Forex Technical Analysis & Forecast 04.09.2020

EURUSD, “Euro vs US Dollar”

The currency pair performed a wave of decline to 1.1800. At the moment, the market corrected to 1.1860 and is now trading in a consolidation range above this level. We expect a decline to 1.1825. Then, in case 1.1865 is broken upwards, a potential of further correction to 1.1905 may appear. In case 1.1810 is broken downwards, the pair may decline to 1.1700.

GBPUSD, “Great Britain Pound vs US Dollar”

The pair has performed a declining wave to 1.3245. At the moment, the pair corrected to 1.3295. At these levels, we expect a consolidation range to develop. With an escape upwards, we will expect further correction to 1.3355, testing it from below. With an escape downwards, the downtrend will continue to 1.3171.

USDRUB, “US Dollar vs Russian Ruble”

The currency pair keeps developing a consolidation range above 75.00. With an escape upwards, we may expect further growth to 76.36. With an escape downwards, the pair may decline to 73.40, then the trend may continue to 71.50.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has performed a wave of growth to 106.60 and corrected to 106.06. Today, it may grow to 106.90. In case 106.00 is broken downwards, the trend may continue to 105.46.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair keeps developing a consolidation area around 0.9100. Upon escaping it upwards, the pair may grow to 0.9188. Then it may correct to 0.9100 and grow to 0.9250. With an escape downwards, the correction may continue to 0.9025.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair formed a consolidation range around 0.7298 and broke it away downwards, performing a measured decline to 0.7250. Today, the pair may correct to 0.7298 and test it from below. Then another wave of decline to 0.7188 may develop.

BRENT

Oil is trading around the consolidation are around 44.00. It may grow to 44.72 and test the level from below. Then it may decline to 42.81, where the correction will end. Then growth to 45.00 will follow.

XAUUSD, “Gold vs US Dollar”

Gold keeps consolidating around 1933.77. Today, the range may extend to 1944.67. If the price escapes it upwards, the price may correct to 1962.00. If the price escapes it downwards, the trend may continue to 1870.50.

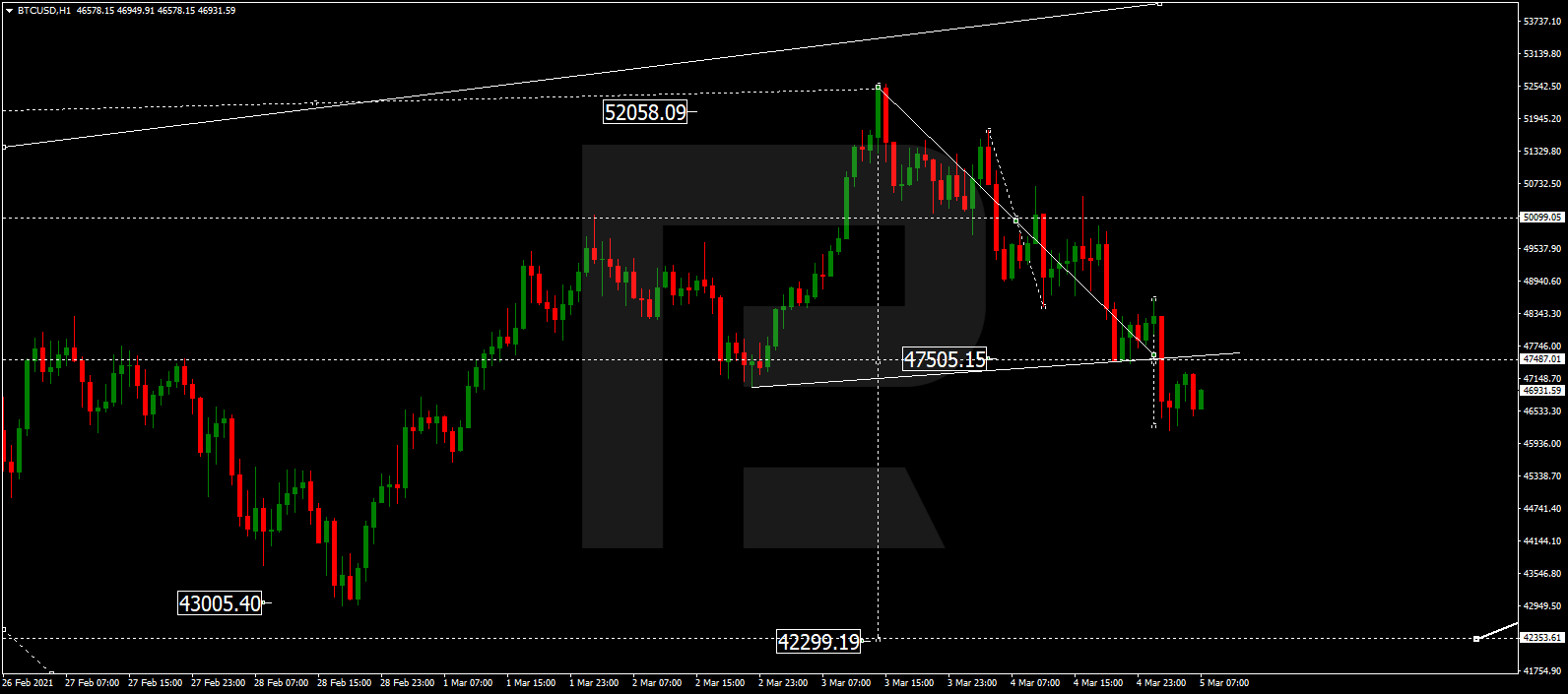

BTCUSD, “Bitcoin vs US Dollar”

По биткоину рынок продолжает развитие волны снижения. Отработана локальная цель на уровне 10080. Сегодня не исключается звено коррекции к 10700, тест снизу. Затем рассмотрим вероятность развития ещё одной волны снижения к уровню 9333.

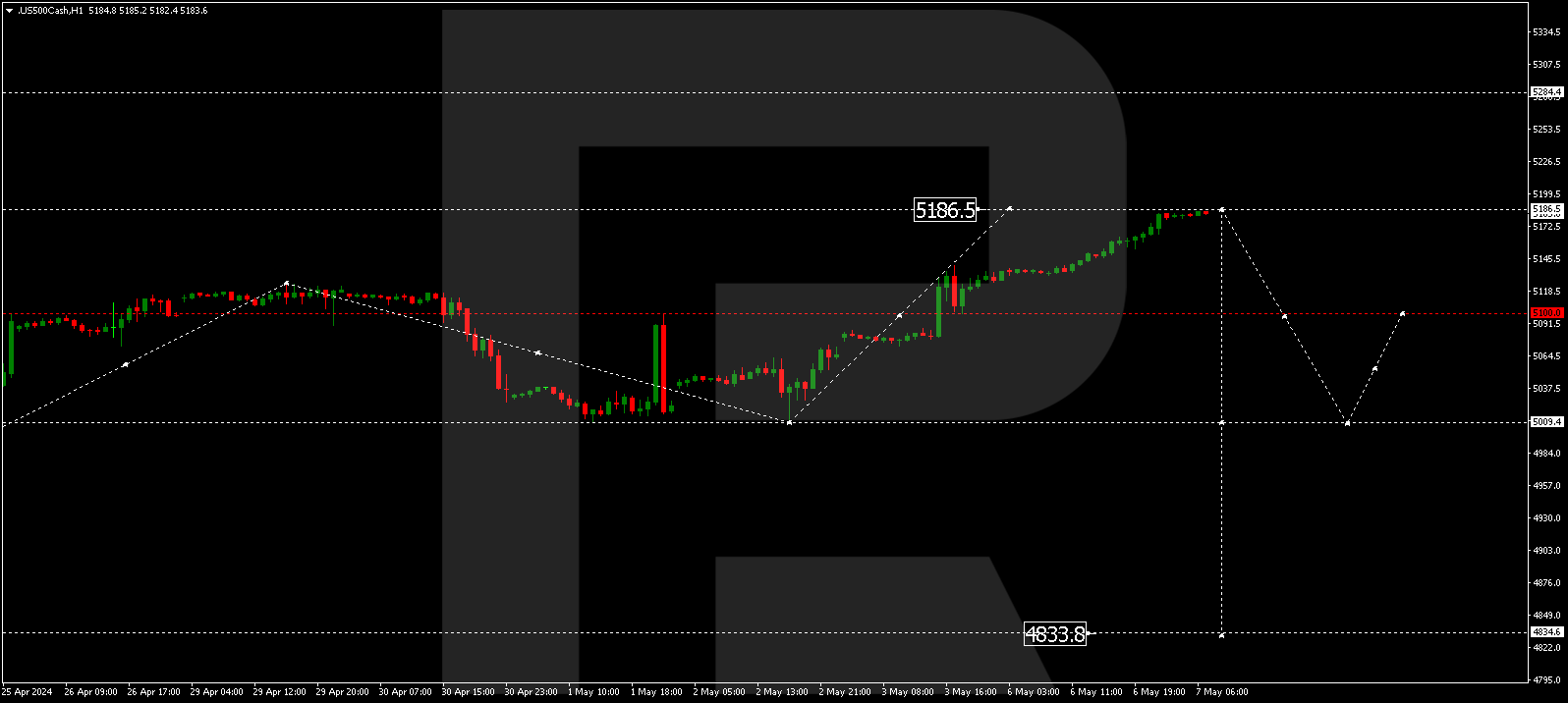

S&P 500

The stock index performed a declining structure to 3529.0 and developed a consolidation range into a trend continuation pattern downwards. Breaking away 3505.0 downwards, it will reach the first goal at 3450.0. The market is forming another consolidation range around this level. We expect the price to escape it upwards and correct to 3520.0,testing it from below. Then the price may decline to 3323.3. The goal is local.