Forex Technical Analysis & Forecast 05.08.2020

EURUSD, “Euro vs US Dollar”

After rebounding from 1.1800 and then reaching 1.1722, EURUSD has failed to break the latter level; right now, it is moving upwards. Possibly, the pair may grow to reach 1.1828 and then form a new descending structure towards 1.1775. Later, the market may start a new consolidation range around this level.

GBPUSD, “Great Britain Pound vs US Dollar”

After rebounding from 1.3100 and then completing another descending structure at 1.2980, GBPUSD has failed to break the latter level; right now, it is moving upwards. Today, the pair may grow to reach 1.3108 and then resume trading downwards with the target at 1.3044. After that, the instrument may consolidate around this level.

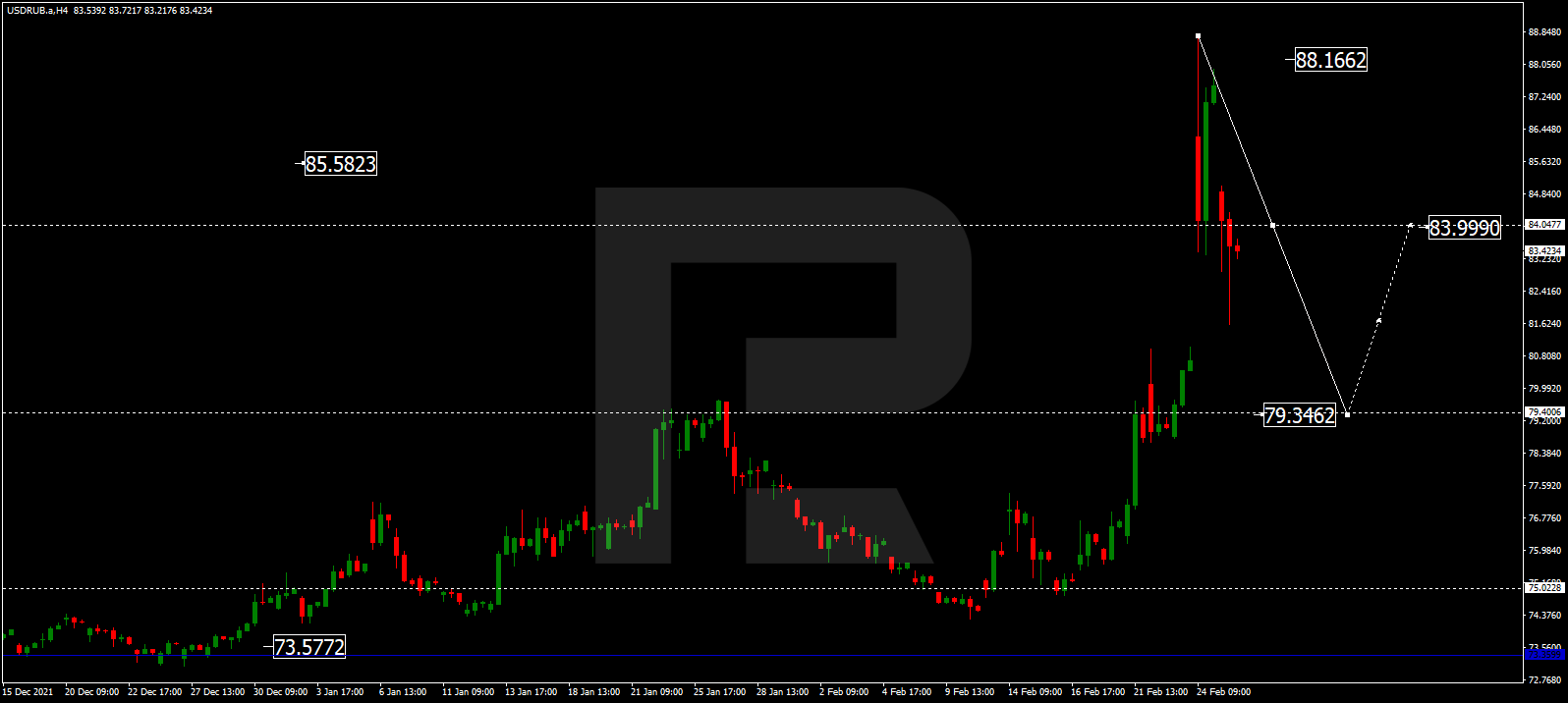

USDRUB, “US Dollar vs Russian Ruble”

After completing the descending impulse at 72.90 along with the correction towards 73.77, USDRUB is expected to form a new descending structure to return to 72.90 and break it. After that, the instrument may continue trading downwards with the short-term target at 71.80.

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has broken 105.80 and may continue the correction towards 105.15, at least. After that, the instrument may resume growing with the target at 106.50.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF is still correcting; after forming a continuation pattern at 0.9166, the price is expected to continue the correction towards 0.9097. Later, the market may resume trading upwards with the target at 0.9240.

AUDUSD, “Australian Dollar vs US Dollar”

After completing the correction at 0.7150, AUDUSD is trading to extend tрis wave. Possibly, today the pair may reach 0.7195 and then start a new decline to return to 0.7150. After that, the instrument may consolidate around this level.

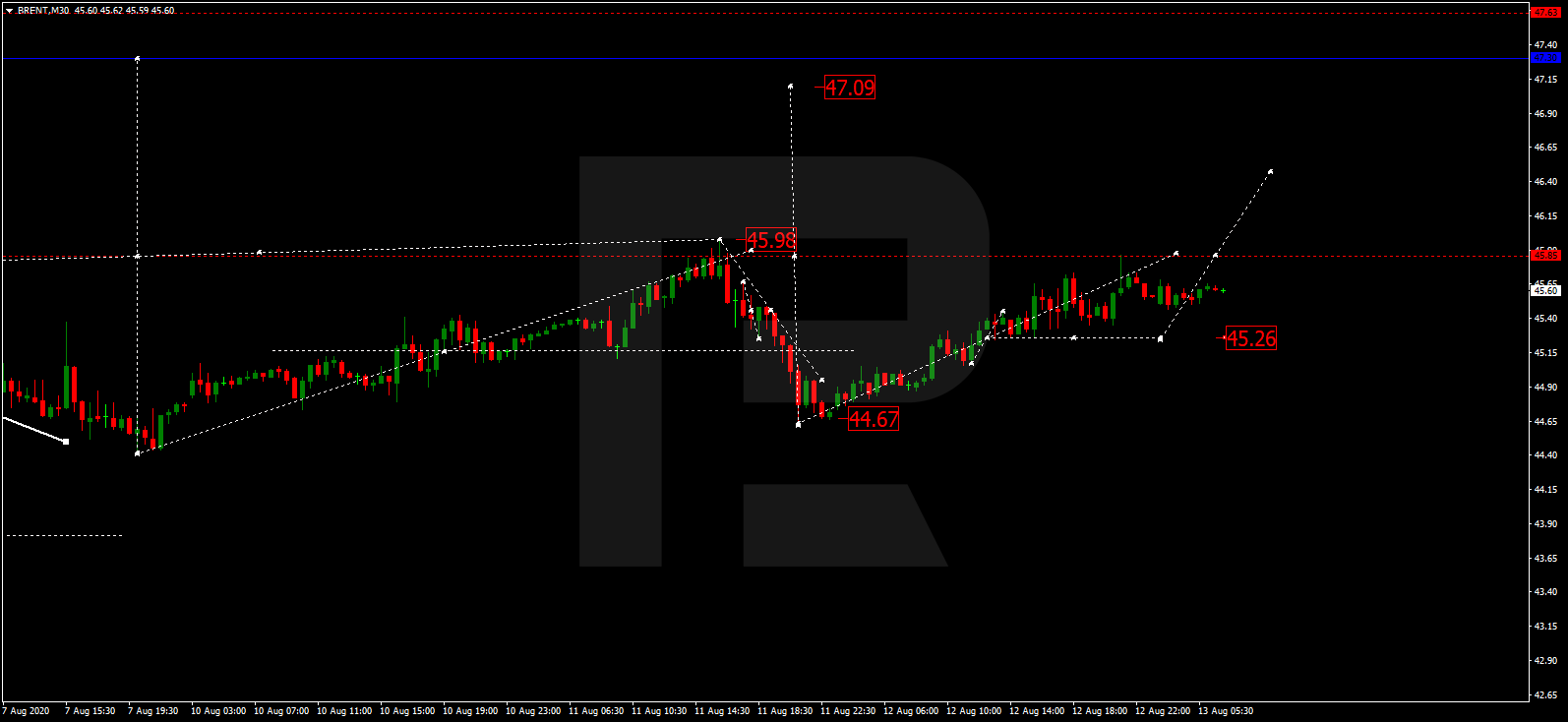

BRENT

After finishing the correction at 43.43 and then completing the ascending wave towards 44.44, Brent is consolidating around the latter level. Possibly, the pair may break the range to the upside and reach the short-term target at 45.45. Later, the market may start a new correction to reach 44.44.

XAUUSD, “Gold vs US Dollar”

After breaking the consolidation range to the upside and reaching 2000.00, Gold has formed a continuation pattern there. Possibly, after breaking the pattern to the upside, the pair may continue trading upwards with the target at 2033.33. Today, the price may reach this level and then correct to test 2000.00 from above. Later, the market may start a new growth to reach 2041.77.

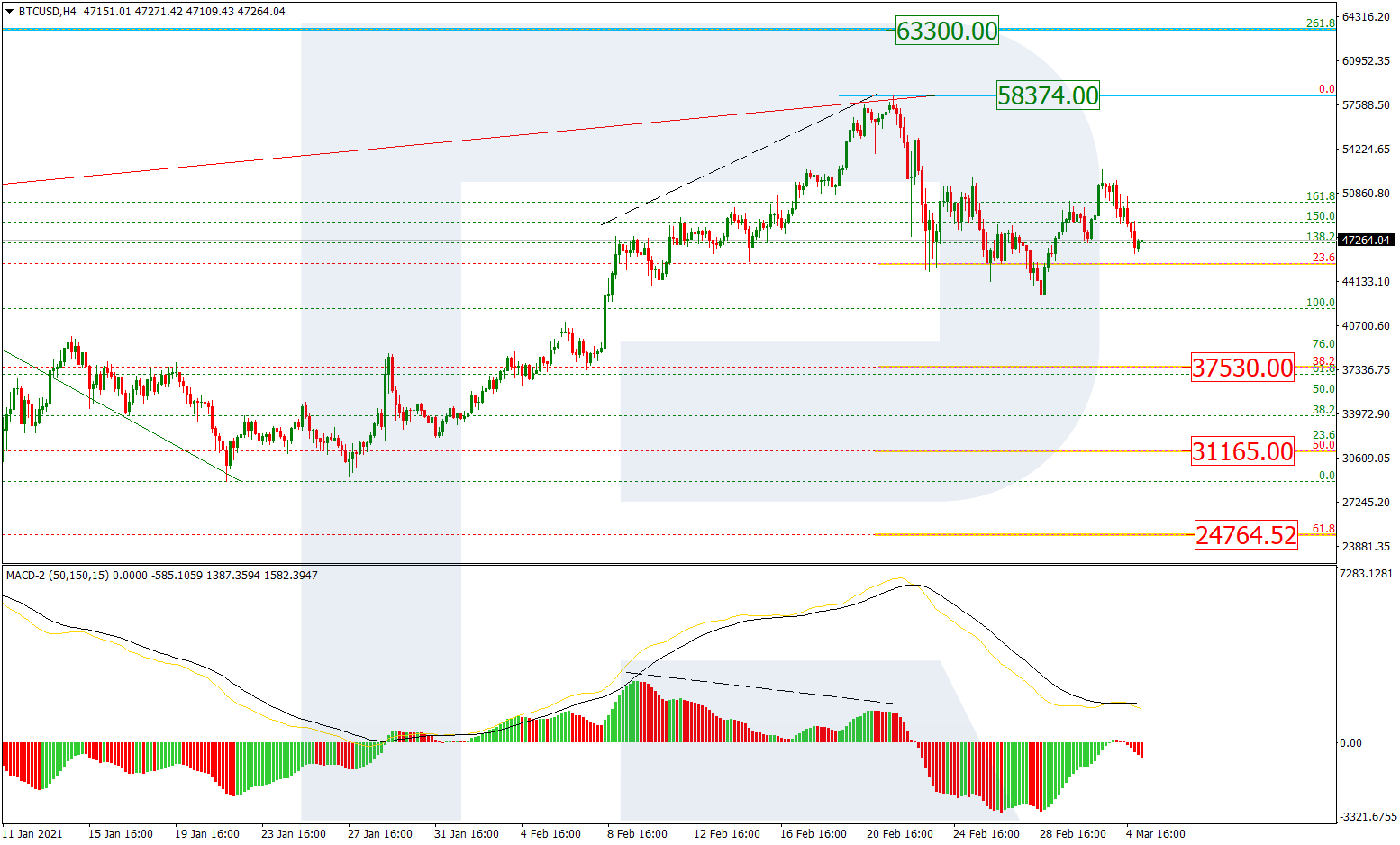

BTCUSD, “Bitcoin vs US Dollar”

BTCUSD is still consolidating around 11200.00. If later the price breaks this range to the upside, the market may form one more ascending structure towards 11900.00; if to the downside – resume falling with the target at 10500.00.

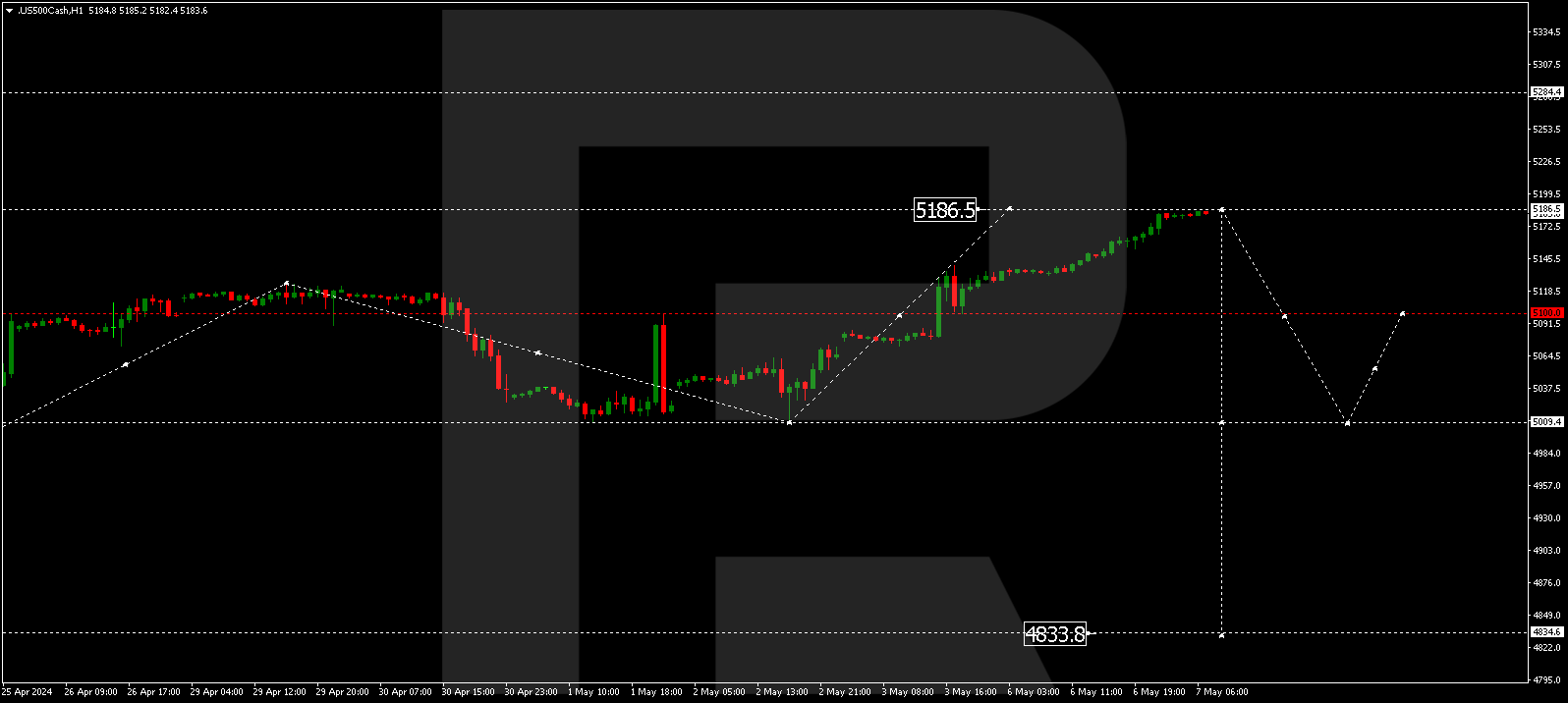

S&P 500

After rebounding from 3284.4, the S&P index is expected to continue growing. Today, the asset may reach 3345.1 and then form a new descending structure to return to 3284.4. Later, the market may resume moving upwards with the target at 3360.0.