Forex Technical Analysis & Forecast 04.12.2020

EURUSD, “Euro vs US Dollar”

The currency pair formed a consolidation area around 1.2107, broke it upwards, and extended it to 1.2172. Today, the market performed an impulse of decline to 1.2131 and corrected to 1.2152. We expect a consolidation range to develop at these highs. With an escape downwards, the price might proceed to 1.2070. The goal is first.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair demonstrated a structure of growth to 1.3375 and formed a consolidation range around this level. With an escape upwards, the market reached 1.3477. Today, the market performed an impulse of decline to 1.3437 and corrected to 1.3464. We expect a structure of decline to develop to 1.3380. The goal is first.

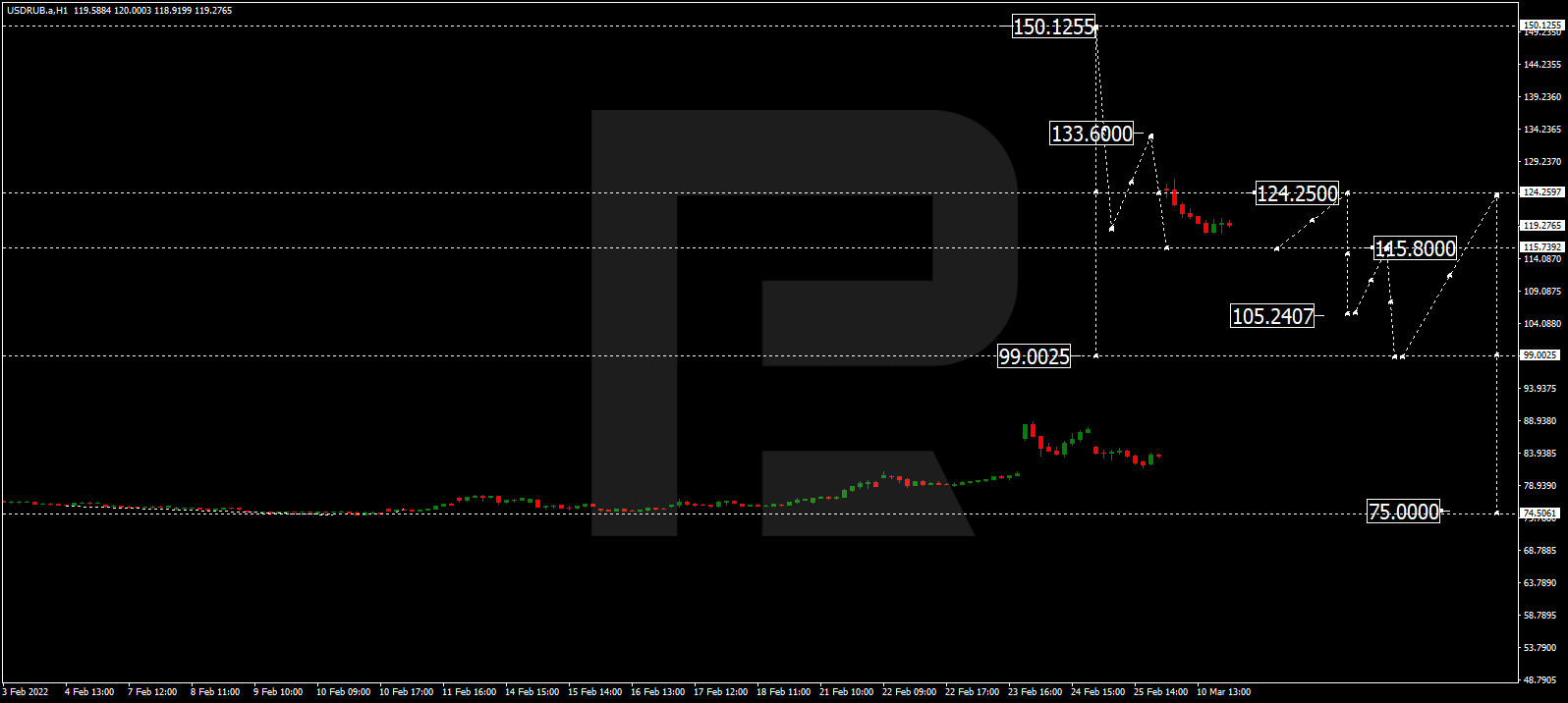

USDRUB, “US Dollar vs Russian Ruble”

The currency pair completed the first wave of decline over 74.31. Today, we expect it to form a consolidation range around these lows. With an escape upwards, a correction to 77.70 might start.

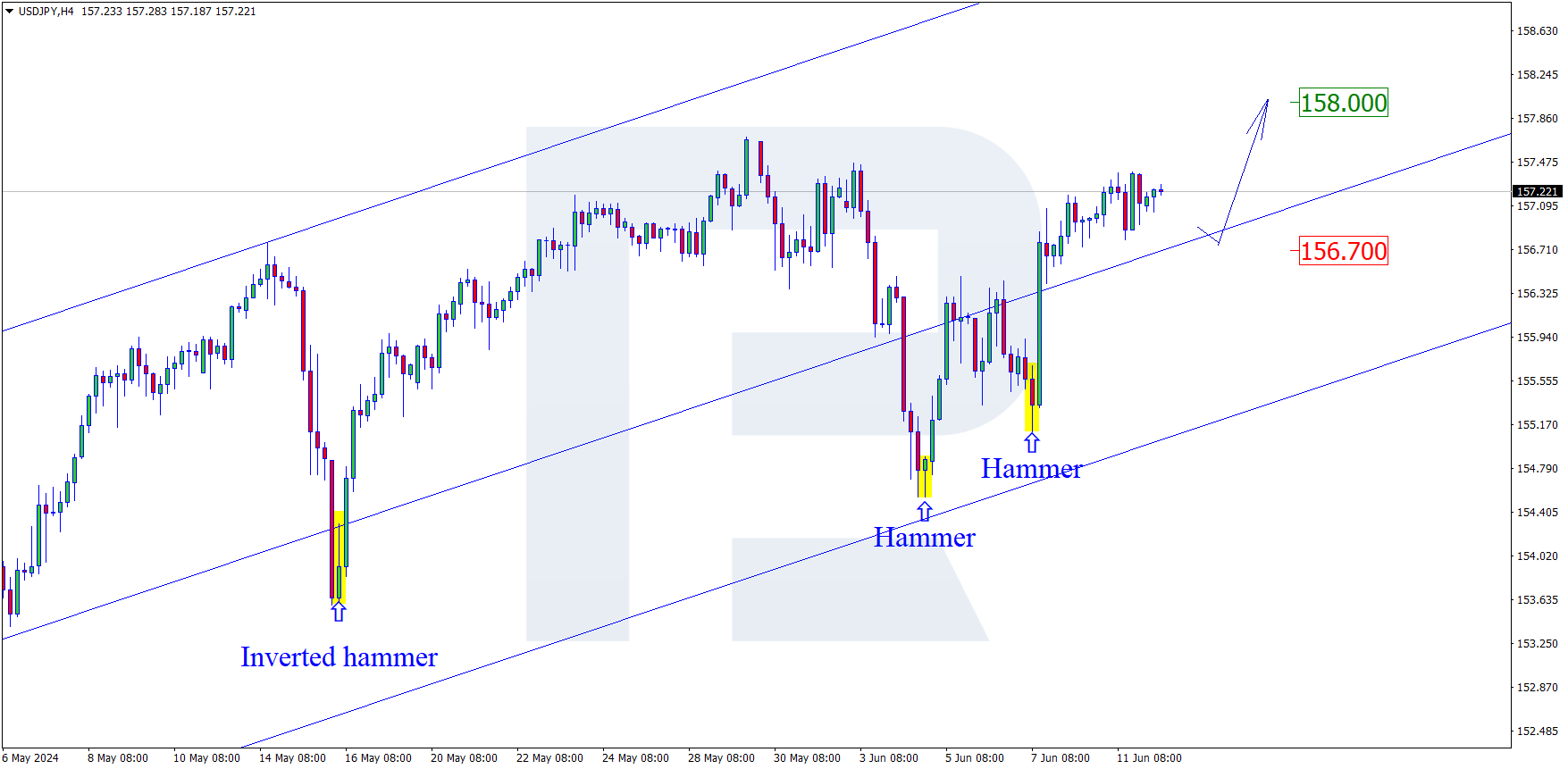

USDJPY, “US Dollar vs Japanese Yen”

The currency pair demonstrated a structure of decline to the lower border of the consolidation range. Today, we expect a link of growth to 104.00 (a test from below). Then a decline to 103.60 might follow. With a breakaway of this level downwards, the quotations might proceed to 103.30. The goal is local.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair performed a wave of decline over 0.8893. Today, we expect a consolidation range to form at the current lows. With an escape upwards, a wave of growth to 0.8971 might start forming. The goal is first.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair completed a wave of growth to 0.7447. Today, the market is trading in an impulse of decline to 0.7391. Upon reaching this level, the quotations might start a correction to 0.7418. We expect a consolidation range to form at these levels. With an escape downwards, a wave of decline to 0.7340 might start,

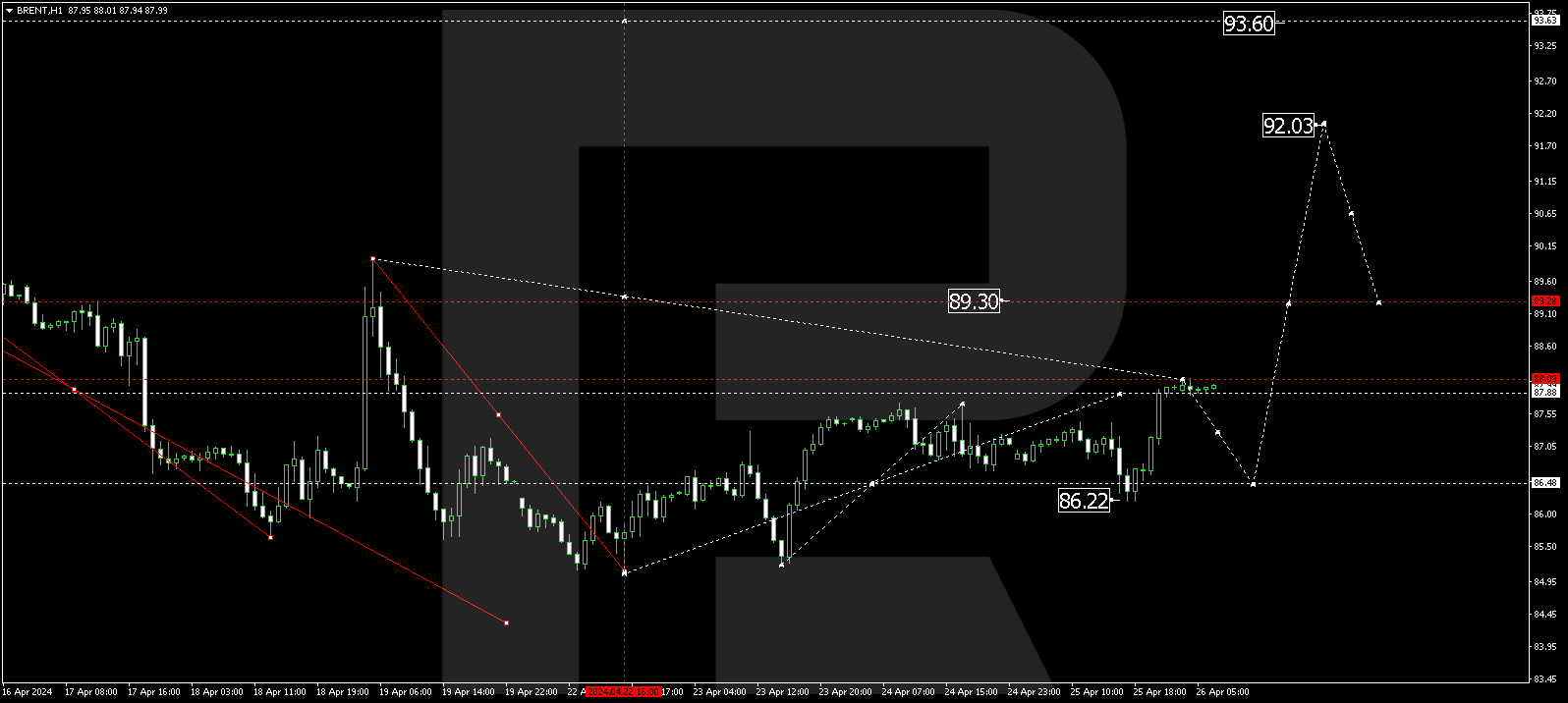

BRENT

Oil demonstrated another wave of growth over 49.59. We expect a consolidation range to form at the current highs. With an escape downwards, a wave of decline to 48.40 is likely to start. The goal is first.

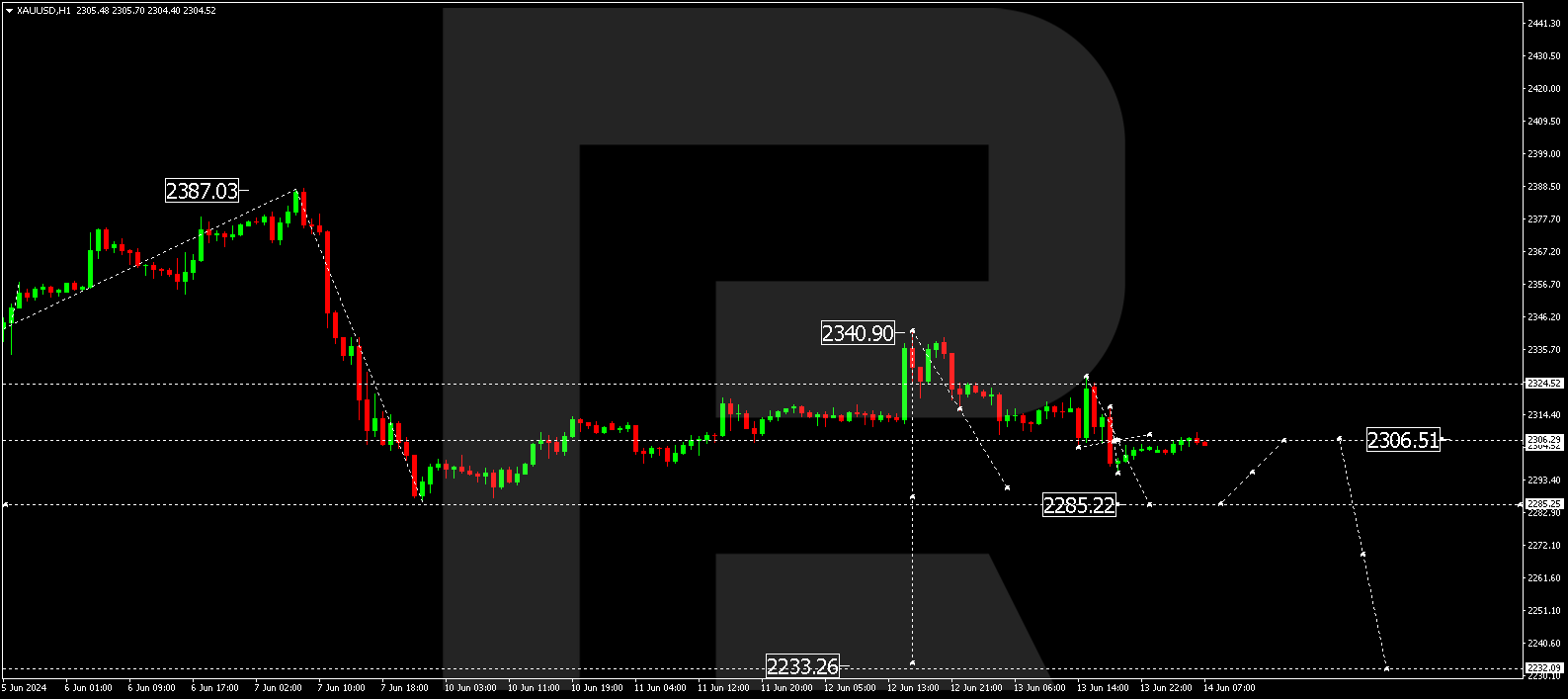

XAUUSD, “Gold vs US Dollar”

Gold performed a decline to 1827.60. Today, we are expecting a wave of growth to 1853.95 that might extend to 1857.70. Upon reaching this level, a consolidation range might develop at these highs. With an escape downwards, the quotations might start declining to 1810.70.

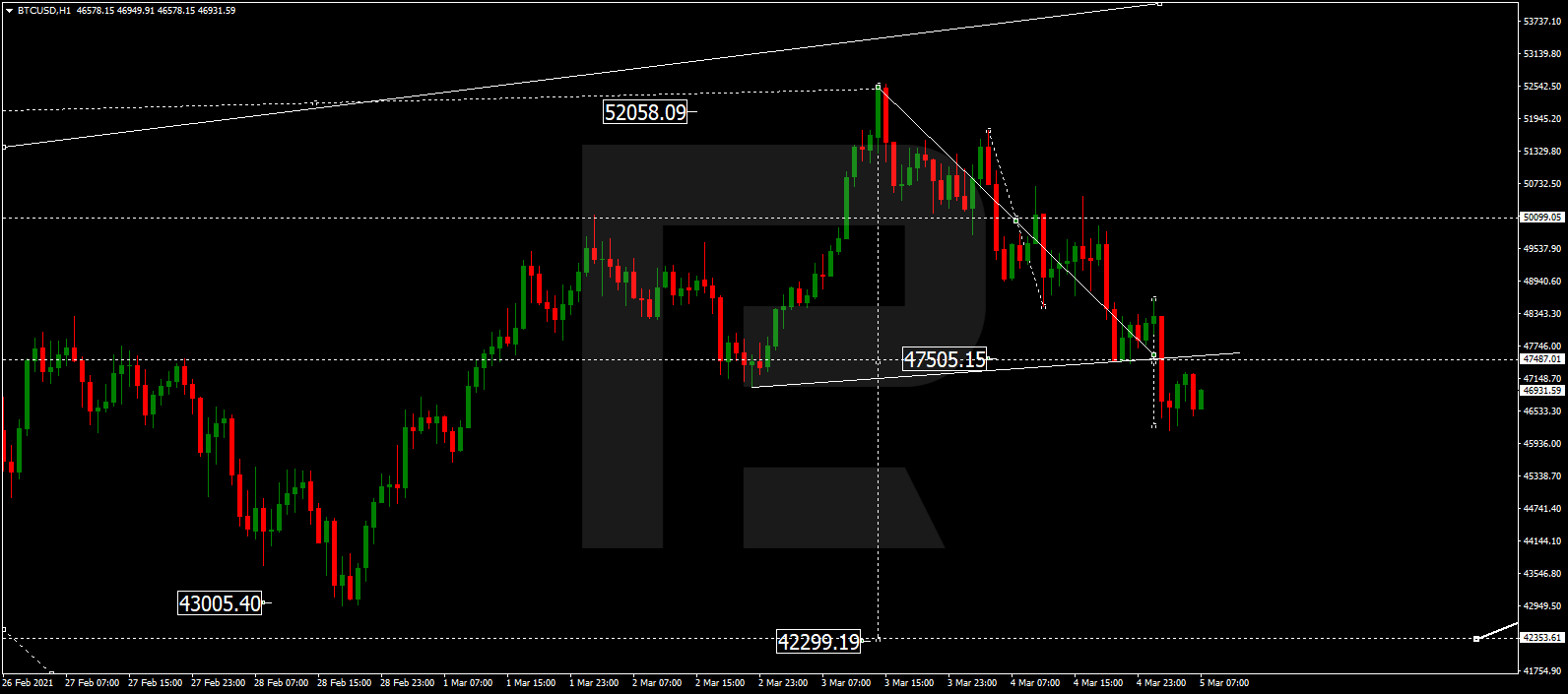

BTCUSD, “Bitcoin vs US Dollar”

Today, the market is trading in a consolidation area around 19,400. With an escape upwards, the market might leap up to 20,000. With an escape downwards, it might decline to 18,200, then grow to 18,800.

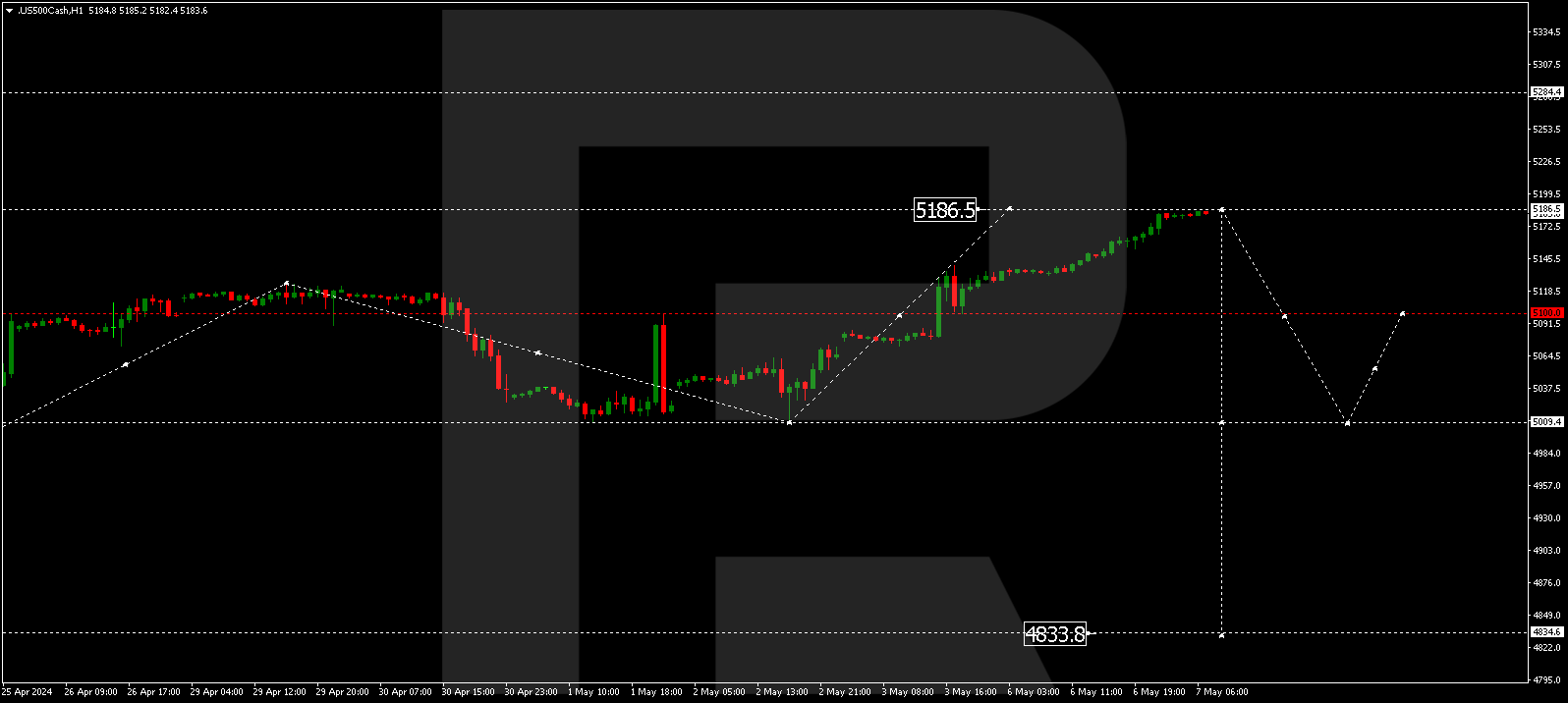

S&P 500

The stock index extended the consolidation range to 3683.8 and performed an impulse of decline to 3657.2. Practically, the market keeps consolidating. With an escape upwards, we expect the wave of growth to continue to 3730.7. With an escape downwards, the correction might continue to 3600.0.