Forex Technical Analysis & Forecast 11.09.2020

EURUSD, “Euro vs US Dollar”

The currency pair is developing a downtrend, correcting the preceding medium-term uptrend. Yesterday the market demonstrated an inner pullback after a convergence on the MACD, setting the borders of a new descending channel; however, today the quotations are returning to the support level at 1.1798 that they have already tested. In the short term, the quotations have a chance to rise again to the resistance line and 1.1900 but after that, they will decline to break away 1.1798 and proceed deeper down to 1.1700.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair is developing a stable downtrend, correcting the preceding medium-term wave of growth. By now, the quotations have stepped over 50.0% Fibo, heading for 61.8% (1.2712). Meanwhile, the MACD lines are converging, which means a potential pullback. The first aim will be 1.2937 and the second aim - 1.3010.

USDRUB, “US Dollar vs Russian Ruble”

The currency pair keeps developing a wave of decline after a divergence. The main goal of the decline is the support line of the medium-term channel and 74.00. In the short term, the market is preparing a breakaway of the local resistance line and growth to 75.45. After the pullback, the quotations may develop another impulse of decline to the main aim.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair is still squeezed in a Triangle but may soon find a way out. A breakaway of the resistance at 106.22 will let the quotations rise to the medium-term resistance level and 106.64. A breakaway of the support level at 105.95, in its turn, will let the downtrend develop to 105.60.

BRENT

Oil is developing a downtrend after a divergence and a breakaway of the support level. The quotations are nearing 23.6% (39.28). The short-term technical picture demonstrates a correctional channel forming after a wave of decline. A bounce off the support level of the correctional channel will let the quotations rise to 41.76 and later - to 43.61. After the pullback is over, wwe should expect another impulse of decline to 37.00.

XAUUSD, “Gold vs US Dollar”

Gold rests in a medium-term downtrend. Yesterday, the market completed a wave of ascending pullback, breaking away the local support line. The aim of the nearest decline is 1927.60. A breakaway of this level will let the quotations test the support level of the medium-term channel and 1895.45. To confirm this, the MACD is preparing a Black Cross.

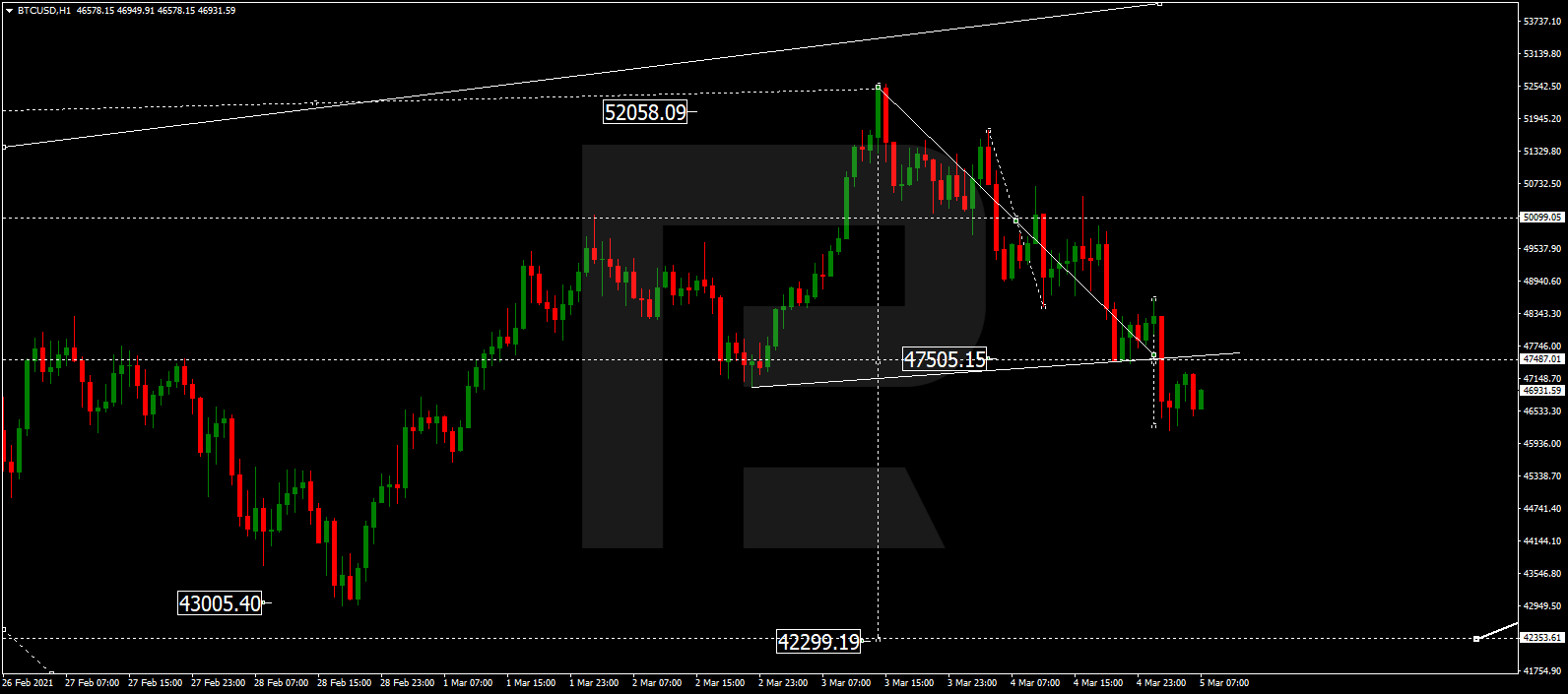

BTCUSD, “Bitcoin vs US Dollar”

The quotations remain in a correctional flat between the resistance and support levels of 10495 and 9834, respectively. In the short term, we should expect a decline to the lower border. A breakaway of the support will let the quotations decline to the main and long-term support line at 9348.