EURUSD, “Euro vs US Dollar”

The pair has completed a link of decline to 1.0669. Today it might grow to 1.0790 and then - decline to 1.0642. The goal is local. After this level is reached, a link of correction to 1.0791 is not excluded. Then a decline to 1.0555 should follow.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair has completed a wave of decline to 1.1960. Today the market is forming a link of correction to 1.2100. After it is over, a link of decline to 1.1940 is expected.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has escaped the range downwards. We expect it to reach 130.33. Then it might grow to 133.15.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair is forming a wave of correction to 0.9177. Then it should grow to 0.9300. Next, one more link of correction to 0.9240 is not excluded. After this correction is over, growth should continue to 0.9370, from where the wave might extend to 0.9400.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair is forming a structure of growth to 0.7010. Then it might fall to 0.6860. And with a breakaway of this level, a pathway down to 0.6777 should open.

BRENT

Brent has completed a wave of growth to 83.88. Today a consolidation range is forming under this level. With an escape downwards, a correction to 81.50 should follow, and then - growth to 86.40. The goal is local.

XAUUSD, “Gold vs US Dollar”

Gold is consolidating around 1873.50. Today the range might extend to 1888.88. Then a decline to 1854.40 should follow.

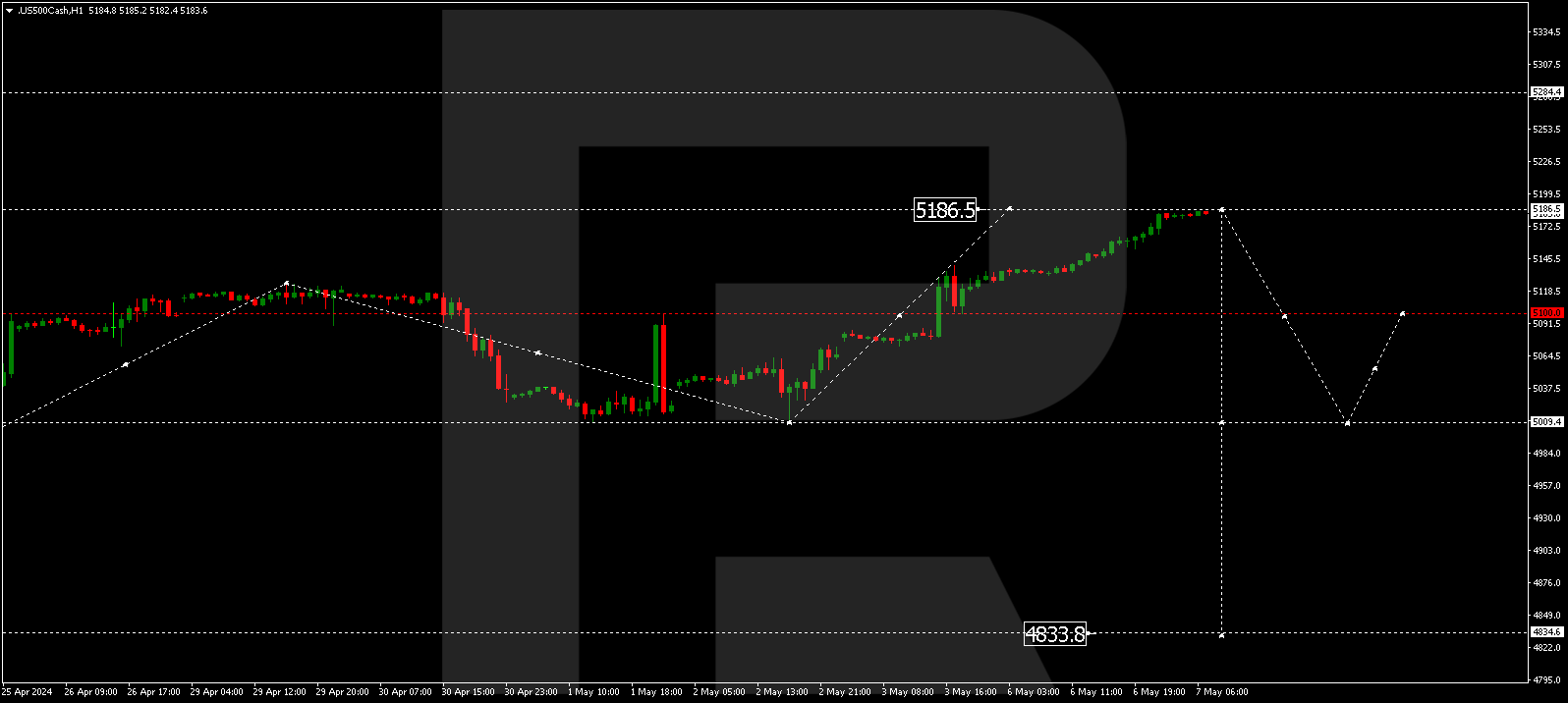

S&P 500

The stock index has completed an impulse of growth to 4160.0. Today the quotes might consolidate around this level. With an escape upwards, a link of growth to 4226.0 is not excluded. With an escape downwards, a pathway down to 4048.8 might open.