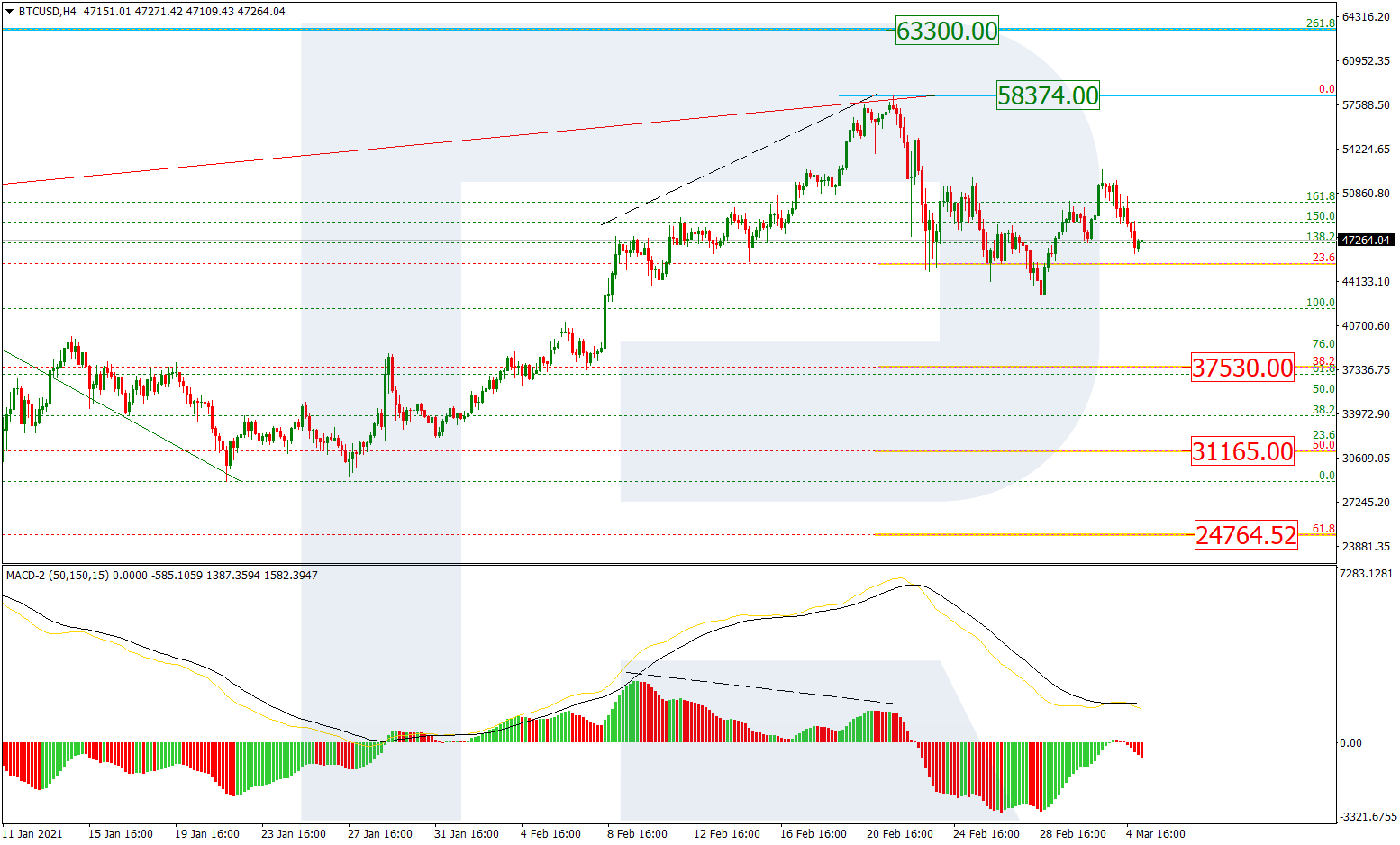

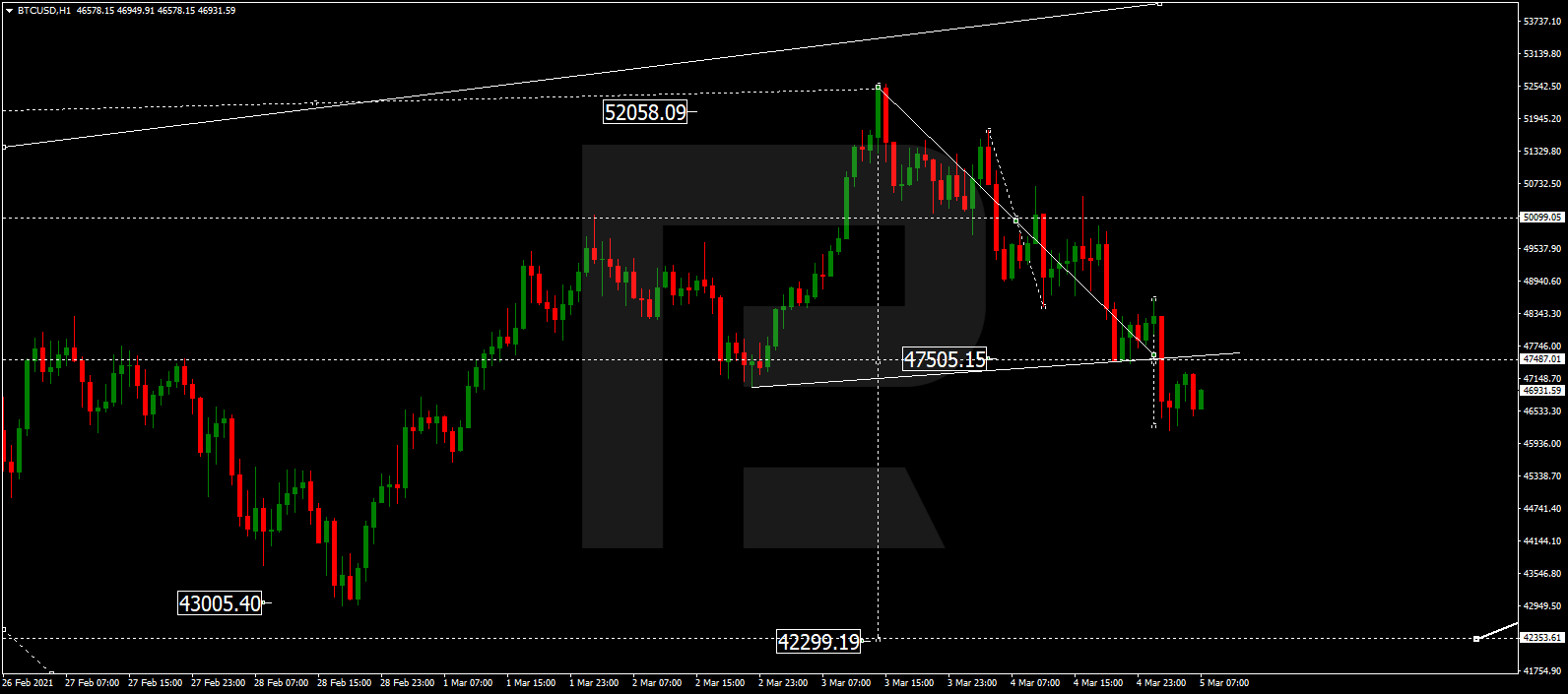

BTCUSD, “Bitcoin vs US Dollar”

Technically speaking, on H4, the quotations are staying inside a post-correctional extension area of 138.2%-161.8% (17660.00-20000.00) Fibo. After a divergence, the quotations started falling and might reach the local low of 16222.00. A breakaway of this level might confirm a trend reversal downwards, aiming at 23.6% (16148,.0), 38.2% (13807.00), and 50.0% (11912.0). The resistance is at the high of 19917.50.

On H1, there is a descending wave developing after a local divergence. The quotations are trying to test 61.8% (17630.00) Fibo for the second time. A breakaway of this level will open a pathway to 76.0% (17111.50) and then – to the local low of 16222.00.

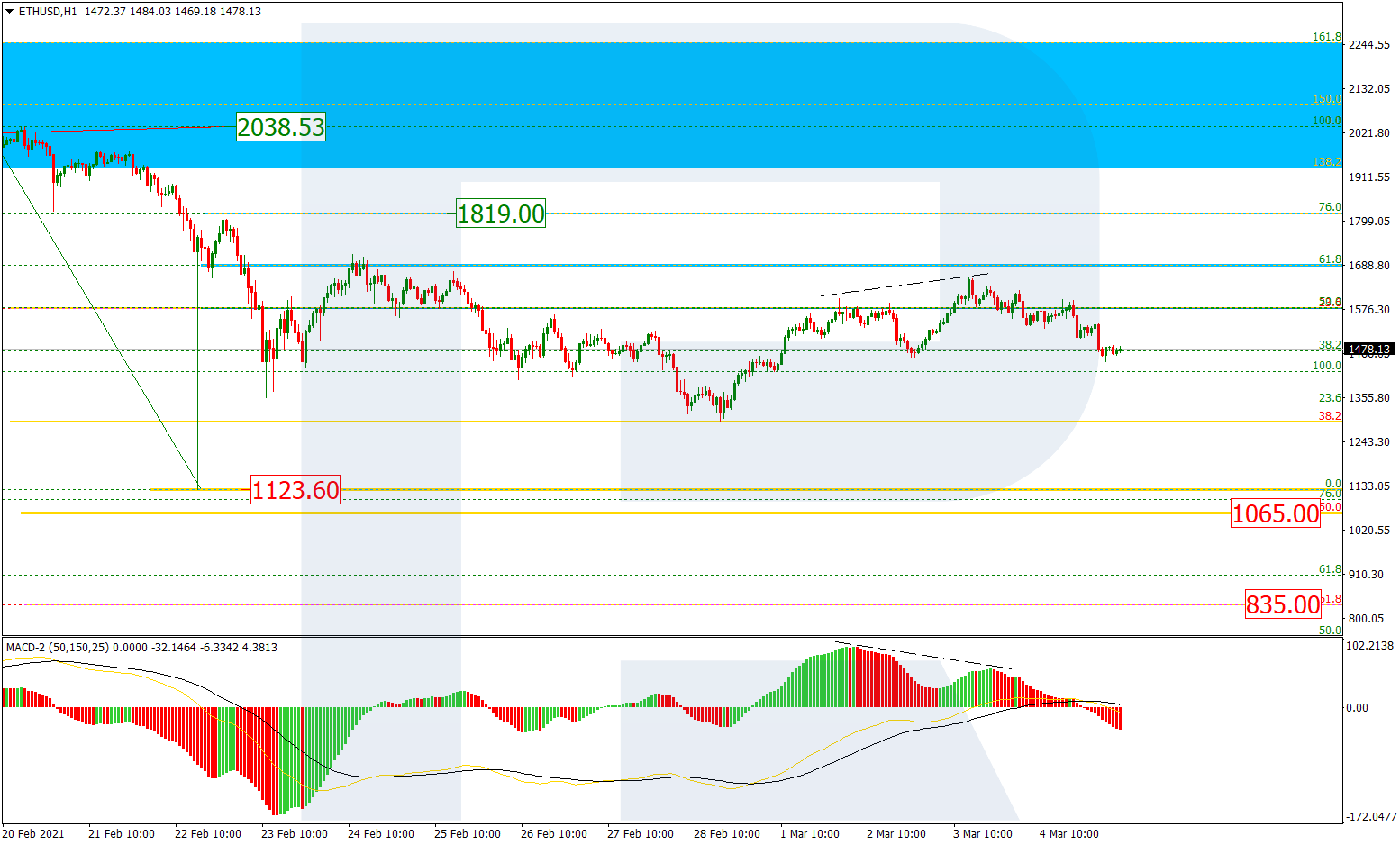

ETHUSD, “Ethereum vs US Dollar”

On D1, a decline is beginning after a local divergence, which can be interpreted as the reversal of the main trend. The aim of the possible downtrend are 23.6% (506.95), 38.2% (428.10), and 50.0% (364.15) Fibo. A breakaway of the high of 636.58 and securing above it will signal the end of the correction and further development of the uptrend.

On H1, a descending wave is developing to correct the preceding wave of growth. By now, the quotations have reached 61.8% Fibo, and the next impulse might head for 76.0% (518.57). A breakaway of the low of 481.10 might mean the reversal of the medium-term trend.