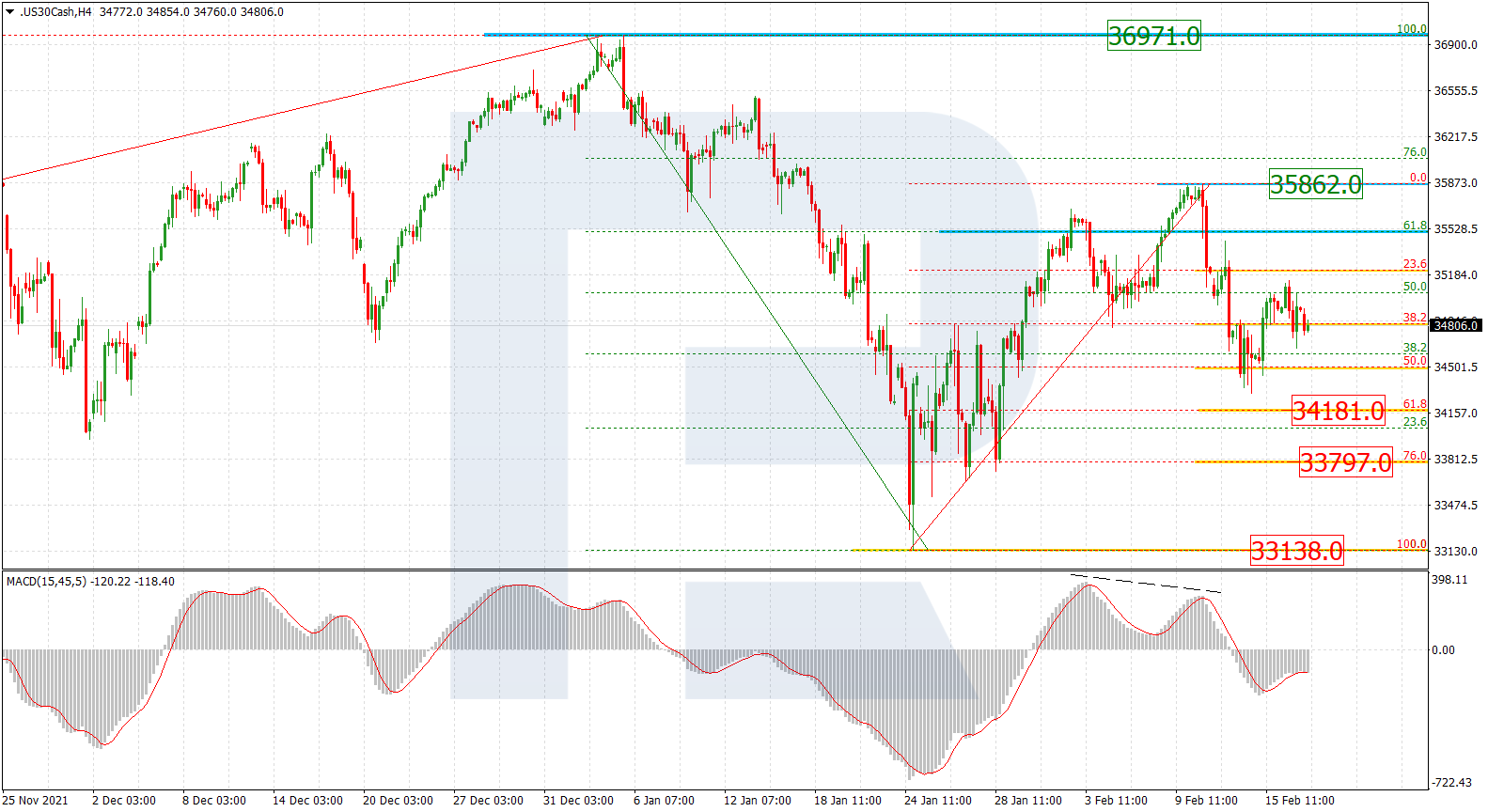

Brent

In the daily chart, the asset is forming a new descending correction after testing the long-term 76.0% fibo. Another signal in favor of a possible reversal is a divergence on MACD. Right now, the price is moving close to its first target, 23.6% fibo at 58.00, and may later continue falling to reach the next ones at 38.2%, 50.0%, and 61.8% fibo at 49.94, 43.46, and 36.93 respectively. A breakout of the high at 71.07 may complete the correction and lead to a further uptrend to reach the fractal high at 87.09.

The H4 chart shows a more detailed structure of the current descending movement. After completing a slight pullback, the asset is trying to start a new impulse to the downside and reach 23.6% and 38.2% fibo.

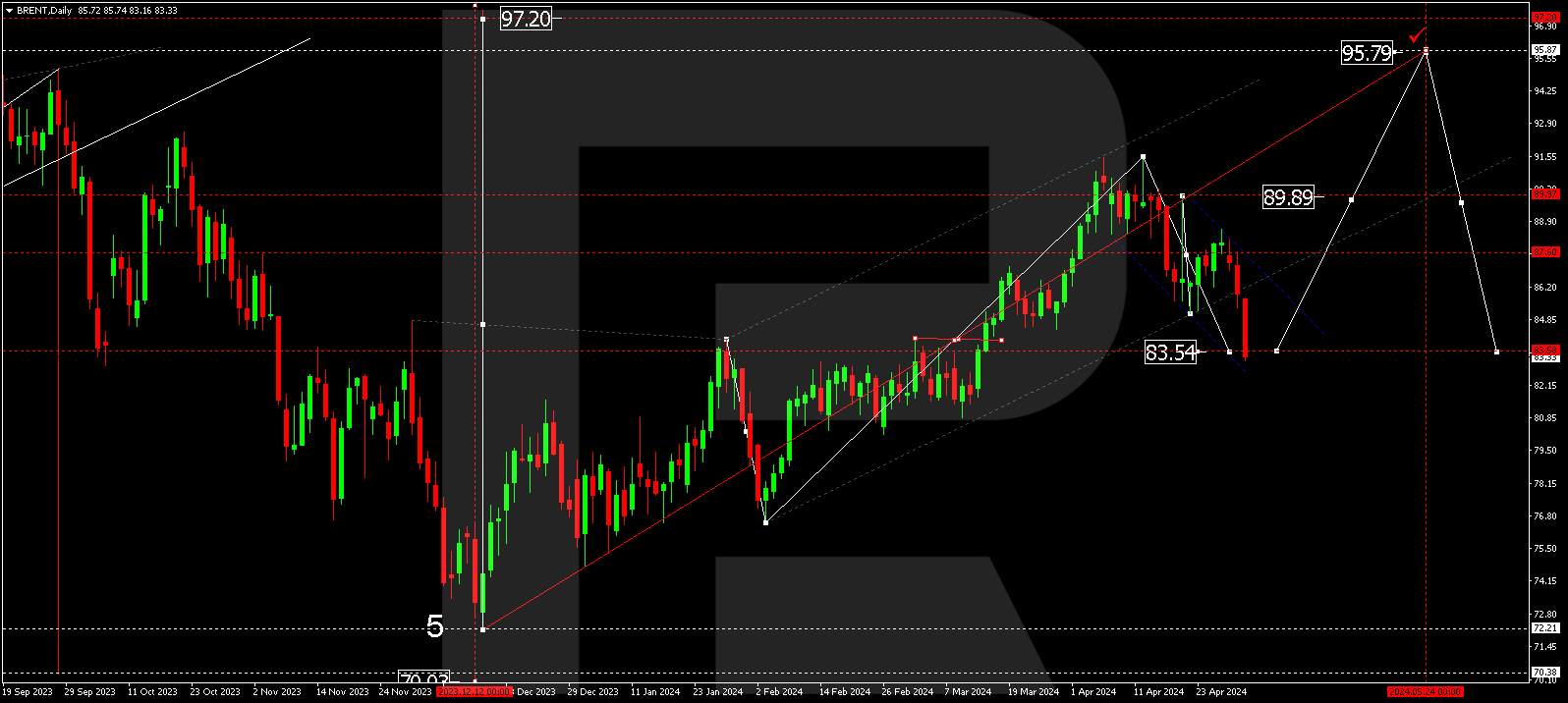

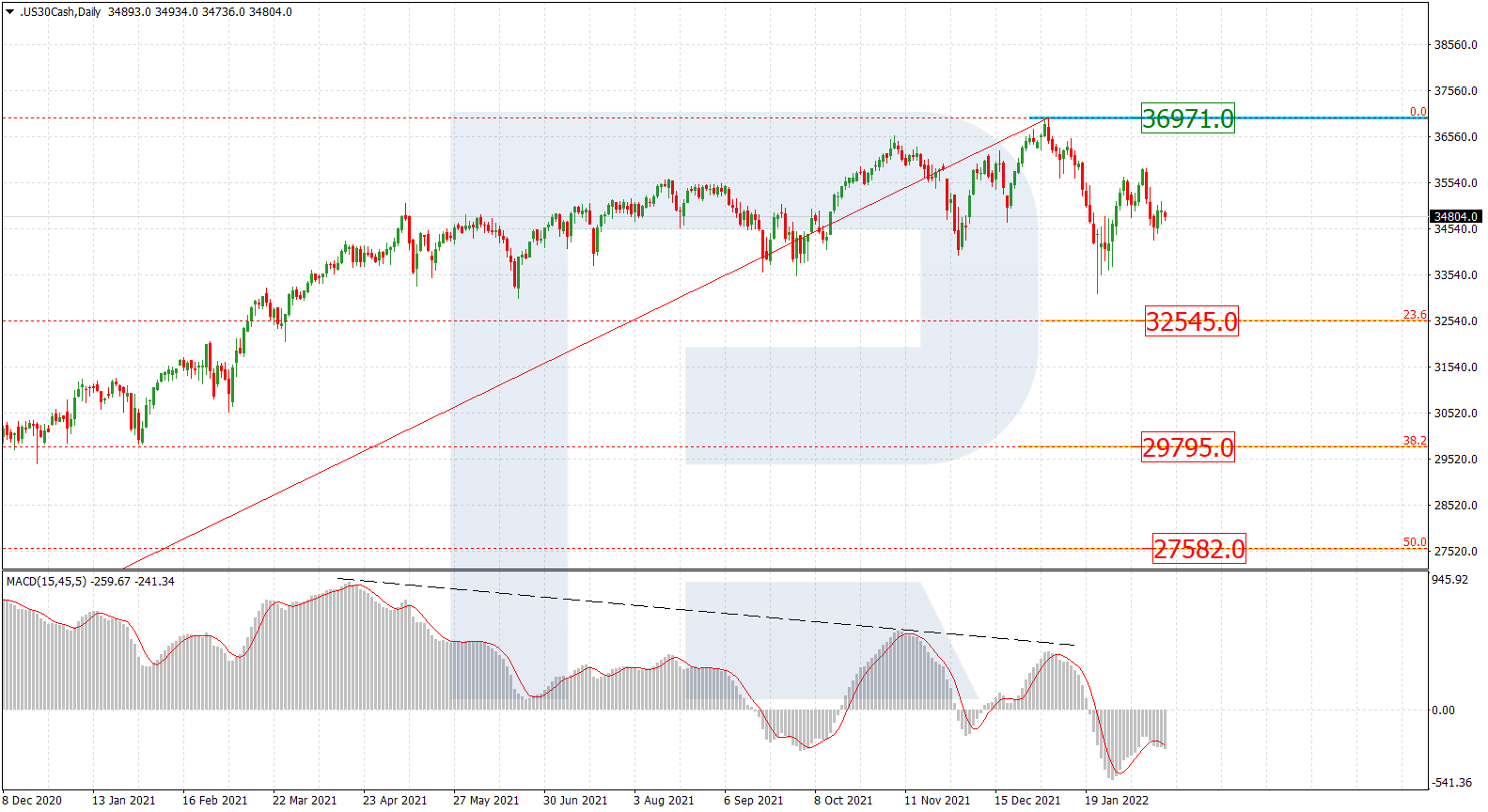

Dow Jones

The daily chart shows that the Dow Jones index continues rising and slowly updating its highs. The current technical picture implies that the asset is expected to continue growing towards the post-correctional extension area between 138.2% and 161.8% fibo at 33910.0 and 36620.0 respectively. At the same time, there is divergence on MACD, which may indicate a new pullback to teach the previously broken level at 29585.9.

As we can see in the H4 chart, the asset is correcting downwards. The correctional targets are 23.6%, 38.2%, and 50.0% fibo at 31553.0, 30504.0, and 29656.0 respectively. The resistance is the high at 33253.0.