Brent

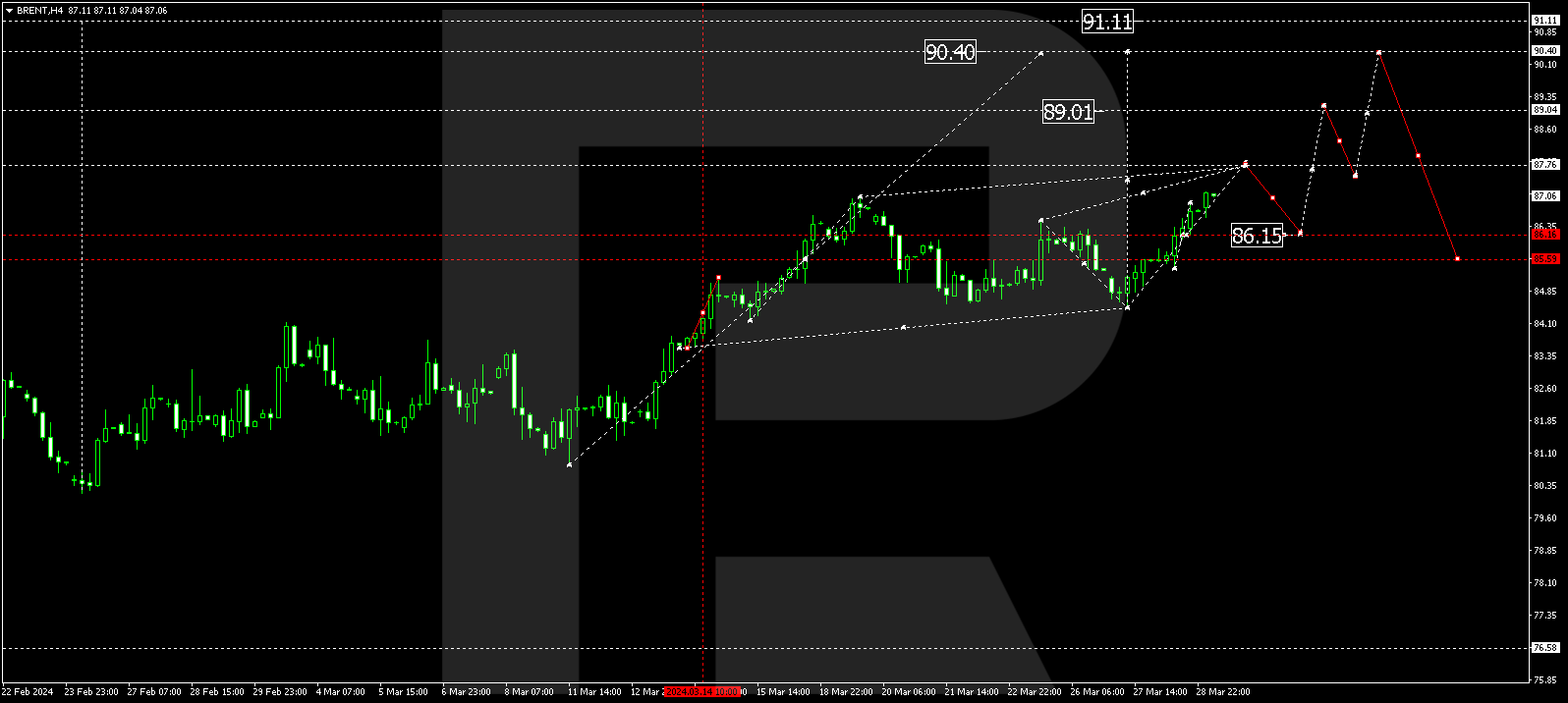

As we can see in the H4 chart, after breaking the high at 86.63 and fixing above it, Brent has tested the psychologically important level of $90 per barrel. In this case, the asset may slightly correct in the nearest future and then resume growing. The next upside targets are inside the post-correctional extension area between 138.2% and 161.8% fibo at 94.50 and 99.45 respectively. The key support is the low at 65.89.

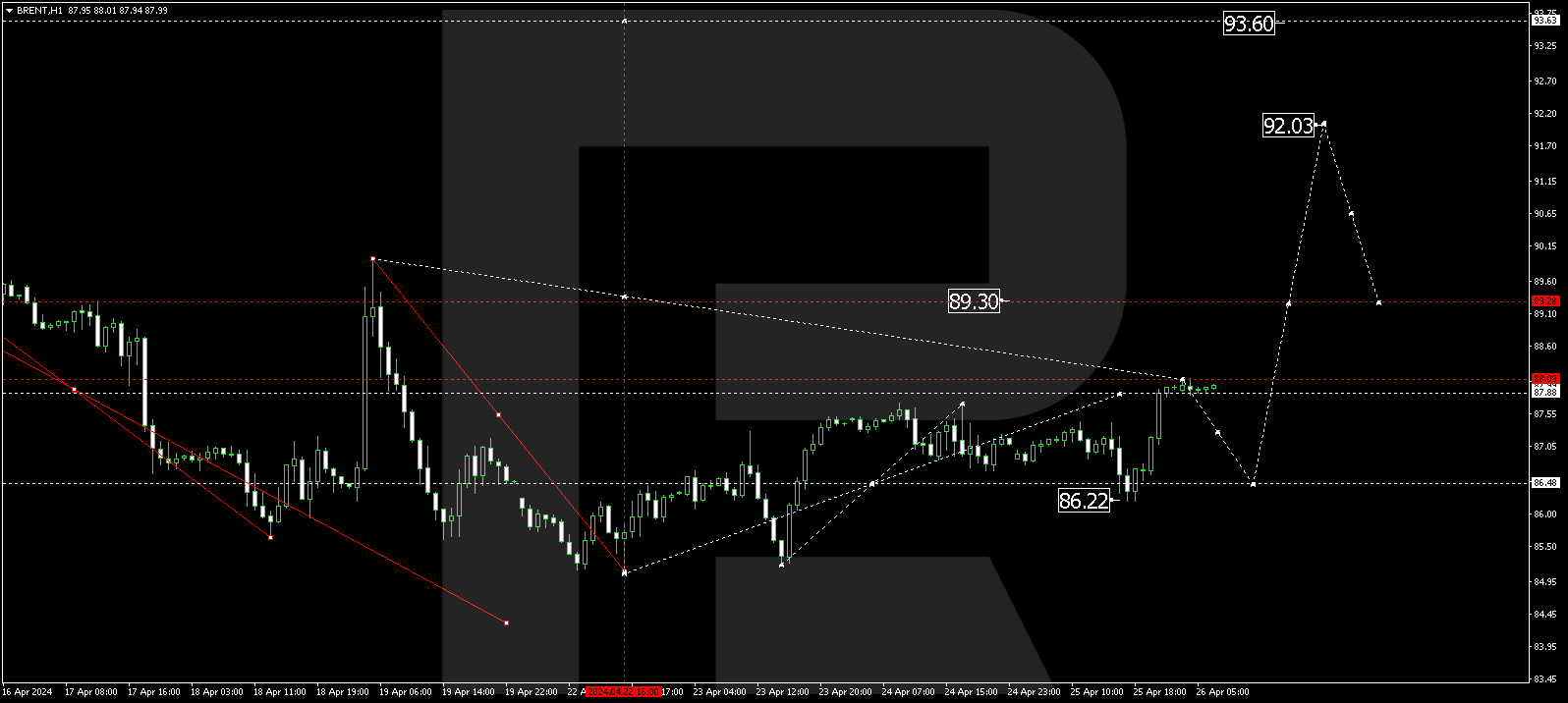

The H1 chart shows a breakout of the previous high and divergence on MACD, which may hint at a possible pullback soon.

Dow Jones

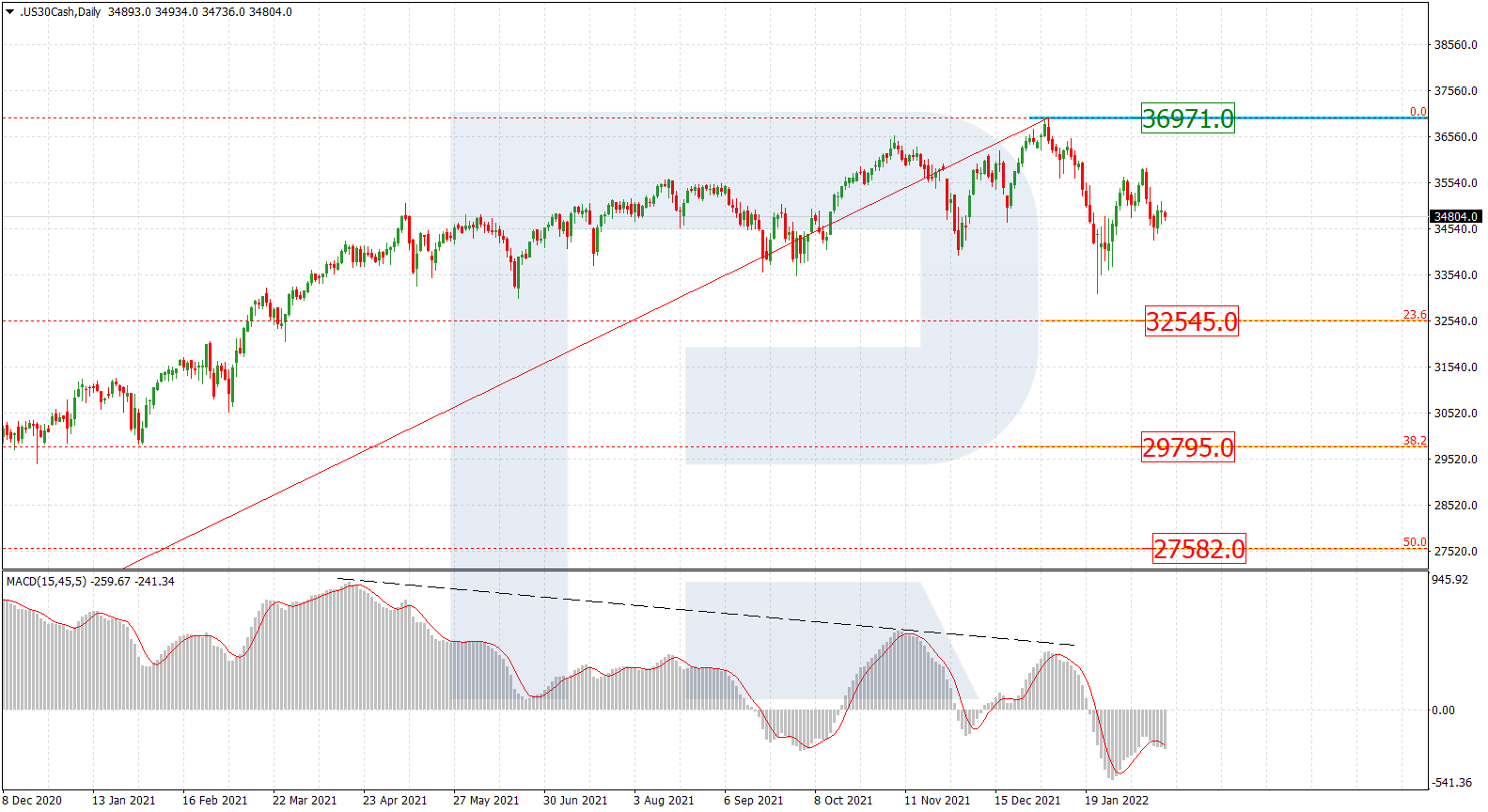

As we can see in the daily chart, after completing the long-term uptrend due to divergence on MACD, the asset is starting a new bearish phase. The closest downside target is 23.6% fibo at 32256.0, while the next ones are 38.2% and 50.0% fibo at 29788.0 and 27577.0 respectively. The key resistance is the high at 36971.0.

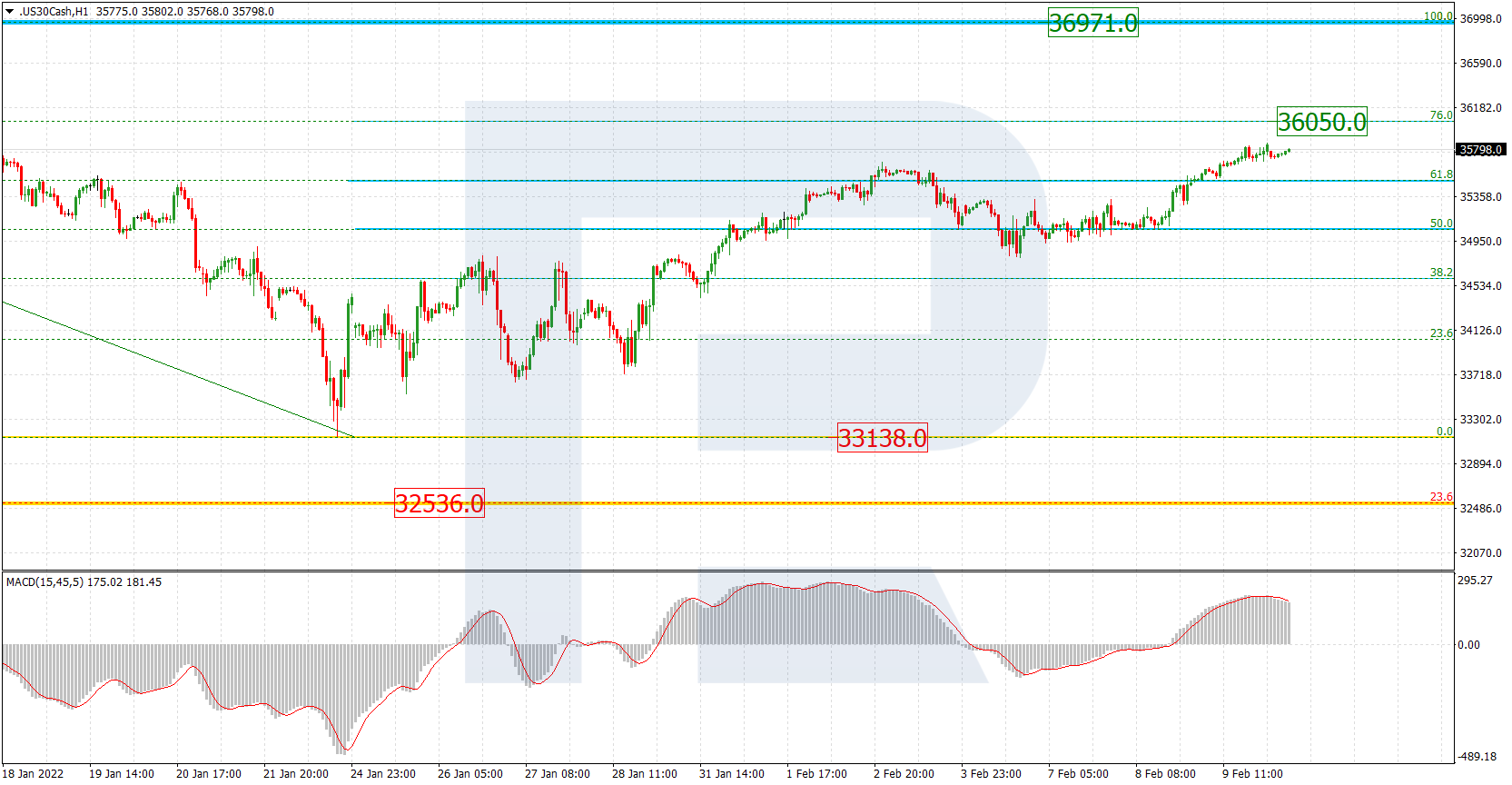

The H1 chart shows a new pullback after a quick decline, which has already reached 38.2% fibo. As long as the asset is trading above the local support at 33138.0, there is a possibility of a new rising impulse towards 50.0% fibo at 35060.0.