Ford Motor Company (F), Amazon.com, Inc. (AMZN), and PepsiCo Inc. (PEP): Q4 2024 earnings reports and stock forecasts

The management teams of Ford, Amazon, and PepsiCo have issued cautious forecasts for 2025, citing geopolitical risks, while PepsiCo also pointed to shifts in consumer preferences. Against this backdrop, their stocks moved lower.

This article presents the key figures from the Q4 earnings reports of Ford, Amazon, and PepsiCo, alongside a technical analysis of F, AMZN, and PEP, forming the basis for a stock forecast for Ford, Amazon, and PepsiCo in Q1 2025.

Ford Motor Company Q4 2024 earnings report

Ford’s financial report for Q4 2024 showed a net profit of 1.8 billion USD, a significant improvement on a 500 million USD loss in the same period last year. The company’s quarterly revenue reached 48.2 billion USD, marking a 5% year-on-year increase. Adjusted earnings per share (EPS) stood at 0.39 USD, exceeding market expectations.

Despite these positive results, Ford predicts a decline in profits in 2025. Adjusted earnings before interest and taxes (EBIT) are forecast at 7.0 to 8.5 billion USD, down from 10.2 billion USD in 2024. The primary reason is the continued losses in the Ford E electric vehicle division, which recorded a 5.1 billion USD loss in 2024 and is expected to incur additional costs of 5.0-5.5 billion USD in 2025 due to intensifying competition and pricing pressures.

Additionally, the Ford Blue division, which focuses on traditional internal combustion engine (ICE) and hybrid vehicles, projects a decline in operating profit to 3.5-4.0 billion USD in 2025 from 5.3 billion USD in 2024. The commercial division, Ford Pro, also expects lower earnings, at 7.5-8.0 billion USD, compared to 9.0 billion USD in 2024.

In response to these challenges, Ford is implementing cost-cutting measures and improving product quality to drive long-term value. The company also plans to expand its powertrain lineup, including fully electric, plug-in hybrid, and extended-range electric vehicles, to strengthen its market position.

However, external factors such as potential tariffs on vehicle imports from Mexico and Canada could negatively impact profits and increase consumer prices. That said, Ford’s strong manufacturing base in the US – where 80% of vehicles sold domestically are produced at local plants – could provide a competitive advantage and help mitigate these risks.

Overall, despite strong financial performance in the latest quarter, Ford faces significant challenges in 2025, particularly in the electric vehicle segment, and from external economic pressures.

Ford Motor Company stock price forecast for Q1 2025

On the daily timeframe, Ford Motor Company shares are trading within a 9-14 USD range and are currently testing support at 9 USD. The MACD indicator has formed a convergence, signalling a potential price increase. Based on Ford Motor Company’s stock performance, we will examine possible movements in Q1 2025.

The optimistic scenario for Ford Motor Company’s stock outlook suggests a rebound from the 9 USD support level, followed by a price increase towards the upper boundary of the range at 14 USD.

The pessimistic scenario for Ford Motor Company’s stock forecast anticipates a break below the 9 USD support level, which could lead to a decline in the stock price towards the next support at 5 USD.

Analysis and forecast for Ford Motor Company stock for Q1 2025Amazon Q4 2024 earnings report

Amazon’s financial report for Q4 2024 showed revenue of 187.8 billion USD, marking a 10% year-on-year increase, while net profit reached 20.0 billion USD, or 1.86 USD per share, exceeding analysts’ expectations. The company’s online store sales grew by 7% during the holiday season, while its cloud computing division, Amazon Web Services (AWS), saw a 19% revenue increase, bringing its annual turnover to 115.0 billion USD, although this figure slightly missed forecasts. Despite these strong financial results, Amazon’s stock declined by over 4% in after-hours trading, following a cautious outlook for Q1 2025. The company expects revenue to range between 151.0 billion and 155.5 billion USD, falling short of analysts’ consensus estimate of 158.0 billion USD. Among the key factors influencing this outlook, Amazon cited unfavourable currency fluctuations and a chip shortage affecting AWS.

Looking ahead, Amazon plans to continue significant investments in AI-powered products and cloud infrastructure, with capital expenditures in 2025 expected to exceed 100.0 billion USD, primarily allocated to AWS and AI initiatives. However, the company faces challenges such as capacity constraints in AWS due to supply chain disruptions in semiconductor deliveries and the potential impact of new import tariffs on Chinese goods, which could affect its supply chain.

Overall, despite strong Q4 financial performance, Amazon is approaching 2025 with cautious optimism, balancing large-scale investment plans with external economic uncertainties.

Amazon.com, Inc. stock forecast for Q1 2025

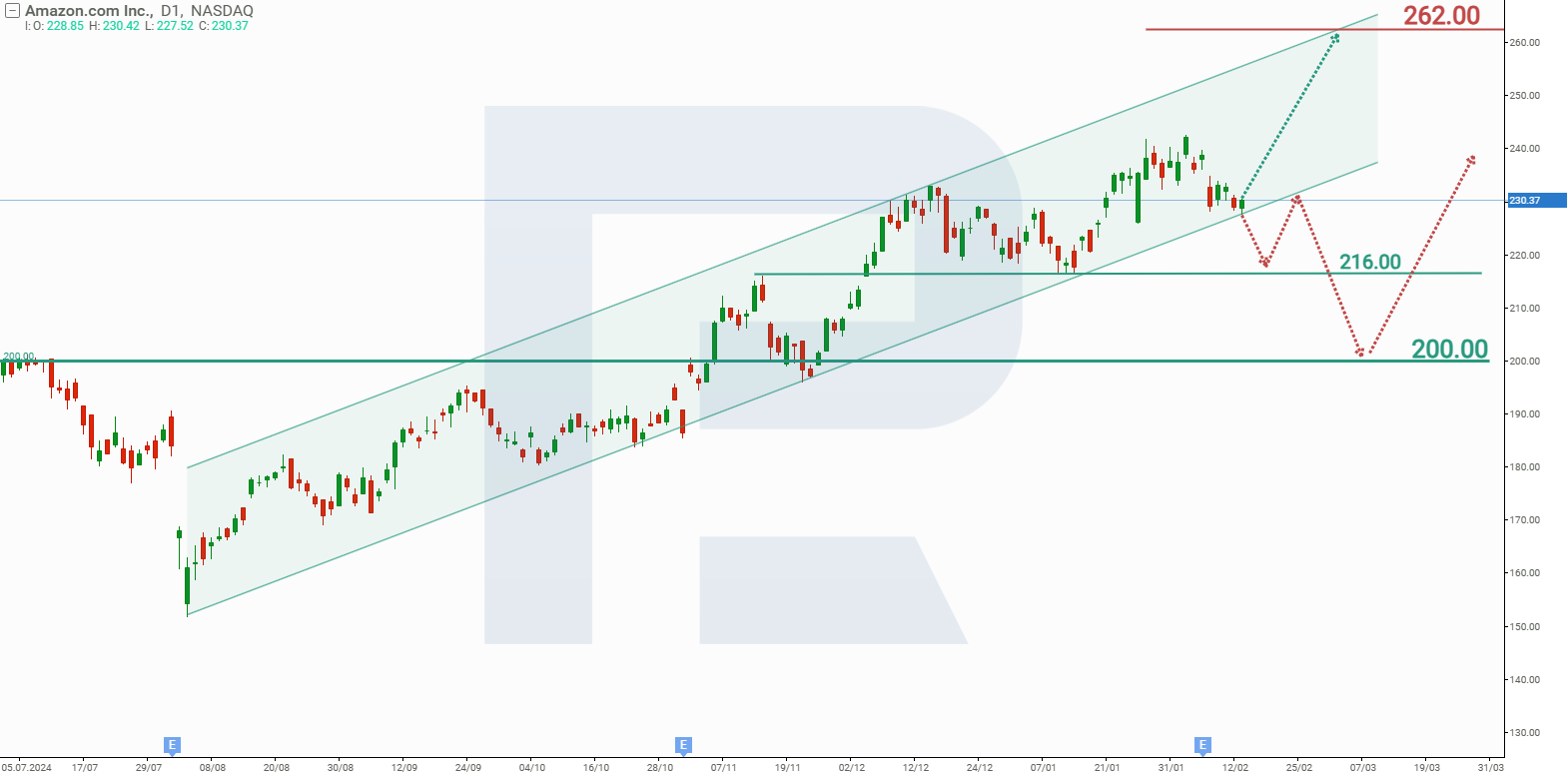

On the daily timeframe, Amazon stock is trading within an ascending channel and is currently testing the trendline, which serves as a support level. We will examine possible movements in Q1 2025 based on Amazon’s current stock performance.

The optimistic scenario for Amazon’s stock outlook suggests a rebound from the trendline, followed by an increase towards the channel’s upper boundary at 262 USD.

The pessimistic scenario for Amazon’s stock forecast anticipates a break below the trendline, leading to a gradual decline towards the 200 USD support. A rebound from this level could indicate a resumption of growth, potentially pushing Amazon’s stock price up to 240 USD.

Analysis and forecast for Amazon.com, Inc. stock for Q1 2025PepsiCo Inc. Q4 2024 report

The financial report for PepsiCo for Q4 2024 showed revenue of 27.8 billion USD, slightly below analysts’ expectations of 27.9 billion USD and a bit worse compared to last year. Net income amounted to 1.5 billion USD (1.11 USD per share), up from 1.3 billion USD (0.94 USD per share) a year earlier. Adjusted earnings per share (EPS) reached 1.96 USD, slightly surpassing the forecast of 1.94 USD.

The revenue decline was partly due to a 2.1% drop in sales in the Frito-Lay North America segment to 7.3 billion USD, caused by decreased demand for salty snacks. The Quaker Foods North America division also saw a 2.1% revenue decline to 874 million USD due to product recalls related to salmonella contamination.

PepsiCo performed more strongly on international markets, reporting 6% organic revenue growth, driven by increased demand in Africa and Asia. The company’s base gross margin increased by 25 basis points, and the operating margin grew by 100 basis points due to efficiency measures and increased investments in advertising and marketing.

For 2025, PepsiCo forecasts modest single-digit percentage growth in organic revenue and earnings per share, acknowledging the potential negative impact of currency fluctuations. The company announced a 5% increase in annual dividends and plans to return about 8.6 billion USD to shareholders through them and share repurchases.

To adapt to shifts in consumer preferences towards healthier products, PepsiCo is focusing on brands like Pepsi Zero Sugar and SunChips and implementing efficiency measures, including automation and the closure of four bottling plants in the US.

Despite these initiatives, the company faces challenges such as inflation and consumer behaviour changes, which have reduced demand for some snack categories. PepsiCo’s shares declined after the report’s release, reflecting investor concerns about these developments.

PepsiCo Inc. stock forecast for Q1 2025

On the daily timeframe, PepsiCo stock is trading within a descending channel and has reached the lower boundary, which serves as a support level. If the price falls below 141 USD, the MACD indicator may form a convergence, potentially signalling a price increase. PepsiCo’s current stock performance makes the following price movements possible in Q1 2025.

Optimistic scenario: PepsiCo’s stock forecast suggests a test of the 141 USD support level (a false break is possible), followed by a rebound and an increase in price towards the trendline at 170 USD.

Pessimistic scenario: if the 141 USD support level is breached, PepsiCo’s stock price may decline to 115 USD.

Analysis and forecast for PepsiCo Inc. stock for Q1 2025