Forex Technical Analysis & Forecast 03.12.2020

EURUSD, “Euro vs US Dollar”

The currency pair has formed a consolidation range around 1.2072 and is trying to extend it to 1.2127. However, this is just an alternative: the main scenario is the developing of a wave of decline to 1.2040. The goal is first.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair performed an impulse of decline to 1.3287 and corrected to 1.3353. Today, the market is forming a consolidation range around this level. We expect the range to be extended to 1.3385, followed by a decline to 1.3353. Then a link of growth to 1.3418 might follow – as an option. The main scenario presumes a decline to 1.3287 and even 1.3150 in the future.

USDRUB, “US Dollar vs Russian Ruble”

The currency pair is developing a wave of decline to 74.60. A link of growth to 75.60 might follow (a test from below). Then further decline to 74.60 might follow, after which we expect the pair to correct to 77.70.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair is developing a consolidation range around 104.22. The market has again probed the upper border at 104.68. Today, it is aiming at 104.22. With a breakaway of this level top-down, a pathway to 103.83 will open, which is the lower border of the range. After an escape from the range downwards, the pair might proceed to 102.50. The goal is main.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair bounced off 0.9015 and performed a wave of decline to 0.8936. We expect a consolidation range to develop at the current lows and a wave of growth to 0.9015 to begin. The goal is first.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair has performed a wave of growth to 0.7419. Today, the market is trading in a consolidation range under this level. The main scenario presumes a decline to 0.7366, followed by growth to 0.7390.

BRENT

Oil has performed a link of correction to 47.84. Today, it might grow to 48.98. Upon reaching this level, the pair might form a consolidation range at these highs. After the price escapes this range downwards, a pathway of decline to 46.80 will open.

XAUUSD, “Gold vs US Dollar”

Gold has reached the goal of the impulse of growth to 1833.33. At the moment, the market is forming a consolidation range around this level. An extension of the range to 1842.54 is not excluded, followed by a decline to 1811.98. After a breakaway of this level downwards, the pair might correct to 1784.07.

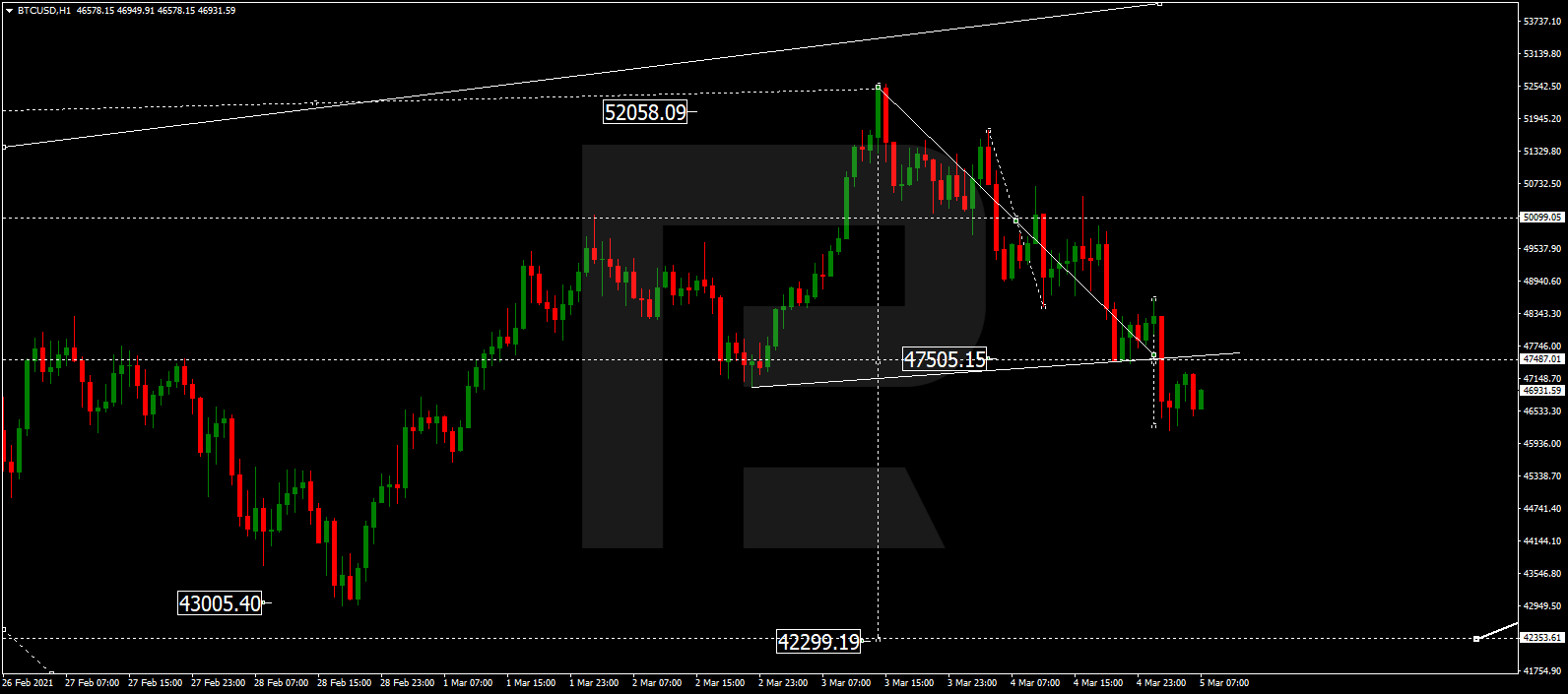

BTCUSD, “Bitcoin vs US Dollar”

Today, the market is consolidating around 18,800. If the price escapes the range upwards, it might leap up to 20,000. If the price goes down, it might fall to 18,000 and then grow to 18,800.

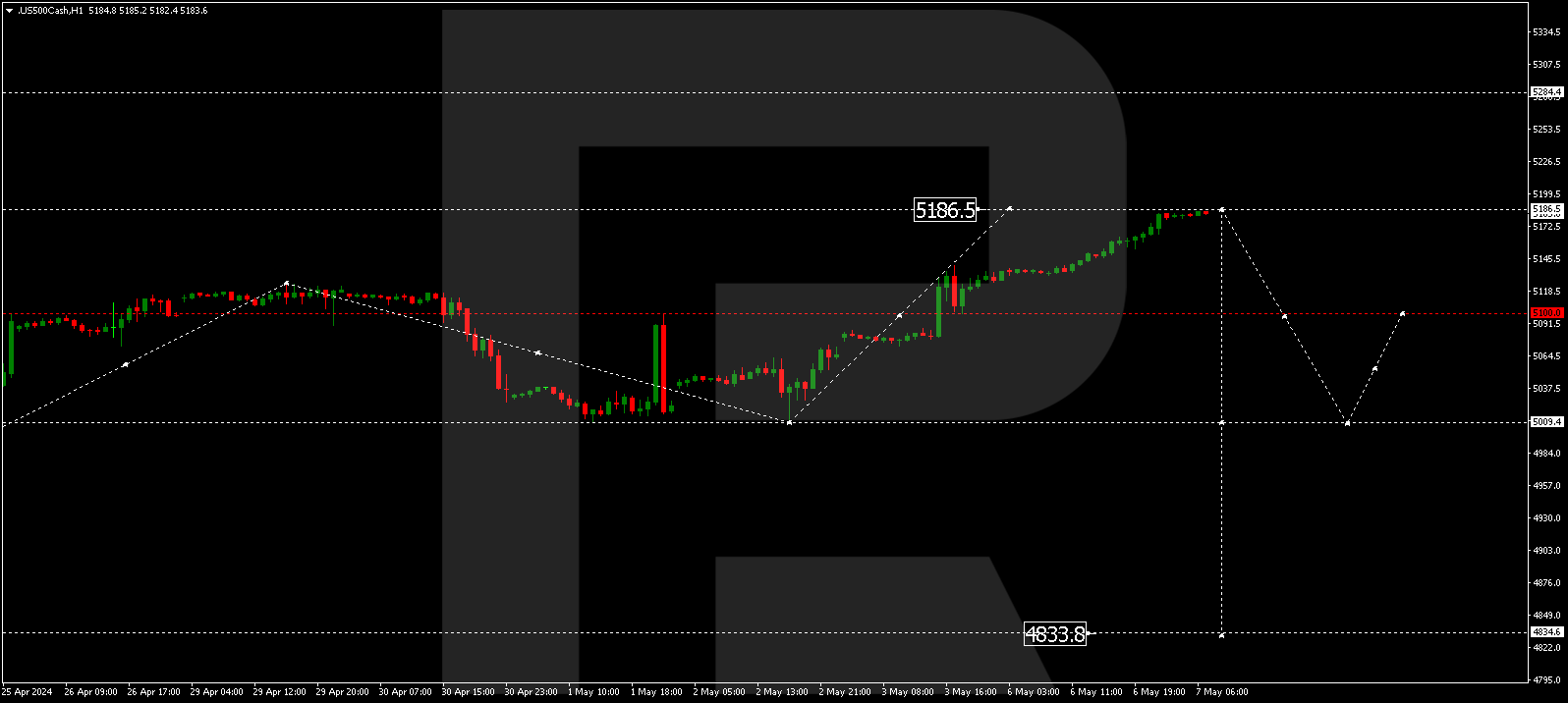

S&P 500

The index keeps forming a consolidation range above 3646.3. The range might extend to 3682.1. Then the price might drop to 3646.3 again. With an escape of the range downwards, we expect a decline to 3613.5, followed by growth to 3646.3 (a test from below). Then the price might go deeper down to 3600.0.