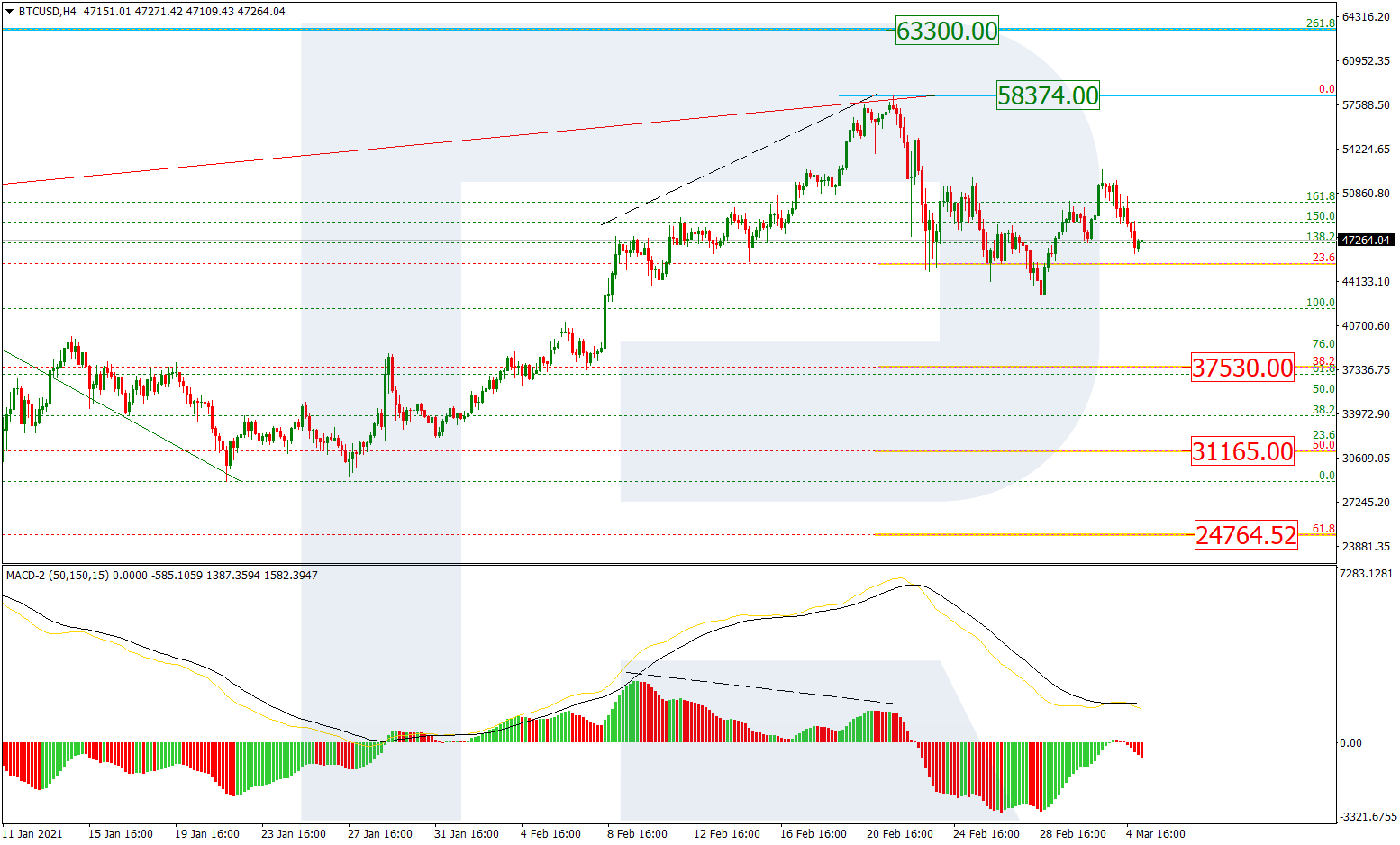

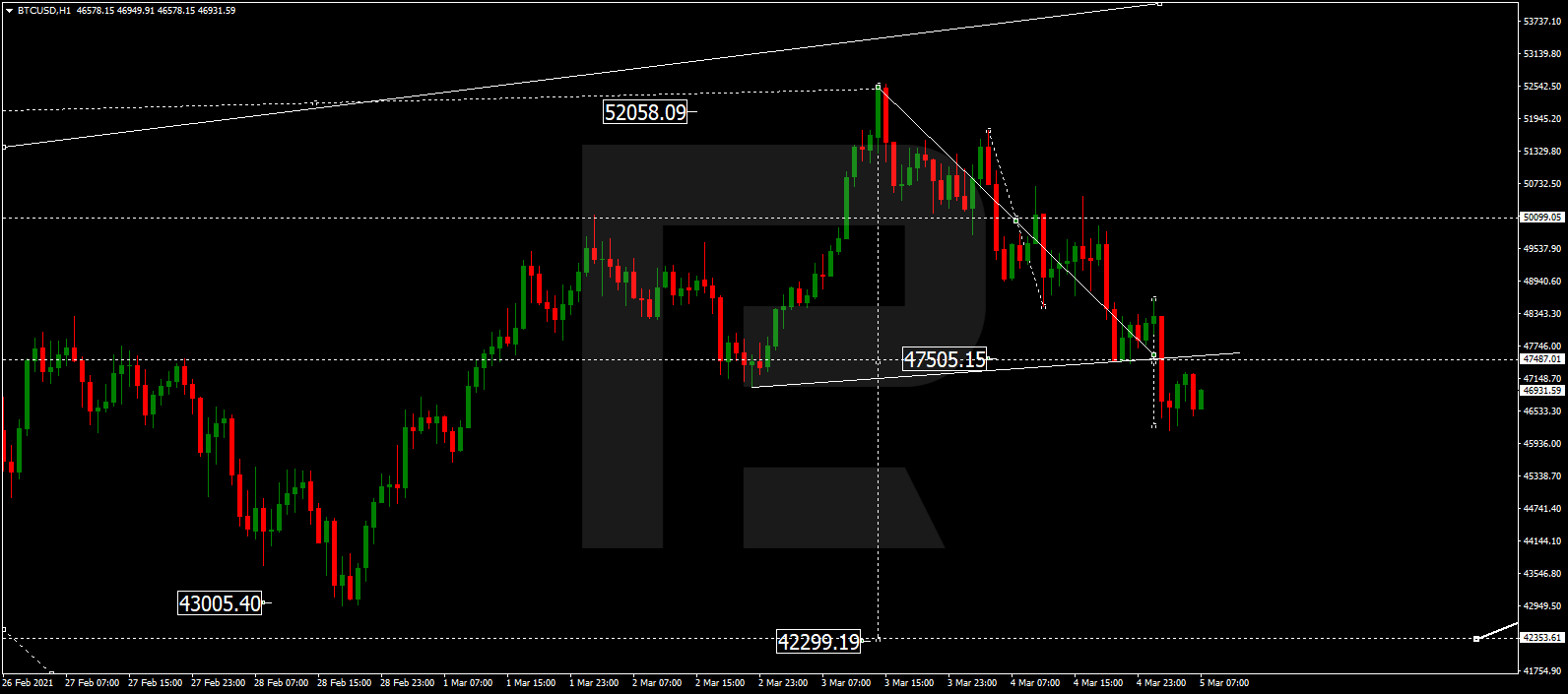

BTCUSD, “Bitcoin vs US Dollar”

As we can see in the H4 chart, the correctional downtrend is slowing down a bit; BTCUSD is testing the retracement of 61.8%. In the future, the pair may continue falling towards the retracement of 76.0% at 3389.00. The key target and the obstruction for the current descending movement is the low at 3121.90. The resistance level is at 3810.00. If the price breaks it, the instrument may expand its mid-term correction towards the key high at 4234.50.

In the H1 chart, the pair is being corrected inside the descending impulse. If the price breaks the low at 3450.00, the instrument may fall towards the post-correctional extension area between the retracements of 138.2% and 161.8% at 3332.00 and 3258.00 respectively.

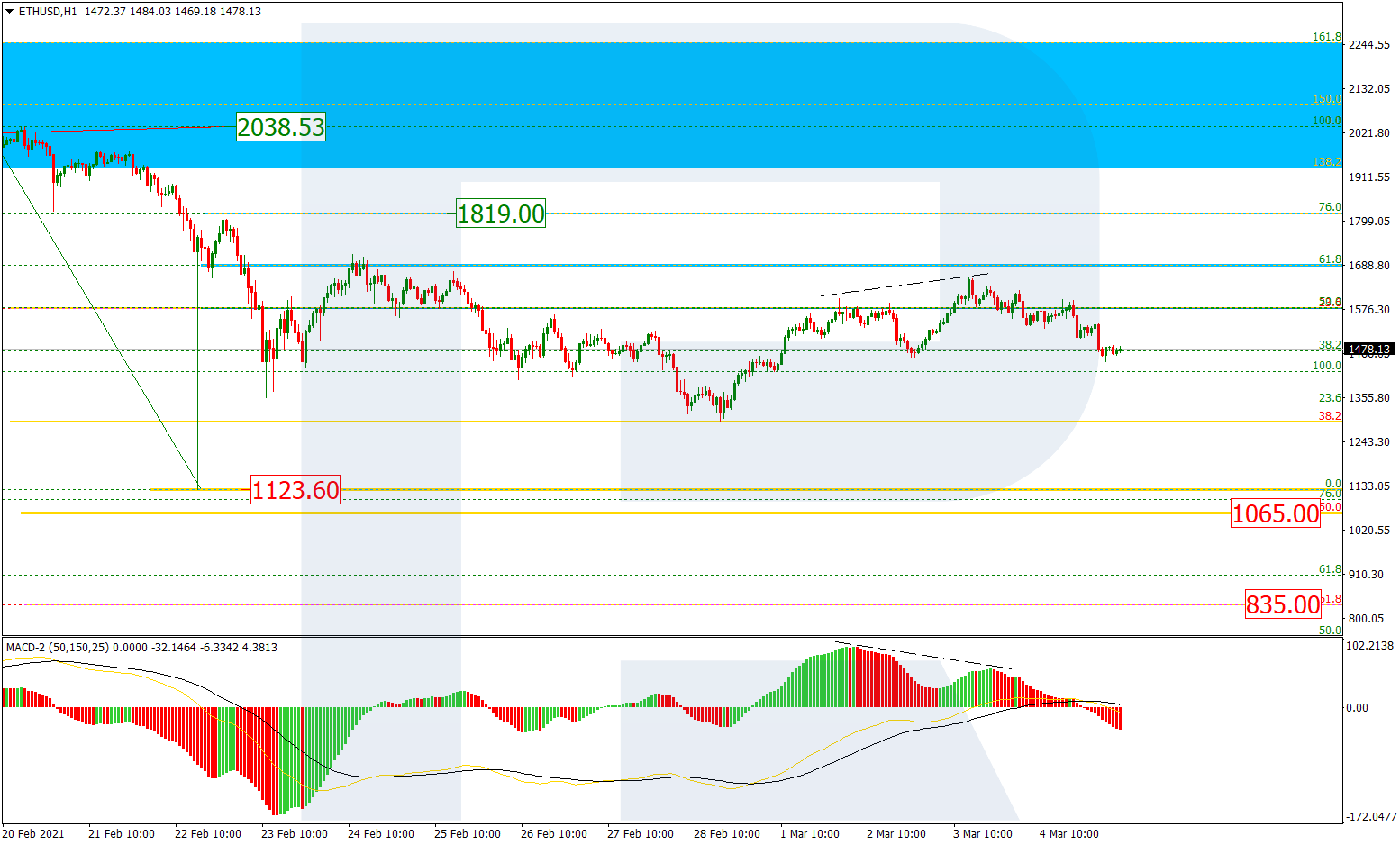

ETHUSD, “Ethereum vs. US Dollar”

As we can see in the H4 chart, the pair reached the retracement of 61.8% and then there was a convergence on MACD. The correction may yet continue to reach the retracement of 76.0% at 100.00. After breaking the local resistance 130.00, the price may start a new rising impulse towards the high at 160.44.

In the H1 chart, the pair is forming a new short-term correction to the upside, which has already reached the retracement of 50.0%. The next upside targets may be the retracements of 61.8% and 76.0% at 120.55 and 122.70 respectively. The support is the low at 111.01.