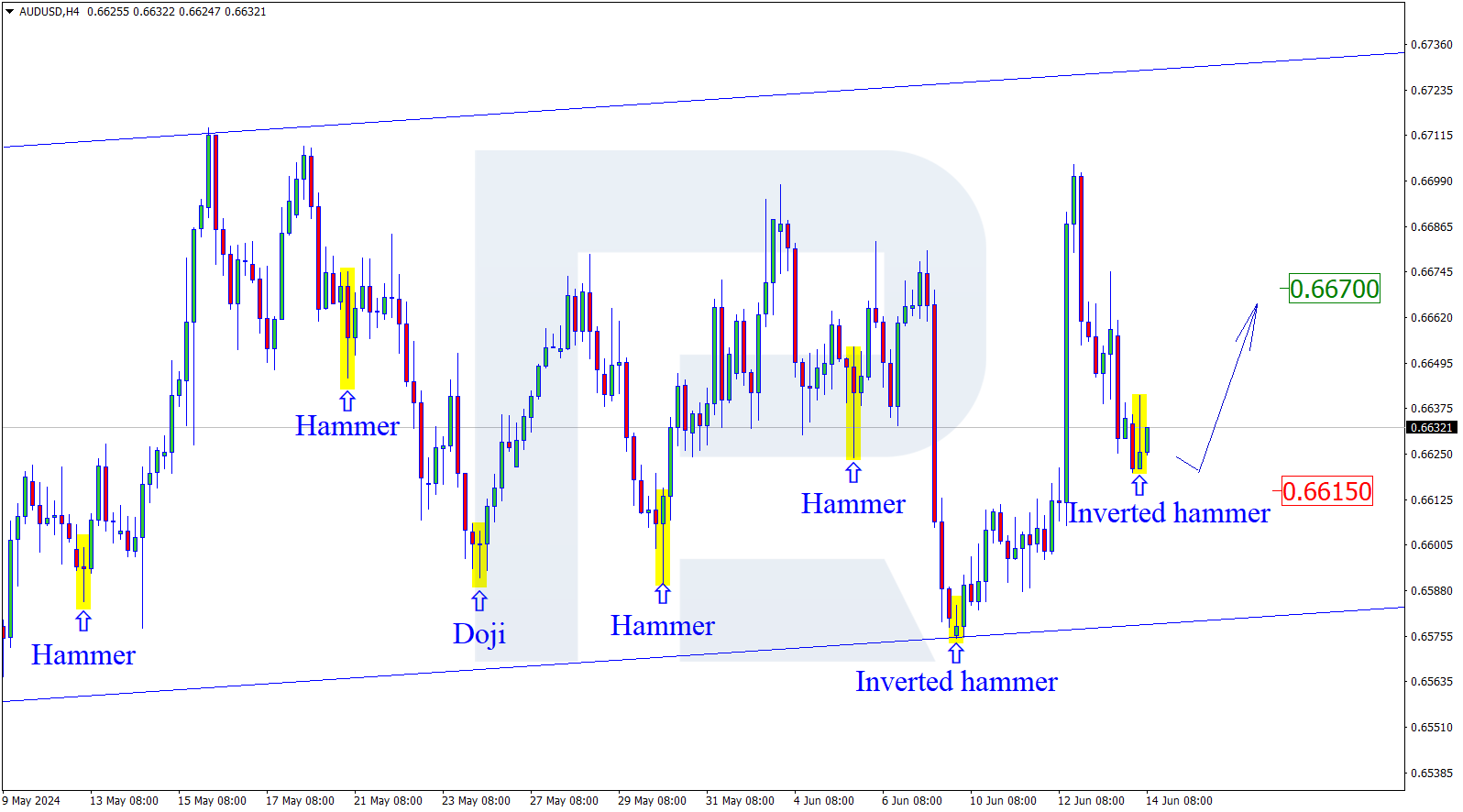

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, convergence on MACD made the pair start a new rising wave, which, after reaching 50.0% fibo, was followed by another pullback. After the pullback is over, the asset may resume growing to complete the correctional phase at 61.8% fibo (0.7591). Later, the market may reverse and start another decline towards the low and the mid-term 38.2% fibo at 0.7106 and 0.7052 respectively.

The H1 chart of AUDUSD shows that the start of a new correctional decline, which has already reached 23.6% fibo and may later continue towards 38.2% and 50.0% fibo at 0.7402 and 0.7358 respectively. A breakout of the local resistance at 0.7546 will complete the correction and lead to a further uptrend.

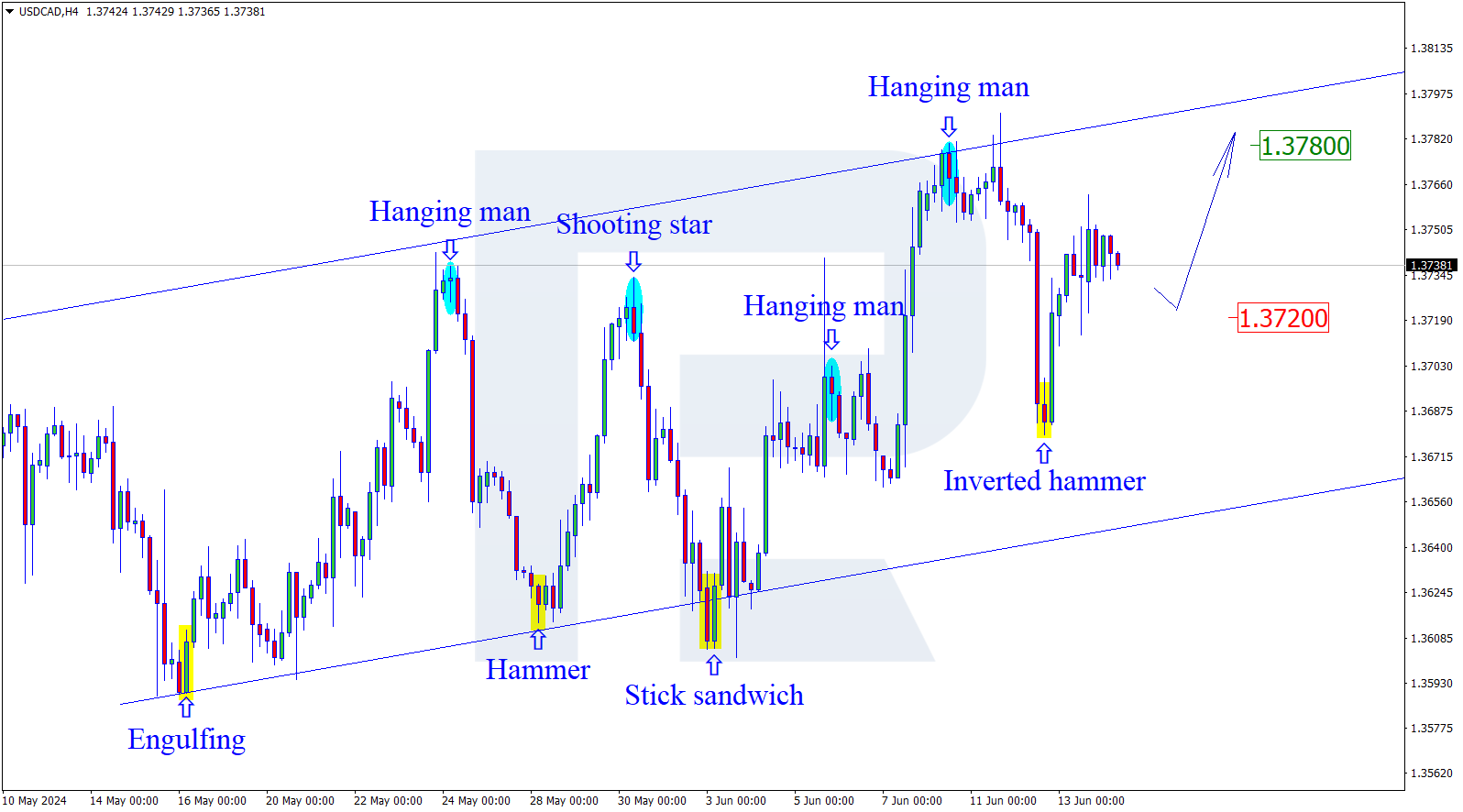

USDCAD, “US Dollar vs Canadian Dollar”

As we can see in the H4 chart, convergence on MACD made the pair stop falling at 61.8% fibo and start a new movement to the upside, which may be the start of another long-term rising wave to break the high at 1.2949 and reach 38.2% fibo at 1.3022. At the same time, an alternative scenario implies one more descending impulse towards 76.0% fibo at 1.2233.

The H1 chart shows a more detailed structure of the current ascending movement after convergence on MACD. The closest upside targets are 23.6%, 38.2%, and 50.0% fibo at 1.2403, 1.2474, and 1.2531 respectively. The support is the low.