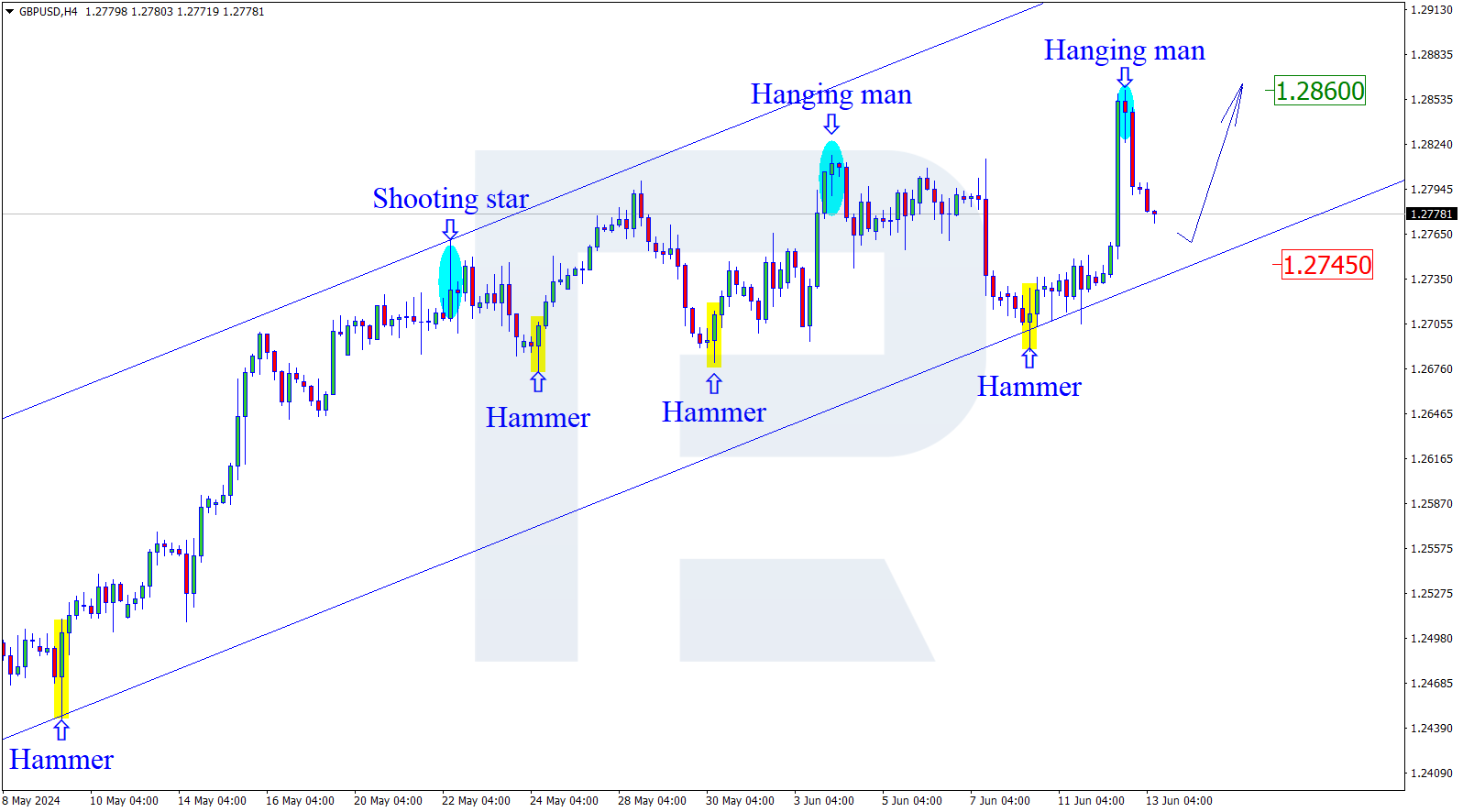

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, GBPUSD is being corrected to the upside and has already reached the retracement of 23.6%. In case the correction continues, the possible targets may be the retracements of 38.2%, 50.0%, and 61.8% at 1.2896, 1.2949, and 1.3001 respectively. If the pair breaks the local support at 1.2723, the instrument may fall to test the key support level at 1.2661.

The H1 chart show more detailed structure of the current correction with a local consolidation range before a new rising impulse.

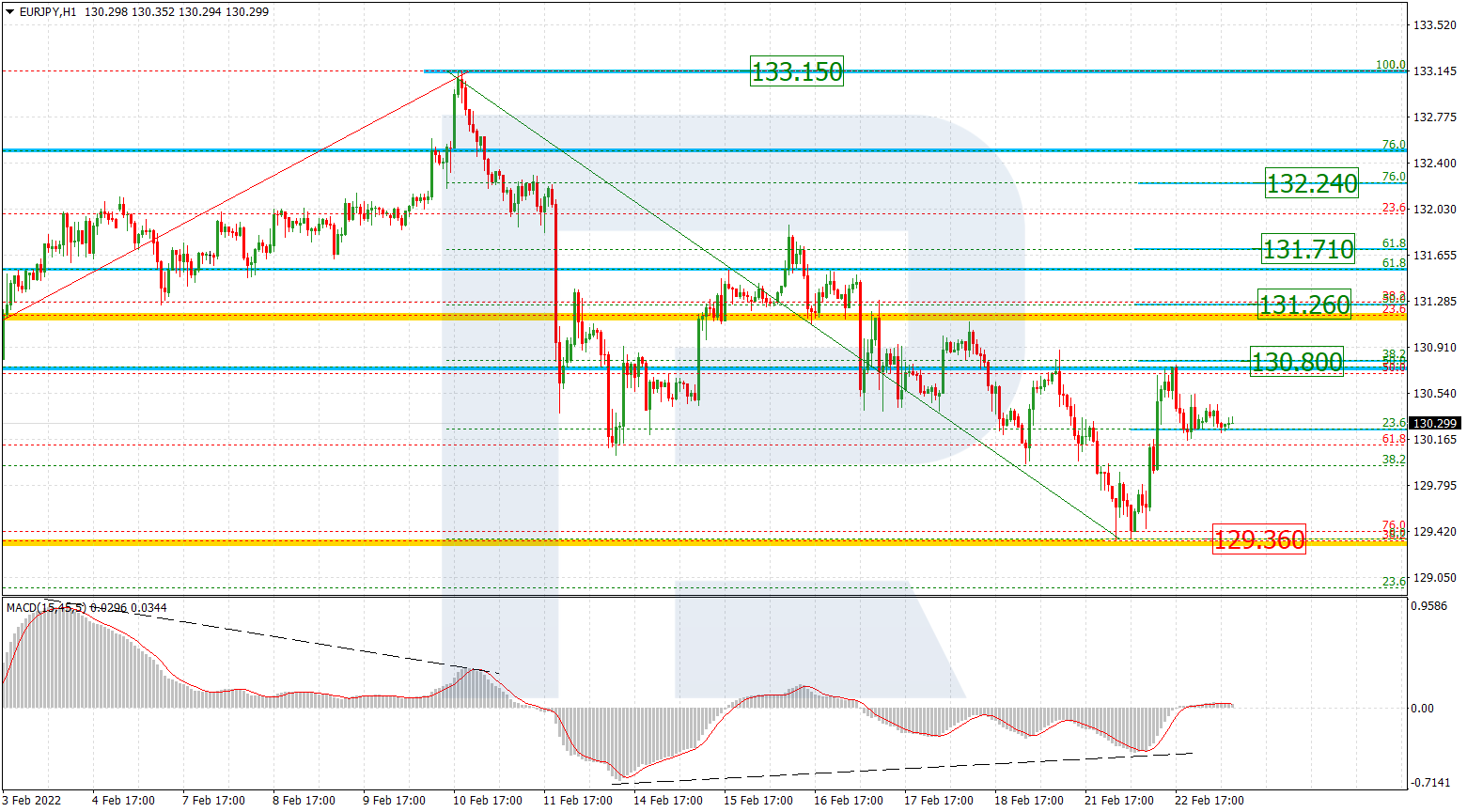

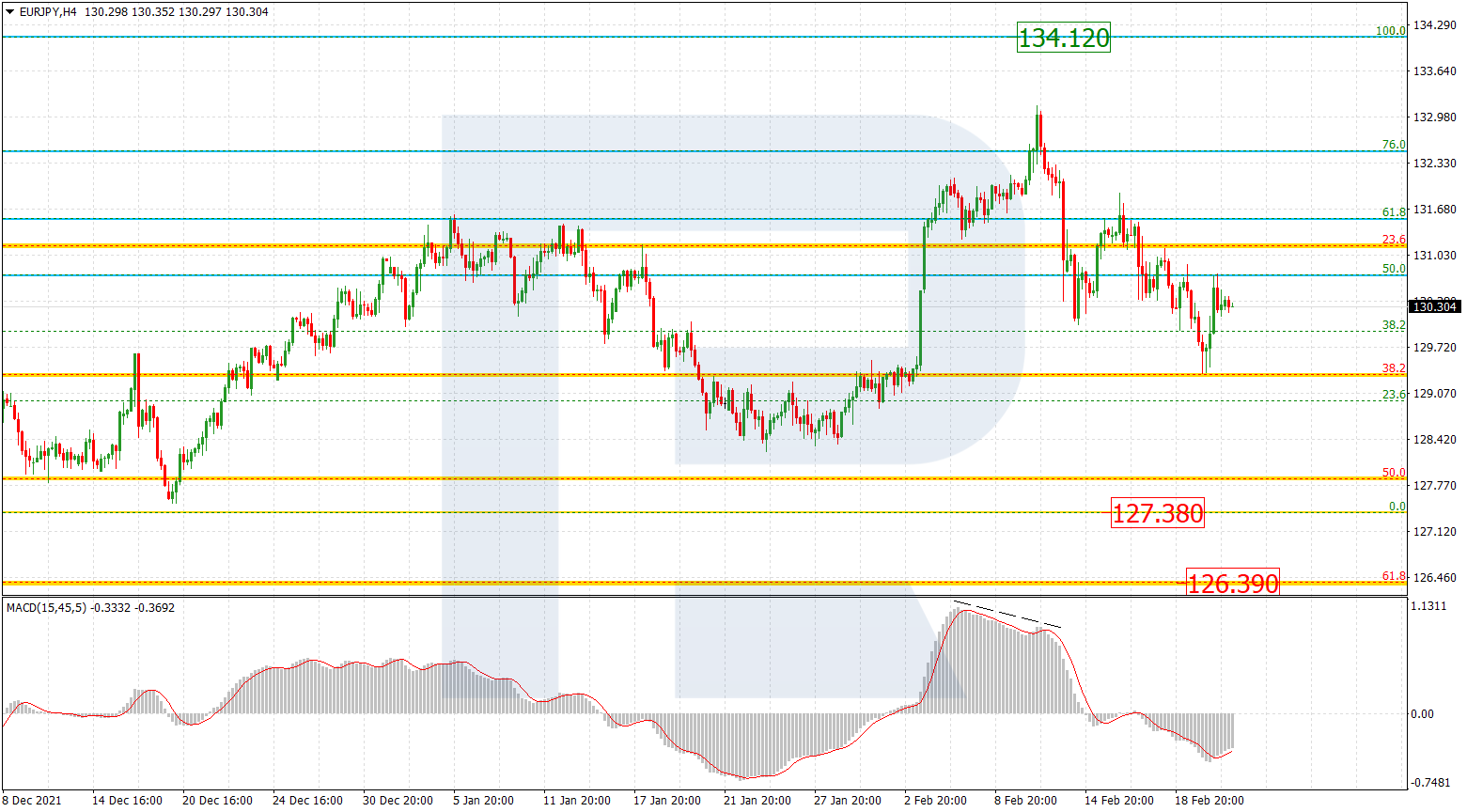

EURJPY, “Euro vs. Japanese Yen”

As we can see in the H4 chart, after being corrected by 50.0%, EURJPY hasn’t been able to reach the support level. The current consolidation range in the form of the Flag indicates that the correctional uptrend may yet continue. The upside target may be the retracements of 61.8% and 76.0% at 130.65 and 131.57 respectively.

In the H1 chart, the pair continues moving sideways inside the ascending correction; it has already reached the retracement of 61.8%. The next possible upside targets may be the retracement of 76.0% at 129.51 or even the high at 130.14. The support level is at 127.50.