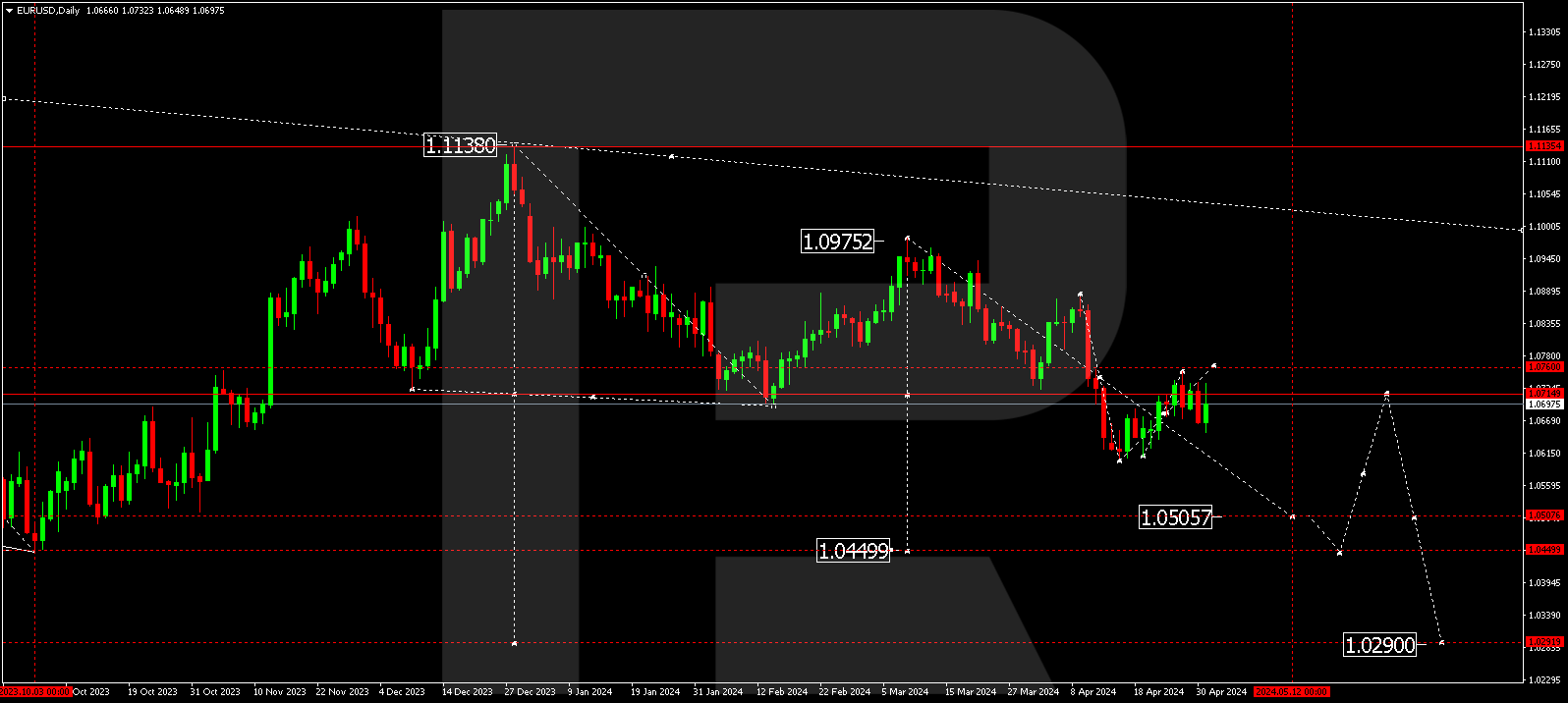

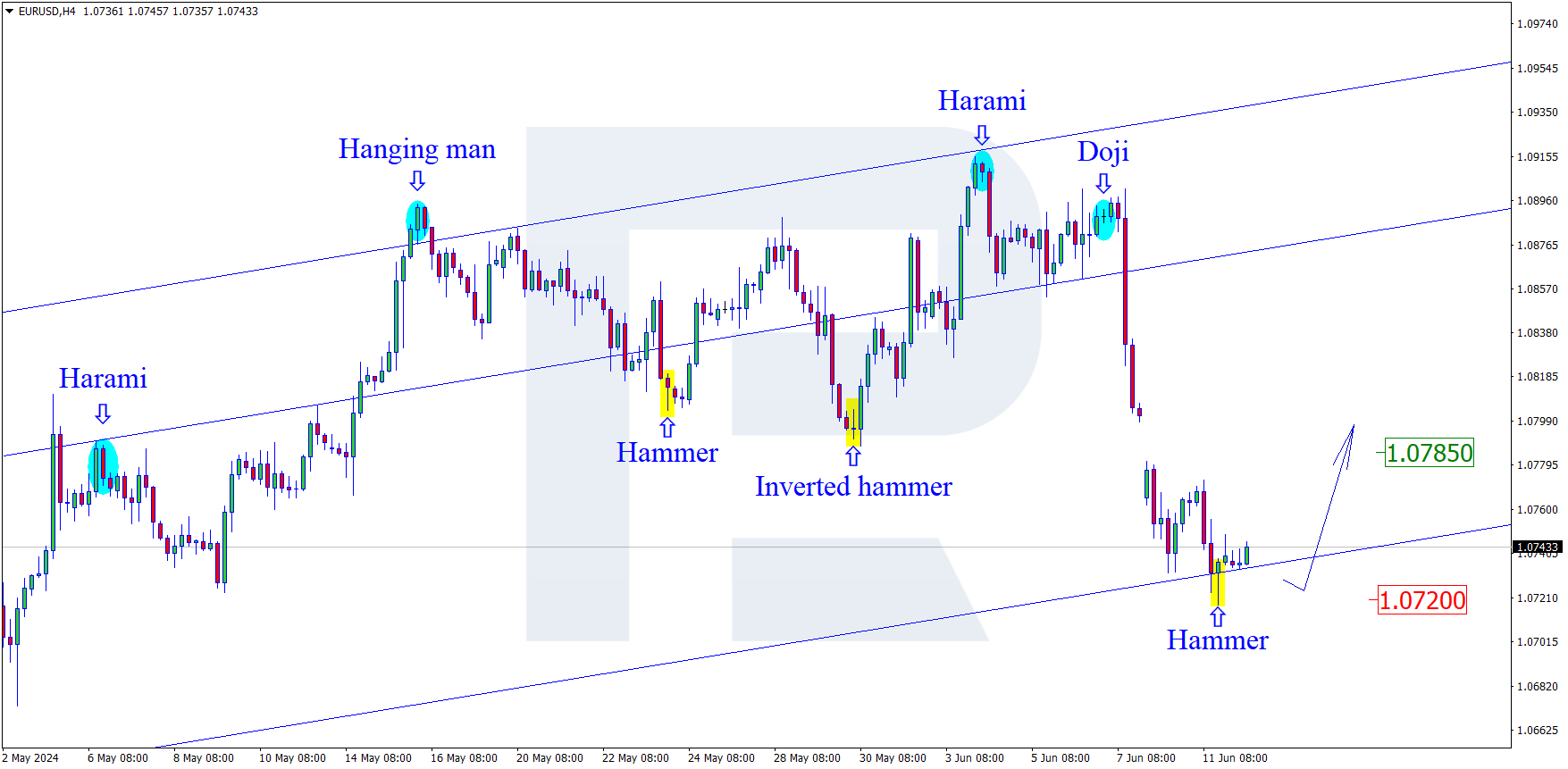

EURUSD, “Euro vs US Dollar”

As we can see in the daily chart, the asset continues the “bearish” phase after a divergence on MACD. After falling and reaching 23.6% fibo, the pair has started consolidating but may soon resume falling towards 38.2%, 50.0%, and 61.8% fibo at 1.1695, 1.1493, and 1.1292 respectively. The key resistance remains at the high at 1.2350.

The H4 chart shows a more detailed structure of the current short-term correction after the previous descending impulse, which has already tested 38.2% fibo twice and may yet continue towards 50.0% fibo at 1.2040. After finishing the correction, the asset may resume falling to reach and break the low at 1.1835. Later, the asset may continue its decline towards the mid-term targets. The key resistance is the fractal high at 1.2243.

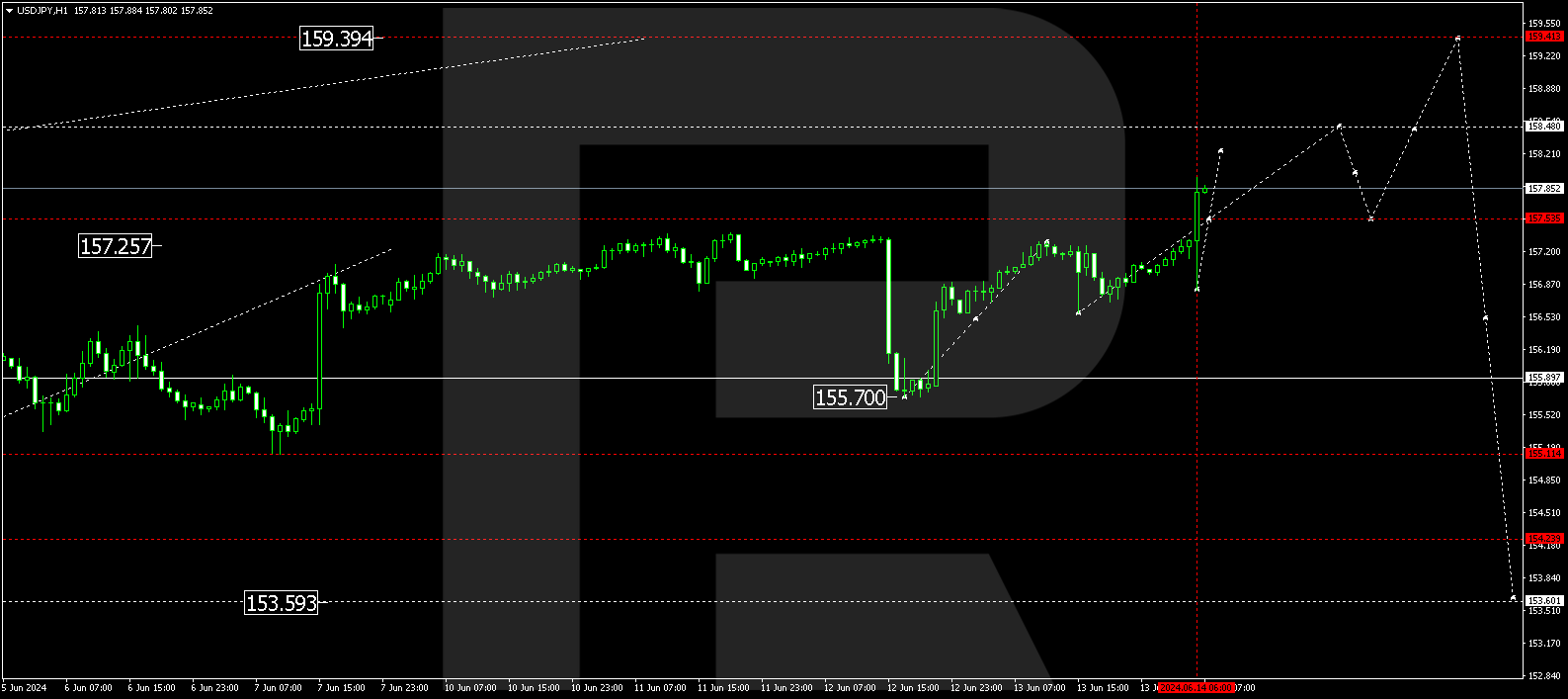

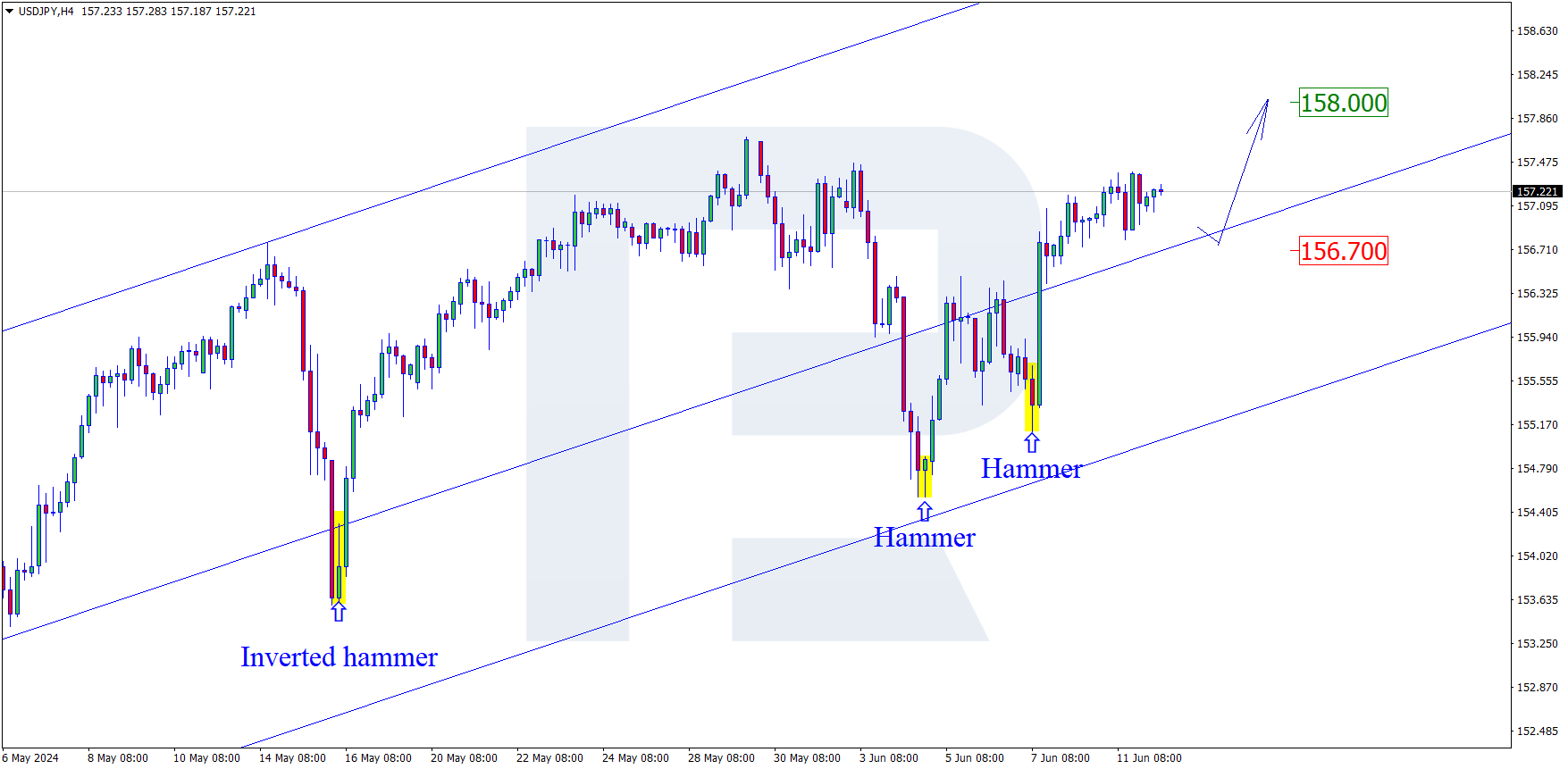

USDJPY, “US Dollar vs. Japanese Yen”

The H4 chart shows a slow descending correction after a divergence on MACD. At the same time, one should note that after breaking 61.8% fibo, the previous uptrend has failed to reach 76.0% fibo at 109.53. The long-term upside target is the fractal high at 111.71. The key correctional target right now is the support at 50.0% fibo at 107.15.

In the H1 chart, USDJPY is correcting to the downside and may reach 23.6, 38.2%, and 50.0% fibo at 108.31, 107.67, and 107.15 respectively. A breakout of the current high at 109.36 may complete the correction.