EURUSD, “Euro vs US Dollar”

The pair completed a declining wave to 1.0400. A link of correction to 1.0500 might occur, followed by a decline to 1.0270. After this level is reached, a link of correction to 1.0500 is expected.

GBPUSD, “Great Britain Pound vs US Dollar”

The pair demonstrated a declining wave to 1.2106. Today a link of correction to 1.2300 is not excluded, followed by a decline to 1.2030.

USDJPY, US Dollar vs Japanese Yen”

The pair performed a growing wave to 135.13 and a correction to 133.60. The correction might continue to 133.11, followed by growth to 136.36.

USDCHF, “US Dollar vs Swiss Franc”

The pair continues a link of growth to 1.0000. When this level is reached, a link of correction to 0.9888 might occur, followed by growth to 1.0055.

AUDUSD, “Australian Dollar vs US Dollar”

The pair continues a declining wave to 0.6888. When this level is reached, a link of correction to 0.7070 is not excluded, followed by a decline to 0.6850.

BRENT

Oil performed a link of correction to 120.00 and an impulse of growth to 124.70. Today it has corrected the impulse to 122.40. Growth is expected to continue to 127.55, and the trend might later reach 129.15.

XAUUSD, “Gold vs US Dollar”

Gold completed a declining wave to 1808.55. Today a link of correction to 1844.20 is not excluded, followed by a decline to 1794.97. The goal is local. After this level is reached, a link of correction to 1844.00 is expected, followed by a decline to 1762.55.

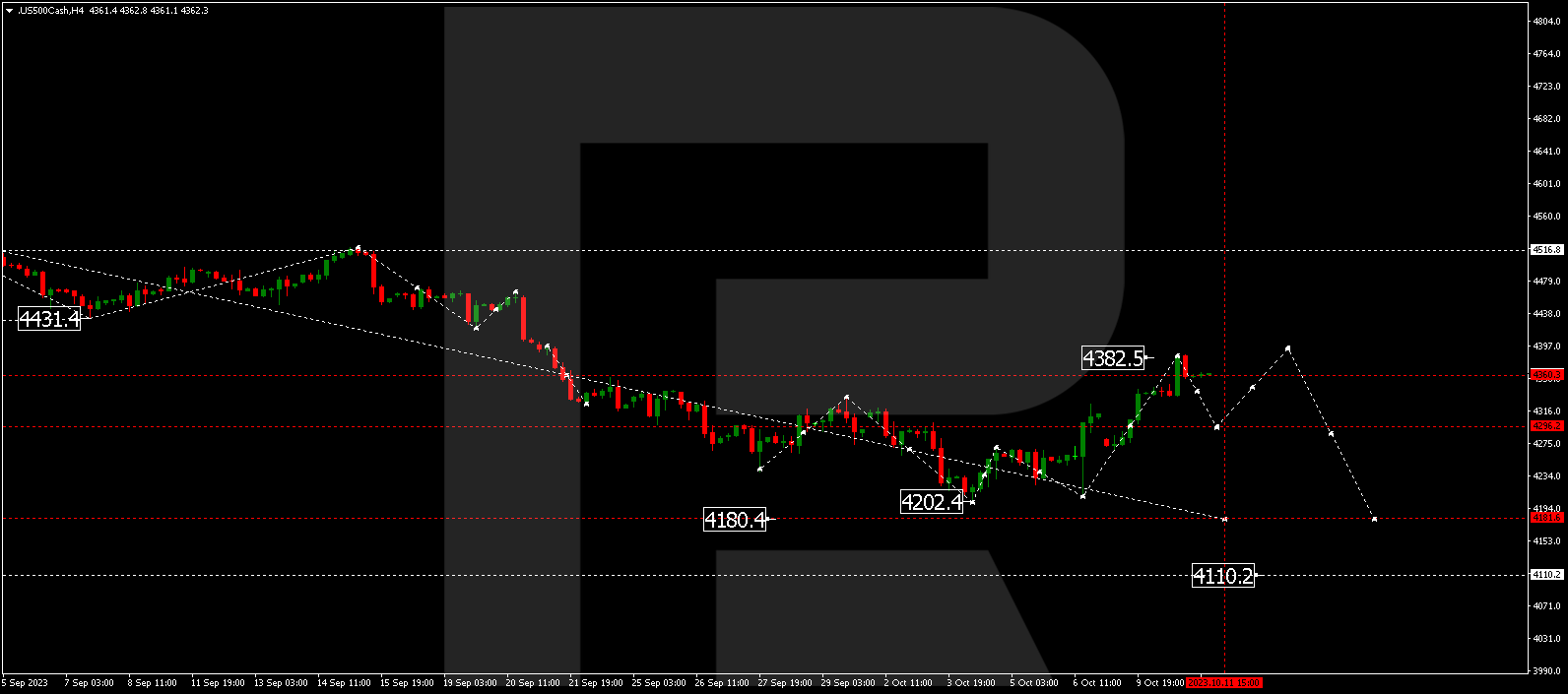

S&P 500

The index performed a declining wave to 3830.0. Currently, the market has formed a consolidation range around this level. With a breakaway downwards, a declining pathway to 3470.0 will open. With a breakaway upwards, a link of correction to 3900.0 is not excluded, followed by a decline to 3111.0.