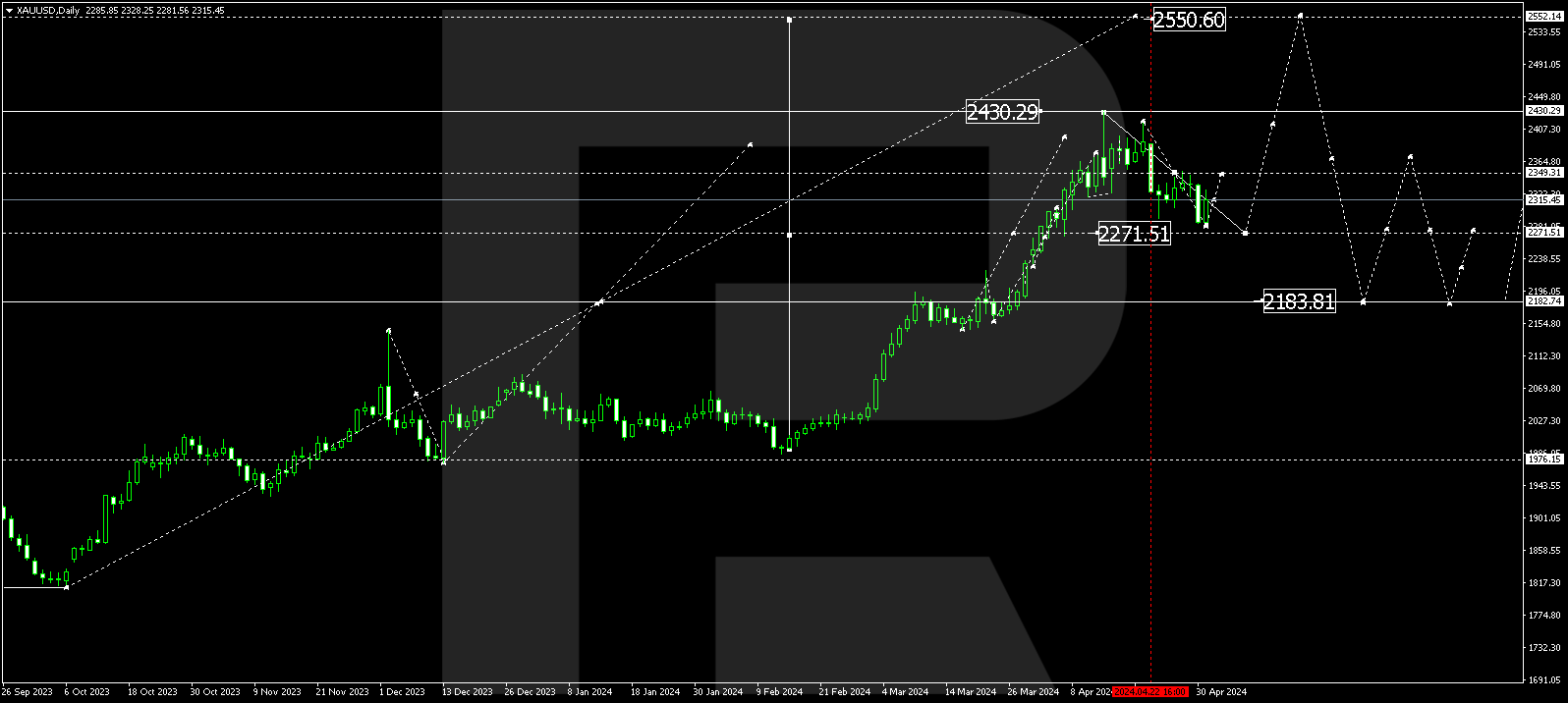

XAUUSD, “Gold vs US Dollar”

As we can see in the daily chart, XAUUSD is totally dominated by bulls. After finishing the correction, the pair has broken its previous high and right now is trading to reach 76.0% fibo at 1708.10. At the same time, there is a divergence on MACD, which may indicate a possible pullback after the instrument reaches the target. The support is 50.0% at 1482.50.

In the H4 chart, the pair has broken the post-correctional extension area between 138.2% and 161.8% fibo and right now is moving towards 76.0% fibo at 1708.10.

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, the divergence on MACD made the pair reverse after reaching 50.0% and start a new descending movement, which has already tested the support at 38.2% fibo (0.9769). If the price breaks this level and fixes below it, the instrument may continue falling to reach the low at 0.9613.

The H1 chart shows more detailed structure of the current downtrend. The pair has already reached 23.6% fibo and may continue falling towards 38.2% and 50.0% fibo at 0.9764 and 0.9738 respectively. The resistance is local high at 0.9848.