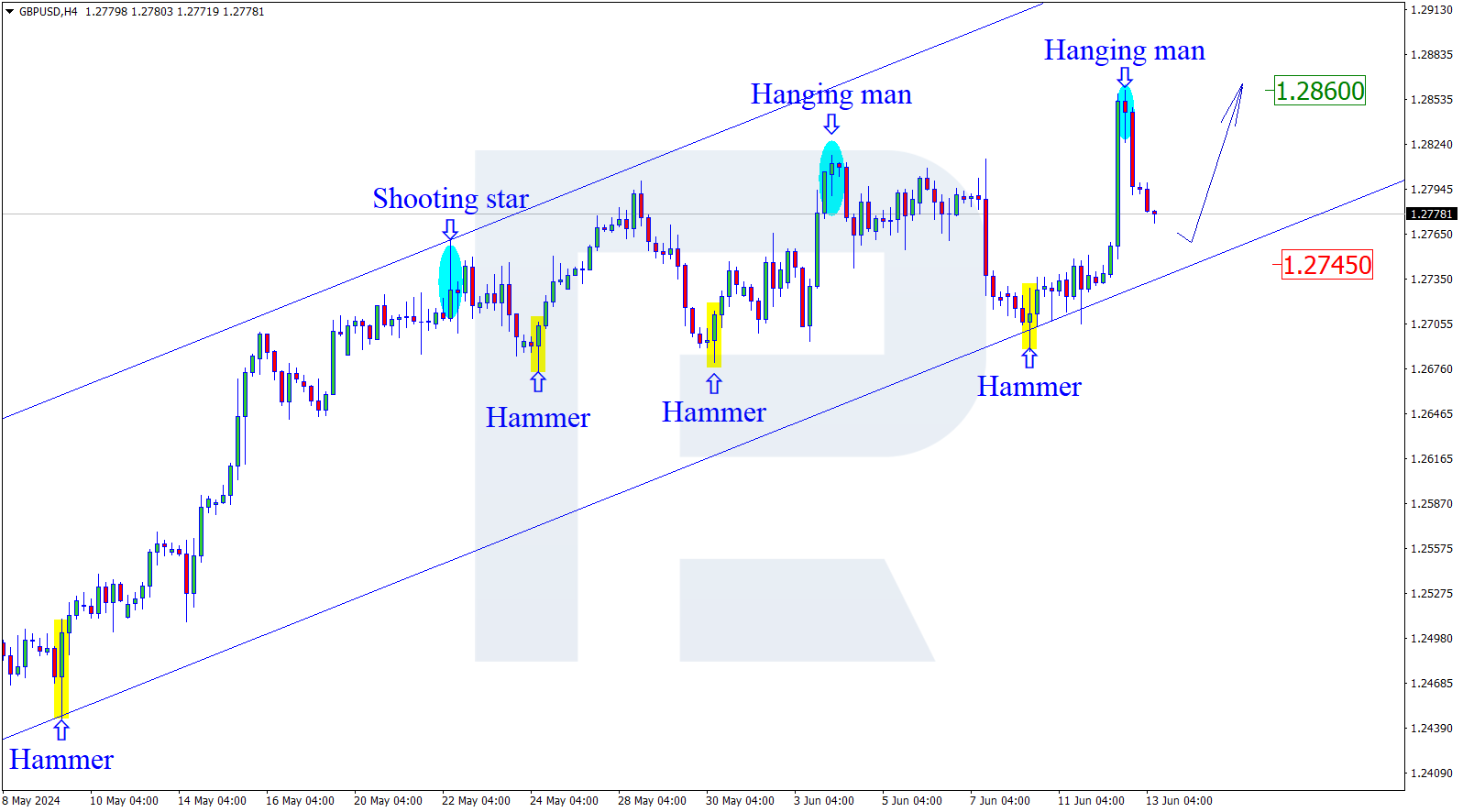

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, GBPUSD is still forming the mid-term descending correction and has already reached the retracement of 61.8%. The next downside targets are the retracements of 76.0% at 1.3672. The main resistance level is the high at 1.4135.

Risk Warning: the results of previous trading operations do not guarantee the same results in the future.

In the H1 chart, the pair is about to complete the ascending correction and may later start a new impulse to the downside. After breaking the low at 1.3856, the instrument may move towards the post-correctional extension area between the retracements of 138.2% and 161.8% at 1.3776 and 1.3727 respectively.

Risk Warning: the results of previous trading operations do not guarantee the same results in the future.

Risk Warning: the results of previous trading operations do not guarantee the same results in the future.

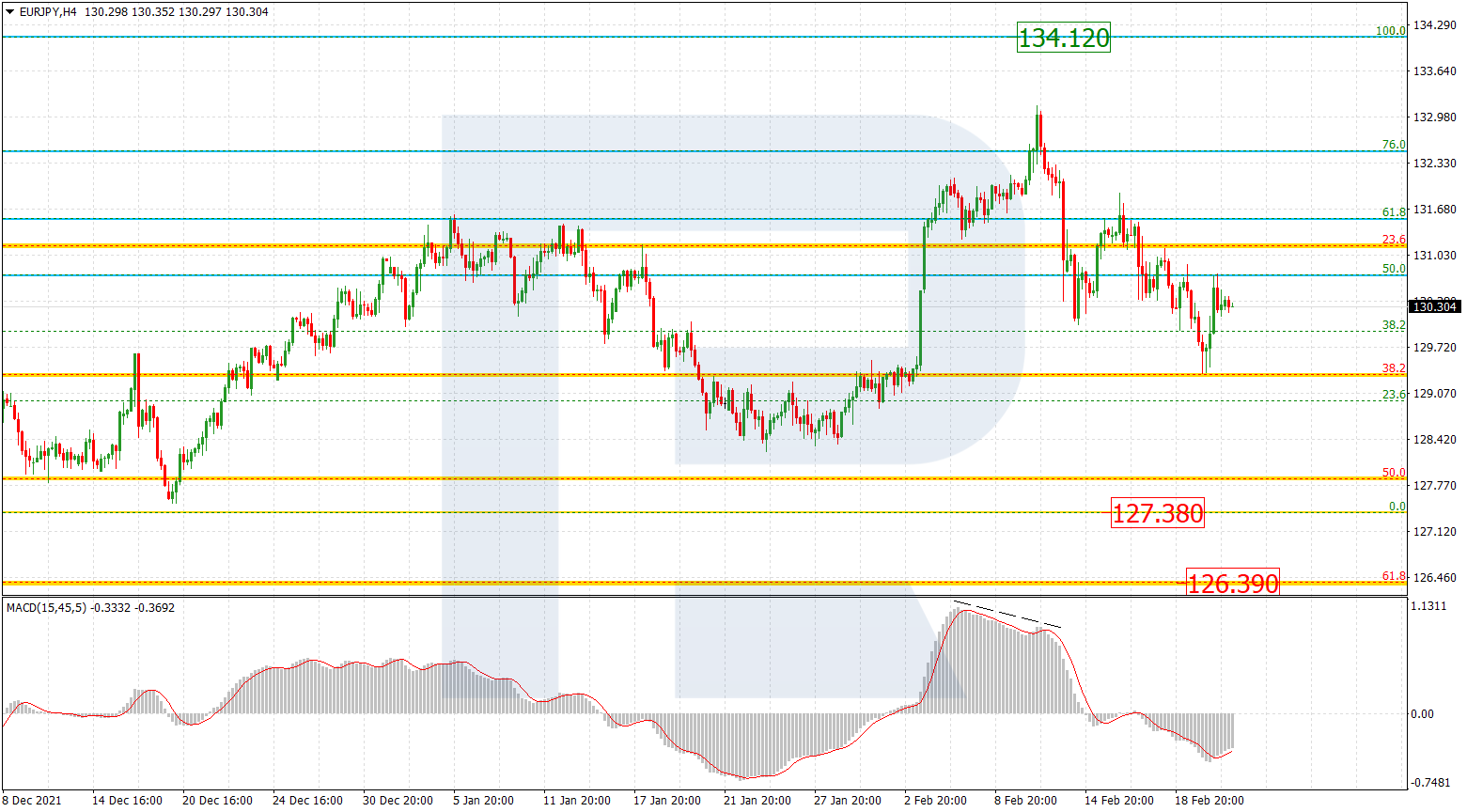

EURJPY, “Euro vs. Japanese Yen”

In the H4 chart, EURJPY is forming a mid-term descending correction, which has already reached the retracement of 23.6% and may continue towards the retracement of 38.2% at 128.85.

Risk Warning: the results of previous trading operations do not guarantee the same results in the future.

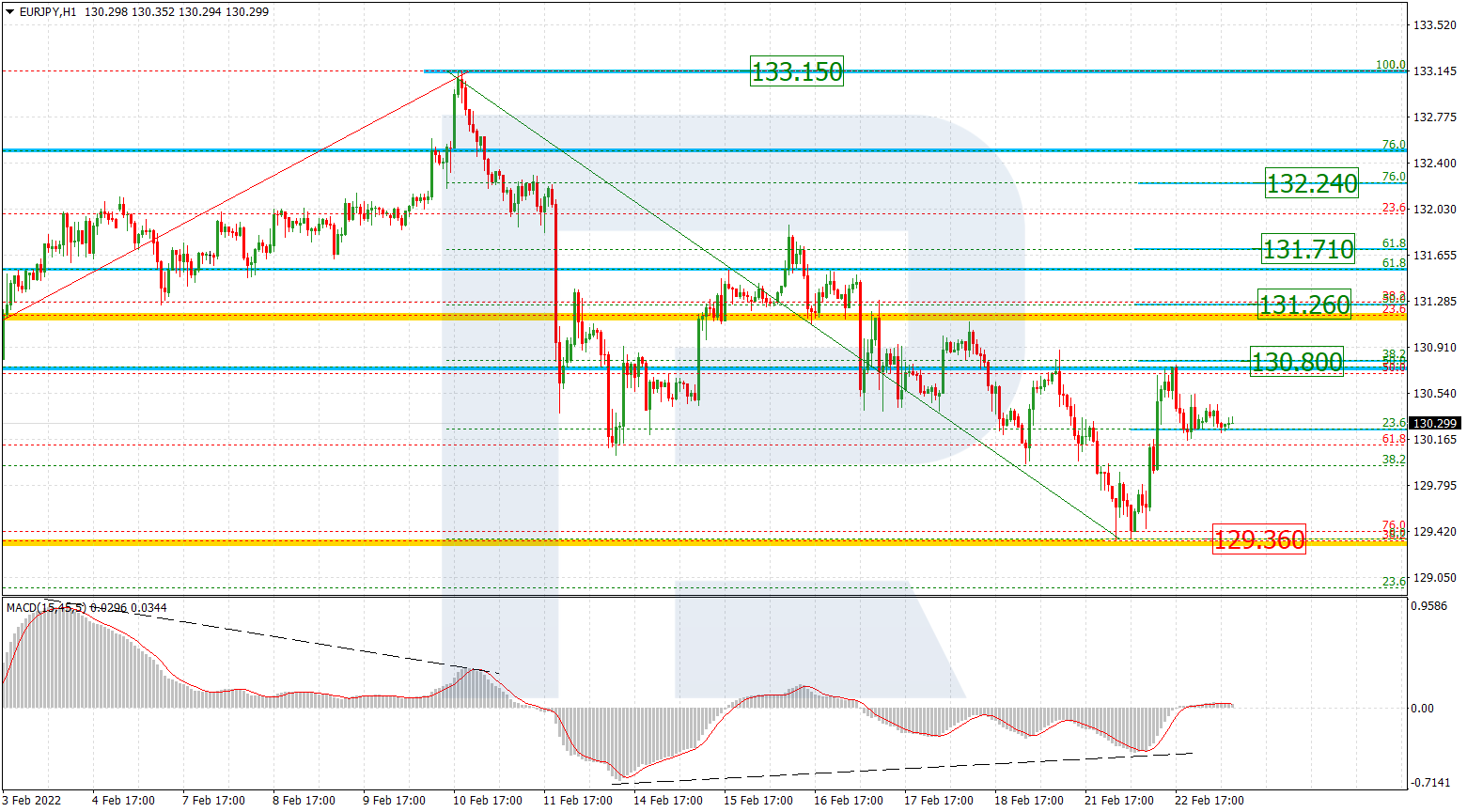

As we can see in the H1 chart, after the previous low, EURJPY started forming a new descending impulse. The instrument is moving towards the post-correctional extension area between the retracements of 138.2% and 161.8% at 130.46 and 130.16 respectively. The resistance level is at 132.18.

Risk Warning: the results of previous trading operations do not guarantee the same results in the future.

RoboForex Analytical Department