Forex Technical Analysis & Forecast 10.09.2020

EURUSD, “Euro vs US Dollar”

The currency pair performed a decline to 1.1753 and is now correcting. Today, it might reach 1.1820, then decline to 1.1790. At these levels, a consolidation range may form. Upon escaping it upwards, the pair may go on correcting to 1.1860. Upon escaping the range downwards, the quotations may decline to 1.1740 and further, to 1.1710, as the low.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair completed another wave of decline at 1.2888 and then – an impulse of growth to 1.3023. Today, we expect a decline to 1.2962 and a consolidation range to form at these levels. With an escape upwards, the price may go on correcting to 1.3105. With an escape downwards, the pair may fall to 1.2800.

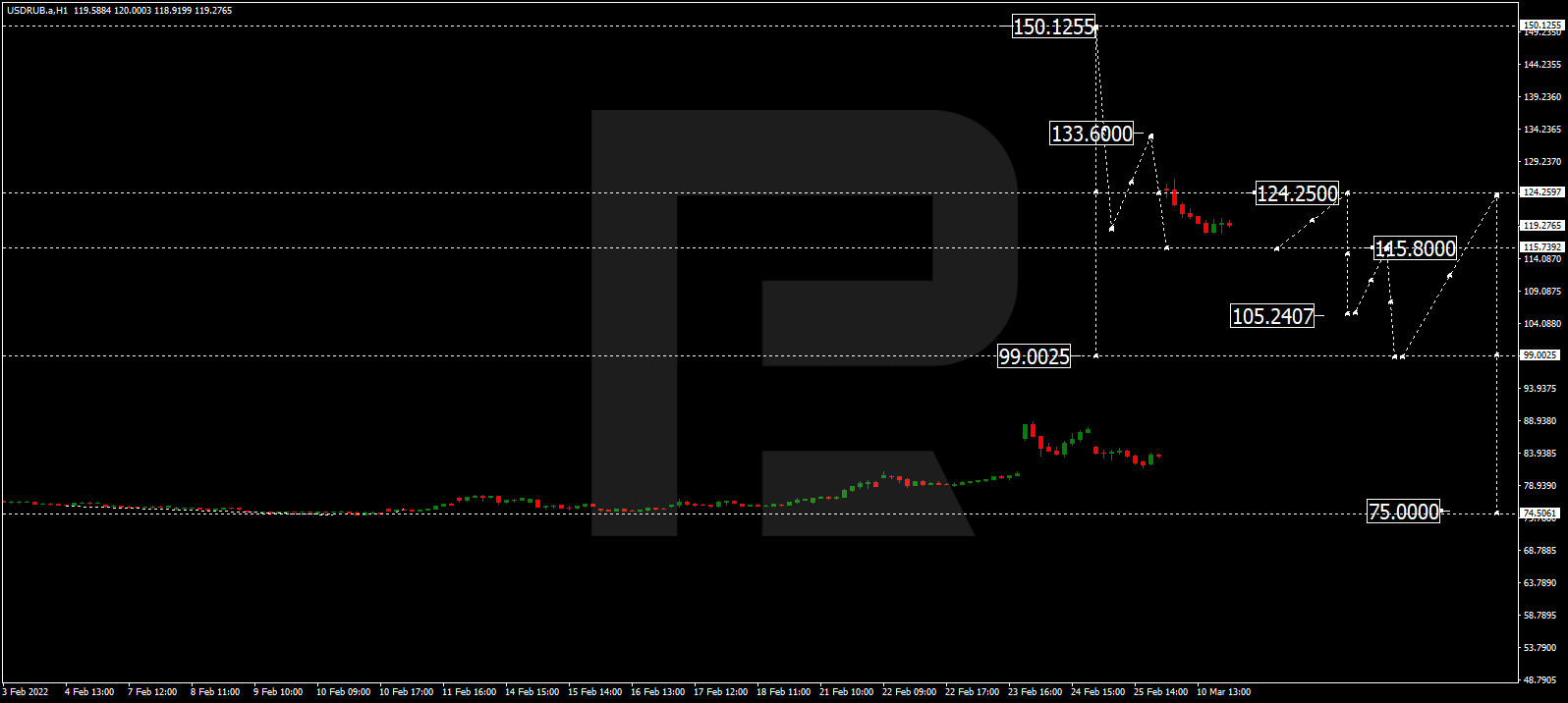

USDRUB, “US Dollar vs Russian Ruble”

The currency pair is trading a wave of decline to 74.87, upon reaching which we expect it to grow to 75.70. At these levels, we expect a consolidation range to form. Upon escaping it downwards, the price may develop a declining wave to 73.40. With an escape upwards, growth to 77.20 is not excluded.

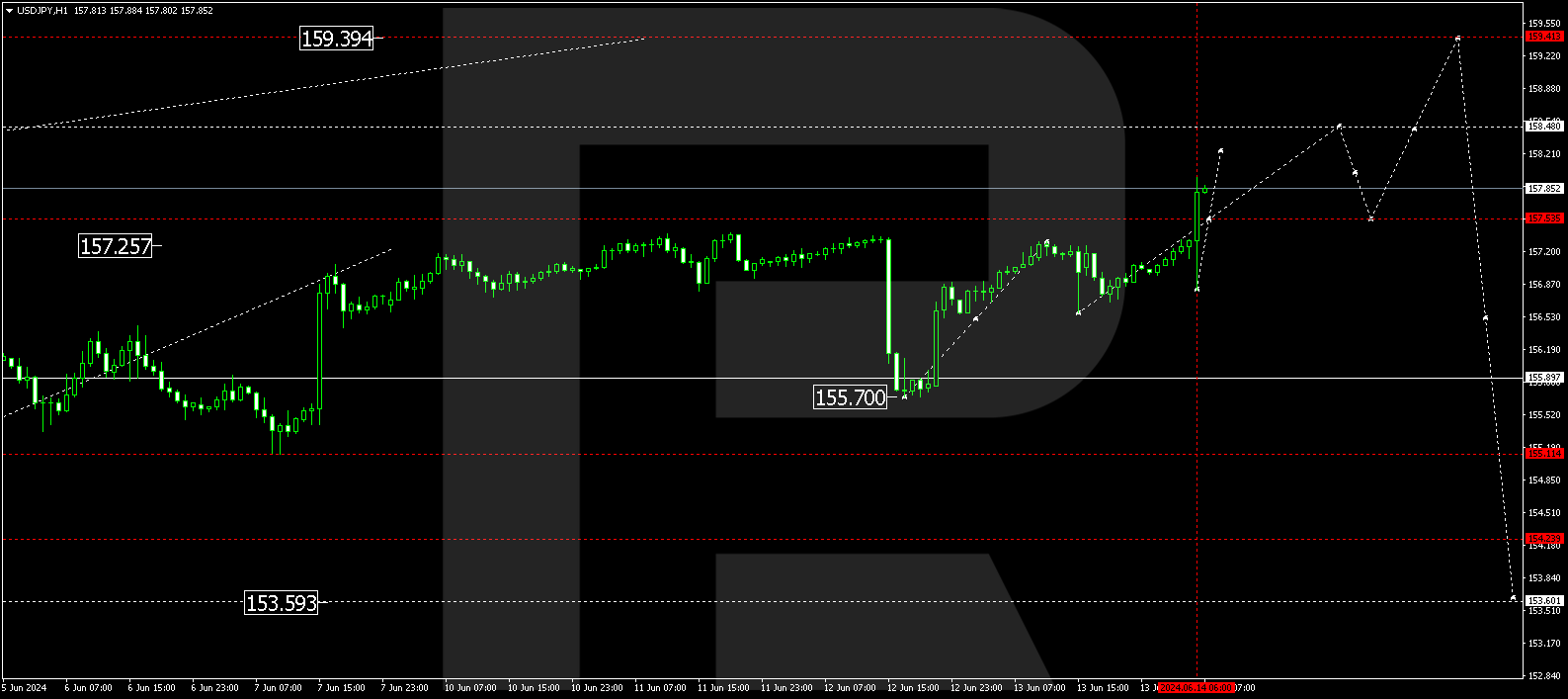

USDJPY, “US Dollar vs Japanese Yen”

The currency pair demonstrated a structure of growth to 106.26, which we interpret as a correction of the previous decline. Today, the market is pressed down. We expect 105.90 to be reached. After a breakaway of this level, we expect the downtrend to continue to 105.40. The goal is local.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair performed a link of decline to 0.9130. For now, the market is pushed downwards. The price may reach 0.9070 as a part of a correction, then grow to 0.9161. Upon breaking this level upwards, the pair may grow to 0.9260. The goal is first.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair broke 0.7240 upwards and performed a link of growth to the upper border of the consolidation range. Today, it may go back to 0.7240 and, breaking it downwards, potentially go on declining to 0.7188 and even 0.7170. The goal of the declining wave is first.

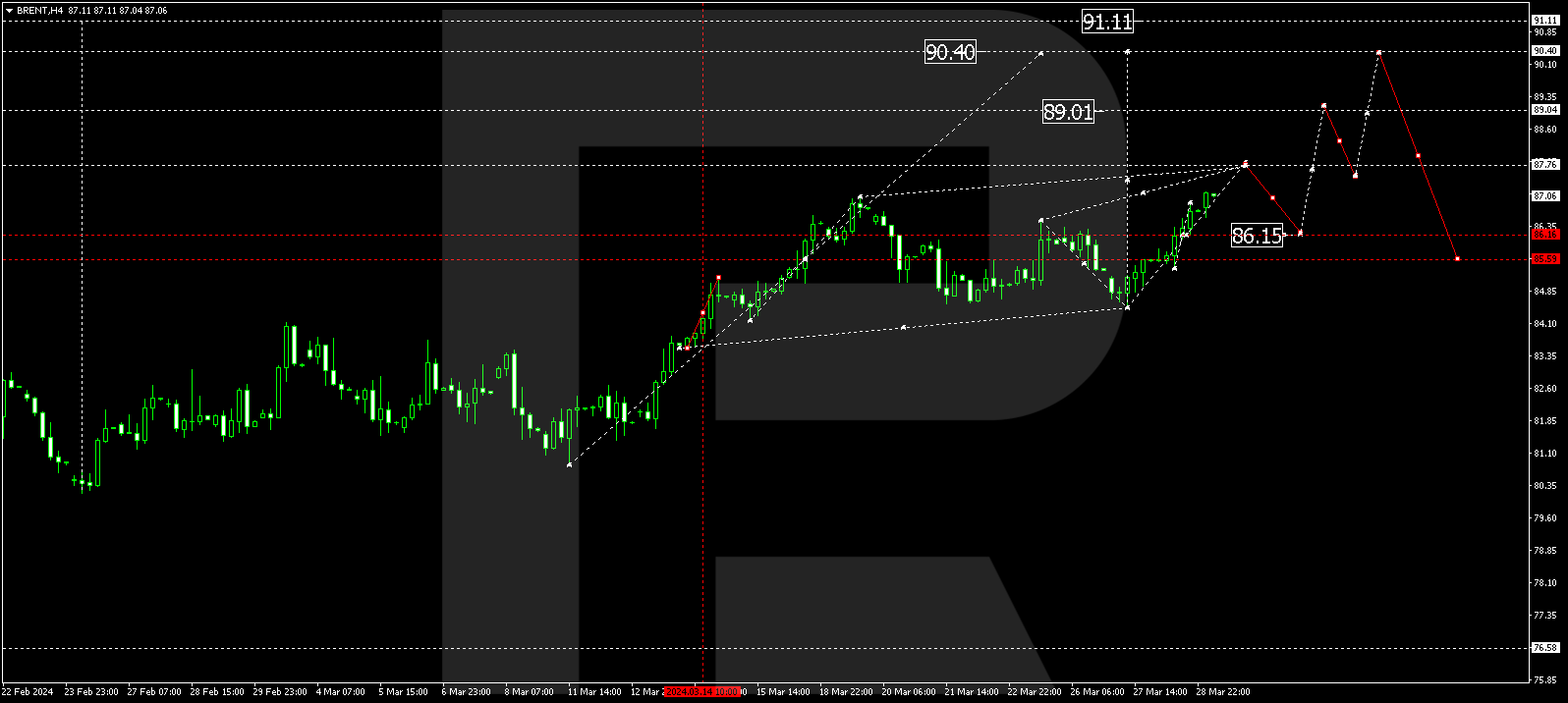

BRENT

Oil is trading in a structure of growth to 41.84, upon reaching which it may go down to 40.72. At these levels, we expect a consolidation range to develop. Upon escaping it upwards, a pathway to 42.50 may open. With an escape downwards, a decline to 38.44 becomes possible.

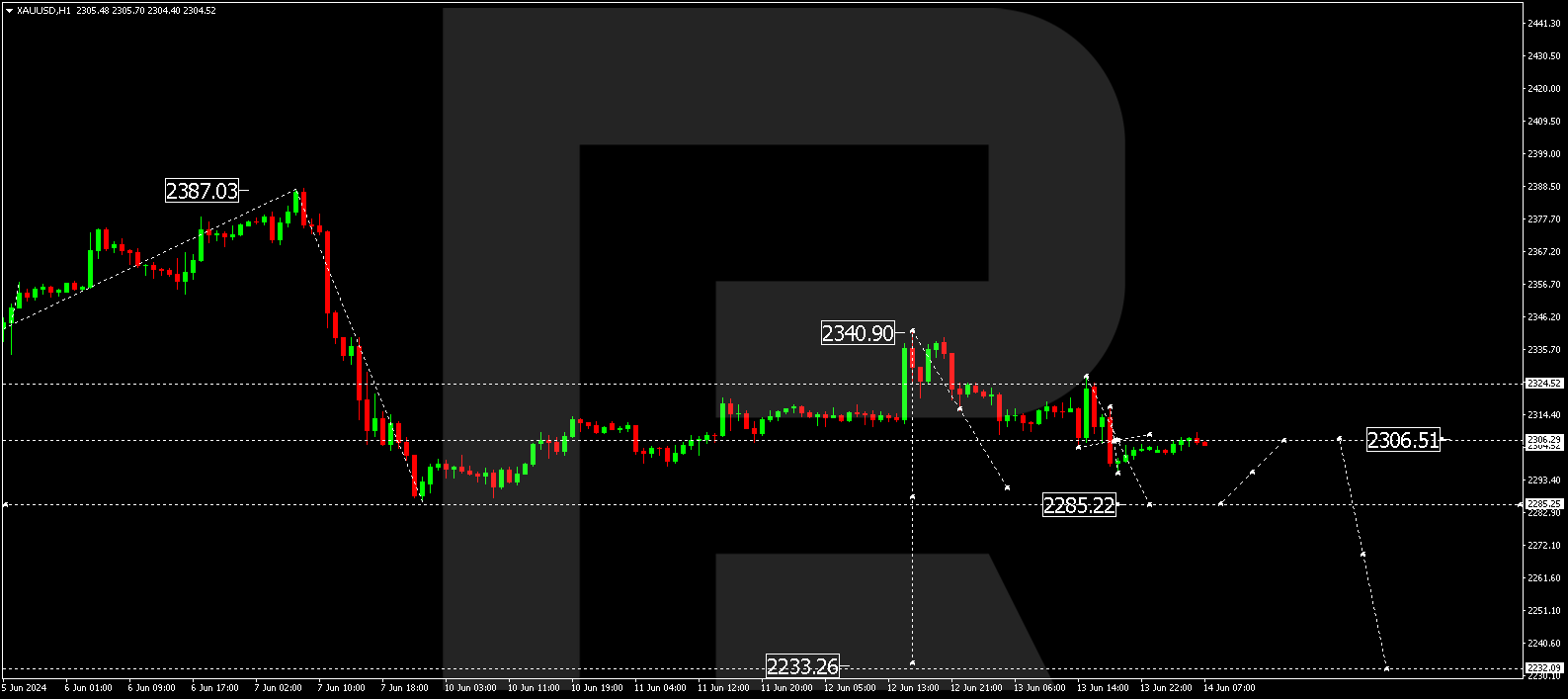

XAUUSD, “Gold vs US Dollar”

Gold broke 1930.11 upwards and reached 1949.00. Practically, the market offers a correction to 1962.44. Today, we may expect a correction to 1930.11 and a test of this level from above. The the price may grow to 1949.00 and, breaking through this level, start moving towards 1962.44.

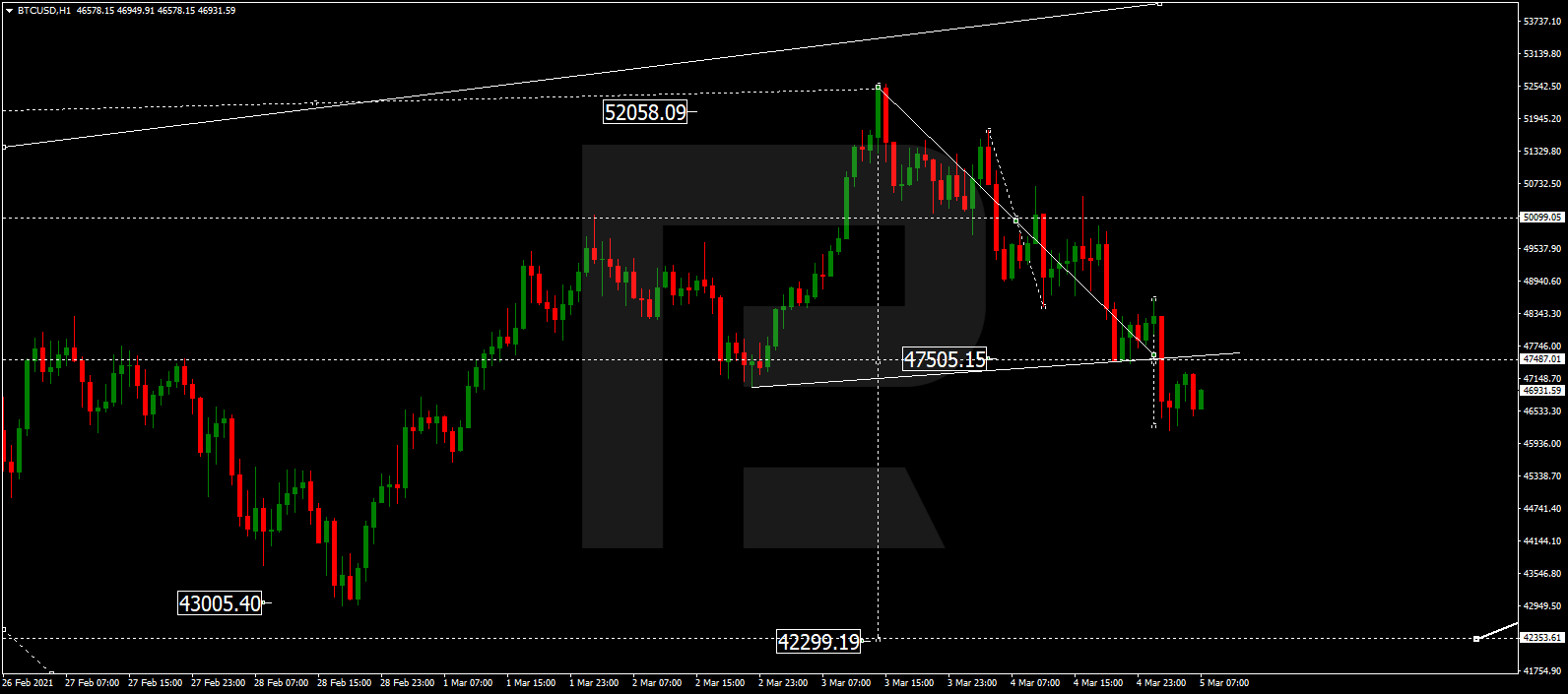

BTCUSD, “Bitcoin vs US Dollar”

The market demonstrated growth to 10140 and, breaking it upwards, keeps developing the wave to 10463. Practically, for now, a consolidation range near 10140 keeps developing. Upon escaping the range upwards, the price may rise to 10670. Upon escaping it downwards, the quotations may go down to 9333.

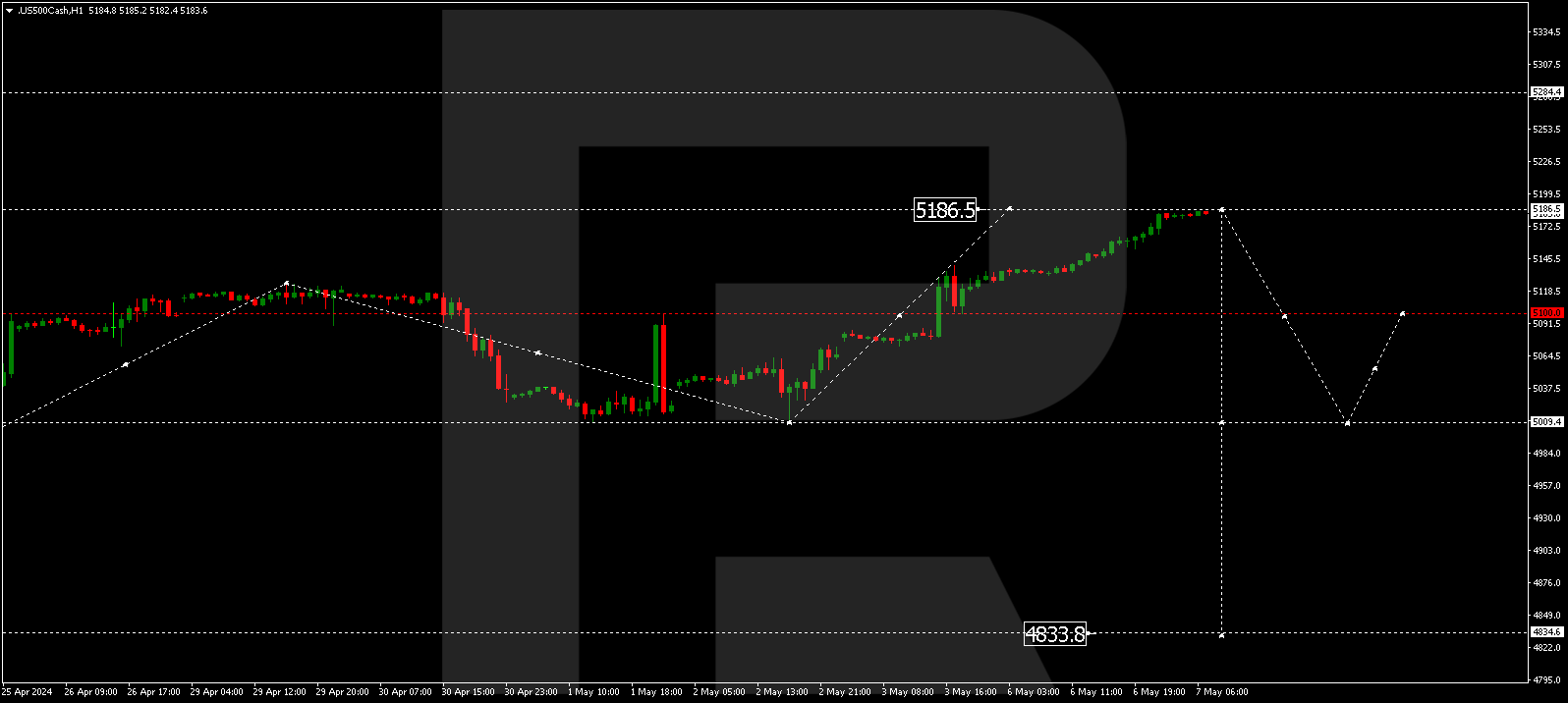

S&P 500

The stock index performed the first wave of decline to 3330.0 and finished the first impulse of growth to 3430.0. Today, this impulse is expected to correct to 3360.3. At these levels, a consolidation range might form. With an escape upwards, the growth may continue to 3468.0. All this growth should be interpreted as a correction of the first wave of decline.