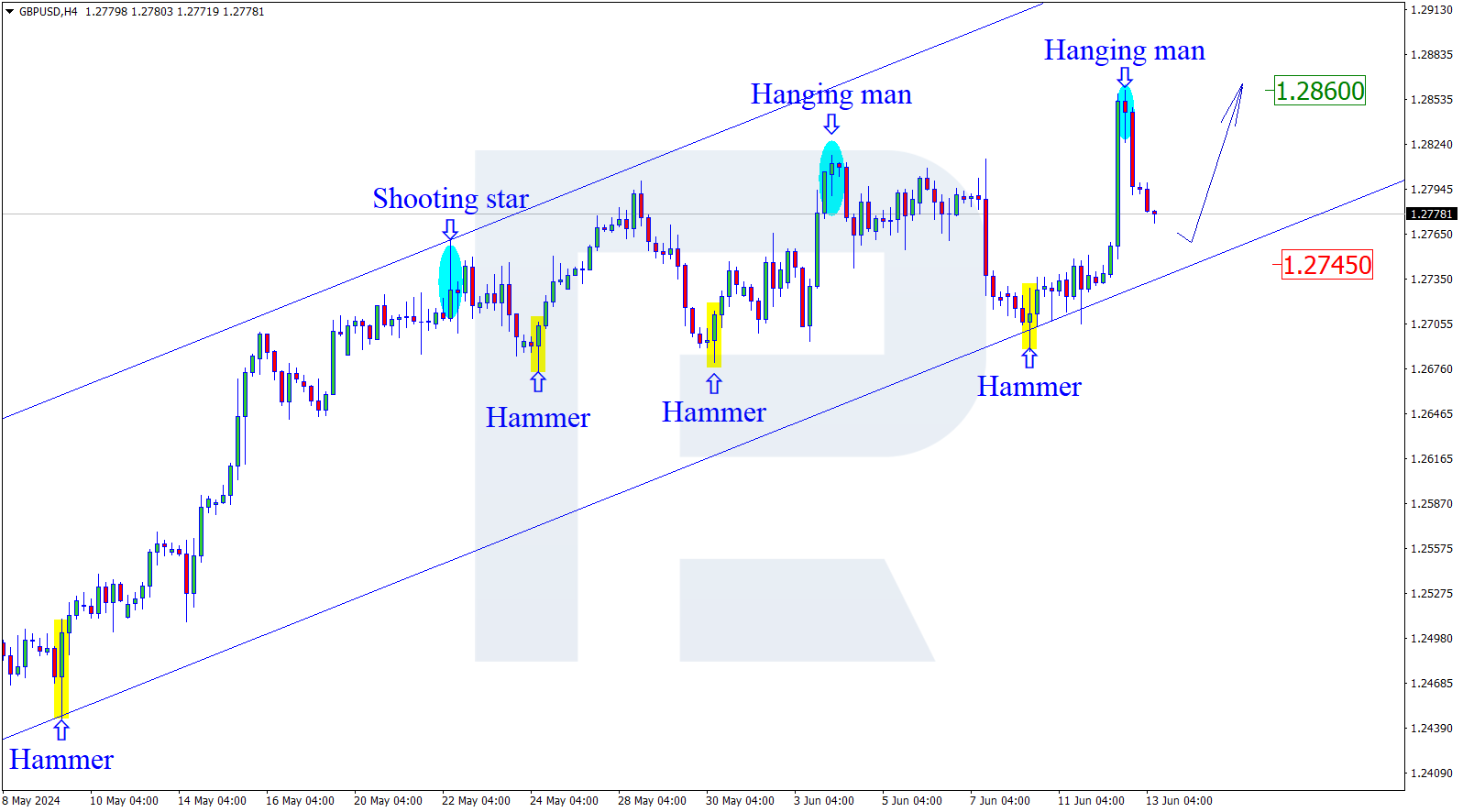

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, after completing the correction not far from 23.6% fibo, GBPUSD is moving downwards and has already broken 38.2% fibo. Later, the market may continue trading downwards to reach 50.0% and 61.8% fibo at 1.3463 and 1.3277 respectively. The resistance remains the same, 1.4250. The asset may reach this level but only after testing 61.8% fibo at 1.3277.

The H1 chart shows a potential of the current correction after convergence on MACD and a breakout of the post-correctional extension area. The first rising wave is heading towards 23.6% fibo at 1.3651, while the next ones may reach 38.2%, 50.0%, and 61.8% fibo at 1.3701, 1.3741, and 1.3781 respectively. The support is the low at 1.3572.

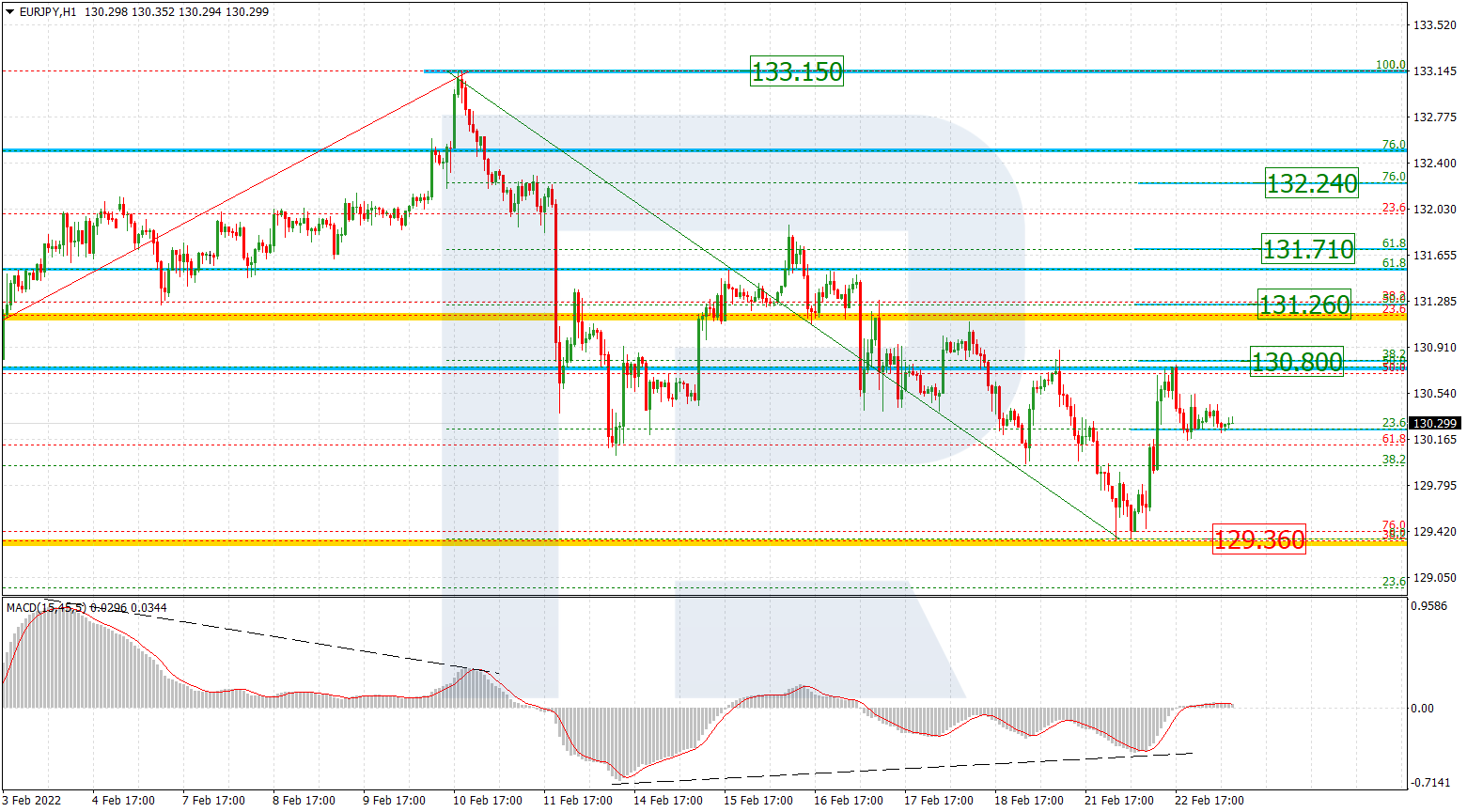

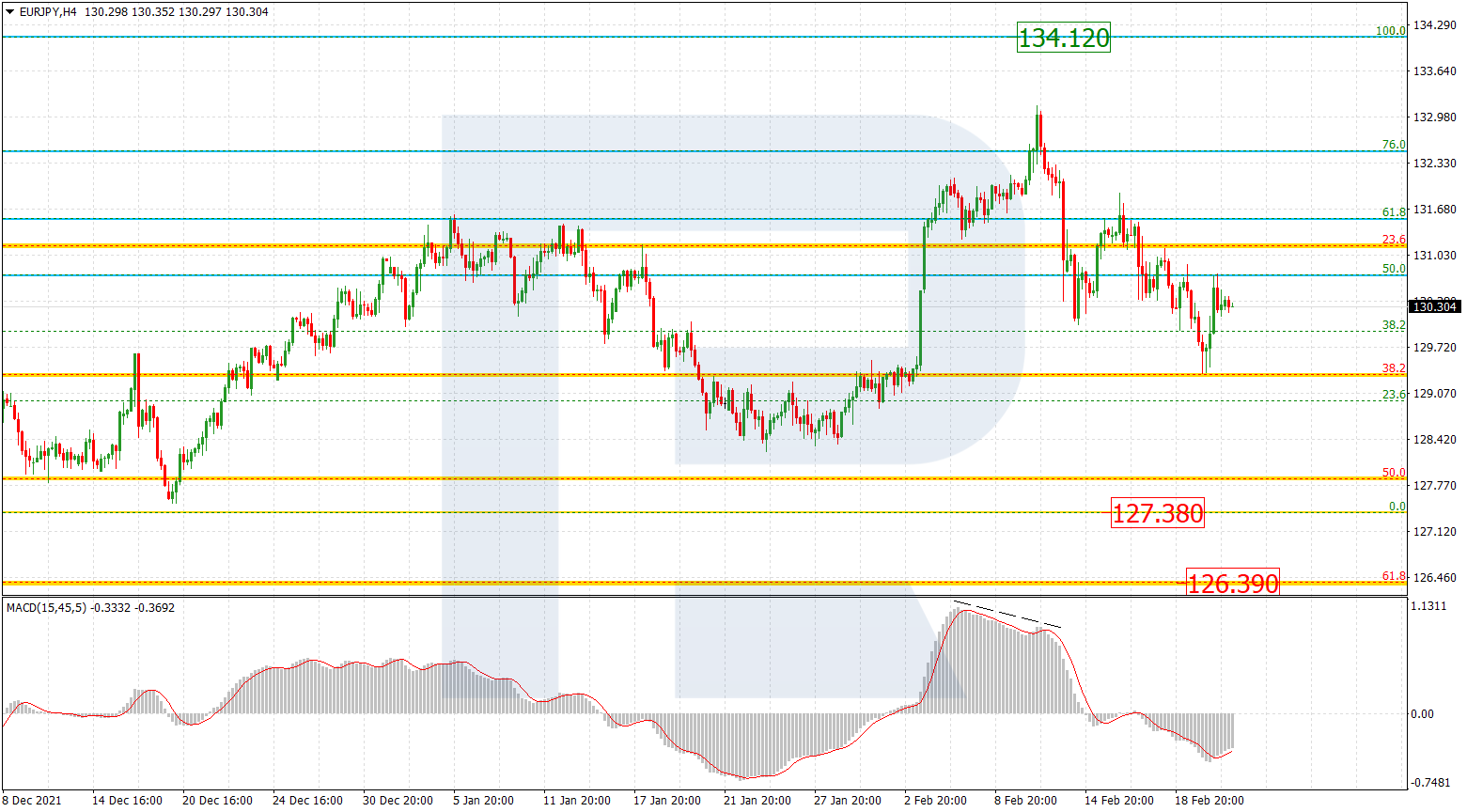

EURJPY, “Euro vs. Japanese Yen”

In the H4 chart, after breaking 38.1% fibo, EURJPY has returned to it, probably due to convergence on MACD. However, so far this movement should be considered as a short-term pullback and the market may later resume falling to reach and test 50.0% fibo at 127.87. After that, the instrument may reverse and start a wave to the upside towards the high at 134.12.

As we can see in the H1 chart, the asset is forming a pullback and testing 23.6% fibo at 129.56. The next rising wave may reach 38.2%, 50.0%, and 61.8% fibo at 130.16, 130.65, and 131.13 respectively. On the other hand, a breakout of the low at 128.60 will lead to a further mid-term downtrend.