EURUSD, “Euro vs US Dollar”

The currency pair has reached a local goal of the wave of growth at 1.0773. Today a correction to 1.0710 should start. After the correction is over, growth to 1.0788 is expected.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair is forming a consolidation range around 1.2140. A link of decline to 1.2084 is not excluded, followed by growth to 1.2290.

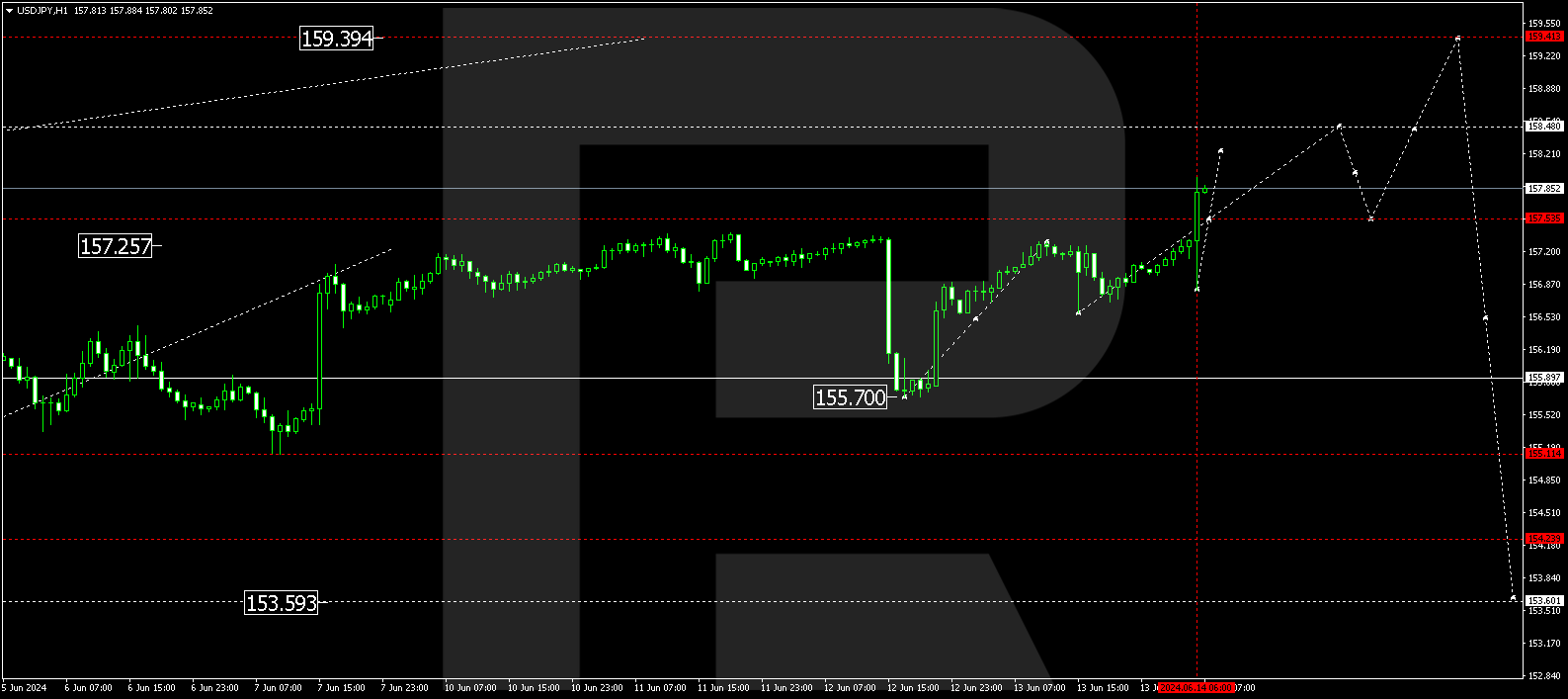

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has completed a wave of correction to 132.80. Today the market continues developing a wave of decline to 130.60. After this level is reached, a link of growth to 131.66 and a decline to 128.90 should follow.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair has completed a structure of a correctional wave to 0.9330. Today the market might continue declining to 0.9105. After this level is reached, a link of correction to 0.9250 (a test from below) is not excluded. Then a decline to 0.9094 should follow.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair is forming a consolidation range around 0.6900. With an escape downwards, a decline to 0.6848 might follow. With an escape upwards, a pathway for a wave of growth to 0.6996 should open.

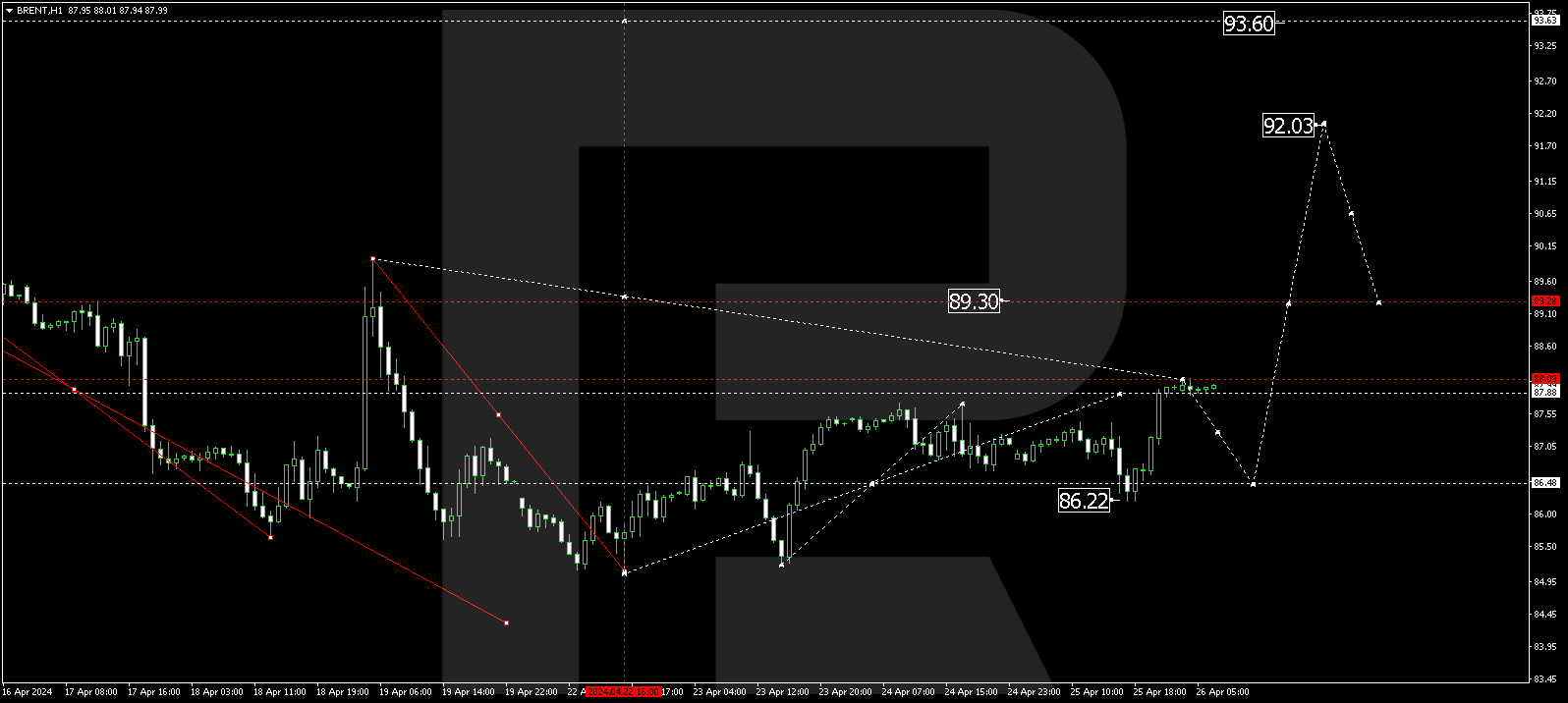

BRENT

Crude oil has completed a wave of growth to 83.23. Today a decline to 81.76 might follow. Then growth to 84.90 should follow, from where the trend might continue to 86.00.

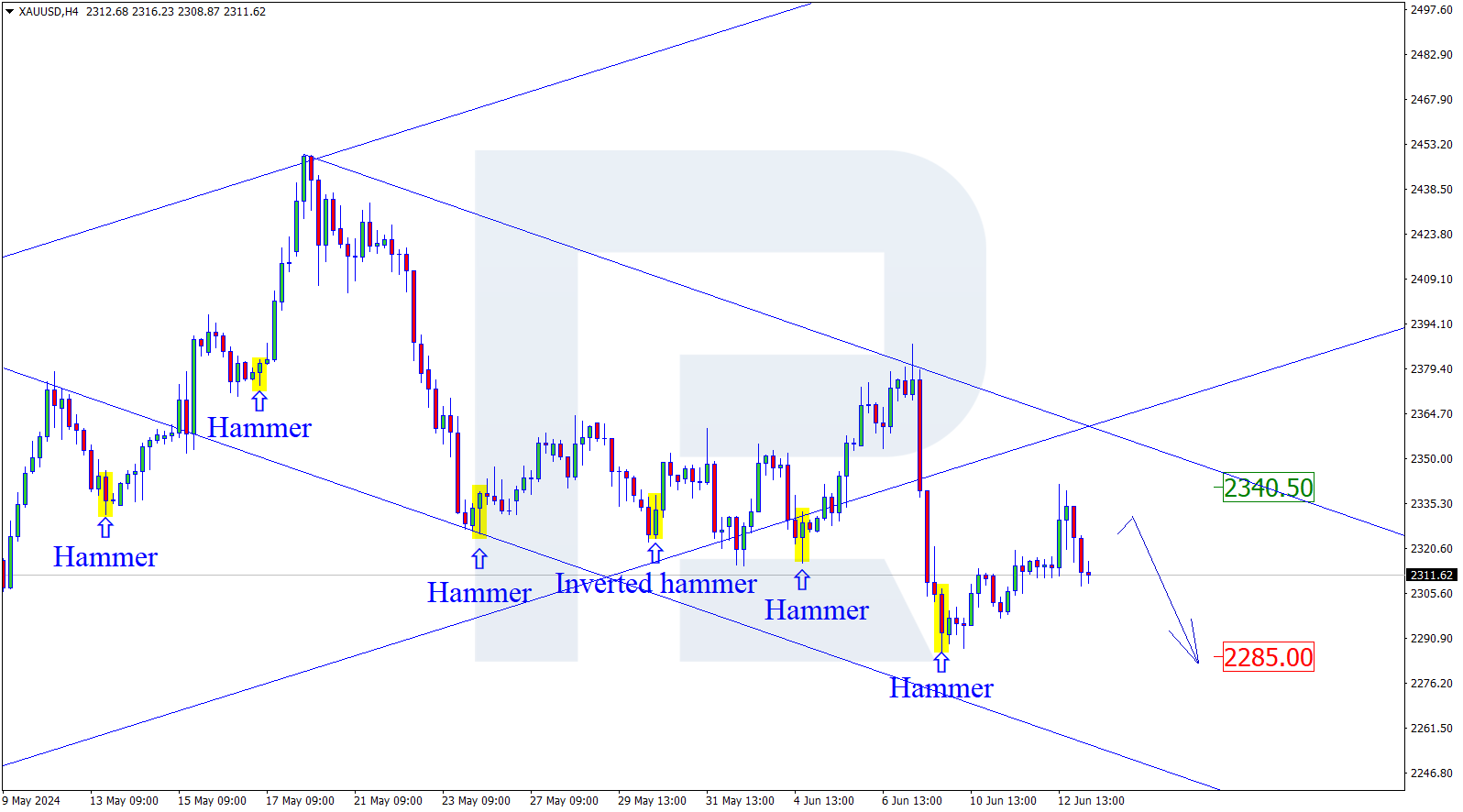

XAUUSD, “Gold vs US Dollar”

Gold is forming a consolidation range around 1877.77. Today the price might grow to 1890.00. The goal is local. After this level is reached, a correction might develop to 1831.30, followed by growth to 1898.00.

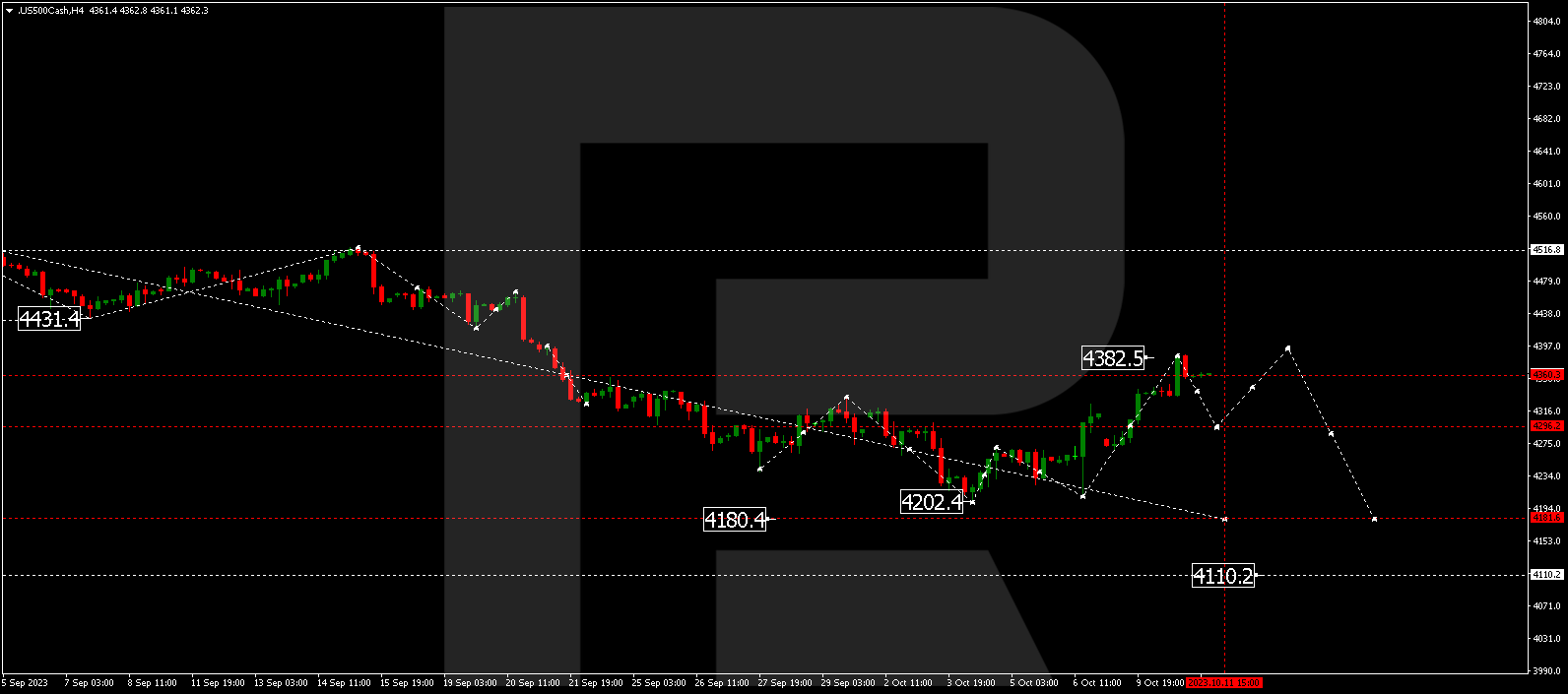

S&P 500

The stock index is forming a consolidation range around 3877.7. Today the range has extended upwards to 3972.6. A decline to 3870.0 is expected. And with a breakaway of this level, a pathway to 3775.0 will open.