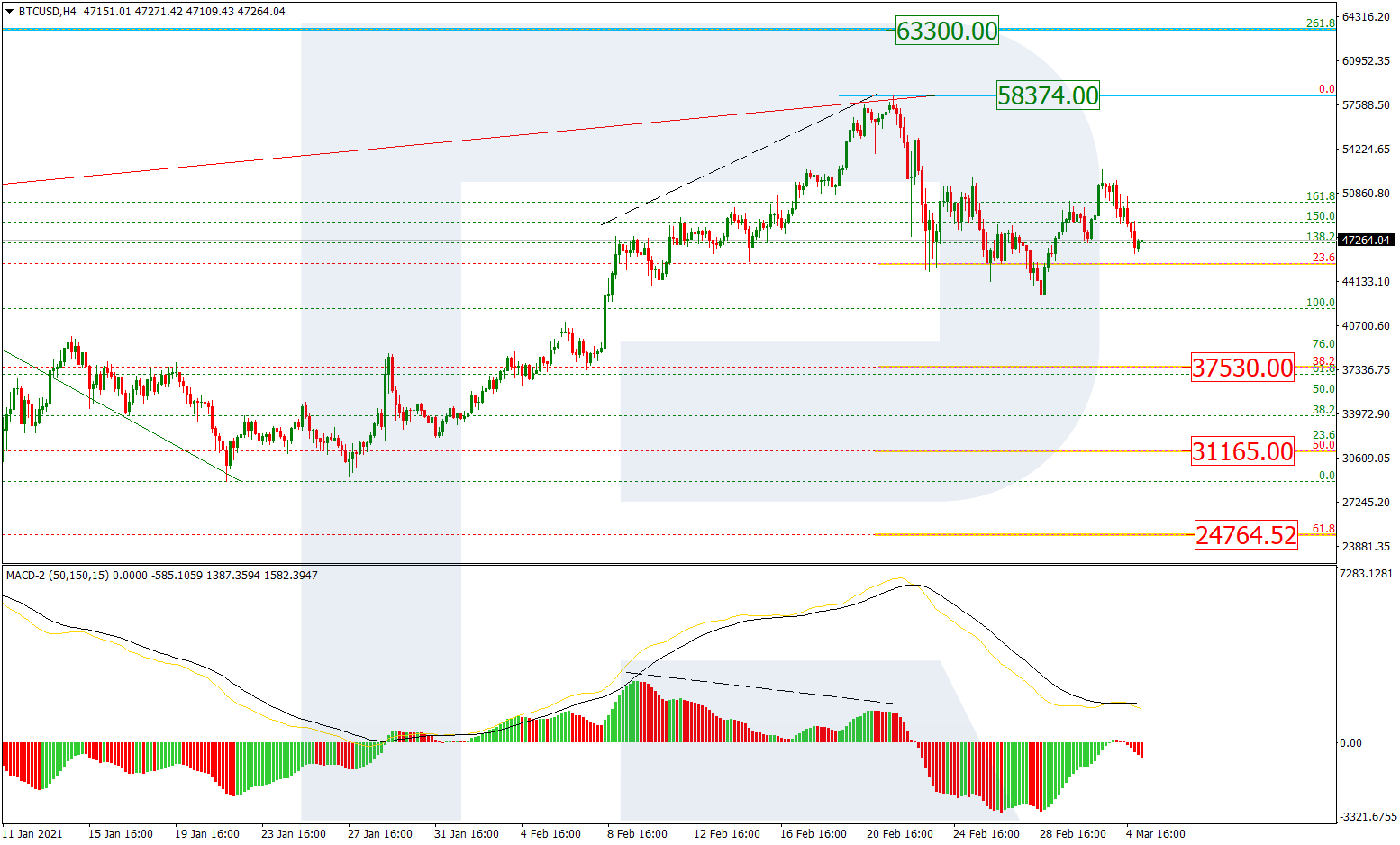

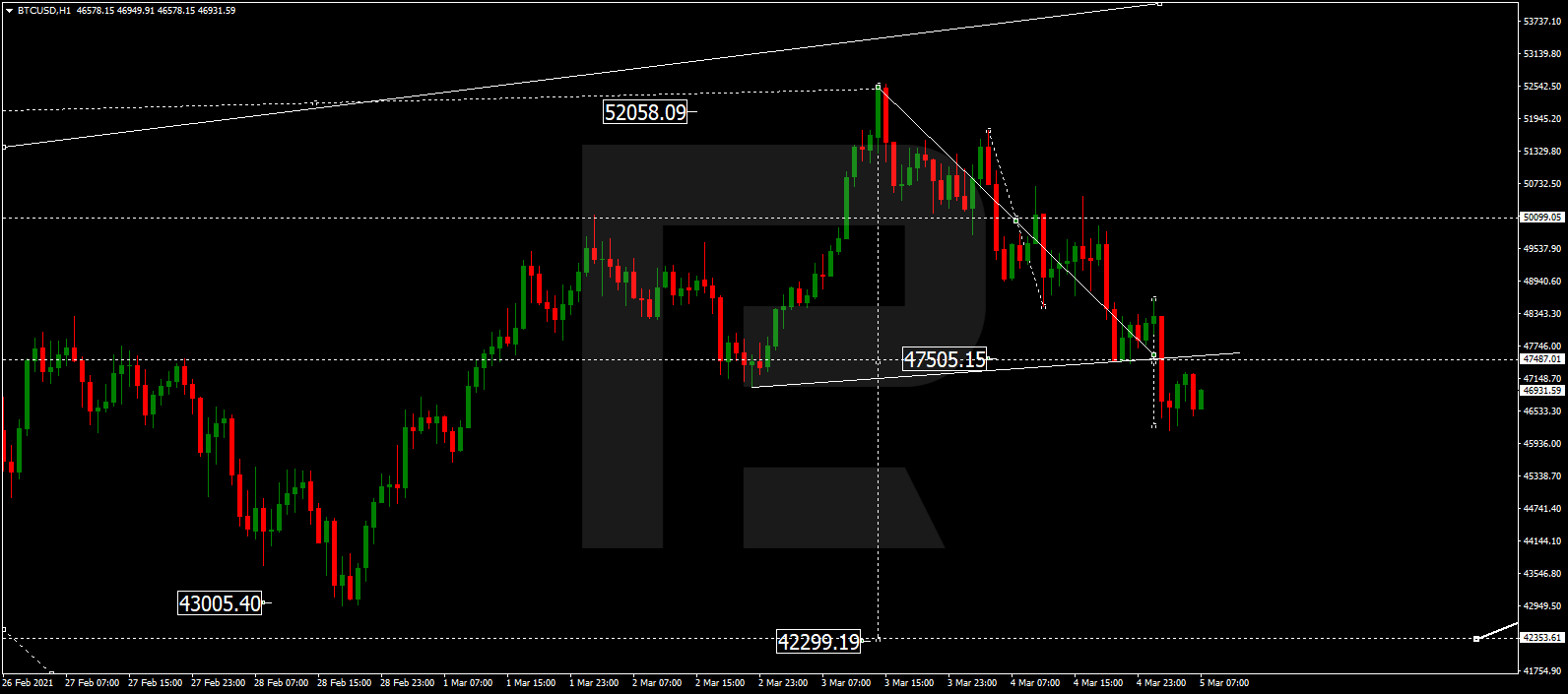

BTCUSD, “Bitcoin vs US Dollar”

As we can see in the H4 chart, BTCUSD is still trading inside the post-correctional extension area between the retracements of 138.2% and 161.8%. The key resistance is at 5751.00. If the price breaks the support at 4052.00, the instrument continue falling towards the psychologically-crucial level at 3000.00.

In the H1 chart, the pair is testing 4052.40. If the price breaks this level, the instrument may continue falling towards the post-correctional extension area between the retracements of 138.2% and 161.8% at 3835.00 and 3691.00 respectively.

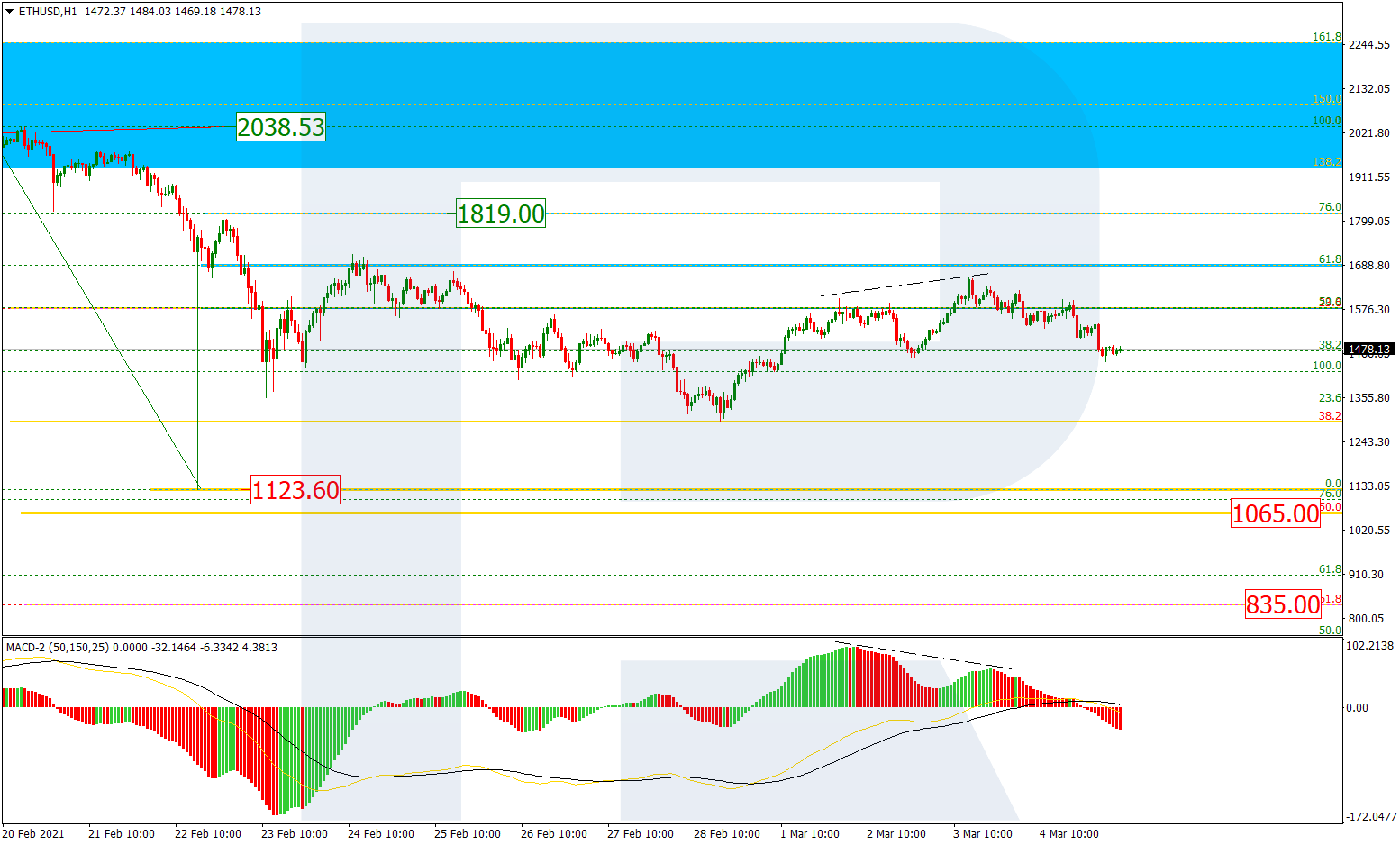

ETHUSD, “Ethereum vs. US Dollar”

In the H4 chart, the downtrend continues. Right now, ETHUSD is trading inside the post-correctional extension area between the retracements of 138.2% and 161.8% at 178.24 and 68.62 respectively. However, there is convergence on MACD, which may indicate a possible short-term correction.

As we can see in the H1 chart, the convergence may force the pair to start a new pullback. The possible targets may be the retracements of 23.6%, 38.2%, and 50.0% at 131.35, 140.77, and 148.04 respectively.