EURUSD, “Euro vs US Dollar”

The currency pair has completed the main wave of growth to 1.0866. Today a wave of decline to 1.0707 should begin, followed by growth to 1.0786 and a decline to 1.0630, from where the trend might continue to 1.0545.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair has completed a wave of growth to 1.2244. Today a wave of decline to 1.2088 should begin. Then growth to 1.2166 and a decline to 1.2020 should follow, from where the trend may continue to 1.1930.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has completed a wave of decline to 128.66. Today the market starts developing a wave of growth to 131.70. After this level is reached, a link of decline to 130.15 should follow, and next - growth to 134.70.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair has completed a structure of a wave of growth to 0.9357. Today the market has corrected to 0.9260. At the moment, the market has started to form a new structure of growth to 0.9393. After this level is reached, a consolidation range might form. With an escape upwards, the trend might continue to 0.9525.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair has completed a wave of growth to 0.6983. Today a wave of decline to 0.6899 should begin. With a breakaway of this level downwards, a pathway down to 0.6791 will open.

BRENT

Crude oil escaped the consolidation range upwards and reached a local goal of 84.55. Today a link of correction to 82.82 is not excluded, followed by growth to 86.66, from where the trend might continue to 88.00.

XAUUSD, “Gold vs US Dollar”

Gold has reached the goal of the wave of growth to 1900.00. Today a wave of decline to 1831.24 is expected to begin. The goal is first. After this level is reached, a link of growth to 1866.00 is expected, followed by a decline to 1795.00.

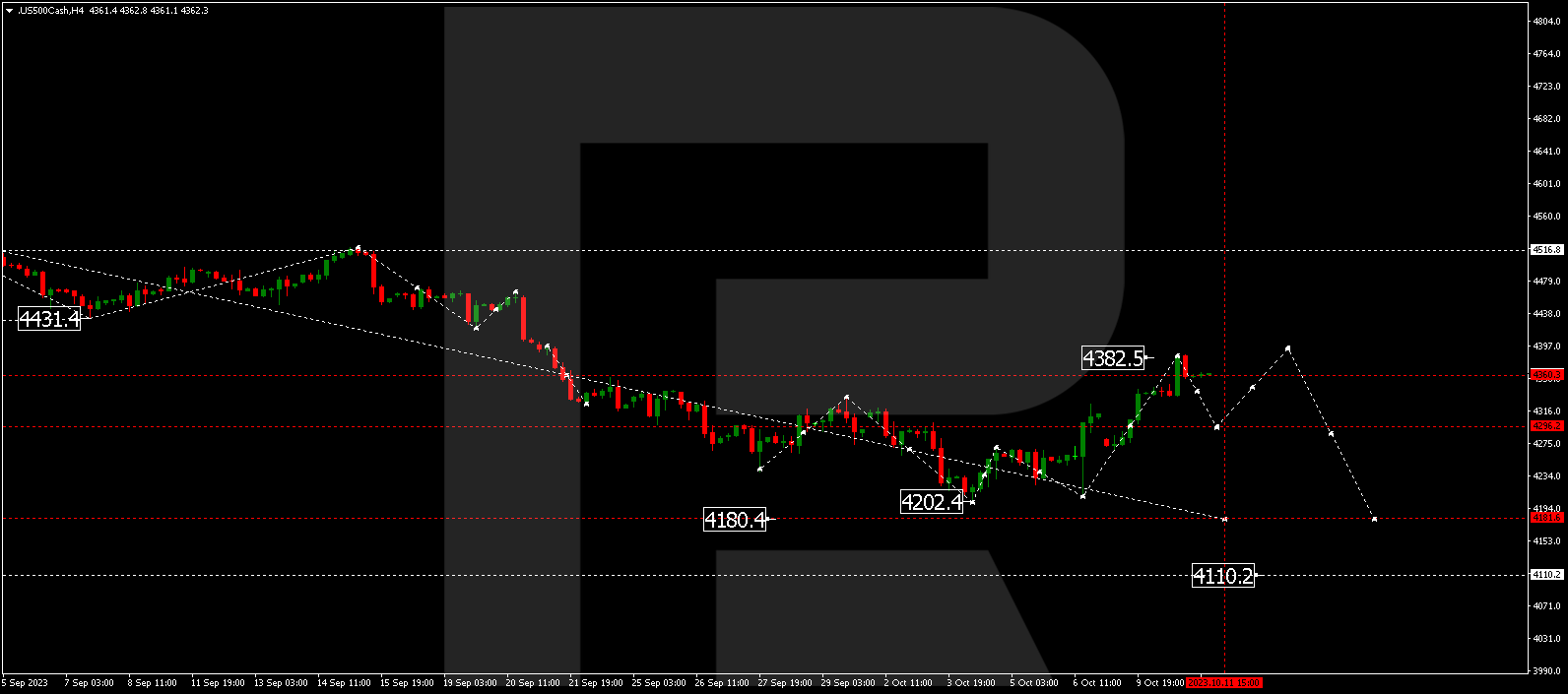

S&P 500

The stock index is forming a consolidation range under 3993.0. Today a decline to 3838.0 is expected. Thus the market will set the borders of the range. With an escape downwards, a pathway to 3675.0 will open.