FOMC reveals its hand – what is next for EURUSD after the minutes?

As markets await the release of the FOMC minutes, the EURUSD pair is forming a correction. Once this phase ends, the pair may resume its upward movement towards the 1.1415 mark. Find more details in our analysis for 28 May 2025.

EURUSD forecast: key trading points

- FOMC meeting minutes release

- EURUSD forecast for 28 May 2025: 1.1415 and 1.1265

Fundamental analysis

Fundamental analysis for 28 May 2025 focuses on the release of the Federal Open Market Committee (FOMC) minutes from the 6-7 May meeting. These documents are expected to provide deeper insight into the Fed’s stance on interest rates and economic risks.

At the latest meeting, the FOMC left the federal funds rate unchanged at 4.25%-4.50%, citing increased uncertainty and rising risks related to both inflation and unemployment. The minutes may shed light on the extent of the committee’s concern about a potential economic slowdown and inflationary pressures driven by trade tariffs and weaker GDP growth.

The Fed is assumed to maintain a wait-and-see approach and refrain from immediate action until more definitive economic signals emerge. Potential rate cuts may come no earlier than September and would depend on inflation and labour market dynamics.

The FOMC minutes could impact the EURUSD forecast, bond yields, and equity markets. Any hint of policy shifts is likely to spark notable market reactions.

Today’s EURUSD outlook appears cautiously optimistic for the euro. If the minutes reflect negative sentiment on the US economy, the EURUSD rate could resume its uptrend.

EURUSD technical analysis

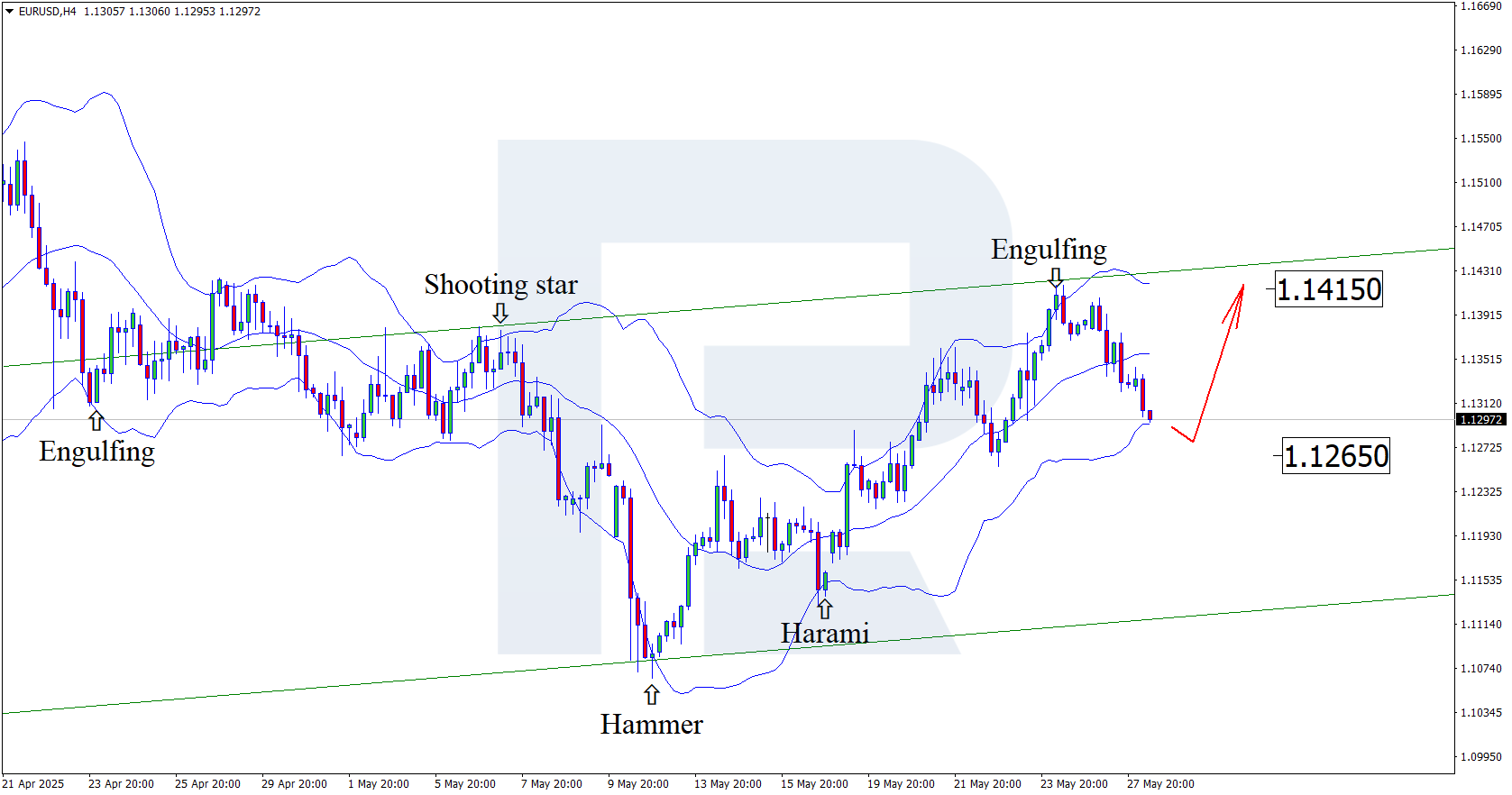

On the H4 chart, the EURUSD pair has formed an Engulfing pattern near the upper Bollinger Band. Currently, the pair is developing a downward wave in response to this signal. Since it remains within the ascending channel, a continued correction towards the 1.1265 support level is likely. A rebound from this level would set the stage for renewed bullish momentum.

Alternatively, the EURUSD rate could climb towards 1.1415 and gain its upward momentum without testing the support line.

Summary

As markets await the FOMC minutes, the EURUSD pair is undergoing a corrective phase. EURUSD technical analysis suggests a potential rise towards the 1.1415 resistance level following the correction.