Forex Tech Analysis & Forecast for 10.08.2021

EURUSD, “Euro vs US Dollar”

The currency pair has created a consolidation range above 1.1745 and is trying to break through it today downwards. We expect the level of 1.1707 to be reached. Next thing, the quotations might test 1.1745 from below, and then they might decline further down to 1.1655, potentially continuing the trend to 1.1600.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair keeps forming a consolidation range around 1.3848. A decline to 1.3800 is expected, followed by a link of growth to 1.3848 and a decline to 1.3743. The goal is local.

USDRUB, “US Dollar vs Russian Ruble”

The currency pair has reached the local goal of correction at 73.70. Today, a link of decline to 73.30 should follow. Next we might see a link of growth to 73.83. There the correction should be over. A decline to 72.72 is to follow.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair is developing a consolidation range under 110.40. With an escape upwards, a pathway to 110.70 should open. With an escape downwards, the trend should continue to 109.50. And if this level is broken, we expect 108.10 to be hit.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair formed a consolidation range around 0.9153 and escaped it upwards. The potential of growth to 0.9250 is realized. The goal is local. When this level is reached, we expect a correction to 0.9153, followed by the trend continuing to 0.9284.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair formed a consolidation range around 0.7360 and escaped it downwards. A pathway to 0.7272 is open. When this level ia reached, we expect a link of growth to 0.7360 (a test from below), followed by a decline to 0.7210.

BRENT

Oil completed a wave of decline to 67.80. We expect a new wave of growth to 72.60 to begin. After this level is reached, a correction to 70.00 will become possible. At these levels, a consolidation range is likely to form. With an escape upwards, growth to 77.33 will become possible. With an escape downwards, a correction to 66.33 is likely to happen.

XAUUSD, “Gold vs US Dollar”

Gold performed an impulse of growth to 1751.30. After this level is reached, gold might go down to 1717.10. Next, growth to 1740.00 should happen, followed by a decline to 1705.55. Then growth might continue to 1735.30.

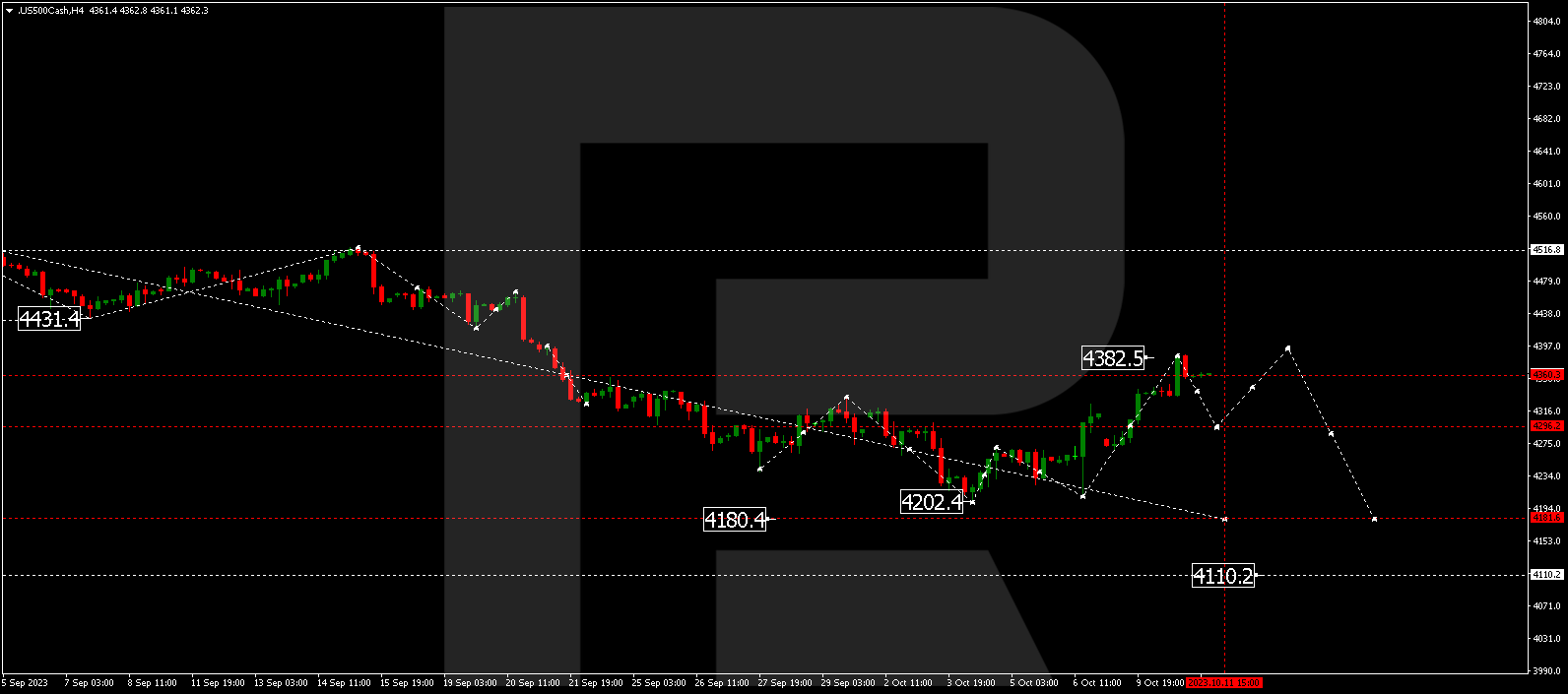

S&P 500

The stock index is forming a consolidation range under 4440.0. We expect the decline to continue to 4400.0,and if this level is also broken away downwards, the decline might continue to 4333.2. Then growth to 4500.0 might happen.